SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2018

(Commission File No. 001-33356),

Gafisa S.A.

(Translation of Registrant's name into English)

Av. Nações Unidas No. 8501, 19th floor

São Paulo, SP, 05425-070

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes ______ No ___X___

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ______ No ___X___

Indicate by check mark whether by furnishing the information contained in this Form,

the Registrant is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes ______ No ___X___

If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b):

N/A

FOR IMMEDIATE RELEASE

- São Paulo, March 8, 2018 – Gafisa S.A. (B3: GFSA3; NYSE: GFA),

one of Brazil’s leading homebuilders, today reports its financial results for the

fourth quarter and fiscal year ended December 31, 2017.

GAFISA ANNOUNCES

4Q17 and 2017 RESULTS

|

March 9, 2018

CONFERENCE CALL

►

12:00 pm Brasília time

Telephone:

+55 (11) 3127-4971 / 3728-5971 (Brasil)

Code: Gafisa

►

10:00 am US EST

In English (simultaneous translation from Portuguese)

+1 516 300-1066 (USA)

Code: Gafisa

Webcast: www.gafisa.com.br/ri

Replay:

+55 (11) 3127-4999

Portuguese: 94216229

English: 44921260

Shares

GFSA3 – B3 (formerly BM&FBovespa)

GFA – NYSE

Total shares outstanding: 28,040,162

1

Average Daily Traded Volume (90 days²):

R$9.5 million

(1) including 938,044 treasury shares;

(2) Until December 31, 2017

|

2017 was a transformational year for Gafisa, drawing attention to: (i) the reduction and restructuring of the Company’s organizational structure, with direct impact on efficiency; (ii) the conclusion of operational and corporate separation of Tenda and Gafisa; (iii) the capital increase approved in 2017 and ratified on February 28, 2018, totaling R$250.8 million, enhancing Gafisa’s operational positioning to this new cycle of the real estate market; and (iv) the postponement of R$456.3 million debt of the Company for 2020 and 2021, as condition for the capital increase, substantially reducing pressure over cash flows in the short term. This new structure allows the Company to directly answer to business opportunities in our target market, therefore, positively impacting on our operational performance.

Concerning the macroeconomic scenario, political uncertainties still impacted Brazil in 2017 and more favorable economic indicators were only seen as of the second half of the year. This gradual recovery, although positive, was not sufficient to bolster an upturn of the real estate market in 2017. Since this is a long-cycle market, it is one of the sectors which take longer to respond to an improved business environment.

Such dynamics between economy and real estate market is even more relevant in the middle and mid-high income residential segment, where Gafisa concentrates its operations. Within this context, the Company outlined a strategy focused on its efforts to sell inventories, with lower level of judiciously designed launches in the markets where the Company operates. In 2017, five projects were launched totaling R$554.0 million in PSV, 39.8% lower than in 2016. Out of these projects, three came from the middle-income segment Moov (Moov Parque Maia, Moov Espaço Cerâmica and Moov Estação Brás) and two from the high-income segment Line (J330 and Parque Ecoville). The 50.0% sale of these launches in 2017 validates Gafisa’s decision-making process and commercialization of new products. Total inventories went down 13.0% versus 2016.

A reduced number of launches in 2017 impacted gross sales, which dropped 14.2% to R$1,132 million. For same reason, in 4Q17, gross sales were 50.5% and 52.4% lower than in 3Q17 and 4Q16, respectively and totaled R$271.0 million.

In 2017, dissolutions went down 19.1% over 2016, to R$411.7 million. Despite signs of improvement, especially when compared to two previous years, dissolutions still pose potential uncertainties for the sector, as evidenced by a 4Q17 performance amounting to R$95.4 million, 13.1%

higher than 3Q17.

|

Net pre-sales, reflecting the factors mentioned above, decreased 11.7% in 2017, to R$720.2 million. In 4Q17, net pre-sales came to R$121.9 million, 65.7% and 65.8% lower than in 3Q17 and 4Q16, respectively. On the other hand, efficient inventory sales and reasonable launches resulted in 0.5 p.p. growth in the 12-month SoS, which ended 2017 at 32.0%. SoS in 4Q17 was 7.4%, reflecting the lower level of launches.

Net revenue in 2017 was down 33.5% to R$608.8 million. Net pre-sales concentrated in more recent projects with slower work evolution impedes a faster recovery of revenues. In 4Q17, net revenue came to R$164.7 million, in line with R$160.3 million in 3Q17, but 37.6% lower than in 4Q16.

Another effect of sales concentrated in more recent projects is evidenced in deferred income, which totaled R$215.8 million in 4Q17 with 34.8% margin, similar to 3Q17 and 13.0% higher than in 4Q16.

General and administrative expenses totaled R$92.7 million 2017, down 13.0% year-on-year and 20.3% considering the average of the last four years, as a result of the Company’s efforts to increase operations’ efficiency and productivity. In 4Q17, general and administrative expenses totaled R$24.2 million. Selling expenses also decreased 7.8% year-on-year to R$87.6 million. In 4Q17, expenses went down 26.6% to R$24.4 million and increased 6.4% from 3Q17.

Accounting adjustments were recorded in 4Q17 which impacted the period’s results. The first adjustment was due to the goodwill impairment test to remeasure the 30% stake in Alphaville, yearly carried out based on the future profitability estimate or when circumstances indicate impairment loss, which identified the need of recognizing a provision for losses of R$127.4 million which, together with the negative result of R$186.9 million in the equity in this investment, totaled an impact of R$314.million in 2017. The second was pricing adjustments of inventory units, which were being sold below the accounting value due to the unfavorable conditions in the real estate market, in addition to certain land areas totaling R$147.3 million.

Thus, Gafisa’s net loss in 2017 totaled R$849.9 million and R$462.6 million in 4Q17. Excluding the effects mentioned above and Alphaville’s equity income, Gafisa’s net loss in 2017 was R$486.4 million and R$125.3 million in 4Q17.

In regards to liquidity and cash management, the operating cash flow totaled R$321.8 million in 2017, with net cash generation of R$104.2 million, excluding the inflow of funds from Tenda transaction. In 4Q17, the operating cash generation totaled R$31.8 million.

Gafisa ended 2017 with a net debt of R$958.0 million, down 30.9% from 2016. Leverage, measured by the net debt to shareholders’ equity ratio was up to 126.1% in 2017, mainly impacted by impairments and equity results in Alphaville, inventories, and land. Excluding project finance, the net debt to shareholders’ equity ratio was 29.5%.

The end of cycle referring to the strategic planning executed over the past four years, comprising the organizational restructuring, the divestment in Alphaville and the separation from Tenda, combined with capital increase completed in 2018, position Gafisa more comfortably for an eventual recovery of the Brazilian real estate market.

Sandro Gamba

CEO

OPERATIONAL RESULTS

Table 1. Operational Performance (R$ 000)

|

|

4Q17

|

3Q17

|

Q/Q (%)

|

4Q16

|

Y/Y (%)

|

2017

|

2016

|

Y/Y (%)

|

|

Launches

|

90,113

|

463,841

|

-80.6%

|

299,417

|

-69.9%

|

553,954

|

920,846

|

-39.8%

|

|

Gross Sales

|

216,988

|

438,429

|

-50.5%

|

455,739

|

-52.4%

|

1,131,823

|

1,319,292

|

-14.2%

|

|

Dissolutions

|

(95,407)

|

(84,390)

|

13.1%

|

(99,968)

|

-4.6%

|

(411,658)

|

(508,827)

|

-19.1%

|

|

Net Pre-Sales

|

121,851

|

354,039

|

-65.7%

|

355,771

|

-65.8%

|

720,164

|

810,464

|

-11.1%

|

|

Sales over Supply (SoS)

|

7.4%

|

18.3%

|

-10.9 p.p.

|

16.8%

|

-9.4 p.p.

|

32.0%

|

31.5%

|

0.5 p.p.

|

|

Delivery PSV

|

41,171

|

75,227

|

-45.3%

|

292,736

|

-85.9%

|

861,325

|

1,745,563

|

-50.7%

|

Launches

The single launch in the quarter was Moov Estação Brás (São Paulo/SP), a project with total PSV of R$90.1 million. In 2017, launches totaled R$554.0 million in PSV, divided into five projects, four in São Paulo and one in Curitiba (the third phase of Parque Ecoville). Sales of projects launched in 2017 reached 50.0% until December 2017, validating Gafisa’s decision-making process and commercialization of new products.

Table 2. Launches (R$ 000)

|

Project

|

City

|

Period

|

PSV

|

|

Parque Ecoville

|

Curitiba/PR

|

3Q17

|

57,168

|

|

J330 Jardins

|

São Paulo/SP

|

3Q17

|

74,321

|

|

MOOV Parque Maia

|

Guarulhos/SP

|

3Q17

|

171,063

|

|

MOOV Espaço Cerâmica

|

São Caetano do Sul/SP

|

3Q17

|

161,289

|

|

MOOV Estação Brás

|

São Paulo/SP

|

4Q17

|

90,113

|

|

TOTAL

|

|

|

553,954

|

Net Pre-Sales

Reduced launches impacted gross sales in 4Q17, which were 50.5% and 52.4% lower than in 3Q17 and 4Q16, respectively, and totaled R$217.0 million. Dissolutions dropped 4.6% from 4Q16, even so, they were up 13.1% from 3Q17, evidencing that there are still uncertainties in the sector. As a result, net pre-sales reached R$121.9 million, decreasing 65.7% and 65.8% compared to 3Q17 and 4Q16, respectively.

In 2017, gross sales totaled R$1,132 million, 14.2% lower than in 2016, reflecting Gafisa’s strategy of concentrating on inventory sales, with only precise and sensible launches. Dissolutions followed the lower volume of deliveries and fell 19.1% to R$411.7 million in 2017. Thus, net sales were 11.1% lower than in 2016 and totaled R$720.2 million.

The projects launched prior to 2017 accounted for 61.4% of net sales in 2017, according to the strategy already mentioned. Among the sale of these remaining projects, 80.6% were projects launched by the end of 2015, improving our inventory profile. Dissolutions, in turn, were higher in projects launched until 2014, where work has progressed further, with consequent impact on revenue recognition and margin composition.

Sales over Supply (SoS)

The reduced number of launches impacted quarterly SoS which was 7.3% in 4Q17, and SoS accumulated in twelve months, which reached 32.0%, 5.6 p.p. lower than in 3Q17. On the other hand, the 0.5 p.p. SoS growth in the last 12 months between 4Q17 and 4Q16 reflects the efficient inventory sale and Gafisa’s assertive launches in 2017.

Inventory (Property for Sale)

The inventory at market value reached R$1,531.6 million at the end of 4Q17, 3.1% lower than in 3Q17. Compared to 2016, inventory decreased 13.0%, more significantly representing the strategy of focusing on the sale of inventories with reduced number of launches.

Table 3. Inventory at Market Value 4Q17 x 3Q17 (R$ thousand)

|

|

Inventories EoP 3Q17

|

Launches

|

Dissolutions

|

Gross Sales

|

Adjustments¹

|

Investories EoP 4Q17

|

Q/Q

(%)

|

|

São Paulo

|

1,237,325

|

90,113

|

77,535

|

(178,023)

|

(14,010)

|

1,212,940

|

-2.0%

|

|

Rio de Janeiro

|

266,861

|

-

|

16,482

|

(21,009)

|

(5,020)

|

257,314

|

-3.6%

|

|

Other Markets

|

77,216

|

-

|

1,391

|

(17,957)

|

684

|

61,335

|

-20.6%

|

|

Total

|

1,581,402

|

90,113

|

95,407

|

(216,988)

|

(18,346)

|

1,531,588

|

-3.1%

|

¹ Adjustments reflect the updates related to the project scope, launch date and pricing update in the period.

Gafisa continues to maintain a commercial balance between launches and finished units. The inventory of finished units fell from R$507.2 million (32.1% of total inventory) in 3Q17 to R$473.5 million in 4Q17 (30.9% of total). Compared to 2016, this decrease was sharper and reached 20.1%.

The inventory of projects outside the strategic markets, of R$61.3 million, represents 4.0% of the total inventory, of which 59.3% are finished units.

Of the total inventory completed, 60.8% are commercial projects. This proportion is due to lower sales speed in this segment, where liquidity is still relatively lower.

Table 4 – Inventory at Market Value - Work Status – POC - (R$ 000)

|

|

Not

Initiated

|

Up to 30% built

|

30% to 70% built

|

More than 70% built

|

Finished Units

|

Total 4Q17

|

|

São Paulo

|

258,561

|

26,914

|

516,072

|

192,489

|

218,905

|

1,212,940

|

|

Rio de Janeiro

|

-

|

7,768

|

-

|

31,355

|

218,190

|

257,314

|

|

Other Markets

|

24,935

|

-

|

-

|

-

|

36,400

|

61,335

|

|

Total

|

283,496

|

34,682

|

516,072

|

223,844

|

473,494

|

1,531,588

|

Delivered Projects and Transfer

The Company delivered 293 units in 4Q17, all in project Barra Viva, with PSV of R$41.2 million. In 2017, deliveries totaled 2,182 units and R$861.3 million. Currently, Gafisa manages the construction of 20 projects, all of which are on schedule according to the Company’s business plan.

Table 5 – Delivered Projects

|

Project

|

City

|

Period

|

PSV (% Gafisa)

R$ Thousand

|

|

Easy Tatuape

|

São Paulo/SP

|

1Q17

|

60,986

|

|

Hi Guaca

|

São Paulo/SP

|

1Q17

|

64,224

|

|

Home Espaço Cerâmica

|

São Caetano do Sul/SP

|

1Q17

|

139,847

|

|

Easy Cidade Universitária

|

São Paulo/SP

|

2Q17

|

151,921

|

|

Square Osasco F1l1

|

Osasco/SP

|

2Q17

|

85,814

|

|

Ristretto Lorian Boulevard

|

São Paulo/SP

|

2Q17

|

178,992

|

|

Today Modern Residences

|

Rio de Janeiro/RJ

|

2Q17

|

63,141

|

|

Go Maraville

|

Jundiaí/SP

|

3Q17

|

75,227

|

|

Barra Viva (Harmonia/Sonho/Vida)

|

São Paulo/SP

|

4Q17

|

41,171

|

|

TOTAL

|

|

|

861,325

|

Over the past few years, the Company has been taking steps to improve the performance of its receivables/transfer process, in an attempt to achieve higher rates of return on capital employed. Currently, the Company’s strategy is to transfer 90% of eligible units in a 90-day period after the delivery of the project. In accordance with this policy, transfers in 4Q17 totaled R$74.8 million, 45.2% lower than in 4Q16 and 40.4% lower than in 3Q17, due to a reduced number of deliveries in the period. In the last 12 months, transfers totaled R$441.2 million in 2017 and for the same reason were 40.4% lower than the same period in in 2016.

Table 6 – Transfer

|

|

4Q17

|

3Q17

|

Q/Q (%)

|

4Q16

|

Y/Y (%)

|

2017

|

2016

|

Y/Y (%)

|

|

PSV Transferred¹

|

74,824

|

125,609

|

-40.4%

|

136,608

|

-45.2%

|

441,217

|

515,341

|

-14.4%

|

|

Delivered Projects

|

1

|

1

|

-

|

3

|

-66.7%

|

9

|

16

|

-43.8%

|

|

Delivered Units

|

293

|

296

|

-1.0%

|

416

|

-29.6%

|

2,182

|

3,527

|

-38.1%

|

|

Delivered PSV²

|

41,171

|

75,227

|

-45.3%

|

292,736

|

-85.9%

|

861,325

|

1,745,563

|

-50.7%

|

1) PSV refers to the potential sales value of the units transferred to financial institutions;

2) PSV = Potential sales value of delivered units.

Landbank

The Company’s landbank, with a PSV of R$4.3 billion, represents 36 potential projects/phases or nearly 8 thousand units. About 60% of the total land was acquired through swaps, being the largest portion

located in Rio de Janeiro. In 4Q17, the Company acquired two new areas of land in São Paulo, as swap, with potential PSV of R$136.6 million.

Table 7 - Landbank (R$ 000)

|

|

PSV

(% Gafisa)

|

% Swap

Total

|

% Swap Units

|

% Swap Financial

|

Potential Units

(% Gafisa)

|

Potential

Units (100%)

|

|

São Paulo

|

2,520,511

|

56.5%

|

49.7%

|

6.9%

|

5,734

|

6,405

|

|

Rio de Janeiro

|

1,774,833

|

73.0%

|

73.0%

|

0.0%

|

2,646

|

2,700

|

|

Total

|

4,295,344

|

62.3%

|

59.2%

|

3.1%

|

8,380

|

9,105

|

1) The swap percentage is measured compared to the historical cost of land acquisition.

2) Potential units are net of swaps and refer to the Gafisa’s and/or its partners’ stake in the project.

Table 8 - Changes in the Landbank (4Q17 x 3Q17 - R$ 000)

|

|

Initial Landbank

|

Land Acquisition

|

Launches

|

Dissolutions

|

Adjustments

|

Final Landbank

|

|

São Paulo

|

2,518,279

|

136,551

|

(90,113)

|

|

(44,206)

|

2,520,511

|

|

Rio de Janeiro

|

1,774,833

|

-

|

-

|

|

-

|

1,774,833

|

|

Total

|

4,293,112

|

136,551

|

(90,113)

|

-

|

(44,206)

|

4,295,344

|

FINANCIAL RESULTS

Revenue

Net revenues in 2017 totaled R$608.8 million, down 33.5% from 2016. In 4Q17 net revenues totaled R$164.7 million, up 2.7% from 3Q17 and down 37.6% from 4Q16. Revenue recognition is affected by the mix of net sales in the period, with sales concentrated in the most recent launches, with small percentage of completed work and, consequently, lower revenue recognition. Dissolutions are still materially impacting the Company’s revenues.

Table 9 – Revenue Recognition (R$ 000)

|

|

4Q17

|

4Q16

|

|

Launches

|

Pre-Sales

|

%

Pre-Sales

|

Revenue

|

%

Revenue

|

Pre-Sales

|

%

Pre-Sales

|

Revenue

|

%

Revenue

|

|

2017

|

52,872

|

43.5%

|

19,337

|

11.7%

|

-

|

0.0%

|

-

|

0.0%

|

|

2016

|

22,514

|

18.5%

|

28,304

|

17.2%

|

251,151

|

70.6%

|

29,772

|

11.3%

|

|

2015

|

31,236

|

25.7%

|

73,273

|

44.5%

|

54,754

|

15.4%

|

58,148

|

22.0%

|

|

2014

|

24,650

|

20.3%

|

24,001

|

14.6%

|

14,391

|

4.0%

|

83,746

|

31.7%

|

|

2013

|

935

|

0.8%

|

12,643

|

7.7%

|

21,414

|

6.0%

|

62,690

|

23.8%

|

|

≤ 2012

|

(10,627)

|

-8.7%

|

7,147

|

4.3%

|

14,061

|

4.0%

|

29,460

|

11.2%

|

|

Total

|

121,581

|

|

164,706

|

|

355,771

|

|

263,817

|

|

|

SP + RJ

|

106,066

|

87.2%

|

163,097

|

99.0%

|

355,388

|

99.9%

|

264,958

|

100.4%

|

|

Other Markets

|

15,515

|

12.8%

|

1,609

|

1.0%

|

382

|

0.1%

|

(1,141)

|

-0.4%

|

Gross Profit & Margin

Adjusted gross profit and margin in the 4Q17 were impacted by provisions totaling R$147.5 million due to pricing adjustments to certain land areas and inventory units, which were sold below the accounting value. Thus, Gafisa recognized a gross loss of R$170.7 million in the quarter, accumulating a gross loss of R$209.9 million in 2017. Excluding these adjustments, the recurring adjusted gross profit would reach R$2.0 million in 4Q17 and would end the year at R$53.9 million. The recurring adjusted gross margin would be 1.2% in 4Q17 and 8.9% in 2017.

Details of Gafisa's gross margin breakdown in 4Q17 are presented below

.

Table 10 – Gross Margin (R$ 000)

|

|

4Q17

|

3Q17

|

Q/Q(%)

|

4Q16

|

Y/Y (%)

|

2017

|

2016

|

Y/Y(%)

|

|

Net Revenue

|

164,706

|

160,325

|

2.7%

|

263,817

|

-37.6%

|

608,823

|

915,698

|

-33.5%

|

|

Gross Profit

|

(170,727)

|

(7,631)

|

2137.3%

|

(144,018)

|

18.5%

|

(209,928)

|

(113,515)

|

84.9%

|

|

Gross Margin

|

-103.7%

|

-4.8%

|

-

|

-54.6%

|

-

|

-34.5%

|

-12.4%

|

-

|

|

(-) Financial Costs

|

25,399

|

26,317

|

-3.5%

|

38,792

|

-34.5%

|

116,515

|

156,812

|

-25.7%

|

|

Adjusted Gross Profit

(1)

|

(145,328)

|

18,686

|

-

|

(105,226)

|

38.1%

|

(93,413)

|

43,295

|

-

|

|

Adjusted Gross Margin

(1)

|

-88.2%

|

11.7%

|

-

|

-39.9%

|

-

|

-15.3%

|

4.7%

|

-

|

|

(-) Landbank impairment

|

147,332

|

-

|

-

|

159,931

|

-7.9%

|

147,332

|

159,931

|

-7.9%

|

|

Recurring Adjusted Gross Profit

|

2,004

|

18,686

|

-89.3%

|

54,705

|

-96.3%

|

53,919

|

203,226

|

-73.5%

|

|

Recurring Adjusted Gross Margin

|

1.2%

|

11.7%

|

-1,044 bps

|

20.7%

|

-

|

8.9%

|

22.2%

|

-1334 bps

|

1) Adjusted by capitalized interests.

Selling, General and Administrative Expenses (SG&A)

In our efforts towards greater efficiency, in 2017, we adopted a new and more balanced operational structure design. This redesign showed positive results, allowing costs and expenses reductions and placing us in a competitive position, with greater efficiency and speed, for a potential new development cycle of the Brazilian real estate market.

In 4Q17, the selling, general and administrative expenses (SG&A) totaled R$48.6 million, 9.5% up from 3Q17 and 26.2% down from 4Q16. In the year to date, the SG&A totaled R$180.3 million, 10.5% down from the same period in 2016.

General and administrative expenses totaled R$24.2 million, down 25.7% from 4Q16. The 12.7% increase compared to 3Q17 reflects IT licenses’ renewals and results sharing provision. The annual reduction reached 13.0%.

Selling expenses totaled R$24.4 million, a 6.4% increase from the 3Q17. In comparison to 4Q16, selling expenses went down 26.6%, mainly due to a reduced volume of launches. In 2017, the decrease was 7.8%, effect of lower sales volume in the period.

Table 11 – SG&A Expenses (R$ 000)

|

|

4Q17

|

3Q17

|

Q/Q(%)

|

4Q16

|

Y/Y (%)

|

2017

|

2016

|

Y/Y(%)

|

|

Selling Expenses

|

(24,399)

|

(22,929)

|

6.4%

|

(33,254)

|

-26.6%

|

(87,568)

|

(94,946)

|

-7.8%

|

|

G&A Expenses

|

(24,165)

|

(21,441)

|

12.7%

|

(32,515)

|

-25.7%

|

(92,713)

|

(106,585)

|

-13.0%

|

|

Total SG&A Expenses

|

(48,564)

|

(44,370)

|

9.4%

|

(65,769)

|

-26.2%

|

(180,281)

|

(201,531)

|

-10.5%

|

The Other Operating Revenues/Expenses totaled R$150.3 million impacted by Alphaville's impairment and higher expenses with lawsuits, due to arbitrage processes.

The table below contains more details on the breakdown of this expense.

Table 12 – Other Operating Revenues/Expenses (R$ 000)

|

|

4Q17

|

3Q17

|

Q/Q(%)

|

4Q16

|

Y/Y (%)

|

2017

|

2016

|

Y/Y(%)

|

|

Litigation Expenses

|

(46,417)

|

(14,654)

|

216.8%

|

(26,255)

|

76.8%

|

(107,848)

|

(70,798)

|

52.3%

|

|

Loss on investment at fair value

|

(101,953)

|

-

|

-

|

-

|

-

|

(101,953)

|

-

|

-

|

|

Others

|

(1,876)

|

4,625

|

-140.6%

|

(4,683)

|

-59.9%

|

(1,749)

|

(8,194)

|

-78.7%

|

|

Total

|

(150,246)

|

(10,029)

|

1,398.1%

|

(30,938)

|

385.6%

|

(211,550)

|

(78,992)

|

167.8%

|

Adjusted EBITDA

The recurring EBITDA (excluding the pricing adjustments to inventories and land) was negative R$249.0 million in 2017, compared with negative R$83.5 million in 2016. In 4Q17, adjusted EBITDA according to the same criterion was negative R$92.4 million.

It is worth noting that Gafisa's adjusted EBITDA does not consider the impacts of the income from discontinued operations (Tenda) and of Alphaville’s equity income.

Table 13 – Adjusted EBITDA (R$ 000)

|

|

4Q17

|

3Q17

|

Q/Q(%)

|

4Q16

|

Y/Y (%)

|

2017

|

2016

|

Y/Y(%)

|

|

Net Income

|

(462,615)

|

(157,841)

|

193.1%

|

(999,308)

|

-53.7%

|

(849,856)

|

(1,163,596)

|

-27.0%

|

|

Discontinued Operation Result

(1)

|

-

|

-

|

-

|

(683,360)

|

-

|

98,175

|

(653,156)

|

-

|

|

(-) Landbank impairment

|

(147,332)

|

-

|

-

|

(159,931)

|

-7.9%

|

(147,332)

|

(159,931)

|

-7.9%

|

|

Adjusted Net Income

(1)

|

(315,283)

|

(157,841)

|

99.7%

|

(156,017)

|

102.1%

|

(800,699)

|

(350,509)

|

128.4%

|

|

(+) Financiaç Results

|

24,249

|

21,069

|

15.1%

|

15,582

|

55.6%

|

107,268

|

25,679

|

317.7%

|

|

(+) Income Taxes

|

(24,773)

|

(622)

|

3882.8%

|

67,785

|

-

|

(23,100)

|

9,760

|

-

|

|

(+) Depreciation & Amortization

|

31,560

|

8,379

|

276.7%

|

10,560

|

198.9%

|

57,522

|

33,892

|

69.7%

|

|

(+) Capitalized Interests

|

25,399

|

26,317

|

-3.5%

|

38,792

|

-34.5%

|

116,515

|

156,812

|

-25.7%

|

|

(+) Expense w Stock Option Plan

|

2,067

|

1,194

|

73.1%

|

1,313

|

57.4%

|

4,964

|

6,821

|

-27.2%

|

|

(+) Minority Shareholders

|

(161)

|

(66)

|

143.9%

|

(171)

|

-5.8%

|

(281)

|

1,871

|

-

|

|

(+) AUSA Income Effect

|

62,569

|

57,371

|

9.1%

|

21,892

|

185.8%

|

186,856

|

32,122

|

481.7%

|

|

(+) Effect of impairment of investment in AUSA

|

101,953

|

-

|

-

|

-

|

-

|

101,953

|

-

|

-

|

|

Recurring Adjusted EBITDA

(2)

|

(92,420)

|

(44,199)

|

109.1%

|

(264)

|

34868.7%

|

(249,002)

|

(83,552)

|

198.0%

|

|

(+) Landbank impairment

|

(147,332)

|

-

|

-

|

(159,931)

|

-7.9%

|

(147,332)

|

(159,931)

|

-7.9%

|

|

Adjusted EBITDA

|

(239,752)

|

(44,199)

|

442.4%

|

(160,195)

|

49.7%

|

(396,334)

|

(243,483)

|

62.8%

|

1) Sale of Tenda shares;

2) Adjusted by expense with stock option plan (non-cash) and minority shareholders. EBITDA does not consider Alphaville's equity income.

Financial Results

In the 4Q17, financial results totaled R$6.0 million, 8.3% lower than in 3Q17 and 39.1% lower than in 4Q16, reflecting the lower cash balance in the period and the interest rate drop incurring on this balance. Financial expenses reached R$30.3 million, compared to the R$27.7 million in 3Q17 and R$25.5 million in 4Q16, mainly, reflecting the financial expenses related to the issue of debentures in the period.

Therefore, the net financial result was negative R$24.2 million in the 4Q17, compared to the negative net financial results of R$21.1 million in the 3Q17 and R$15.6 million in the 4Q16. The accumulated net financial result was R$107.3 million negative in 2017.

Taxes

In the 4Q17, the income tax and social contribution line was positive at R$24.8 million, reflecting the tax credit of R$25.0 million deriving from the impairment of goodwill recorded in Alphaville. For this same reason, provision for income tax and social contribution was R$23.1 million positive in 2017.

Net Income

As a result of the effects previously discussed, the net income in the 4Q17, excluding the results of the Alphaville’s equity income and the adjustments to the inventory and land pricing and goodwill of interest in Alphaville, was negative R$125.3 million, compared to a net loss of R$100.6 million in 3Q17 and R$134.1 million in 4Q16. In the year to date, the recurring adjusted net loss was R$486.4 million.

Table 14 – Net Income (R$ 000)

|

|

4Q17

|

3Q17

|

Q/Q(%)

|

4Q16

|

Y/Y (%)

|

2017

|

2016

|

Y/Y(%)

|

|

Net Revenue

|

164,706

|

160,325

|

2.7%

|

263,817

|

-37.6%

|

608,823

|

915,698

|

-33.5%

|

|

Gross Profit

|

(170,727)

|

(7,631)

|

2137.3%

|

(144,018)

|

18.5%

|

(209,928)

|

(113,515)

|

84.9%

|

|

Gross Margin

|

-103,7%

|

-4.8%

|

-9890 bps

|

-54.6%

|

-4907 bps

|

-34.5%

|

-12.4%

|

-2208 bps

|

|

(-) Landbank impairment

|

(147,332)

|

-

|

-

|

(159,931)

|

-7.9%

|

(147,332)

|

(159,931)

|

-7.9%

|

|

Recurring Adjusted Gross Profit

(1)

|

2,004

|

18,686

|

-89.3%

|

54,703

|

-96.3%

|

53,919

|

203,226

|

-73.5%

|

|

Recurring Adjusted Gross Margin

|

1.2%

|

11.7%

|

-1044 bps

|

20.7%

|

-1952 bps

|

8.9%

|

22.2%

|

413 bps

|

|

Recurring Adjusted EBITDA

(2)

|

(92,420)

|

(44,199)

|

109.1%

|

(264)

|

34869%

|

(249,002)

|

(83,552)

|

198%

|

|

Recurring Adjusted EBITDA Margin

|

-56.1%

|

-27.6%

|

-2854 bps

|

-0.1%

|

-5601 bps

|

-40.9%

|

-9.1%

|

-3177 bps

|

|

Income from Discontinued

Operation

(3)

|

-

|

-

|

-

|

(683,360)

|

-

|

98,175

|

(653,156)

|

-

|

|

Adjusted Net Income

(4)

|

(315,283)

|

(157,841)

|

99.7%

|

(156,017)

|

102.1%

|

(800,699)

|

(350,509)

|

128.4%

|

|

( - ) Equity income from Alphaville

|

(62,569)

|

(57,371)

|

9.1%

|

(21,892)

|

185.8%

|

(186,856)

|

(32,122)

|

481.7%

|

|

( - ) Impairment of invesment in Alphaville

|

(127,429)

|

-

|

-

|

-

|

-

|

(127,429)

|

-

|

-

|

|

Adjusted Net Income (ex-AUSA)

|

(125,285)

|

(100,470)

|

24.7%

|

(134,125)

|

-6.6%

|

(486,414)

|

(318,387)

|

52.8%

|

1) Adjusted by capitalized interests;

2) Adjusted by note 1, by expense with stock option plan (non-cash) and minority shareholders. EBITDA does not consider Alphaville's equity income;

3) Sale of Tenda shares;

4) Adjusted by item 3.

Backlog of Revenues and Results

The backlog of results to be recognized under the PoC method totaled R$215.8 million at the end of 4Q17, with margin to be recognized of 34.8%, same level of the previous quarter. The backlog performance reflects the good execution of the launches in 2017, signaling a positive outlook for revenue volume and gross profit in the next periods.

Table 15 – Backlog Results (REF) (R$ 000)

|

|

4QT17

|

3Q17

|

Q/Q(%)

|

4Q16

|

Y/Y(%)

|

|

Backlog Revenues

|

620,821

|

630,168

|

-1.5%

|

505,991

|

22.7%

|

|

Backlog Costs (units sold)

|

(405,064)

|

(409,994)

|

-1.2%

|

(315,061)

|

28.6%

|

|

Backlog Results

|

215,758

|

220,174

|

-2.0%

|

190,930

|

13.0%

|

|

Backlog Margin

|

34.8%

|

34.9%

|

0.1 p.p.

|

37.7%

|

-2.9 p.p.

|

1) Backlog results net of PIS/COFINS taxes (3.65%) and excluding the impact of PVA (Present Value Adjustment) method according to Law 11.638.

2) Backlog results comprise the projects restricted by condition precedent.

BALANCE SHEET

Cash and Cash Equivalents and Marketable Securities

On December 31, 2017, cash and cash equivalents and marketable securities totaled R$147.5 million, down 5.8% from September 30, 2017.

Receivables

At the end of 4Q17, total accounts receivable totaled R$1.3 billion, a 6.5% decrease compared to R$1.4 billion in 3Q17. Currently, the Company has approximately R$351.8 million in accounts receivable from finished units.

Table 16 – Total Receivables (R$ 000)

|

|

4Q17

|

3Q17

|

Q/Q(%)

|

4Q16

|

Y/Y (%)

|

|

Receivables from developments (off balance sheet)

|

644,340

|

654,040

|

-1.5%

|

525,159

|

22.7%

|

|

Receivables from PoC- ST (on balance sheet)

|

485,324

|

570,303

|

-14.9%

|

722,640

|

-32.8%

|

|

Receivables from PoC- LT (on balance sheet)

|

199,317

|

197,407

|

1.0%

|

271,322

|

-26.5%

|

|

Total

|

1,328,981

|

1,421,750

|

-6.5%

|

1,519,121

|

-12.5%

|

Notes: ST – Short term | LT- Long term | PoC – Percentage of Completion Method.

Receivables from developments: accounts receivable not yet recognized according to PoC and BRGAAP

Receivables from PoC: accounts receivable already recognized according to PoC and BRGAAP.

Table 17 – Receivables Schedule (R$ 000)

|

|

Total

|

2018

|

2019

|

2020

|

2021

|

2022 – an after

|

|

Receivables from PoC

|

684,641

|

485,324

|

104,246

|

87,554

|

2,992

|

4,525

|

Cash Generation

The operating cash generation totaled R$32.0 million in the 4Q17, lower than the R$93.0 million generated in 3Q17, mainly due to the lower number of delivered projects and consequent reduction in transfers and higher construction cost due to the start of construction works in certain projects. In the year to date, excluding the inflow of funds deriving from Tenda operation, the operating cash flows totaled R$321.8 million, with a net cash generation of R$103.5 million.

Table 18 – Cash Generation (R$ 000)

|

|

1Q17

|

2Q17

|

3Q17

|

4Q17

|

|

Availabilities

1

|

236,934

|

214,572

|

155,997

|

147,462

|

|

Change in Availabilities² (1)

|

(16,246)

|

(22,362)

|

(58,575)

|

(8,535)

|

|

Total Debt + Investor Obligations

|

1,589,312

|

1,326,977

|

1,219,273

|

1,104,898

|

|

Change in Total Debt + Investor Obligations (2)

|

(49,492)

|

(262,335)

|

(107,704)

|

(114,375)

|

|

Other Investments

|

237,109

|

237,109

|

237,109

|

237,109

|

|

Change in Other Investments (3)

|

-

|

-

|

-

|

-

|

|

Tenda transaction inflow (4)

|

-

|

219,510

|

-

|

105,171

|

|

Cash Generation in the period (1) - (2) + (3) -(4)

|

33,246

|

20,463

|

49,130

|

669

|

|

Cash Generation Final

|

33,246

|

53,710

|

102,840

|

103,508

|

1) Cash and cash equivalentes and marketable securities.

Liquidity

At the end of the 4Q17, the Company’s Net Debt/Shareholders’ Equity ratio was 126.1%, reflecting the quarterly adjustments and accumulated losses over the last periods, higher than the debt reduction. Excluding project finance, the Net Debt/Shareholders’ Equity ratio was 29.5%.

It is worth mentioning that, in December 2017, Gafisa paid to Caixa Economica Federal the last installment of the 7

th

Issuance of Debentures, totaling R$157.5 million, including principal and interest. The funds partially derived from the anticipated refund referring to Tenda’s capital reduction.

In the 4Q17, the gross debt reached R$1.1 billion, down 9.4% q-o-q and and withnexpressive reduction of 32.5% y-o-y. The net debt amounted to R$958 million, 9.9% lower than in 3Q7.

On February 28, 2018, Gafisa’s Board of Directors ratified the capital increase approved at the Extraordinary Shareholders’ Meeting held in December 2017. This capital increase totaling R$250.8 million, contributed to adjust the Company’s capital structure and strengthen its operational positioning to this new cycle of the Brazilian real estate market.

Table 19 – Debt and Investor Obligations (R$ 000)

|

|

4Q17

|

3Q17

|

Q/Q (%)

|

4Q16

|

Y/Y (%)

|

|

Debentures - FGTS (A)

|

-

|

154,830

|

-

|

302,363

|

-

|

|

Debentures – Working Capital (B)

|

207,713

|

127,424

|

63.0%

|

148,905

|

39.5%

|

|

Project Financing SFH – (C)

|

733,103

|

753,639

|

-2.7%

|

1,022,038

|

-28.3%

|

|

Working Capital (D)

|

164,082

|

183,379

|

-10.5%

|

164,261

|

-0.1%

|

|

Total (A)+(B)+(C)+(D) = (E)

|

1,104,898

|

1,219,272

|

-9.4%

|

1,637,567

|

-32.5%

|

|

Investor Obligations (F)

|

-

|

-

|

-

|

1,237

|

-

|

|

Total Debt (E)+(F) = (G)

|

1,104,898

|

1,219,272

|

-9.4%

|

1,638,804

|

-32.6%

|

|

Cash and Availabilities¹ (H)

|

146,899

|

155,998

|

-5.8%

|

253,180

|

-42.0%

|

|

Net Debt (G)-(H) = (I)

|

957,999

|

1,063,274

|

-9.9%

|

1,385,624

|

-30.9%

|

|

Equity + Minority Shareholders (J)

|

759,404

|

1,221,093

|

-37.8%

|

1,930,453

|

-60.7%

|

|

(Net Debt) / (Equity) (I)/(J) = (K)

|

126.1%

|

87.1%

|

3900 bps

|

71.8%

|

5430 bps

|

|

(Net Debt – Proj Fin) / Equity (I)-((A)+(C))/(J) = (L)

|

29.5%

|

12.7%

|

1686 bps

|

3.2%

|

2637 bps

|

1) Cash and cash equivalents and marketable securities.

The Company ended 4Q17 with R$569.3 million in total debt maturing in the short term, or 51.5% of the total debt, compared to 48.7% at the end of 3Q17. We point out that Gafisa renegotiated the maturity of debts expiring in 2018 and 2019 in the approximate amount of R$456.3 million for 2020 and 2021, which was condition precedent to the capital increase mentioned above. The new debt profile can be viewed in the 1Q18 earnings results release.

On December 31, 2017

, the consolidated average cost of debt was 11.65% p.a..

Table 20 – Debt Maturity

|

(R$ mil)

|

Average Cost (p.y.)

|

Total

|

Until Dec/18

|

Until Dec/19

|

Until Dec/20

|

Until Dec/21

|

|

Debentures - FGTS (A)

|

-

|

-

|

-

|

-

|

-

|

-

|

|

Debentures – Working Capital (B)

|

CDI + 2.8% / CDI + 5.25% / IPCA + 8.22%

|

207,713

|

88,177

|

51,530

|

68,006

|

-

|

|

Project Financing SFH (C)

|

TR + 8.30% to 14.19% / 12.87% and 137% CDI

|

733,103

|

371,847

|

260,078

|

98,422

|

2,756

|

|

Working Capital (D)

|

130% CDI / CDI + 2.5% / CDI + 3% / CDI + 4.25% / CDI + 5%

|

164,082

|

109,226

|

27,149

|

18,377

|

9,330

|

|

Total Debt (A)+(B)+(C)+(D) = (E)

|

|

1,104,898

|

569,250

|

338,757

|

184,804

|

12,087

|

|

% of Total Maturity per period

|

|

|

51.52%

|

30.66%

|

16.73%

|

|

Project debt maturing as % of total debt ((A)+ (C))/ (E)

|

|

|

65.32%

|

76.77%

|

53.26%

|

|

Corporate debt maturing as % of total debt ((B)+(D))/ (E)

|

|

|

34.68%

|

23.23%

|

46.74%

|

|

Ratio Corporate Debt / Mortgage

|

33.6% / 66.4%

|

|

|

|

|

|

|

|

|

|

|

|

|

SUBSEQUENT EVENT

Capital Increase

On December 20, 2017, the Extraordinary Shareholders’ Meeting approved the Company’s capital increase, by means of the issue, for private subscription of, at least, 13,333,334 shares (R$200,000,010.00) and, at most, twenty million (20,000,000) new non-par, book-entry, registered, common shares, considering (i) the term to exercise the preemptive right, (ii) the two periods to subscribe to unsubscribed shares and (iii) the cancellations of preemptive rights; the Board of Directors, in a meeting held on February 28, 2018, ratified the partial capital increase, so that the Company’s capital stock will total R$2,521,318,365.26, divided into 44,757,914 non-par, book-entry, registered, common shares, and total subscription, including the amount allocated to the capital reserve reached R$250,766,280.00.

São Paulo, March 07, 2018.

Alphaville Urbanismo SA releases its results for the fiscal year of 2017.

In 2017, net revenues were R$ 108 million and the net income was R$-764 million.

|

|

2017

|

2016

|

2017 vs. 2016

|

|

Net revenue

|

108

|

716

|

-85%

|

|

Net profit/loss

|

-764

|

-108

|

n/a

|

|

|

|

|

|

For further information, please contact our Investor Relations team at

ri@alphaville.com.br

or +55 11 3038-7131.

Impairment

In 2017, the Company’s impairment test of the goodwill on the acquisition and reassessment of investment in Alphaville resulted in the recognition of an impairment provision of R$127.4 million.

The Company assessed the recovery of goodwill adopting the concept of “value in use”, using a discounted cash flows model, which involves the use of cash flows assumptions, judgments and estimates. These assumptions are based on the business plan approved by Management and on market comparable data. The main assumptions adopted were: a) revenues – projected between 2018 and 2022 considering sales growth, work progress and customer base; b) operating costs and expenses projected in line with historical performance and historical growth of revenues; c) discount rate – 14.70% (nominal), d) growth rate used to extrapolate cash flow projections – 6.8% and e) perpetuity – 4.1% p.a. growth corresponding to the estimate of long-term inflation projected by the Brazilian Central Bank.

It is also worth mentioning that due to the negative shareholders’ equity of Alphaville at the end of 2017, the Company reduced to zero the accounting balance of its 30% stake in Alphaville, which accordingly, implies the end of future consolidation of losses into Gafisa due to Alphaville’s results by means of equity income. From now on, only Alphaville’s positive results in the future may favorably impact Gafisa’s results, except for any potential impairment of this investment.

Consolidated Financial Statements

|

|

4Q17

|

3Q17

|

Q/Q (%)

|

3Q16

|

Y/Y (%)

|

12M17

|

12M16

|

Y/Y (%)

|

|

Net Revenue

|

164,706

|

160,325

|

3%

|

263,817

|

-38%

|

608,823

|

915,698

|

-34%

|

|

Operating Costs

|

(335,433)

|

(167,956)

|

100%

|

(407,835)

|

-18%

|

(818,751)

|

(1,029,213)

|

-20%

|

|

Gross Profit

|

(170,727)

|

(7,631)

|

2137%

|

(144,018)

|

19%

|

(209,928)

|

(113,515)

|

85%

|

|

Gross Margin

|

-103,7%

|

-4,8%

|

-9890 bps

|

-54,6%

|

-4907 bps

|

-34,5%

|

-12,4%

|

-2208 bps

|

|

Operating Expenses

|

(292,573)

|

(129,829)

|

125%

|

(153,812)

|

90%

|

(654,216)

|

(362,747)

|

80%

|

|

Selling Expenses

|

(24,399)

|

(22,929)

|

6%

|

(33,254)

|

-27%

|

(87,568)

|

(94,946)

|

-8%

|

|

General and Administrative Expenses

|

(24,165)

|

(21,441)

|

13%

|

(32,516)

|

-26%

|

(92,713)

|

(106,585)

|

-13%

|

|

Other Operating Revenue/Expenses

|

(150,246)

|

(10,029)

|

1398%

|

(30,938)

|

386%

|

(211,550)

|

(78,992)

|

168%

|

|

Depreciation and Amortization

|

(31,560)

|

(8,379)

|

277%

|

(10,560)

|

199%

|

(57,522)

|

(33,892)

|

70%

|

|

Equity Income

|

(62,203)

|

(67,051)

|

-7%

|

(46,544)

|

34%

|

(204,863)

|

(48,332)

|

324%

|

|

Operational Result

|

(463,300)

|

(137,460)

|

237%

|

(297,830)

|

56%

|

(864,144)

|

(476,262)

|

81%

|

|

Financial Income

|

6,053

|

6,604

|

-8%

|

9,945

|

-39%

|

29,733

|

58,439

|

-49%

|

|

Financial Expenses

|

(30,302)

|

(27,673)

|

10%

|

(25,527)

|

19%

|

(137,001)

|

(84,118)

|

63%

|

|

Net Income Before taxes on Income

|

(487,549)

|

(158,529)

|

208%

|

(313,412)

|

56%

|

(971,412)

|

(501,941)

|

94%

|

|

Deferred Taxes

|

25,932

|

-

|

0%

|

(90,321)

|

-129%

|

25,932

|

(89,358)

|

-129%

|

|

Income Tax and Social Contribution

|

(1,159)

|

622

|

-286%

|

(3,114)

|

-63%

|

(2,832)

|

(10,722)

|

-74%

|

|

Net Income After Taxes on Income

|

(462,776)

|

(157,907)

|

193%

|

(406,847)

|

14%

|

(948,312)

|

(602,021)

|

58%

|

|

Continued Op. Net Income

|

(462,776)

|

(157,907)

|

193%

|

(406,847)

|

14%

|

(948,312)

|

(602,021)

|

58%

|

|

Discontinued Op. Net Income

|

-

|

-

|

0%

|

(592,631)

|

-100%

|

98,175

|

(559,704)

|

-118%

|

|

Minority Shareholders

|

(161)

|

(66)

|

144%

|

(170)

|

-5%

|

(281)

|

1,871

|

-115%

|

|

Net Income

|

(462,615)

|

(157,841)

|

193%

|

(999,308)

|

-54%

|

(849,856)

|

(1,163,596)

|

-27%

|

Consolidated Balance Sheet

|

|

4Q17

|

3Q17

|

Q/Q(%)

|

4Q16

|

Y/Y(%)

|

|

Current Assets

|

|

|

|

|

|

|

Cash and cash equivalents

|

28,527

|

26,626

|

7%

|

29,534

|

-3%

|

|

Securities

|

118,935

|

129,372

|

-8%

|

223,646

|

-47%

|

|

Receivables from clients

|

484,761

|

570,303

|

-15%

|

722,640

|

-33%

|

|

Properties for sale

|

882,189

|

987,657

|

-11%

|

1,122,724

|

-21%

|

|

Other accounts receivable

|

110,626

|

122,968

|

-10%

|

106,791

|

4%

|

|

Prepaid expenses and other

|

5,535

|

5,526

|

0%

|

2,548

|

117%

|

|

Land for sale

|

102,352

|

3,270

|

3030%

|

3,306

|

2996%

|

|

|

-

|

-

|

0%

|

1,189,011

|

-100%

|

|

Subtotal

|

1,732,925

|

1,845,722

|

-6%

|

3,400,200

|

-49%

|

|

|

|

|

|

|

|

|

Long-term Assets

|

|

|

|

|

|

|

Receivables from clients

|

199,317

|

197,407

|

1%

|

271,322

|

-27%

|

|

Properties for sale

|

339,797

|

475,700

|

-29%

|

592,975

|

-43%

|

|

Other

|

86,351

|

193,076

|

-55%

|

93,476

|

-8%

|

|

Subtotal

|

625,465

|

866,183

|

-28%

|

957,773

|

-35%

|

|

Intangible. Property and Equipment

|

40,622

|

44,613

|

-9%

|

52,205

|

-22%

|

|

Investments

|

479,126

|

665,813

|

-28%

|

799,911

|

-40%

|

|

|

|

|

|

|

|

|

Total Assets

|

2,878,138

|

3,422,331

|

-16%

|

5,210,089

|

-45%

|

|

|

|

|

|

|

|

|

Current Liabilities

|

|

|

|

|

|

|

Loans and financing

|

481,073

|

354,592

|

36%

|

669,795

|

-28%

|

|

Debentures

|

88,177

|

238,671

|

-63%

|

314,139

|

-72%

|

|

Obligations for purchase of land and

advances from customers

|

156,457

|

170,680

|

-8%

|

205,388

|

-24%

|

|

Material and service suppliers

|

98,662

|

89,975

|

10%

|

79,120

|

25%

|

|

Taxes and contributions

|

46,430

|

50,412

|

-8%

|

51,842

|

-10%

|

|

Other

|

342,887

|

335,353

|

2%

|

303,454

|

13%

|

|

|

-

|

-

|

0%

|

651,812

|

-100%

|

|

Subtotal

|

1,213,686

|

1,239,683

|

-2%

|

2,275,550

|

-47%

|

|

|

|

|

|

|

|

|

Long-term liabilities

|

|

|

|

|

|

|

Loans and financings

|

416,112

|

582,426

|

-29%

|

516,505

|

-19%

|

|

Debentures

|

119,536

|

43,583

|

174%

|

137,129

|

-13%

|

|

Obligations for Purchase of Land and

advances from customers

|

152,377

|

98,117

|

55%

|

90,309

|

69%

|

|

Deferred taxes

|

74,473

|

100,405

|

-26%

|

100,405

|

-26%

|

|

Provision for Contingencies

|

82,063

|

72,381

|

13%

|

83,904

|

-2%

|

|

Other

|

60,487

|

64,643

|

-6%

|

75,834

|

-20%

|

|

Subtotal

|

905,048

|

961,555

|

-6%

|

1,004,086

|

-10%

|

|

|

|

|

|

|

|

|

Shareholders’ Equity

|

|

|

|

|

|

|

Shareholders’ Equity

|

755,557

|

1,217,086

|

-38%

|

1,928,325

|

-61%

|

|

Minority Shareholders

|

3,847

|

4,007

|

-4%

|

2,128

|

81%

|

|

Subtotal

|

759,404

|

1,221,093

|

-38%

|

1,930,453

|

-61%

|

|

Total Liabilities and Shareholders’ Equity

|

2,878,138

|

3,422,331

|

-16%

|

5,210,089

|

-45%

|

Cash Flow

|

|

4Q17

|

4Q16

|

12M17

|

12M16

|

|

Income Before Taxes on Income and Social Contribution

|

(487,549)

|

(855,281)

|

(971,413)

|

(1,043,812)

|

|

Expenses/Income not affecting working capital

|

267,063

|

895,365

|

554,781

|

1,036,838

|

|

Depreciation and amortization

|

6,084

|

10,560

|

32,046

|

33,892

|

|

Impairment

|

147,332

|

166,518

|

136,191

|

160,216

|

|

Expense with stock option plan and shares

|

2,066

|

1,315

|

4,964

|

6,821

|

|

Project delay fines

|

-

|

-

|

-

|

(1,404)

|

|

Unrealized interest and financial

|

(807)

|

25,609

|

46,168

|

100,508

|

|

Equity income

|

62,201

|

46,544

|

204,862

|

48,332

|

|

Disposal of fixed asset

|

-

|

6,165

|

-

|

7,666

|

|

Provision for guarantee

|

3,941

|

(3,156)

|

(3,498)

|

(12,390)

|

|

Provision for lawsuits

|

46,417

|

26,254

|

107,848

|

70,796

|

|

Profit Sharing provision

|

3,981

|

6,250

|

13,375

|

18,750

|

|

Allowance for doubtful accounts and dissolutions

|

(4,123)

|

(921)

|

13,644

|

6,950

|

|

Income from financial instruments

|

(29)

|

122

|

(819)

|

(13,404)

|

|

Provision for impairment of discontinued operation

|

-

|

610,105

|

-

|

610,105

|

|

Fair Value AUSA

|

101,953

|

-

|

101,953

|

-

|

|

Goodwill AUSA

|

25,476

|

-

|

25,476

|

-

|

|

Clients

|

79,562

|

89,117

|

260,090

|

288,999

|

|

Properties held for sale

|

(5,043)

|

21,371

|

258,476

|

21,759

|

|

Other accounts receivable

|

(44)

|

16,779

|

(9,316)

|

29,471

|

|

Prepaid expenses

|

(9)

|

(227)

|

(2,987)

|

(460)

|

|

Obligations on land purchase and advances from clients

|

40,037

|

19,723

|

13,137

|

(73,603)

|

|

Taxes and contributions

|

(3,982)

|

3,580

|

(5,412)

|

(9,874)

|

|

Providers

|

8,163

|

36,617

|

18,683

|

31,991

|

|

Salaries and payroll charges

|

(5,379)

|

(7,133)

|

(14,266)

|

(17,740)

|

|

Other liabilities

|

(8,527)

|

(29,753)

|

(43,920)

|

(152,209)

|

|

Related party transactions

|

(4,642)

|

15,870

|

(27,548)

|

100,207

|

|

Taxes paid

|

(1,159)

|

(4,077)

|

(2,832)

|

(10,722)

|

|

Cash provided by/used in operating activities /discontinued operation

|

-

|

(25,572)

|

51,959

|

68,821

|

|

Net cash from operating activities

|

5,920

|

176,379

|

206,861

|

269,666

|

|

Investment activities

|

-

|

-

|

-

|

-

|

|

Purchase of fixed and intangible asset

|

(2,093)

|

(5,389)

|

(20,463)

|

(35,838)

|

|

Capital contribution in subsidiaries

|

(3,892)

|

15,157

|

(2,598)

|

(110)

|

|

Redemption of financial investment

|

332,660

|

409,009

|

1,183,878

|

1,611,200

|

|

Funding financial investments

|

(322,224)

|

(377,828)

|

(1,079,168)

|

(1,417,794)

|

|

Cash provided by/used in investment activities / discontinued operation

|

-

|

(7,079)

|

48,663

|

4,997

|

|

Discontinued operation transaction costs

|

-

|

-

|

(9,545)

|

-

|

|

Receivable from exercise of preemptive rights Tenda

|

-

|

-

|

219,510

|

-

|

|

Tenda Capital Restitution

|

-

|

-

|

105,170

|

-

|

|

Net cash from investment activities

|

109,621

|

33,870

|

445,447

|

162,455

|

|

Financing activities

|

-

|

-

|

-

|

-

|

|

Related party contributions

|

6,281

|

(1,906)

|

5,044

|

(3,658)

|

|

Addition of loans and financing

|

(255,805)

|

63,500

|

-

|

579,391

|

|

Amortization of loans and financing

|

1,174,449

|

(302,155)

|

453,373

|

(944,795)

|

|

Share buyback

|

(1,032,204)

|

-

|

(1,032,204)

|

(8,693)

|

|

Result from the sale of treasury shares

|

818

|

2,149

|

818

|

9

|

|

Assignment of credit receivables, net

|

(21,513)

|

18,948

|

-

|

72,776

|

|

Loan operations with related parties

|

(5,625)

|

(6,400)

|

-

|

1,130

|

|

Sale of treasury shares

|

(1,554)

|

(2,149)

|

(1,237)

|

-

|

|

Cash provided by/used in financing activities/ discontinued operation

|

-

|

(67,946)

|

24,089

|

(135,291)

|

|

Paid dividends and interest on own capital

|

21,513

|

(17,682)

|

21,513

|

(17,682)

|

|

Net cash variation/discontinued operation

|

(113,640)

|

(313,641)

|

(528,604)

|

(456,813)

|

|

Increase (decrease) in cash and cash equivalents

|

-

|

(28,414)

|

(124,711)

|

(28,414)

|

|

Opening balance of cash and cash equivalents

|

1,901

|

(131,806)

|

(1,007)

|

(53,106)

|

|

Closing balance of cash and cash equivalentes

|

26,626

|

161,340

|

29,534

|

82,640

|

|

Increase (decrease) in cash and cash equivalents

|

28,527

|

29,534

|

28,527

|

29,534

|

|

Net cash variation/discontinued operation

|

1,901

|

(131,806)

|

(1,007)

|

(53,106)

|

|

Gafisa is one Brazil’s leading residential and commercial properties development and construction companies. Founded over 60 years ago, the Company is dedicated to growth and innovation oriented to enhancing the well-being, comfort and safety of an increasing number of households. More than 15 million square meters have been built, and approximately 1,100 projects delivered under the Gafisa brand - more than any other company in Brazil. Recognized as one of the foremost professionally managed homebuilders, Gafisa’s brand is also one of the most respected, signifying both quality and consistency. In addition to serving the upper-middle and upper class segments through the Gafisa brand, the Company also participates through its 30% interest in Alphaville, a leading urban developer in the national development and sale of residential lots. Gafisa S.A. is a Corporation traded on the Novo Mercado of the B3 – Brasil, Bolsa, Balcão (B3:GFSA3) and is the only Brazilian homebuilder listed on the New York Stock Exchange (NYSE:GFA) with an ADR Level III, which ensures best practices in terms of transparency and corporate governance

.

This release contains forward-looking statements about the business prospects, estimates for operating and financial results and Gafisa’s growth prospects. These are merely projections and, as such, are based exclusively on the expectations of management concerning the future of the business and its continued access to capital to fund the Company’s business plan. Such forward-looking statements depend, substantially, on changes in market conditions, government regulations, competitive pressures, the performance of the Brazilian economy and the industry, among other factors; therefore, they are subject to change without prior notice.

|

IR Contacts

Carlos Calheiros

Fernando Campos

Telephone: +55 11 3025-9242

Email: ri@gafisa.com.br

IR Website: www.gafisa.com.br/ri

Media Relations

Máquina Cohn & Wolfe

Marilia Paiotti / Bruno Martins

Telephone: +55 11 3147-7463

Fax: +55 11 3147-7438

E-mail: gafisa@grupomaquina.com

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: March 9, 2018

|

Gafisa S.A.

|

|

|

|

|

|

By:

|

|

|

|

Name: Sandro Gamba

Title: Chief Executive Officer

|

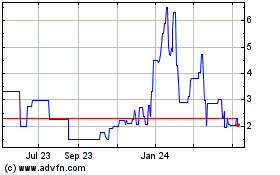

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Mar 2024 to Apr 2024

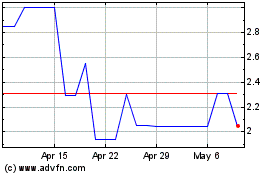

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Apr 2023 to Apr 2024