Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

February 27 2018 - 7:23AM

Edgar (US Regulatory)

|

|

|

|

|

|

|

|

|

Issuer Free Writing Prospectus

Filed by Mitsubishi UFJ Financial Group, Inc.

|

|

|

|

|

|

Pursuant to Rule 433

Reg-Statement No. 333-209455

February 26, 2018

|

5-Year Floating Rate Notes Due 2023

5-Year Fixed Rate Notes Due 2023

7-Year Fixed Rate Notes Due 2025

10-Year Fixed Rate Notes Due 2028

5-Year Floating Rate Notes Due 2023

|

|

|

|

|

Issuer:

|

|

Mitsubishi UFJ Financial Group, Inc.

|

|

|

|

|

Size:

|

|

U.S.$ 750,000,000

|

|

|

|

|

Issuer Ratings (Moody’s / S&P / Fitch) *:

|

|

A1 / A- / A

|

|

|

|

|

Expected Security Ratings (Moody’s / S&P / Fitch) *:

|

|

A1 / A- / A

|

|

|

|

|

Security Type:

|

|

Senior Notes

|

|

|

|

|

Currency:

|

|

U.S.$

|

|

|

|

|

Interest:

|

|

Per annum rate equal to U.S. Dollar

3-month

LIBOR + 74 basis points

|

|

|

|

|

Trade Date:

|

|

February 26, 2018

|

|

|

|

|

Settlement Date:

|

|

March 2, 2018

|

|

|

|

|

Maturity:

|

|

March 2, 2023

|

|

|

|

|

Interest Payment Dates:

|

|

Quarterly in arrears on March 2, June 2, September 2 and December 2 of each year.

|

|

|

|

|

First Interest Payment Date:

|

|

June 2, 2018

|

|

|

|

|

Pricing Benchmark:

|

|

U.S. Dollar

3-month

LIBOR

|

|

|

|

|

Spread to Benchmark:

|

|

74 basis points

|

|

|

|

|

Issue Price:

|

|

100% of principal amount plus accrued interest, if any, from March 2, 2018

|

|

|

|

|

Underwriting Discount:

|

|

0.35%

|

|

|

|

|

Net Proceeds before Expenses:

|

|

U.S.$ 747,375,000

|

|

|

|

|

Day Count:

|

|

Actual/360

|

|

|

|

|

Business Days:

|

|

New York, Tokyo and London Banking Day

|

|

|

|

|

Business Day Convention:

|

|

Modified Following Business Day Convention (Following Business Day Convention for the maturity date and any other date fixed for redemption)

|

1

|

|

|

|

|

Denominations:

|

|

U.S.$2,000 x U.S.$1,000

|

|

|

|

|

Listing:

|

|

Luxembourg Stock Exchange’s Euro MTF Market

|

|

|

|

|

Governing Law:

|

|

New York law

|

|

|

|

|

Billing & Delivering:

|

|

Morgan Stanley & Co. LLC

|

|

|

|

|

Joint Lead Managers and Joint Bookrunners:

|

|

Morgan Stanley & Co. LLC

MUFG Securities Americas Inc.

|

|

|

|

Citigroup Global Markets Inc.

|

|

|

|

|

Senior

Co-Managers:

|

|

Barclays Capital Inc.

|

|

|

|

|

|

|

HSBC Securities (USA) Inc.

|

|

|

|

|

|

|

J.P. Morgan Securities LLC

|

|

|

|

|

|

|

Merrill Lynch, Pierce, Fenner & Smith Incorporated

|

|

|

|

|

Co-Managers:

|

|

BNP Paribas

|

|

|

|

|

|

|

Credit Agricole Securities (USA) Inc.

|

|

|

|

|

|

|

Credit Suisse Securities (USA) LLC

|

|

|

|

|

|

|

Deutsche Bank Securities Inc.

|

|

|

|

|

|

|

Natixis Securities Americas LLC

|

|

|

|

|

|

|

Nomura Securities International, Inc.

|

|

|

|

|

|

|

RBC Capital Markets, LLC

|

|

|

|

|

|

|

Société Générale

|

|

|

|

|

Security Codes:

|

|

CUSIP: 606822 AS3

ISIN: US606822AS32

Common Code: 178620037

|

|

|

|

|

Definitions:

|

|

Unless otherwise defined herein, all capitalized terms have the meaning set forth in the Preliminary Prospectus (as defined below).

|

2

5-Year Fixed Rate Notes Due 2023

|

|

|

|

|

Issuer:

|

|

Mitsubishi UFJ Financial Group, Inc.

|

|

|

|

|

Size:

|

|

U.S.$1,500,000,000

|

|

|

|

|

Issuer Ratings (Moody’s / S&P / Fitch) *:

|

|

A1 / A- / A

|

|

|

|

Expected Security Ratings

(Moody’s / S&P / Fitch) *:

|

|

A1 / A- / A

|

|

|

|

|

Security Type:

|

|

Senior Notes

|

|

|

|

|

Currency:

|

|

U.S.$

|

|

|

|

|

Interest:

|

|

3.455% per annum

|

|

|

|

|

Trade Date:

|

|

February 26, 2018

|

|

|

|

|

Settlement Date:

|

|

March 2, 2018

|

|

|

|

|

Maturity:

|

|

March 2, 2023

|

|

|

|

|

Interest Payment Dates:

|

|

Semi-annually in arrears on March 2 and September 2 of each year

|

|

|

|

|

First Interest Payment Date:

|

|

September 2, 2018

|

|

|

|

|

Pricing Benchmark:

|

|

2.625% due 2/2023

|

|

|

|

|

Benchmark Spot (Price/Yield):

|

|

100-03/

2.605%

|

|

|

|

|

Spread to Benchmark:

|

|

85 basis points

|

|

|

|

|

Issue Price:

|

|

100% of principal amount plus accrued interest, if any, from March 2, 2018

|

|

|

|

|

Yield to Maturity:

|

|

3.455%

|

|

|

|

|

Underwriting Discount:

|

|

0.35%

|

|

|

|

|

Net Proceeds before Expenses:

|

|

U.S.$1,494,750,000

|

|

|

|

|

Day Count:

|

|

30/360

|

|

|

|

|

Business Days:

|

|

New York and Tokyo

|

|

|

|

|

Business Day Convention:

|

|

Following Business Day Convention

|

|

|

|

|

Denominations:

|

|

U.S.$2,000 x U.S.$1,000

|

|

|

|

|

Listing:

|

|

Luxembourg Stock Exchange’s Euro MTF Market

|

|

|

|

|

Governing Law:

|

|

New York law

|

|

|

|

|

Billing & Delivering:

|

|

Morgan Stanley & Co. LLC

|

|

|

|

|

Joint Lead Managers and

Joint Bookrunners:

|

|

Morgan Stanley & Co. LLC

MUFG Securities Americas Inc.

|

|

|

|

|

|

|

Citigroup Global Markets Inc.

|

3

|

|

|

|

|

Senior

Co-Managers:

|

|

Barclays Capital Inc.

|

|

|

|

|

|

|

HSBC Securities (USA) Inc.

|

|

|

|

|

|

|

J.P. Morgan Securities LLC

|

|

|

|

|

|

|

Merrill Lynch, Pierce, Fenner & Smith Incorporated

|

|

|

|

|

Co-Managers:

|

|

BNP Paribas

|

|

|

|

|

|

|

Credit Agricole Securities (USA) Inc.

|

|

|

|

|

|

|

Credit Suisse Securities (USA) LLC

|

|

|

|

|

|

|

Deutsche Bank Securities Inc.

|

|

|

|

|

|

|

Natixis Securities Americas LLC

|

|

|

|

|

|

|

Nomura Securities International, Inc.

|

|

|

|

|

|

|

RBC Capital Markets, LLC

|

|

|

|

|

|

|

Société Générale

|

|

|

|

|

Security Codes:

|

|

CUSIP: 606822 AT1

ISIN: US606822AT15

Common Code: 178620169

|

|

|

|

|

Definitions:

|

|

Unless otherwise defined herein, all capitalized terms have the meaning set forth in the Preliminary Prospectus (as defined below).

|

4

7-Year Fixed Rate Notes Due 2025

|

|

|

|

|

Issuer:

|

|

Mitsubishi UFJ Financial Group, Inc.

|

|

|

|

|

Size:

|

|

U.S.$750,000,000

|

|

|

|

|

Issuer Ratings (Moody’s / S&P / Fitch) *:

|

|

A1 / A- / A

|

|

|

|

Expected Security Ratings

(Moody’s / S&P / Fitch) *:

|

|

A1 / A- / A

|

|

|

|

|

Security Type:

|

|

Senior Notes

|

|

|

|

|

Currency:

|

|

U.S.$

|

|

|

|

|

Interest:

|

|

3.777% per annum

|

|

|

|

|

Trade Date:

|

|

February 26, 2018

|

|

|

|

|

Settlement Date:

|

|

March 2, 2018

|

|

|

|

|

Maturity:

|

|

March 2, 2025

|

|

|

|

|

Interest Payment Dates:

|

|

Semi-annually in arrears on March 2 and September 2 of each year

|

|

|

|

|

First Interest Payment Date:

|

|

September 2, 2018

|

|

|

|

|

Pricing Benchmark:

|

|

2.750% due 2/2025

|

|

|

|

|

Benchmark Spot (Price/Yield):

|

|

99-26+

/ 2.777%

|

|

|

|

|

Spread to Benchmark:

|

|

100 basis points

|

|

|

|

|

Issue Price:

|

|

100% of principal amount plus accrued interest, if any, from March 2, 2018

|

|

|

|

|

Yield to Maturity:

|

|

3.777%

|

|

|

|

|

Underwriting Discount:

|

|

0.40 %

|

|

|

|

|

Net Proceeds before Expenses:

|

|

U.S.$747,000,000

|

|

|

|

|

Day Count:

|

|

30/360

|

|

|

|

|

Business Days:

|

|

New York and Tokyo

|

|

|

|

|

Business Day Convention:

|

|

Following Business Day Convention

|

|

|

|

|

Denominations:

|

|

U.S.$2,000 x U.S.$1,000

|

|

|

|

|

Listing:

|

|

Luxembourg Stock Exchange’s Euro MTF Market

|

|

|

|

|

Governing Law:

|

|

New York law

|

|

|

|

|

Billing & Delivering:

|

|

Morgan Stanley & Co. LLC

|

|

|

|

|

Joint Lead Managers and Joint Bookrunners:

|

|

Morgan Stanley & Co. LLC

MUFG Securities Americas Inc.

|

|

|

|

|

|

|

Citigroup Global Markets Inc.

|

5

|

|

|

|

|

|

|

|

Senior

Co-Managers:

|

|

Barclays Capital Inc.

HSBC Securities (USA) Inc.

J.P. Morgan Securities LLC

Merrill Lynch, Pierce, Fenner & Smith Incorporated

|

|

|

|

|

Co-Managers:

|

|

BNP Paribas

Credit Agricole Securities (USA) Inc.

Credit Suisse Securities (USA) LLC

Deutsche Bank Securities Inc.

Natixis Securities Americas LLC

Nomura Securities International, Inc.

RBC Capital Markets, LLC

Société Générale

|

|

|

|

|

Security Codes:

|

|

CUSIP: 606822 AU8

ISIN: US606822AU87

Common Code: 178620142

|

|

|

|

|

Definitions:

|

|

Unless otherwise defined herein, all capitalized terms have the meaning set forth in the Preliminary Prospectus (as defined below).

|

6

10-Year Fixed Rate Notes Due 2028

|

|

|

|

|

Issuer:

|

|

Mitsubishi UFJ Financial Group, Inc.

|

|

|

|

|

Size:

|

|

U.S.$ 500,000,000

|

|

|

|

|

Issuer Ratings (Moody’s / S&P / Fitch) *:

|

|

A1 / A- / A

|

|

|

|

|

Expected Security Ratings (Moody’s / S&P / Fitch) *:

|

|

A1 / A- / A

|

|

|

|

|

Security Type:

|

|

Senior Notes

|

|

|

|

|

Currency:

|

|

U.S.$

|

|

|

|

|

Interest:

|

|

3.961% per annum

|

|

|

|

|

Trade Date:

|

|

February 26, 2018

|

|

|

|

|

Settlement Date:

|

|

March 2, 2018

|

|

|

|

|

Maturity:

|

|

March 2, 2028

|

|

|

|

|

Interest Payment Dates:

|

|

Semi-annually in arrears on March 2 and September 2 of each year

|

|

|

|

|

First Interest Payment Date:

|

|

September 2, 2018

|

|

|

|

|

Pricing Benchmark:

|

|

2.750% due 2/2028

|

|

|

|

|

Benchmark Spot (Price/Yield):

|

|

99-01+

/ 2.861%

|

|

|

|

|

Spread to Benchmark:

|

|

110 basis points

|

|

|

|

|

Issue Price:

|

|

100% of principal amount plus accrued interest, if any, from March 2, 2018

|

|

|

|

|

Yield to Maturity:

|

|

3.961%

|

|

|

|

|

Underwriting Discount:

|

|

0.45 %

|

|

|

|

|

Net Proceeds before Expenses:

|

|

U.S.$ 497,750,000

|

|

|

|

|

Day Count:

|

|

30/360

|

|

|

|

|

Business Days:

|

|

New York and Tokyo

|

|

|

|

|

Business Day Convention:

|

|

Following Business Day Convention

|

|

|

|

|

Denominations:

|

|

U.S.$2,000 x U.S.$1,000

|

|

|

|

|

Listing:

|

|

Luxembourg Stock Exchange’s Euro MTF Market

|

|

|

|

|

Governing Law:

|

|

New York law

|

|

|

|

|

Billing & Delivering:

|

|

MUFG Securities Americas Inc.

|

|

|

|

|

Joint Lead Managers and Joint Bookrunners:

|

|

Morgan Stanley & Co. LLC

MUFG Securities Americas Inc.

|

|

|

|

|

|

|

Citigroup Global Markets Inc.

|

7

|

|

|

|

|

|

|

|

Senior

Co-Managers:

|

|

Barclays Capital Inc.

HSBC Securities (USA) Inc.

J.P. Morgan Securities LLC

Merrill Lynch, Pierce, Fenner & Smith Incorporated

|

|

|

|

|

Co-Managers:

|

|

BNP Paribas

Credit Agricole Securities (USA) Inc.

Credit Suisse Securities (USA) LLC

Deutsche Bank Securities Inc.

Natixis Securities Americas LLC

Nomura Securities International, Inc.

RBC Capital Markets, LLC

Société Générale

|

|

|

|

|

Security Codes:

|

|

CUSIP: 606822 AV6

ISIN: US606822AV60

Common Code: 178608975

|

|

|

|

|

Definitions:

|

|

Unless otherwise defined herein, all capitalized terms have the meaning set forth in the Preliminary Prospectus (as defined below).

|

8

This communication is intended for the sole use of the person to whom it is provided by us. This communication

does not constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction or to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

The Issuer has filed a registration statement (including a prospectus dated February 10, 2016 (the “Base Prospectus”)) and a preliminary

prospectus supplement dated February 26, 2018 (the “Preliminary Prospectus Supplement,” and together with the Base Prospectus, the “Preliminary Prospectus”) with the U.S. Securities and Exchange Commission (“SEC”) for

this offering. Before you invest, you should read the Preliminary Prospectus for this offering, and other documents the Issuer has filed with the SEC and which are incorporated by reference therein for more complete information about the Issuer and

this offering. You may get these documents for free by searching the SEC online database (EDGAR

®

) at www.sec.gov.

Alternatively, the Issuer, any underwriter or any dealer participating in the transaction will arrange to send you the Preliminary Prospectus if you

request it by calling Morgan Stanley & Co. LLC toll-free at

1-866-718-1649

or MUFG Securities Americas Inc. toll-free at

1-877-649-6848.

*Note: A

security rating is not a recommendation to buy, sell or hold securities and may be subject to revision, suspension or withdrawal at any time.

9

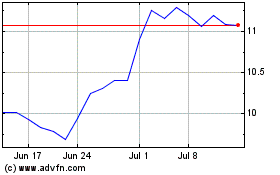

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

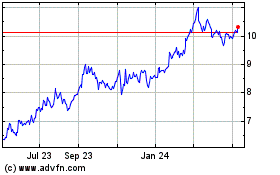

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Apr 2023 to Apr 2024