By Annie Gasparro and Cara Lombardo

General Mills Inc., burdened with stagnant sales of cereal and

yogurt, is paying around $8 billion for a pet-food business to help

it generate revenue growth in the U.S.

The Minneapolis-based food conglomerate, which hasn't sold pet

food since the 1960s, said Friday it plans to buy Blue Buffalo Pet

Products Inc. as it looks for a piece of the rapidly expanding

natural pet-food market.

General Mills Chief Executive Jeff Harmening said the deal

accelerates his plan to diversify its business by buying

faster-growing brands and offloading some of its lackluster ones.

Last fiscal year, General Mills' sales fell 5.6% to $15.6 billion,

as brands like Yoplait yogurt and Betty Crocker lost the attention

of American consumers.

"The Blue Buffalo acquisition brings back the growth in the U.S.

and growth on a consistent basis," Mr. Harmening said in an

interview Friday.

The pet-food company was founded by Bill Bishop, its chief

executive, and his family in 2002, inspired by their dog Blue who

died of cancer.

Blue Buffalo is now the top natural pet-food brand in the U.S.

and has been growing faster than rivals in the $30 billion U.S.

pet-food segment, Mr. Harmening said. Its sales have risen by an

average of 12% a year over the past three years to $1.3 billion in

its latest fiscal year.

When it went public in 2015, Blue Buffalo's stock rose 36% on

its first day of trading.

Mr. Harmening, who became CEO of General Mills in June, said he

and Mr. Bishop signed the deal Thursday night over beer and chicken

wings at a restaurant in Blue Buffalo's hometown of Wilton,

Conn.

Under terms of the agreement, General Mills would pay $40 a

share for Blue Buffalo, a premium of more than 17% over its

Thursday closing price. It expects to complete the deal by May as

Blue Buffalo's majority shareholders have already approved it.

Shares in Blue Buffalo jumped 17% Friday, while General Mills

shares dropped 4%.

Jefferies analyst Akshay Jagdale said the deal makes sense

strategically, but "the price is steep, and General Mills will have

to work to extract value from the deal."

Pet food and pet-care products have been a bright spot in

grocery stores. Mainstay canned and packaged foods are struggling

as Americans buy more natural food and high-end treats for their

pets, just as they are for themselves.

"The humanization and premium-ization is what's driving the

pet-food marketplace," said Mr. Bishop, who will retain the chief

executive position after the deal.

As a result, food makers have invested in pet-food brands in

recent years. Last year, Mars Inc. said it would pay $7.7 billion

to buy veterinary and dog day-care company VCA Inc. J.M. Smucker

Co. paid more than $3 billion in 2015 to buy Milk-Bone owner Big

Heart, and Nestlé bought the maker of Purina pet food for more than

$10 billion in 2001.

Smucker said its pet-food business, led by the all-natural

brands, has been a growth driver for the company, with sales up 2%

in the latest quarter.

"Pet food and snacks have now become the largest

center-of-the-store category in the U.S. food and beverage market,"

said Smucker Chief Mark Smucker at a conference this week, adding

that Smucker could potentially acquire more.

Industry executives say there is still room for expansion.

Only 10% of American households buy wholesome, natural pet food

now, while 68% own pets, according to General Mills and the

American Pet Products Association.

Pet foods labeled all-natural and grain-free -- especially those

that use simple, whole ingredients like chicken, blueberries and

sweet potatoes -- are growing faster than mainstream varieties.

For consumers, the shift is motivated less by scientific

evidence and more by a desire to treat their pets like family.

The fancier products also have higher price tags, making them

more profitable for the companies that sell them.

Blue Buffalo says its food uses higher-quality proteins, like

chicken rather than poultry byproduct and that it doesn't "cut

corners" by using corn like some of its competitors.

In 2014, rival Purina filed a legal complaint against Blue

Buffalo, accusing it of making false advertising claims about what

its products could do. Blue Buffalo countersued for defamation. The

companies settled after two years, though the terms were

confidential.

For General Mills, getting into pet food will be a return to its

past. The company produced pet food as far back as the 1930s, when

it sold dog food, and later it sold food for cats and birds

too.

The deal marks the second-largest pet-food deal ever, according

to Dealogic, and it's the first major one for Mr. Harmening, who

took the CEO job at General Mills in June. He had gained acclaim in

previous roles for spearheading the company's shift toward natural

foods, namely through the 2014 acquisition of Annie's

Homegrown.

General Mills says it plans to expand Blue Buffalo by selling it

in more places, including convenience stores and big-box retailers,

a strategy it says helped make Annie's successful.

But competition is rising, especially as retailers seek to

promote their own premium pet products under store brands, said

Sikich Investment Banking director Thomas Davenport. Commodity

giant Cargill Inc. recently acquired Pro-Pet, an Ohio-based

manufacturer of private label pet foods, to capitalize on the

trend.

Write to Annie Gasparro at annie.gasparro@wsj.com and Cara

Lombardo at cara.lombardo@wsj.com

(END) Dow Jones Newswires

February 23, 2018 16:44 ET (21:44 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

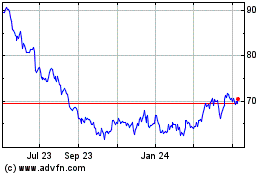

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

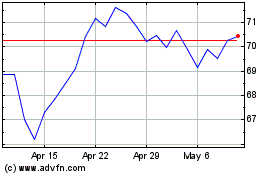

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024