Holiday Shoppers Fuel Rebound at Best Buy and Kohl's -- 2nd Update

March 01 2018 - 5:41PM

Dow Jones News

By Khadeeja Safdar and Suzanne Kapner

Shoppers opened their wallets for electronics, beauty products

and clothes during the holiday season, as strong consumer spending

gave a boost to several brick-and-mortar retailers.

Same-store sales at Best Buy Co. surged 9% in the holiday

quarter, as the electronics retailer benefited from higher

videogame demand and store closures at some of its competitors.

Other chains, including Kohl's Corp., Macy's Inc., Gap Inc. and

Nordstrom Inc. posted sales gains as well.

"The consumer is in a much better mind-set," said Best Buy Chief

Executive Hubert Joly on a media call Thursday. "The better macro

conditions were helpful to all the retailers for sure."

Kohl's said comparable-store sales rose 6.3%, its largest sales

increase since 2001. Gap reported a 5% gain, its fifth consecutive

quarter of positive comparable sales growth. And Nordstrom reported

a same-store sales increase of 2.6%. Both its full-line department

stores and discount Rack stores posted same-store sales gains.

Kohl's CEO Kevin Mansell said the sales gains were driven by

improvements in customer traffic. Mr. Mansell said that all product

categories and geographical regions had positive sales in the

period. Even though sales slowed in January, he said the company

"entered 2018 with a lot of momentum on the top line."

Shares of Best Buy closed up 4% as U.S. stocks overall were

broadly lower. Kohl's shares were down more than 5%. Shares of Gap

rose 8% in after-hours trading.

Analysts and economists have said that low unemployment and

rising wages gave consumers the confidence to spend this holiday

season. "Everybody in retail right now is benefiting from strong

consumer confidence," Macy's CEO Jeff Gennette said in an interview

earlier this week.

Earlier in the year, Target Corp. said sales were strong in

November and December. The company is expected to report quarterly

results next week.

The latest results come as retailers contend with the rise of

online shopping and the fallout from years of overbuilding. More

than 6,000 store closures were announced last year, and at least 50

retailers filed for bankruptcy, including Gymboree Corp., Payless

ShoeSource Inc. and Toys 'R' Us Inc.

Best Buy said this week that it will be closing all of its 250

mobile-phone stores in the U.S. by the end of May, in response to a

more mature smartphone market.

The electronics retailer has largely avoided mass store closures

by ramping up its e-commerce efforts, promising to match the prices

of online rivals, and offering technical-support services. Mr. Joly

said those efforts helped boost results. In the fourth quarter,

Best Buy's domestic online sales jumped 18% on a comparable basis.

The company also topped sales and profit expectations for the

quarter.

Mr. Joly said there was better product availability during the

holiday season after shortages and recalls from manufacturers hurt

results the previous year.

At Gap Inc., the results were largely driven by a 9% increase at

its budget brand Old Navy. The parent company has been shifting its

footprint accordingly. Last year, it announced plans to close about

200 Banana Republic and Gap stores over the next three years, while

opening new Old Navy and Athleta locations.

While Kohl's hasn't announced mass store closures, it is

shrinking its square footage. Mr. Mansell said the company will

lease space to discount grocer Aldi in as many as 10 stores.

Kohl's said partnerships with Under Armour Inc. and Amazon.com

Inc. helped boost sales during the latest quarter. Mr. Mansell said

Kohl's had begun discussions with Amazon to expand their pact,

which includes having Amazon shops in Kohl's stores and allowing

customers to return items they purchased at the online retailer at

a handful of its locations.

Not all retailers fared better. On Wednesday, L Brands Inc.,

which owns Victoria's Secret and Bath & Body Works, said

comparable sales rose 2% in the fourth quarter, but the retailer

gave a downbeat earnings outlook for its current fiscal year.

L Brands CEO Leslie Wexner has been trying to fix weakness in

the bra business by changing product lines and sprucing up stores.

Unlike other mall chains, his retailers have been expanding their

store footprints. Shares were down 12% on Thursday afternoon.

Last month, Walmart Inc. said it stumbled in the fourth quarter

after misjudging its online inventory for the holiday season.

--Imani Moise contributed to this article.

Write to Khadeeja Safdar at khadeeja.safdar@wsj.com and Suzanne

Kapner at Suzanne.Kapner@wsj.com

(END) Dow Jones Newswires

March 01, 2018 17:26 ET (22:26 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

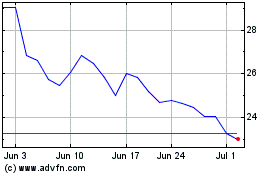

Gap (NYSE:GPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gap (NYSE:GPS)

Historical Stock Chart

From Apr 2023 to Apr 2024