Estimated NAV5% more than doubles from

potential impact of new technology and re-scoped mine plan

Coeur Mining, Inc. (“Coeur” or the “Company”) (NYSE: CDE) today

released a re-scoped mine plan and preliminary economic assessment

(“PEA”) for its Rochester silver-gold mine in Nevada. The PEA,

which will be included in a NI 43-101 Technical Report expected to

be filed on March 5, 2018, incorporates the positive economic

impact expected from the potential addition of a high pressure

grinding roll (“HPGR”) to Rochester’s crushing circuit in early

2019 at an estimated cost of approximately $20 million. In

addition, the PEA reflects lower projected capital expenditures

related to the planned construction of a larger scale, more

efficient crusher expected to include a second HPGR unit, beginning

in 2020.

The introduction of HPGR technology has the potential to

increase Rochester’s silver recoveries from 61% over 20 years to

70% in just over two years, significantly improving the mine’s

economics. The re-scoped mine plan incorporates inferred material

in the open pit, thereby reducing Rochester’s strip ratio by more

than half from 0.8:1 to less than 0.4:1. Coeur plans to finalize

engineering of the potential HPGR addition in the coming months and

complete infill drilling over the next three years with the goal of

upgrading this inferred material to reserves.

The PEA reflects the following improvements compared to

Rochester’s current NI 43-101 Technical Report filed in early

2017:

- More than doubling Rochester’s NAV5%

from $280 million to $609 million

- 122% increase in total pre-tax life of

mine cash flows from $431 million to $955 million

- Marked increase in anticipated pre-tax

cash flow margin from 19% to 31%

- Further extension of Rochester’s mine

life out to 2038

“The implementation of this technology should be a game-changer

for Rochester’s costs, margins, cash flows, mine life and net asset

value,” said Mitchell J. Krebs, Coeur’s President and Chief

Executive Officer. “In 2017, Rochester’s costs per silver

equivalent1 ounce were $13.08. During the initial ten years after

adding this HPGR technology, costs are expected to decline by over

20% to less than $10.00 per silver equivalent1 ounce, and average

annual pre-tax cash flow is expected to be $48 million. As a

result, we believe this investment and this technology can generate

high returns and unlock significant value for our

stockholders.”

Comparison of the 2017 Technical Report

and 2018 PEA Life of Mine (“LOM”) Economic Analyses

February 2017Technical

Report

February 2018PEA

Estimated Mine Life 2031

2038 PROVEN & PROBABLE RESERVES

Mineralized material tons tons (000s) 244,804

-

Mineralized material gold grade oz/t 0.003

- Mineralized

material silver grade oz/t 0.46

-

MEASURED & INDICATED RESOURCES Mineralized material tons

tons (000s) - 277,151 Mineralized material gold grade oz/t - 0.003

Mineralized material silver grade oz/t - 0.44

INFERRED RESOURCES Mineralized material tons tons (000s) -

74,632 Mineralized material gold grade oz/t - 0.002 Mineralized

material silver grade oz/t - 0.38

METALLURGICAL RECOVERIES Metallurgical recovery gold % 92%

92% Metallurgical recovery silver % 61% 70%

REVENUE Gold price (2018 - LOM) $/oz $1,250 $1,250 Silver

price (2018 - LOM) $/oz $17.50 $17.50 Gross revenue $M

$2,225 $3,129

OPERATING COSTS Mining $M ($549)

($602) Crushing/Processing $M ($613) ($904) General and

administrative $M ($135) ($174) Smelting and refining $M ($20)

($29) Corporate management fee $M ($35) ($45) Net proceeds tax $M

($43) ($69) Royalties $M $0 $0 Total operating cost $M ($1,394)

($1,823) Cost per silver equivalent ounce1 (71.4:1) $/oz $10.97

$10.20 Cost per silver equivalent ounce1 (60:1) $/oz

$11.79 $10.85

CASH FLOW Operating cash flow $M $831

$1,306 Capital expenditures $M ($387) ($351) Royalties and other

$M ($12) $0

Total pre-tax cash flow

$M $431 $955 Average

annual pre-tax cash flow $M $33

$48 Project pre-tax NPV (5% discount rate)

$M $280 $609 Notes to the

above economic analyses: a. February 2018 PEA is effective

February 26, 2018 and the February 2017 Technical Report is

effective December 31, 2016. b. Assumed metals prices for estimated

February 2018 Mineral Resources were $20.00 per ounce of silver and

$1,400 per ounce of gold. Assumed metal prices for estimated 2016

year-end Mineral Reserves were $17.50 per ounce of silver and

$1,250 per ounce of gold and for estimated year-end Mineral

Resources were $19.00 per ounce of silver and $1,275 per ounce of

gold. c. Mineral Resources are in addition to Mineral Reserves and

do not have demonstrated economic viability. Inferred Mineral

Resources are considered too speculative geologically to have the

economic considerations applied to them that would enable them to

be considered for estimation of Mineral Reserves, and there is no

certainty that the Inferred Mineral Resources will be realized. d.

Rounding of tons and ounces, as required by reporting guidelines,

may result in apparent differences between tons, grade, and

contained metal content. e. For details on the estimation of

mineral reserves, mineral resources, and inferred mineral

resources, including the key assumptions, parameters and methods

used to estimate the Mineral Reserves, Mineral Resources, and

Inferred Mineral Resources, Canadian investors should refer to the

2017 NI 43-101 Technical Report on file at www.sedar.com as well as

the 2018 Technical Report, including the PEA, expected to be filed

March 5, 2018. f. The Mineral Reserves silver equivalent cut-off

grade equals 0.49 oz/t and the gold multiplier equals 109. The gold

multiplying factor for silver equivalent is based on: [($Price Au -

$Refining Au) / ($Price Ag - $Refining Ag)] x [(%Recovery Au) /

(%Recovery Ag)]. The Mineral Resources cut-off grade equals 0.40

oz/t and the gold multiplier equals 103. g. Rounding of short tons,

grades, and troy ounces, as required by reporting guidelines, may

result in apparent differences between tons, grades, and contained

metal contents. h. Mineral Reserves are contained within the

Measured and Indicated pit designs, or in stockpiles are supported

by a plan featuring variable throughput rates, stockpiling and

cut-off optimization. The PEA plan is contained within the

Measured, Indicated and Inferred pit design and has a different

mining sequence, variable production rate and an alternative

cut-off grade as described in footnotes b, e & f.

The PEA for the re-scoped mine plan is preliminary in nature and

includes inferred mineral resources, and does not have as high a

level of certainty as a plan based solely on proven and probable

reserves. Inferred mineral resources are considered too speculative

geologically to have the economic considerations applied to them

that would enable them to be considered for estimation of mineral

reserves and there is no certainty that the results from the

preliminary economic assessment will be realized should the Company

decide to proceed with the re-scoped mine plan. This decision has

not yet been made. Coeur expects to continue evaluating and

optimizing the HPGR option and expects to make a development

decision in early 2019.

About Coeur

Coeur Mining, Inc. is a well-diversified, growing precious

metals producer with six mines in the Americas employing

approximately 2,300 people. Coeur’s wholly-owned continuing

operations include the Palmarejo silver-gold complex in Mexico, the

Silvertip silver-zinc-lead mine in British Columbia, the Rochester

silver-gold mine in Nevada, the Kensington gold mine in Alaska, and

the Wharf gold mine in South Dakota. The sale of the Company’s San

Bartolomé silver mine in Bolivia is expected to be completed in

early 2018. In addition, the Company owns the La Preciosa project

in Mexico, a silver-gold exploration stage project. Coeur conducts

exploration activities in North America.

Cautionary Statements

This news release contains forward-looking statements within the

meaning of securities legislation in the United States and Canada,

including statements regarding the anticipated installation of high

pressure grinding roll units and planned construction of a larger

scale, more efficient crusher as well as anticipated capital

expenditures, recoveries, strip ratios, costs, revenues, asset

values, margins, cash flows, value creation and mine life. Such

forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause Coeur's actual

results, performance or achievements to be materially different

from any future results, performance or achievements expressed or

implied by the forward-looking statements. Such factors include,

among others, the risk that the anticipated installation of high

pressure grinding roll units does not occur and the anticipated

benefits thereof are not attained on a timely basis or at all, the

risk that planned drilling programs may be curtailed or canceled

due to budget constraints or other reasons, the risk that

anticipated cost reductions are not attained, the risks and hazards

inherent in the mining business (including risks inherent in

developing large-scale mining projects, environmental hazards,

industrial accidents, weather or geologically related conditions),

changes in the market prices of gold and silver and a sustained

lower price environment, the uncertainties inherent in Coeur's

production, exploratory and developmental activities, including

risks relating to permitting and regulatory delays, ground

conditions, grade variability, any future labor disputes or work

stoppages, the uncertainties inherent in the estimation of gold and

silver reserves, changes that could result from Coeur's future

acquisition of new mining properties or businesses, the loss of any

third-party smelter to which Coeur markets silver and gold, the

effects of environmental and other governmental regulations, the

risks inherent in the ownership or operation of or investment in

mining properties or businesses in foreign countries, Coeur's

ability to raise additional financing necessary to conduct its

business, make payments or refinance its debt, as well as other

uncertainties and risk factors set out in filings made from time to

time with the United States Securities and Exchange Commission, and

the Canadian securities regulators, including, without limitation,

Coeur's most recent report on Form 10-K. Actual results,

developments and timetables could vary significantly from the

estimates presented. Readers are cautioned not to put undue

reliance on forward-looking statements. Coeur disclaims any intent

or obligation to update publicly such forward-looking statements,

whether as a result of new information, future events or otherwise.

Additionally, Coeur undertakes no obligation to comment on

analyses, expectations or statements made by third parties in

respect of Coeur, its financial or operating results or its

securities.

Christopher Pascoe, Coeur's Director, Technical Services and a

qualified person under Canadian National Instrument 43‐101,

reviewed and approved the scientific and technical information

concerning Coeur's mineral projects in this news release. Mineral

resources are in addition to mineral reserves and do not have

demonstrated economic viability. Inferred mineral resources are

considered too speculative geologically to have the economic

considerations applied to them that would enable them to be

considered for estimation of mineral reserves, and there is no

certainty that the inferred mineral resources will be realized. For

a description of the key assumptions, parameters and methods used

to estimate mineral reserves and resources, as well as data

verification procedures and a general discussion of the extent to

which the estimates may be affected by any known environmental,

permitting, legal, title, taxation, socio‐political, marketing or

other relevant factors, Canadian investors should refer to the

Technical Report for Rochester expected to be filed March 5, 2018

on SEDAR at www.sedar.com.

Cautionary Note to U.S. Investors ‐ The United States Securities

and Exchange Commission permits U.S. mining companies, in their

filings with the SEC, to disclose only those mineral deposits that

a company can economically and legally extract or produce. We may

use certain terms in public disclosures, such as "measured,"

"indicated," "inferred" and "resources," that are recognized by

Canadian regulations, but that SEC guidelines generally prohibit

U.S. registered companies from including in their filings with the

SEC. U.S. investors are urged to consider closely the disclosure in

our Form 10‐K which may be secured from us, or from the SEC's

website at http://www.sec.gov.

Notes 1. For purposes of silver equivalence, metals prices

of $17.50 per ounce silver and $1,250 per ounce gold were used,

except where noted as silver equivalence assuming a 60:1

silver-to-gold ratio.

Conversion Table

1 short ton = 0.907185 metric tons 1 troy ounce

= 31.10348 grams

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180226005455/en/

Coeur Mining, Inc.Courtney Lynn, Vice President, Investor

Relations and TreasurerPhone: (312) 489-5800www.coeur.com

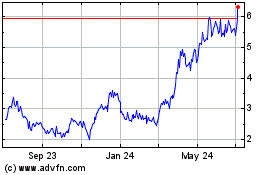

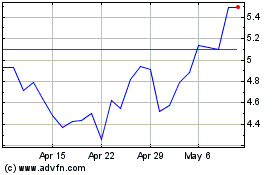

Coeur Mining (NYSE:CDE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coeur Mining (NYSE:CDE)

Historical Stock Chart

From Apr 2023 to Apr 2024