Report of Foreign Issuer (6-k)

March 05 2018 - 6:32AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of March, 2018

Commission File Number 1-14732

COMPANHIA SIDERÚRGICA NACIONAL

(Exact name of registrant as specified in its charter)

National Steel Company

(Translation of Registrant's name into English)

Av. Brigadeiro Faria Lima 3400, 20º andar

São Paulo, SP, Brazil

04538-132

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports

under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

Expiration of Tender Offers for up to U.S.$350 million of 2019 Notes and 2020 Notes by CSN Resources S.A.

São Paulo, March 2, 2018 – Companhia Siderúrgica Nacional

(“

CSN

”) (NYSE: SID),

announced today the expiration of the previously announced cash tender offers by its subsidiary, CSN Resources S.A. (“

CSN Resources

”), for:

|

(1)

|

|

up to U.S.$350,000,000 in aggregate principal amount of 6.875% Senior Unsecured Guaranteed Notes due 2019 (the “

2019 Notes

”) (144A CUSIP / ISIN Nos. 12642KAA2/US12642KAA25 and Reg S CUSIP / ISIN Nos. G2583XAA9/USG2583XAA93) issued by CSN Islands XI Corp., a finance subsidiary of CSN (the “

2019 Notes Tender Offer

”); and

|

|

|

|

|

|

(2)

|

|

6.50% Senior Unsecured Guaranteed Notes due 2020 (the “

2020 Notes

” and, together with the 2019 Notes, the “

Notes

”) (144A CUSIP / ISIN Nos. 12644VAA6/US12644VAA61 and Reg S CUSIP / ISIN Nos. L21779AA8/USL21779AA88) issued by CSN Resources in an aggregate principal amount such that the aggregate principal amount of 2020 Notes accepted for purchase does not exceed (A) U.S.$ 350,000,000

less

(B) the aggregate principal amount of 2019 Notes validly tendered and accepted for purchase pursuant to the 2019 Notes Tender Offer (the “

2020 Notes Maximum Tender Amount

”) (the “

2020 Notes Tender Offer

” and, together with the 2019 Notes Tender Offer, the “

Tender Offers

”).

|

Each of the Tender Offers expired at 11:59 p.m., New York City time, on March 1, 2018 (the “

Expiration Date

”).

CSN Resources previously accepted for purchase U.S.$202,806,000 in aggregate principal amount of 2019 Notes that were validly tendered at or prior to the Early Tender Date, and paid for such early tendered 2019 Notes on February 15, 2018. According to D.F. King & Co., Inc., the tender agent and information agent (the “

Tender Agent and Information Agent

”) for the Tender Offers, additional tenders were received (and not validly withdrawn) after 5:00 p.m., New York City time, on February 14, 2018 (the “

Early Tender Date

”) but at or prior to the Expiration Date from holders of 2019 Notes representing approximately U.S.$100,000 in aggregate principal amount of 2019 Notes. Subject to the terms and conditions of the 2019 Notes Tender Offer, holders who validly tendered their 2019 Notes after the Early Tender Date but at or prior to the Expiration Date and whose 2019 Notes are accepted for purchase will be entitled to receive, for each U.S.$1,000 principal amount of 2019 Notes accepted for purchase, U.S.$970, plus accrued interest. Pursuant to the terms of the 2019 Notes Tender Offer, CSN Resources has accepted for purchase all such 2019 Notes validly tendered after the Early Tender Date but at or prior to the Expiration Date and will pay for such tendered 2019 Notes on March 5, 2018 (the “

Final Settlement Date

”). Consequently, upon the Final Settlement Date, the total amount of 2019 Notes tendered and cancelled under the 2019 Notes Tender Offer will be U.S.$202,906,000.

As of the Expiration Date, according to the Tender Agent and Information Agent, tenders were received (and not validly withdrawn) from holders of 2020 Notes representing U.S.$521,194,000 in aggregate principal amount of 2020 Notes. Subject to the terms and conditions of the 2020 Notes Tender Offer, including the 2020 Notes Maximum Tender Amount, holders who validly tendered their 2020 Notes at or prior to the Early Tender Date and whose 2020 Notes are accepted for purchase are eligible to receive U.S.$1,000 for each U.S.$1,000 principal amount of 2020 Notes validly tendered (and not validly withdrawn), which includes an early tender payment equal to U.S.$30, plus accrued interest. Holders of 2020 Notes who validly tendered 2020 Notes after the Early Tender Date but at or prior to the Expiration Date and whose 2020 Notes are accepted for purchase will be entitled to receive, for each U.S.$1,000 principal amount of 2020 Notes accepted for purchase, U.S.$970.

Pursuant to the terms of the 2020 Notes Tender Offer, including the 2020 Notes Maximum Tender Amount, CSN Resources has accepted for purchase U.S.$147,094,000 in aggregate principal amount of 2020 Notes and will pay for such tendered 2020 Notes, on a

pro rata

basis, on the Final Settlement Date. The proration ratio that will be applied to each tendering holder of 2020 Notes is equal to (i) the amount of 2020 Notes validly tendered (and not validly withdrawn) at or prior to the Expiration Date multiplied by (ii) a fraction, the numerator of which would be equal to the 2020 Notes Maximum Tender Amount and the denominator of which would be equal to the total principal amount of 2020 Notes tendered in the 2020 Notes Tender Offer, rounded downward to the nearest U.S.$1,000 principal amount.

CSN Resources intends to use the net proceeds from its offering of 7.625% senior unsecured notes due 2023,

which closed on February 13, 2018, to purchase all Notes validly tendered in the Tender Offers and to pay related costs and expenses.

The Final Settlement Date, CSN and its consolidated subsidiaries will have the following debt maturity profile:

As a result of the above transactions, CSN has completed another step in the process of lengthening its debt maturity profile and improving liquidity as part of its strategy to readjust its capital structure.

Disclaimer

This press release is for informational purposes only and does not constitute an offer to purchase or the solicitation of an offer to sell any securities.

This release may contain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the United States Securities Exchange Act of 1934, as amended, including those related to the Tender Offers. Forward-looking information involves important risks and uncertainties that could significantly affect anticipated results in the future, and, accordingly, such results may differ from those expressed in any forward-looking statements.

Investor Relations

David Moise Salama

Investor Relations Executive Officer

Phone: +55 (11) 3049-7588

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: March 5, 2018

|

COMPANHIA SIDERÚRGICA NACIONAL

|

|

|

|

By:

|

/

S

/ Benjamin Steinbruch

|

|

|

Benjamin Steinbruch

Chief Executive Officer

|

|

|

|

|

|

By:

|

/

S

/ David Moise Salama

|

|

|

David Moise Salama

Executive Officer

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

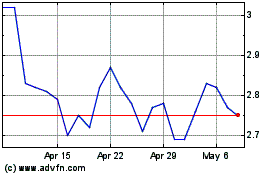

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From Mar 2024 to Apr 2024

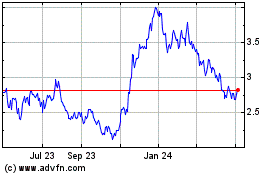

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From Apr 2023 to Apr 2024