Rite Aid Corporation (NYSE: RAD) today provided an update on the

progress of its plans to sell stores to Walgreens Boots Alliance,

Inc. (Nasdaq: WBA) pursuant to the previously disclosed Amended and

Restated Asset Purchase Agreement, dated as of September 18, 2017

(the “Asset Purchase Agreement”). As of March 2, 2018, Rite Aid has

transferred 1,651 stores and related assets to WBA, and has

received cash proceeds of $3.6 billion, which the Company continues

to use to reduce debt. Under the Asset Purchase Agreement, WBA will

purchase a total of 1,932 stores, three distribution centers and

related inventory from Rite Aid for an all-cash purchase price of

$4.4 billion on a cash-free, debt-free basis. Rite Aid expects to

complete the store transfer process in the spring of 2018.

The majority of the closing conditions have been satisfied, and

the subsequent transfers of Rite Aid stores and related assets

remain subject to minimal customary closing conditions applicable

only to the stores being transferred at such subsequent closing, as

specified in the Asset Purchase Agreement. Additional details

regarding today’s announcement have been filed with the Securities

and Exchange Commission on Form 8-K.

Rite Aid is one of the nation's leading drugstore chains with

fiscal 2017 annual revenues of $32.8 billion. Information about

Rite Aid, including corporate background and press releases, is

available through the company's website at www.riteaid.com.

Cautionary Statement Regarding Forward Looking

Statements

Statements in this release that are not historical, are

forward-looking statements made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

Such statements include, but are not limited to, statements

regarding the expected timing of subsequent closings of the sale of

Rite Aid stores and assets to WBA; the ability of the parties to

complete each of the subsequent closings for sale and related

subsequent transactions considering the various closing conditions

applicable to the stores, related assets and/or distribution

centers being transferred at such subsequent closing; the outcome

of legal and regulatory matters in connection with the sale of

stores and assets of Rite Aid to WBA; the expected benefits of the

transactions such as improved operations, growth potential, market

profile and financial strength; the competitive ability and

position of Rite Aid following completion of the proposed

transactions; the ability of Rite Aid to implement new business

strategies following the completion of the proposed transactions;

the ability of Rite Aid to repay its debt using the proceeds from

the proposed transactions and any assumptions underlying any of the

foregoing. Words such as “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,”

“project,” “should,” and “will” and variations of such words and

similar expressions are intended to identify such forward-looking

statements. These forward-looking statements are not guarantees of

future performance and involve risks, assumptions and

uncertainties, including, but not limited to, our high level of

indebtedness and our ability to make interest and principal

payments on our debt and satisfy the other covenants contained in

our debt agreements; general economic, industry, market,

competitive, regulatory and political conditions; our ability to

improve the operating performance of our stores in accordance with

our long term strategy; the impact of private and public

third-party payers continued reduction in prescription drug

reimbursements and efforts to encourage mail order; our ability to

manage expenses and our investments in working capital; outcomes of

legal and regulatory matters; changes in legislation or

regulations, including healthcare reform; our ability to achieve

the benefits of our efforts to reduce the costs of our generic and

other drugs; risks related to the proposed transactions, including

the possibility that the subsequent transactions may not close,

including because a governmental entity may prohibit, delay or

refuse to grant approval for the consummation of the transactions,

or may require conditions, limitations or restrictions in

connection with such approvals, the risk that there may be a

material adverse change of Rite Aid, or the business of Rite Aid

may suffer as a result of uncertainty surrounding the proposed

transactions; risks related to the ability to realize the

anticipated benefits of the proposed transactions; risks associated

with the financing of the proposed transaction; disruption from the

proposed transaction making it more difficult to maintain business

and operational relationships; the effect of the pending sale on

Rite Aid’s business relationships (including, without limitation,

customers and suppliers), operating results and business generally;

risks related to diverting management’s or employees’ attention

from ongoing business operations; the risk that Rite Aid’s stock

price may decline significantly if the proposed transaction is not

completed; significant transaction costs; unknown liabilities; the

risk of litigation and/or regulatory actions related to the

proposed transactions; potential changes to our strategy in the

event the remaining proposed transactions do not close, which may

include delaying or reducing capital or other expenditures, selling

assets or other operations, attempting to restructure or refinance

our debt, or seeking additional capital, and other business

effects.

These and other risks, assumptions and uncertainties are more

fully described in Item 1A (Risk Factors) of our most recent Annual

Report on Form 10-K, and in other documents that we file or furnish

with the Securities and Exchange Commission, which you are

encouraged to read.Should one or more of these risks or

uncertainties materialize, or should underlying assumptions prove

incorrect, actual results may vary materially from those indicated

or anticipated by such forward-looking statements. Accordingly, you

are cautioned not to place undue reliance on these forward- looking

statements, which speak only as of the date they are made. Rite Aid

expressly disclaims any current intention to update publicly any

forward-looking statement after the distribution of this release,

whether as a result of new information, future events, changes in

assumptions or otherwise.

Additional Information and Where to Find It

In connection with the proposed strategic combination involving

Rite Aid and Albertsons Companies, Inc. (“Albertsons”), Rite Aid

and Albertsons intend to file relevant materials with the SEC,

including that Albertsons will file a registration statement on

Form S-4 that will include a proxy statement/prospectus to be

distributed to Rite Aid’s stockholders. Rite Aid will mail the

proxy statement/prospectus and a proxy card to each stockholder

entitled to vote at the special meeting relating to the proposed

merger. INVESTORS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS

WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT

INFORMATION. RITE AID’S EXISTING PUBLIC FILINGS WITH THE SEC SHOULD

ALSO BE READ, INCLUDING THE RISK FACTORS CONTAINED THEREIN.

Investors and security holders may obtain copies of the Form

S-4, including the proxy statement/prospectus, as well as other

filings containing information about Rite Aid, free of charge, from

the SEC’s Web site (www.sec.gov). Investors and security holders

may also obtain Rite Aid’s SEC filings in connection with the

transaction, free of charge, from Rite Aid’s Web site

(www.RiteAid.com) under the link “Investor Relations” and then

under the tab “SEC Filings,” or by directing a request to Rite Aid,

Byron Purcell, Attention: Senior Director, Treasury Services &

Investor Relations. Copies of documents filed with the SEC by

Albertsons will be made available, free of charge, on Albertsons

website at www.albertsonscompanies.com.

Participants in Solicitation

Rite Aid, Albertsons and their respective directors, executive

officers and employees and other persons may be deemed to be

participants in the solicitation of proxies from the holders of

Company common stock in respect of the proposed transaction.

Information regarding Rite Aid’s directors and executive officers

is available in its definitive proxy statement for Rite Aid’s 2017

annual meeting of stockholders filed with the SEC on June 7, 2017,

as modified or supplemented by any Form 3 or Form 4 filed with the

SEC since the date of such definitive proxy statement. Information

about the directors and executive officers of Albertsons will be

set forth in the Form S-4. Other information regarding the

interests of the participants in the proxy solicitation will be

included in the proxy statement/prospectus when it becomes

available. These documents can be obtained free of charge from the

sources indicated above. This communication shall not constitute an

offer to sell or the solicitation of an offer to sell or the

solicitation of an offer to buy any securities, nor shall there be

any sale of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

No offer of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act of 1933, as amended.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180305006179/en/

Rite Aid CorporationINVESTORS:Byron Purcell, 717-975-5809or

investor@riteaid.comorMEDIA:Susan Henderson, 717-730-7766

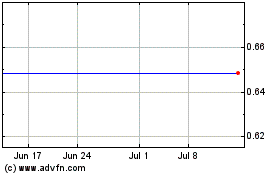

Rite Aid (NYSE:RAD)

Historical Stock Chart

From Mar 2024 to Apr 2024

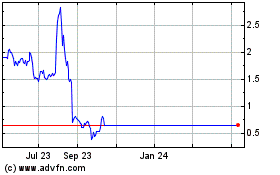

Rite Aid (NYSE:RAD)

Historical Stock Chart

From Apr 2023 to Apr 2024