By Annie Gasparro and Cara Lombardo

General Mills Inc., afflicted with stagnant cereal and yogurt

sales, is paying around $8 billion for a pet food business to

generate revenue growth in the U.S.

The Minneapolis-based food conglomerate, which hasn't sold pet

food since the 1960s, said Friday it plans to buy Blue Buffalo Pet

Products Inc. as it looks for a piece of the rapidly expanding

natural pet food market.

General Mills Chief Executive Jeff Harmening said the deal

accelerates his plan to enhance the company's growth prospects by

diversifying its business through acquisitions and divestitures of

brands. Last fiscal year, General Mills' sales fell 5.6% to $15.6

billion, as brands like Yoplait yogurt and Betty Crocker lost the

attention of American consumers.

"The Blue Buffalo acquisition brings back the growth in the U.S.

and growth on a consistent basis," Mr. Harmening said in an

interview Friday.

Blue Buffalo, which had annual sales of $1.3 billion in its last

fiscal year, has been growing faster than its rivals in the $30

billion U.S. pet food segment, Mr. Harmening said.

Under terms of the agreement, General Mills would pay $40 a

share for Blue Buffalo, a more-than-17% premium over its Thursday

closing price of $34.12. It expects to complete the deal by May.

Shares in Blue Buffalo jumped 17% in early trading Friday, while

General Mills shares dropped 4%.

Jefferies analyst Akshay Jagdale said the deal makes sense

strategically, but "the price is steep and General Mills will have

to work to extract value from the deal."

The pet food and pet-care industry has been a bright spot in

grocery stores, where mainstays like canned and packaged foods are

landing in fewer shopping carts. Americans are buying more natural

food and high-end treats for their pets, just as they would for

themselves.

"The humanization and premiumization is what's driving the pet

food marketpalce," said Blue Buffalo Chief Billy Bishop in an

interview Friday.

As a result, food makers have invested more in pet food brands

in recent years. Last year, Mars Inc. said it would pay $7.7

billion to buy veterinary and dog day-care company VCA Inc. J.M.

Smucker Co. paid more than $3 billion in 2015 to buy Milk-Bone

owner Big Heart, and Nestlé bought the maker of Purina pet food for

more than $10 billion in 2001.

Smucker said its pet food business, led by the all-natural

brands, has been a growth driver for the company, with sales up 2%

in the latest quarter.

"Pet food and snacks have now become the largest

center-of-the-store category in the U.S. food and beverage market,"

and remains one of the fastest-growing ones, said Smucker Chief

Mark Smucker at a conference this week, adding that Smucker could

also potentially acquire more brands in the space.

For General Mills, it will be a return to the past. The company

produced pet food as far back as the 1930s, when it sold dog food

through feed stores, and in the 1950s it marketed food for dogs,

cats and birds.

Mr. Harmening said he and Mr. Bishop signed the deal Wednesday

over beer and wings at a restaurant in Blue Buffalo's hometown of

Wilton, Conn. General Mills would maintain those headquarters and

Mr. Bishop would keep his position.

The deal marks the first major acquisition for Mr. Harmening,

who took the job in June. Mr. Harmening had gained acclaim in

previous roles for spearheading the company's shift toward natural

foods, namely through the 2014 acquisition of Annie's

Homegrown.

Blue Buffalo, which went public in 2015, was founded by Mr.

Bishop and his family, as their dog Blue suffered several bouts of

cancer at a young age. They wanted him to have food made with

high-quality proteins like turkey and salmon. While Blue died of

cancer, his legacy lives on through the company, which refers to

him as the founder.

Mr. Bishop and his family own 8% of Blue Buffalo shares and

stand to make about $625 million in market value from the deal,

which has been approved by both the boards of General Mills and

Blue Buffalo. The Bishop family and Blue Buffalo's largest

shareholder, Invus Public Equities, have signed off on the deal, so

it doesn't require additional signoff from other Blue Buffalo

shareholders, General Mills said.

Mr. Harmening said his family is also a dog-loving group. He

bought his dog Fox while working for General Mills in Switzerland,

so the seven-year-old dog only responds to their commands when they

say them in French.

Mr. Bishop, who had two dogs after Blue who have also since

died, now has a cat named Bobby.

Write to Annie Gasparro at annie.gasparro@wsj.com and Cara

Lombardo at cara.lombardo@wsj.com

(END) Dow Jones Newswires

February 23, 2018 11:12 ET (16:12 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

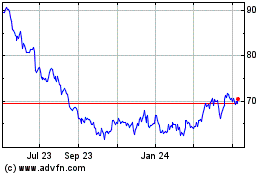

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

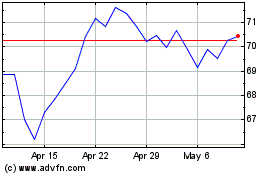

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024