Nasdaq Files Patent Infringement Lawsuit to Protect Intellectual Property

March 01 2018 - 4:30PM

Nasdaq (Nasdaq:NDAQ) filed a patent infringement lawsuit in the

United States District Court for the District of New Jersey today,

aiming to protect Nasdaq’s electronic trading technology from

unauthorized use by IEX Group, Inc. and Investors Exchange LLC

(IEX).

The seven patents asserted in the lawsuit represent millions of

dollars in investment over decades, and cover several

industry-leading innovations. These patents contribute to the

performance of Nasdaq’s trading platforms related to closing

auction processes, multi-parallel order processing, matching engine

performance, and data feed optimizations. The lawsuit asserts IEX

knowingly violated this series of Nasdaq patents in the development

of its trading platform.

“In addition to using our technology to power our markets,

Nasdaq is a leading technology provider to other market operators

across the world,” said Edward S Knight, Nasdaq General Counsel and

Chief Regulatory Officer. “These seven patents cover important

innovations that we, and our customers, rely on for reliability,

scalability, and transparency.”

As described in the lawsuit, IEX employs several former Nasdaq

employees familiar with Nasdaq technologies who have been involved

in the development of IEX’s trading platform. IEX admitted in

public filings that its closing auction process was “designed based

on extensive review of” Nasdaq’s patented process and that the

information its system is designed to disseminate to the market

during closing auctions is “substantially similar” to the “Nasdaq

Net Imbalance Order Indicator,” one of the key features of patents

asserted in the lawsuit.

The lawsuit seeks to stop, and obtain fair compensation for,

IEX’s unauthorized use of Nasdaq intellectual property.

The patent infringement lawsuit is Nasdaq v. IEX Group, Inc.

About Nasdaq

Nasdaq (Nasdaq:NDAQ) is a leading global provider of trading,

clearing, exchange technology, listing, information and public

company services. Through its diverse portfolio of solutions,

Nasdaq enables customers to plan, optimize and execute their

business vision with confidence, using proven technologies that

provide transparency and insight for navigating today's global

capital markets. As the creator of the world's first electronic

stock market, its technology powers more than 90 marketplaces in 50

countries, and 1 in 10 of the world's securities transactions.

Nasdaq is home to approximately 3,900 total listings with a market

value of approximately $13 trillion. To learn more, visit:

http://business.nasdaq.com

For Media Inquiries:

Allan Schoenberg (212) 231-5534allan.schoenberg@nasdaq.com

Joe Christinat(646) 441-5121joseph.christinat@nasdaq.com

-NDAQG-

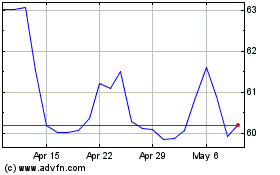

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

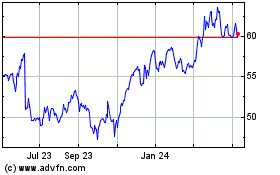

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From Apr 2023 to Apr 2024