Goldman Takes Aim At Private Equity -- WSJ

February 23 2018 - 3:02AM

Dow Jones News

By Dawn Lim and Laura Kreutzer

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 23, 2018).

Goldman Sachs Group Inc. said it raised $2.5 billion to buy

minority stakes in private-equity firms, betting on an industry

that is commanding increasing influence as more businesses choose

to stay private longer.

Petershill, a group within Goldman's asset-management arm,

originally had targeted $2 billion for the fund.

Goldman is zeroing on an industry that has secured a record

amount of dollars from pensions and endowments in recent years to

buy and lend money to businesses. U.S. private-equity firms raised

over $362 billion in 2017, the most money in a year since 2007,

according to LP Source, a data provider owned by Dow Jones &

Co., publisher of The Wall Street Journal.

These firms can be attractive targets for investors who want to

hold long-term stakes, as the firms' funds typically lock up the

money of major institutions for at least a decade, earning fees and

a cut of profits along the way. The investment pool Goldman raised

for the strategy, which includes Petershill Private Equity LP and

other related funds, channels the approach of Warren Buffett's

Berkshire Hathaway Inc., in that it doesn't set deadlines to exit

its bets.

Over time, Goldman could cash in on the positions by selling

stakes to investment managers and other buyers. It also could take

a portion of the portfolio public, making it available for

individual investors and mutual funds to invest in. There is no

guarantee Petershill will make these moves. If Goldman does list a

pool of manager stakes, it would further open up a market that has

largely been out of the reach of mom-and-pop investors. The

majority of private-equity firms don't list their shares publicly,

and their funds typically don't accept money from small investors.

This means that only large institutions, such as pensions and

endowments, as well as the ultrarich have broad exposure to the

asset class.

"If you're a public investor, there are not a lot of ways to

invest in private equity through the public markets," said Michael

Brandmeyer, co-chief investment officer of Goldman's alternative

investments and manager selection group, in which the Petershill

unit is housed. "We think there could be a potentially enthusiastic

audience for a listing."

Goldman already has put a chunk of its new fund to work,

acquiring minority stakes in private-equity firms.

The fund generally will buy passive stakes in midsize firms with

assets of $5 billion to $20 billion that Goldman believes have

potential to expand.

The latest Petershill pool has taken stakes in

technology-focused firm Accel-KKR, energy-infrastructure investor

ArcLight Capital Partners and oil-and-gas manager Riverstone

Holdings.

These sorts of transactions set a price tag for private-equity

firms, allowing founders to put a dollar figure on the wealth they

have created and paving the way for some of them to transfer

ownership to other executives. Firms that sell a minority stake can

use the new cash to fund expansion efforts. The Petershill unit

also can act as a sounding board for the firms it backs.

"Many organizations are collections of excellent investors,"

said Christopher Kojima, who heads Goldman's alternative

investments and manager selection group, which oversees more than

$200 billion. "But many of them might not be institutions."

The first Petershill fund, which Goldman launched in 2007 to

invest in hedge funds, delivered 2.5 times its investor money, even

as many hedge funds across the industry delivered disappointing

returns and bled investor money. Goldman exited all hedge-fund

positions in that pool after it struck a deal to sell stakes in

five managers to Affiliated Managers Group Inc. for about $800

million in 2016.

Goldman continues to manage a pool of hedge-fund interests from

another $1.5 billion Petershill fund, taking the view that sound

firms can deliver returns even as the industry faces

challenges.

"Our focus is on firms with their best years ahead of them,"

said Mr. Kojima.

Goldman made its first direct investment in a private-equity

firm in 2016 when it acquired a minority stake in Littlejohn &

Co. It joins a number of other investment firms -- including

Neuberger Berman Group LLC's Dyal Capital Partners, Blackstone

Group LP and Carlyle Group LP -- that are pursuing stakes in

private-equity firms as well.

Write to Dawn Lim at dawn.lim@wsj.com and Laura Kreutzer at

laura.kreutzer@wsj.com

(END) Dow Jones Newswires

February 23, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

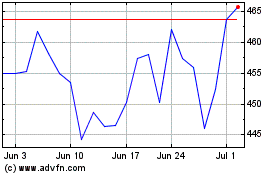

Goldman Sachs (NYSE:GS)

Historical Stock Chart

From Mar 2024 to Apr 2024

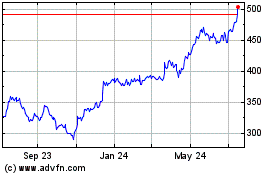

Goldman Sachs (NYSE:GS)

Historical Stock Chart

From Apr 2023 to Apr 2024