By Anna Wilde Mathews and Joseph Walker

UnitedHealth Group Inc.'s insurance arm will change how it

handles some rebates it gets from drugmakers, passing them on to

individuals who take the medicines amid pressure to reduce costs

and bolster transparency around pharmaceuticals.

The move by the biggest U.S. insurer, which will affect only a

limited slice of customers, spotlights a broader debate over

spending on drugs and the industry's opaque system of discounts and

rebates. The Trump administration has suggested it might make a

similar change in the Medicare program.

At issue are the rebates that drugmakers routinely pay to

insurers and pharmacy-benefit managers on brand-name drugs,

offsetting the full listed prices. The companies use the rebates in

a variety of ways, including lowering their own costs and keeping

premiums down. They also often pass along much of the benefit to

employer clients. But critics, including some drugmakers, say more

of the rebates should go directly to the consumers who take the

drugs.

UnitedHealth said that, starting next year, the plans that its

UnitedHealthcare unit insures for employers will redirect the

"overwhelming majority" of the rebate sums to the individuals

taking the affected drugs. The change, for around 7.5 million

covered people, will reduce costs for individuals by amounts

ranging from a few dollars to more than a thousand dollars per

prescription, UnitedHealth said.

Dan Schumacher, president of UnitedHealthcare, said the company

believes it is the first major insurer to make such a change. "We

see it, for those most directly affected, as an opportunity to

provide greater benefit and lower costs."

But UnitedHealth said the change won't affect the approximately

18.6 million consumers in UnitedHealthcare's "self-insured" plans,

where the employer is the payer. PBMs and insurers, including

UnitedHealth, have previously offered employers the option to pass

along the rebates to individuals. But only around 4% of employers

do it, while 68% use the money more generally to offset their

spending on drugs, according to a survey of employers by the

Pharmacy Benefit Management Institute.

A spokeswoman for Express Scripts Holding Co. said most of its

clients "prefer to use the savings from rebates to keep costs low

for all members" by holding down premiums. CVS Health Corp. said

clients covering around 12 million people, out of the 94 million

whose drug benefits the company manages, pass on the rebates to

individuals taking the drugs.

Nathan Cassin, an assistant vice president at Aon PLC, said

employers "like the flexibility" of being able to use rebate money

as they choose, and PBMs typically charge a fee to pass along

rebates to individuals. "That's a reason not to do it," he

said.

The focus on rebates has grown as brand-name drug prices

skyrocketed in recent years. Insurers and PBMs have demanded

ever-larger rebates in exchange for covering the drugs. Last year,

rebates paid by drugmakers to insurers and PBMs represented an

estimated 23.8% of gross drug costs in Medicare's Part D, the

prescription drug program for seniors and the disabled, up from

9.6% in 2007, according to Medicare's board of trustees.

Currently, people enrolled in high-deductible employer plans can

end up paying the full list-price of their medicine before they

meet their deductible, even though the insurer is getting it at a

discounted cost.

Aetna Inc. said, "The majority of rebates we receive go toward

lowering premiums and fees for members." Cigna Corp. said it

"obtains and shares those discounts with our clients according to

the benefit plan design they have chosen." Anthem Inc. said,

"Rebates are used in helping to make premiums and copays more

affordable."

UnitedHealth said that after its change is implemented,

out-of-pocket payments made before a consumer hits a deductible and

"coinsurance," where a consumer pays a percentage of the drug's

cost, will be calculated using post-rebate prices. Consumers with

flat copayments will pay their typical amounts, unless the

after-rebate cost is lower than their copay. In that case, they

will pay the smaller sum.

Last year, federal officials said they were considering

requiring insurers to use a fixed percentage of their rebates to

reduce Part D patients' out-of-pocket costs on prescriptions.

Several PBMs and insurers -- including UnitedHealth -- oppose the

idea and say it will require them to raise premiums.

UnitedHealth's Mr. Schumacher said Medicare plans have a "very

different benefit structure and funding methodology" than its

employer products. The impact of the rebate change on the premiums

of fully insured employer plans will be "negligible," he said.

Peter Bach, a critic of the pharmaceutical industry's pricing

practices and health policy researcher at Memorial Sloan Kettering

Cancer Center in New York, said that rebates should help

individuals who take the affected drugs, including those in

Medicare -- it's "good for consumers to have lower prices at the

pharmacy counter," he said.

Gerard Anderson, a professor at Johns Hopkins University, said

that passing on rebates to consumers could raise premiums for

everyone, and he warned that drug manufacturers already make

payments to PBMs that aren't labeled as rebates, and those could

increase. "You rename it and it's no longer a rebate," he said.

Write to Anna Wilde Mathews at anna.mathews@wsj.com and Joseph

Walker at joseph.walker@wsj.com

(END) Dow Jones Newswires

March 06, 2018 07:14 ET (12:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

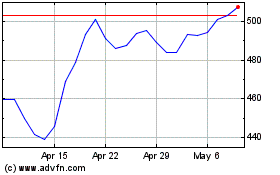

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Mar 2024 to Apr 2024

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Apr 2023 to Apr 2024