Despite Loss, Barclays Chief Is Optimistic -- WSJ

February 23 2018 - 3:02AM

Dow Jones News

By Max Colchester

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 23, 2018).

LONDON -- Barclays PLC Chief Executive Jes Staley pledged

Thursday to more than double dividends at the loss-making British

bank, as the U.S. executive looks to appease disgruntled

shareholders.

The move came as the bank reported a GBP1.9 billion ($2.64

billion) net loss for 2017, compared with a GBP1.6 billion profit

the prior year, hit by a charge related to the U.S. tax overhaul

and poor returns at its investment bank's trading unit.

However, Mr. Staley said his turnaround plan is about to pay off

and that the return of volatility to markets was helping boost

trading revenue at the investment bank. "For the first time in five

years, the bank begins 2018 with a clear operating model," he

said.

Barclays said it would raise its dividend from 3 pence a share

to 6.5 pence a share this year, back to where it was two years ago

when it was cut to fund a restructuring at the group. Its shares

rose 4.4% in London.

The results come as Barclays is at a crossroads. After more than

two years of restructuring, Mr. Staley has now completed his

reshaping of the lender into a universal bank with major operations

in the U.S. and U.K.

However, Barclays was one of the worst-performing European bank

stocks last year, with shareholders questioning Mr. Staley's

decision to continue backing the bank's battered trading unit.

Investors now want to see how the businesses -- stretching from

credit cards to equity derivatives -- click together.

Sustained profits still look a ways off. The bank said on

Thursday that it would meet its cost of equity, around 10%, only by

2020.

Total income fell 2% on the year to GBP21.1 billion as the bank

shed operations. The investment bank continued to drag on results,

with markets revenue sliding 17% in the last quarter from the year

before.

Mr. Staley has been dealt a tough hand, analysts say. The

investment bank's trading business has struggled with record-low

levels of volatility. The Brexit vote has spooked investors,

worried that the U.K. economy could suffer, dragging Barclays's

sizable retail business with it. And analysts fret that the bank's

red hot growth in U.S. credit cards could see the bank burned if

the economic cycle there cools. Barclays on Thursday warned that

delinquencies on card payments in the U.S. were rising.

The first few months of the year, however, provided some hope

for the investment bank, as choppy markets prompted increased

client activity. Falling tax rates in the U.S. are expected to help

bolster returns, the bank said. Barclays previously disclosed it

was taking a $1.3 billion write-down on its 2017 accounts following

U.S. corporate tax cuts.

Going into 2018, Barclays still faces several legal hurdles,

including a criminal investigation into an emergency fundraising

during the financial crisis. The U.S. Justice Department is suing

Barclays, alleging it fraudulently sold more than $30 billion of

mortgage-linked securities that helped fuel the financial crisis.

Barclays has said it wants to settle the allegations but only at

the right price. Mr. Staley and the bank are being probed over

attempts to reveal the identity of a whistleblower that critiqued a

hire made by the executive. The bank put aside GBP240 million to

cover a foreign-exchange matter in the last quarter of the

year.

Write to Max Colchester at max.colchester@wsj.com

(END) Dow Jones Newswires

February 23, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

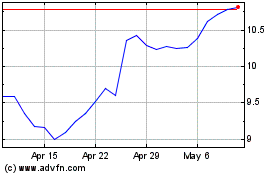

Barclays (NYSE:BCS)

Historical Stock Chart

From Mar 2024 to Apr 2024

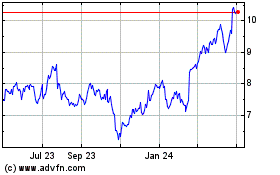

Barclays (NYSE:BCS)

Historical Stock Chart

From Apr 2023 to Apr 2024