By Cara Lombardo

As Americans pay more for natural dog food, organic macaroni and

cheese and small-batch tequila, beer companies say light beer

drinkers want an upgrade, too.

Constellation Brands Inc., the U.S. distributor of Corona, and

Anheuser-Busch InBev SA are rolling out lower-calorie,

higher-priced brews they say are aimed at satisfying drinkers'

thirst for a more sophisticated light beer.

U.S. shipments of the biggest brands such as Bud Light and

Miller Lite have been falling for years, while shipments of

Michelob Ultra, a low-carbohydrate, low-calorie brew AB InBev

launched in 2002, jumped 21% last year and have increased every

year since 2011.

That is evidence there is a "leaky bucket" of light-beer

drinkers eager to move onto something better, according to Paul

Hetterich, president of Constellation's beer division.

"You think about every single consumer-goods category that's

been trading up," Mr. Hetterich said in an interview. "What has

been offered for light drinkers that has the attributes of light?

Hardly anything."

With that in mind, Constellation is descending onto Michelob

Ultra's turf with a new light beer called Corona Premier, the first

new Corona-branded drink in 29 years. Not to be outdone, AB InBev

is launching Michelob Ultra Pure Gold, an even lower-calorie

version of its Ultra that is made with organic grains.

A six-pack of regular Michelob Ultra costs about 15% more than

traditional light beer. Constellation said Corona Premier will be

priced the same as Corona and Corona Light, which sell for about

40% more than traditional light beers. Corona Premier has 90

calories -- nine fewer than Corona Light -- and Michelob Ultra has

95. Michelob Ultra Pure Gold will have 85 calories and cost about

15% more than Ultra, according to an AB InBev spokeswoman.

Constellation's chief marketing officer, Jim Sabia, said he

expects Corona Premier to resonate with men, particularly those

above 35 who represent a segment that drinks 54% of the country's

light beer.

Constellation, whose Mexican imports have been a bright spot in

U.S. beer sales, will spend $35 million launching Premier. The

company estimates it could sell between 841,000 and 1.7 million

barrels a year. By comparison, the company shipments of Corona

Light reached 1.2 million barrels last year, according to Beer

Marketer's Insights.

Justin Adams, a 31-year-old living in Asheville, N.C., said that

while most of his friends graduated to bitter IPAs after college,

he never acquired a taste for them and switched to Michelob Ultra

instead. "I've always drank light beer since I turned 21," Mr.

Adams said. "Michelob Ultra has a little bit more class than Bud

Light and Miller Lite."

The new offerings fill a void but also pose risks because brand

extensions often cut into existing sales or cause confusion, said

Harry Schuhmacher, editor and publisher of industry publication

Beer Business Daily. Corona Premier, Mr. Schuhmacher said, could

damage Corona's image as "a beach in a bottle" by making it more of

a fitness drink. "You're not thinking about going to the gym when

you're on the beach," he said. "There's a little bit of a tug of

war between the two."

He is even more skeptical about Michelob Ultra Pure Gold, which

he said appears to be trying to appeal to both those willing to pay

more, with its use of organic grains, and those willing to pay less

for what is effectively a watered-down beer.

Azania Andrews, vice president of marketing for Michelob Ultra,

said Ultra Pure Gold's selling point is that it is made with

organic grains. It targets consumers who are focused on what they

put into their bodies, she said.

Macquarie analyst Caroline Levy said that it would take

continued marketing dollars for Corona Premier to be successful and

that the new beer would be competing with at least three other new

products Constellation has planned. One is another extension of the

Corona line, a flavored malt beverage targeting women called Corona

Refresca.

"It's hard to unseat a brand like Michelob Ultra and it takes a

long-term commitment," Ms. Levy said. "It does not happen

overnight."

In three test markets, company executives said, more than 70% of

Corona Premier sales were incremental, meaning they didn't cut into

sales from the rest of the company's beer portfolio, excluding its

craft beers.

MillerCoors' parent company, Molson Coors Brewing Co., has said

it plans to compete by heavily marketing Sol, a Mexican import, and

a spiked seltzer called Henry's Hard Sparkling. It doesn't have

plans to launch its own take on Michelob Ultra.

"We have the original 'fitness beer,' it's called Miller Lite,"

Molson Coors Chief Executive Mark Hunter told analysts on a recent

earnings call when asked about the budding category. Miller Lite

has one calorie more than Michelob Ultra.

MillerCoors has for years sold the reduced-calorie MGD 64, now

known as Miller 64, but shipments of the beer have been falling

since 2010 and there is little advertising support behind it. The

company declined to comment.

Matt Ben, a 23-year-old airline mechanic living in Clover, S.C.,

usually drinks Miller Lite or Budweiser. "I'm young, I can get away

with the extra calories," he said. He and his older brother, T.J.,

recently tried Michelob Ultra, but only because the bar they were

at ran out of Miller Lite.

--Nick Kostov contributed to this article.

Write to Cara Lombardo at cara.lombardo@wsj.com

(END) Dow Jones Newswires

March 06, 2018 08:14 ET (13:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

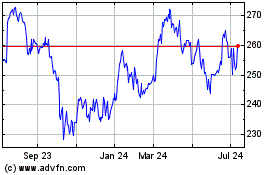

Constellation Brands (NYSE:STZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

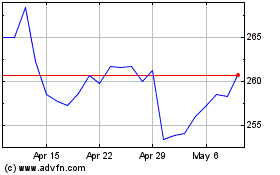

Constellation Brands (NYSE:STZ)

Historical Stock Chart

From Apr 2023 to Apr 2024