- Third Quarter Net Sales Increased 4.1% to

$585.5 Million -

- Third Quarter Net Income Improved by 139%

to $19.7 Million -

- Third Quarter Adjusted EBITDA Increased

3.8% to $42.2 Million -

GMS Inc. (NYSE:GMS), a leading North American distributor of

wallboard and suspended ceilings systems, today reported financial

results for the third quarter of fiscal 2018 ended January 31,

2018.

Third Quarter 2018 Highlights Compared to Third Quarter

2017

- Net sales increased 4.1% to a record

$585.5 million; base business net sales increased 2.9%

- Net income increased to $19.7 million,

or $0.47 per diluted share, compared to $8.2 million, or $0.20 per

diluted share

- Adjusted EBITDA grew 3.8% to a record

$42.2 million

- Gross margin expanded 40 basis points

to 33.4%

Mike Callahan, President and CEO of GMS, stated, “We delivered

record revenue and Adjusted EBITDA performance during the third

quarter, topping a very challenging year-over-year comparison. I am

particularly encouraged that we delivered solid organic revenue

growth despite the impact of adverse weather conditions in the

southern U.S. I am also pleased to report we captured approximately

three points of wallboard price growth during the third quarter and

expanded our overall gross margin on both a sequential and annual

basis, which keeps us on track to achieve our previously announced

guidance of gross margin in excess of 32.5% for fiscal year

2018.”

Mr. Callahan continued, “We generated broad-based sales growth

across all of our product groups led by strong double-digit growth

in ceilings during the third quarter. We completed one acquisition

in the quarter and maintain a very robust pipeline that we

anticipate will become more active over the next few quarters.

Looking towards the balance of the year, we remain confident in our

ability to deliver another year of record net sales and Adjusted

EBITDA.”

Third Quarter 2018 Results

Net sales for the third quarter of fiscal 2018 ended January 31,

2018 were $585.5 million, compared to $562.5 million for the third

quarter of fiscal 2017 ended January 31, 2017.

- Wallboard sales of $256.4 million

increased 0.6%, compared to the third quarter of fiscal 2017 with

wallboard unit volume decline of 1.9% to 826.3 million square feet

offset by pricing improvement of 2.9%. Wallboard volume decline was

partially driven by lost shipping days due to abnormal weather

conditions across many of our largest markets in the southern U.S.

as well as a tough comparison to an extremely strong third quarter

of fiscal 2017.

- Ceilings sales of $90.4 million rose

10.5%, compared to the third quarter of fiscal 2017, mainly due to

greater commercial activity, price gains and the positive impact of

acquisitions.

- Steel framing sales of $96.7 million

grew 3.5%, compared to the third quarter of fiscal 2017, mainly

driven by pricing improvement.

- Other product sales of $142.0 million

were up 7.4%, compared to the third quarter of fiscal 2017, as a

result of strategic initiatives, price gains and the positive

impact of acquisitions.

Gross profit of $195.4 million grew 5.2%, compared to $185.7

million in the third quarter of fiscal 2017, mainly attributable to

higher pricing and increased sales. Gross margin expanded 40 basis

points to 33.4%, compared to 33.0% in the third quarter of fiscal

2017 largely due to pricing discipline and purchasing initiatives.

On a sequential basis, gross margin improved 60 basis points from

32.8% from the second quarter of fiscal 2018.

Net income of $19.7 million, or $0.47 per diluted share,

increased by 139% or $11.5 million, compared to $8.2 million, or

$0.20 per diluted share, in the third quarter of fiscal 2017.

Adjusted net income of $15.3 million, or $0.36 per diluted share,

grew $0.5 million, compared to $14.8 million, or $0.36 per diluted

share, in the third quarter of fiscal 2017.

Adjusted EBITDA of $42.2 million rose 3.8%, compared to $40.7

million in the third quarter of fiscal 2017. Adjusted EBITDA margin

was 7.2% as a percentage of net sales, flat compared to the third

quarter of fiscal 2017, with improvement in gross margin offset by

an increase in SG&A related expenses.

Capital Resources

As of January 31, 2018, GMS had cash of $28.9 million and total

debt of $597.5 million, compared to cash of $19.8 million and total

debt of $610.5 million as of October 31, 2017.

Tax Legislation Update

We recognized an income tax benefit of $4.5 million during the

three months ended January 31, 2018 compared to income tax expense

of $5.4 million during the three months ended January 31, 2017. The

change over the third quarter of fiscal 2017 is primarily related

to the Tax Cuts and Jobs Act of 2017 (the “Tax Act”) which was

signed into law on December 22, 2017. More specifically, we

recognized a provisional income tax benefit of $7.8 million, or

$0.18 per diluted share, related to the re-measurement of net

deferred tax liabilities in connection with the enactment of the

Tax Act. Our Adjusted EPS disclosures exclude the net benefit from

this item and reflects an effective tax rate of 34.5% based on our

estimated taxes under the Tax Act. For fiscal 2019, we anticipate

our full year effective tax rate will be approximately 23% to

25%.

Lease Accounting

In order to take advantage of the Tax Act’s accelerated

depreciation provisions, facilitate the implementation of the new

lease accounting standard which we will adopt in fiscal 2020, and

improve the comparability of our financial statements with our

publicly traded peers, beginning in fiscal 2019 we intend to

finance the purchase of new commercial vehicles under capital

leases and to convert the majority of our legacy equipment

operating leases into capital leases or purchase the equipment

outright. We anticipate that this will reduce our SG&A expense

and increase our Adjusted EBITDA by approximately $21.0 to $24.0

million per year beginning in fiscal 2019. The change is also

expected to increase the property and equipment and debt accounts

by approximately $75 million as of the first quarter of fiscal

2019.

Conference Call and Webcast

GMS will host a conference call and webcast to discuss its

results for the third quarter ended January 31, 2018 at 10:00

a.m. Eastern Time on March 6, 2018. Investors who wish to

participate in the call should dial 800-239-9838 (domestic) or

323-794-2551 (international) at least 5 minutes prior to the start

of the call. The live webcast will be available on the Investors

section of the Company’s website at www.gms.com. There will be a

slide presentation of the results available on that page of

the website as well. Replays of the call will be available through

April 6, 2018 and can be accessed at 844-512-2921 (domestic) or

412-317-6671 (international) and entering the pass code

2730994.

About GMS Inc.

Founded in 1971, GMS operates a network of more than 210

distribution centers across the United States. GMS’s extensive

product offering of wallboard, suspended ceilings systems, or

ceilings, and complementary interior construction products is

designed to provide a comprehensive one-stop-shop for our core

customer, the interior contractor who installs these products in

commercial and residential buildings.

Use of Non-GAAP Financial Measures

GMS reports its financial results in accordance with GAAP.

However, it presents Adjusted net income, Adjusted EBITDA, Adjusted

EBITDA margin and base business growth, which are not recognized

financial measures under GAAP. GMS believes that Adjusted net

income, Adjusted EBITDA and Adjusted EBITDA margin assist investors

and analysts in comparing its operating performance across

reporting periods on a consistent basis by excluding items that the

Company does not believe are indicative of its core operating

performance. The Company’s management believes Adjusted net income,

Adjusted EBITDA, Adjusted EBITDA margin and base business growth

are helpful in highlighting trends in its operating results, while

other measures can differ significantly depending on long-term

strategic decisions regarding capital structure, the tax

jurisdictions in which the Company operates and capital

investments. In addition, the Company utilizes Adjusted EBITDA in

certain calculations under its senior secured asset based revolving

credit facility and its senior secured first lien term loan

facility.

You are encouraged to evaluate each adjustment and the reasons

GMS considers it appropriate for supplemental analysis. In

addition, in evaluating Adjusted net income and Adjusted EBITDA,

you should be aware that in the future, the Company may incur

expenses similar to the adjustments in the presentation of Adjusted

net income and Adjusted EBITDA. The Company’s presentation of

Adjusted net income and Adjusted EBITDA should not be construed as

an inference that its future results will be unaffected by unusual

or non-recurring items. In addition, Adjusted net income and

Adjusted EBITDA may not be comparable to similarly titled measures

used by other companies in GMS’s industry or across different

industries.

Forward-Looking Statements and Information:

This press release includes “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. You can generally identify forward-looking statements by the

Company’s use of forward-looking terminology such as “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “intend,”

“may,” “might,” “plan,” “potential,” “predict,” “seek,” or

“should,” or the negative thereof or other variations thereon or

comparable terminology. In particular, statements about the markets

in which GMS operates, including the potential for growth in the

commercial, residential and repair and remodeling, or R&R,

markets, statements about its expectations, beliefs, plans,

strategies, objectives, prospects, assumptions or future events or

performance, statements related to net sales, gross profit, gross

margins and capital expenditures, as well as non-GAAP financial

measures such as Adjusted EBITDA, Adjusted net income and base

business growth, statements regarding the impact of the recent tax

legislation and anticipated changes related to lease accounting,

including the expected impact on the fiscal 2019 effective tax

rate, SG&A and Adjusted EBITDA, and statements regarding

potential acquisitions and future greenfield locations, demand

trends and future SG&A savings contained in this press release

are forward-looking statements. The Company has based these

forward-looking statements on its current expectations,

assumptions, estimates and projections. While the Company believes

these expectations, assumptions, estimates and projections are

reasonable, such forward-looking statements are only predictions

and involve known and unknown risks and uncertainties, many of

which are beyond its control. Forward-looking statements involve

risks and uncertainties, including, but not limited to, economic,

competitive, governmental and technological factors outside of the

Company’s control, that may cause its business, strategy or actual

results to differ materially from the forward-looking statements.

These risks and uncertainties may include, among other things:

changes in the prices, supply, and/or demand for products which GMS

distributes; general economic and business conditions in the United

States; the activities of competitors; changes in significant

operating expenses; changes in the availability of capital and

interest rates; adverse weather patterns or conditions; acts of

cyber intrusion; variations in the performance of the financial

markets, including the credit markets; and other factors described

in the “Risk Factors” section in the Company’s Annual Report on

Form 10-K for the fiscal year ended April 30, 2017, and

in its other periodic reports filed with the SEC. In addition, the

statements in this release are made as of March 6, 2018. The

Company undertakes no obligation to update any of the forward

looking statements made herein, whether as a result of new

information, future events, changes in expectation or otherwise.

These forward-looking statements should not be relied upon as

representing the Company’s views as of any date subsequent to March

6, 2018.

GMS Inc. Condensed

Consolidated Statements of Operations and Comprehensive Income

(Unaudited) Three and Nine Months Ended January 31, 2018 and

2017 (in thousands, except per share data)

Three Months Ended Nine Months Ended January

31, January 31, 2018 2017 2018

2017 Net sales $ 585,508 $ 562,523 $ 1,875,669 $ 1,704,169

Cost of sales (exclusive of depreciation and amortization shown

separately below) 390,088 376,796

1,262,885 1,146,633 Gross profit

195,420 185,727 612,784

557,536 Operating expenses: Selling, general and

administrative 156,262 147,260 472,232 432,116 Depreciation and

amortization 16,490 18,316

49,548 51,479 Total operating expenses

172,752 165,576 521,780

483,595 Operating income 22,668 20,151 91,004 73,941 Other

(expense) income: Interest expense (7,871 ) (7,431 ) (23,288 )

(22,162 ) Write-off of debt discount and deferred financing fees —

(211 ) (74 ) (7,103 ) Other income, net 401

1,081 965 2,170 Total other

(expense), net (7,470 ) (6,561 ) (22,397 )

(27,095 ) Income before taxes 15,198 13,590 68,607 46,846

Provision (benefit) for income taxes (4,488 ) 5,363

15,555 12,232 Net income $

19,686 $ 8,227 $ 53,052 $ 34,614

Weighted average common shares outstanding: Basic 41,036 40,943

41,004 40,035 Diluted 42,228 41,578 42,167 40,670 Net income per

share: Basic $ 0.48 $ 0.20 $ 1.29 $ 0.86

Diluted $ 0.47 $ 0.20 $ 1.26 $ 0.85

GMS Inc. Condensed Consolidated

Balance Sheets (Unaudited) January 31, 2018 and April 30,

2017 (in thousands, except per share data)

January 31, April 30, 2018 2017

Assets Current assets: Cash and cash equivalents $ 28,939 $

14,561 Trade accounts and notes receivable, net of allowances of

$10,665 and $9,851, respectively 319,025 328,988 Inventories, net

227,564 200,234 Prepaid expenses and other current assets

18,104 11,403 Total current assets

593,632 555,186 Property and equipment, net of

accumulated depreciation of $81,648 and $71,409, respectively

158,013 154,465 Goodwill 426,810 423,644 Intangible assets, net

232,214 252,293 Other assets 7,682 7,677

Total assets $ 1,418,351 $ 1,393,265

Liabilities and Stockholders’ Equity Current liabilities:

Accounts payable $ 98,924 $ 102,688 Accrued compensation and

employee benefits 49,043 58,393 Other accrued expenses and current

liabilities 40,020 37,891 Current portion of long-term debt

15,949 11,530 Total current liabilities

203,936 210,502 Non-current liabilities:

Long-term debt, less current portion 581,535 583,390 Deferred

income taxes, net 14,256 26,820 Other liabilities 34,958 35,371

Liabilities to noncontrolling interest holders, less current

portion 15,381 22,576 Total liabilities

850,066 878,659 Commitments and

contingencies Stockholders’ equity: Common stock, par value $0.01

per share, 500,000 shares authorized; 41,041 and 40,971 shares

issued as of January 31, 2018 and April 30, 2017, respectively 410

410 Preferred stock, par value $0.01 per share, 50,000 shares

authorized; 0 shares issued as of January 31, 2018 and April 30,

2017 — — Additional paid-in capital 488,289 488,459 Retained

earnings 79,673 26,621 Accumulated other comprehensive loss

(87 ) (884 ) Total stockholders’ equity 568,285

514,606 Total liabilities and stockholders’

equity $ 1,418,351 $ 1,393,265

GMS

Inc. Condensed Consolidated Statements of Cash Flows

(Unaudited) Nine Months Ended January 31, 2018 and 2017

(in thousands) Nine Months Ended January

31, 2018 2017 Cash flows from operating

activities: Net income $ 53,052 $ 34,614 Adjustments to

reconcile net income to net cash provided by operating activities:

Depreciation and amortization of property and equipment 18,021

19,395 Write-off, accretion and amortization of debt discount and

deferred financing fees 2,141 9,142 Amortization of intangible

assets 31,527 32,084 Provision for losses on accounts and notes

receivable 133 (434 ) Provision for obsolescence of inventory 113

427 Increase (decrease) in fair value of contingent consideration

195 (388 ) Equity-based compensation 1,473 1,669 (Gain) on sale of

assets (648 ) (242 ) Changes in assets and liabilities net of

effects of acquisitions: Trade accounts and notes receivable 14,545

(3,179 ) Inventories (23,617 ) (25,708 ) Accounts payable (5,723 )

318 Deferred income taxes (12,860 ) (14,773 ) Prepaid expenses and

other assets (1,719 ) (1,425 ) Accrued compensation and employee

benefits (7,140 ) (3,057 ) Accrued expenses and liabilities 1,289

(321 ) Liabilities to noncontrolling interest holders (2,000 ) 908

Income tax receivable / payable (5,049 ) (12,690 )

Cash provided by operating activities 63,733

36,340

Cash flows from investing activities:

Purchases of property and equipment (13,408 ) (6,900 ) Proceeds

from sale of assets 2,374 3,245 Acquisition of businesses, net of

cash acquired (23,568 ) (145,976 ) Cash used in

investing activities (34,602 ) (149,631 )

Cash

flows from financing activities: Repayments on the revolving

credit facility (597,092 ) (817,598 ) Borrowings from the revolving

credit facility 493,739 836,507 Payments of principal on long-term

debt (4,332 ) (3,381 ) Principal repayments of capital lease

obligations (4,530 ) (3,819 ) Proceeds from issuance of common

stock in initial public offering, net of underwriting discounts —

156,941 Repayment of term loan — (160,000 ) Borrowings from term

loan amendment 577,616 481,225 Repayment of term loan amendment

(477,616 ) (381,225 ) Debt issuance costs on revolving credit

facility amendment — (1,342 ) Debt issuance costs (636 ) (2,487 )

Payments for taxes related to net share settlement of equity awards

(1,441 ) — Proceeds from exercises of stock options 130 — Other

financing activities (591 ) — Cash (used in)

provided by financing activities (14,753 ) 104,821

Increase (decrease) in cash and cash equivalents 14,378

(8,470 ) Cash and cash equivalents, beginning of period

14,561 19,072 Cash and cash equivalents, end

of period $ 28,939 $ 10,602 Supplemental cash flow

disclosures: Cash paid for income taxes $ 35,005 $ 39,831 Cash paid

for interest 21,192 20,038 Supplemental schedule of noncash

activities: Assets acquired under capital lease $ 7,953 $ 6,667

Issuance of installment notes associated with equity-based

compensation liability awards 11,898 5,353

GMS Inc. Net Sales by

Product Group Three and Nine Months Ended January 31, 2018

and 2017 (dollars in thousands) Three Months

Ended Nine Months Ended January 31, % of

January 31, % of January 31, % of

January 31, % of 2018 Total 2017

Total 2018 Total 2017 Total

(dollars in thousands) Wallboard $ 256,413 43.8 % $ 254,979

45.3 % $ 829,568 44.2 % $ 776,250 45.6 % Ceilings 90,360 15.4 %

81,768 14.6 % 291,716 15.6 % 253,518 14.8 % Steel framing 96,744

16.5 % 93,514 16.6 % 304,598 16.2 % 273,931 16.1 % Other products

141,991 24.3 % 132,262 23.5 % 449,787 24.0 %

400,470 23.5 % Total net sales $ 585,508 $ 562,523 $

1,875,669 $ 1,704,169

GMS Inc. Reconciliation of

Net Income to Adjusted EBITDA Three and Nine Months Ended

January 31, 2018 and 2017 (in thousands) Three

Months Ended Nine Months Ended January 31,

January 31, 2018 2017 2018 2017

Net income $ 19,686 $ 8,227 $ 53,052 $ 34,614 Interest

expense 7,871 7,431 23,288 22,162 Write-off of debt discount and

deferred financing fees — 211 74 7,103 Interest income (44 ) (23 )

(93 ) (101 ) Provision (benefit) for income taxes (4,488 ) 5,363

15,555 12,232 Depreciation expense 6,009 6,465 18,021 19,395

Amortization expense 10,481 11,851

31,527 32,084 EBITDA $ 39,515 $

39,525 $ 141,424 $ 127,489 Stock appreciation

expense or (income)(a) 631 (498 ) 1,863 (734 ) Redeemable

noncontrolling interests(b) 340 256 1,370 3,079 Equity-based

compensation(c) 430 622 1,277 1,981 Severance and other permitted

costs(d) 8 57 325 315 Transaction costs (acquisitions and other)(e)

75 305 321 2,783 (Gain) loss on sale of assets (51 ) (114 ) (648 )

(244 ) Management fee to related party(f) — — — 188 Effects of fair

value adjustments to inventory(g) 89 155 276 776 Interest rate cap

mark-to-market(h) 276 109 710 241 Secondary public offering

costs(i) 894 — 1,525 — Debt transaction costs(j) —

261 758 264 EBITDA add-backs

2,692 1,153 7,777

8,649 Adjusted EBITDA $ 42,207 $ 40,678 $

149,201 $ 136,138 Adjusted EBITDA margin 7.2 % 7.2 %

8.0 % 8.0 % (a) Represents non-cash

compensation expenses (income) related to stock appreciation rights

agreements. (b) Represents non-cash compensation expense related to

changes in the redemption values of noncontrolling interests. (c)

Represents non-cash equity-based compensation expense related to

the issuance of share-based awards. (d) Represents severance

expenses and other costs permitted in calculations under the ABL

Facility and the First Lien Facility. (e) Represents one-time costs

related to our IPO and acquisitions paid to third party advisors.

(f) Represents management fees paid by us to AEA. Following our

IPO, AEA no longer receives management fees from us. (g) Represents

the non-cash cost of sales impact of purchase accounting

adjustments to increase inventory to its estimated fair value. (h)

Represents the mark-to-market adjustments for the interest rate

cap. (i) Represents one-time costs related to our secondary

offerings paid to third party advisors. (j) Represents expenses

paid to third party advisors related to debt refinancing

activities.

GMS Inc. Reconciliation

of Income Before Taxes to Adjusted Net Income Three and Nine

Months Ended January 31, 2018 and 2017 (in thousands, except

per share data) Three Months Ended Nine Months

Ended January 31, January 31, 2018

2017 2018 2017 Income before taxes $ 15,198 $

13,590 $ 68,607 $ 46,846 EBITDA add-backs 2,692 1,153 7,777 8,649

Write-off of debt discount and deferred financing fees — 211 74

7,103 Purchase accounting depreciation and amortization (1)

5,493 7,615 16,038 23,264 Adjusted pre-tax

income 23,383 22,569 92,496 85,862 Adjusted income tax expense

8,067 7,786 31,912 29,622 Adjusted net

income $ 15,316 $ 14,782 $ 60,584 $ 56,240 Effective tax rate (2)

34.5 % 34.5 % 34.5 % 34.5 % Weighted average shares

outstanding: Basic 41,036 40,943 41,004 40,035 Diluted 42,228

41,578 42,167 40,670 Adjusted net income per share: Basic $ 0.37 $

0.36 $ 1.48 $ 1.40 Diluted $ 0.36 $ 0.36 $ 1.44 $ 1.38

(1) Depreciation and amortization from the increase

in value of certain long-term assets associated with the April 1,

2014 acquisition of the predecessor company. Full year projected

amounts are $21.8 million and $15.6 million for FY18 and FY19,

respectively. (2) Normalized cash tax rate determined based on our

estimated taxes for fiscal 2018 under the Tax Cuts and Jobs Act of

2017, excluding the impact of purchase accounting and certain other

deferred tax accounts.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180306005607/en/

GMS Inc.Investor Relations:ir@gms.com678-353-2883orMedia

Relations:marketing@gms.com770-723-3378

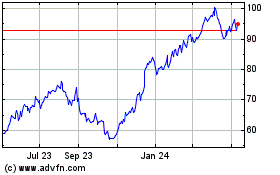

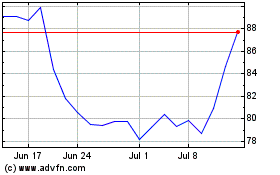

GMS (NYSE:GMS)

Historical Stock Chart

From Mar 2024 to Apr 2024

GMS (NYSE:GMS)

Historical Stock Chart

From Apr 2023 to Apr 2024