Dish Network Gains Sling TV Subscribers but Retention Is a Problem -- 2nd Update

February 21 2018 - 5:15PM

Dow Jones News

By Shalini Ramachandran and Imani Moise

Dish Network Corp. said its Sling TV streaming-video service has

signed up 2.2 million subscribers in the company's first disclosure

of a figure, but Chairman Charlie Ergen said customer retention is

a significant challenge.

Dish launched the streaming service nearly three years ago in an

attempt to lure younger viewers and people giving up cable TV. The

hope was that it would be an avenue for growth as Dish's

traditional satellite TV business declines.

The subscriber figure disclosed Wednesday came as part of the

company's fourth-quarter earnings report.

The number of Sling TV customers grew 47% compared with the

year-ago period, but it wasn't enough to offset a 9.4% decline in

satellite TV subscribers. The company finished the quarter with

13.2 million subscribers overall, including Sling and satellite

customers, down from 13.7 million subscribers last year. In the

fourth quarter, satellite TV subscribers fell by 121,000.

Sling TV added 711,000 subscribers in 2017, below the 878,000 in

the previous year. Growth slowed partly because of increased

competition with other streaming services.

Streaming TV services such as Sling, Sony PlayStation's Vue,

Alphabet Inc.'s YouTube TV and an offering from Hulu have marketed

themselves as consumer-friendly alternatives to cable TV, without

the headaches of bulky equipment and two-year contracts.

But Mr. Ergen said service cancellations, or churn, are a major

issue for these services, in part because subscription demand can

be seasonal. Some consumers only want to sign up for a month to

watch the "March Madness" college basketball tournament, after

which they disconnect, for example. Moreover, every streaming

service has free-trial offers.

"You buy one month and then turn it off," Mr. Ergen said on a

conference call to discuss the quarterly results. "You can move

from player to player to player. I'm sure there's some college kids

who are going a year and never paying a dime for multichannel

TV."

Mr. Ergen said streaming services "aren't suicidal" and are

likely to rein in promotional offers over time. Dish is also

working with television programmers to address high customer

turnover. "We both have a motivation to reduce the short-term

churn," he said.

As its tries to diversify away from pay TV, Dish is seeking an

entry into the wireless business. The company said Thursday that it

plans to spend up to $1 billion to build out the first phase of a

wireless network to comply with government-mandated deadlines

related to wireless airwaves it has licensed.

Overall for the quarter, Dish reported earnings of $1.39

billion, or $2.64 a share, up from $355 million, or 73 cents a

share, a year earlier. The period was helped by a $1.2 billion

benefit related to the recently enacted tax overhaul.

Revenue fell 7.8% to $3.48 billion, missing the $3.53 billion

forecast by Thomson Reuters.

Write to Shalini Ramachandran at shalini.ramachandran@wsj.com

and Imani Moise at imani.moise@wsj.com

(END) Dow Jones Newswires

February 21, 2018 17:00 ET (22:00 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

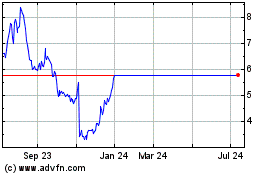

DISH Network (NASDAQ:DISH)

Historical Stock Chart

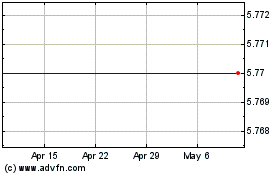

From Mar 2024 to Apr 2024

DISH Network (NASDAQ:DISH)

Historical Stock Chart

From Apr 2023 to Apr 2024