SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

21

February 2018

LLOYDS BANKING GROUP

plc

(Translation

of registrant's name into English)

5th Floor

25 Gresham Street

London

EC2V 7HN

United Kingdom

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual

reports

under

cover Form 20-F or Form 40-F.

Form

20-F..X.. Form 40-F

Indicate

by check mark whether the registrant by furnishing the

information

contained

in this Form is also thereby furnishing the information to

the

Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of

1934.

Yes

No ..X..

If

"Yes" is marked, indicate below the file number assigned to the

registrant in connection with Rule

12g3-2(b):

82- ________

Index

to Exhibits

21

February 2018

LLOYDS BANKING GROUP STRATEGIC UPDATE

'I am

delighted to announce today our strategy for the next three years

which will transform the Group for success in a digital world.

Over

the last six years the Group has made huge progress and has built

many strong capabilities including the largest and top rated

digital bank in the UK. As we enter the next phase of our journey

our team is determined to further improve the business, enhance

customer experience and deliver superior shareholder

returns.

The

external environment is evolving rapidly and I am confident that

this exciting and ambitious plan, with the significant additional

investment, will mean we remain at the forefront of UK financial

services, and continue to deliver our mission of Helping Britain

Prosper.'

António

Horta-Osório, Group Chief Executive

|

Key actions of the 2018-2020 strategic plan:

●

Transform the Group into a

digitised, simple, low risk, customer focused, UK financial

services provider

●

Leverage our multi-brand and

multi-channel model, including the UK's largest digital bank and

branch network, to be the best bank for

customers

●

Invest more than £3

billion in strategic initiatives, an increase of more than 40 per

cent on the previous strategy, to further enhance customer

propositions, further digitise the Group, maximise capabilities as

an integrated financial service provider and transform the way we

work.

Key outcomes and financial targets:

●

Growth in targeted segments

with strong statutory profit growth

●

Operating costs of less than

£8 billion in 2020 with cost: income ratio in low 40s as we

exit 2020

●

Asset quality ratio of

around 35 basis points through the cycle and less than 30 basis

points during the plan period

●

Strong and superior returns

(14-15 per cent return on tangible equity from 2019) on a higher

CET1 capital base

●

Strong capital generation

(170-200 basis points per year pre dividend) will continue to drive

attractive and sustainable capital returns

|

Strategy overview

Over

the last six years we have successfully transformed the Group,

restructuring and simplifying the business whilst enhancing

customer experience, Helping Britain Prosper and significantly

increasing shareholder returns.

We have

made strong progress, leveraging the unique strengths and assets of

the Group including our differentiated multi-brand strategy, our

multi-channel propositions, market leading efficiency, and the

largest digital bank and branch network in the UK.

As we

look to the future, we see the external environment evolving

rapidly. Changing customer behaviours, the pace of technological

evolution and changes in regulation all present opportunities.

Given our strong capabilities and the significant progress made in

recent years we believe we are in a unique position to compete and

win in this environment by developing additional competitive

advantages. We will continue to transform ourselves to succeed in

this digital world and the next phase of our strategy will ensure

we have the capabilities to deliver future success.

Strategic priorities

We have

identified four strategic priorities focused on the financial needs

and behaviours of the customer of the future: further enhancing our

leading customer experience; further digitising the Group;

maximising Group capabilities; and transforming ways of working. We

will invest more than £3 billion in these strategic

initiatives through the plan period that will drive our

transformation into a digitised, simple, low risk, customer focused

UK financial services provider.

Delivering a leading customer experience

We will

drive stronger customer relationships through best in class

propositions while continuing to provide our customers with

brilliant servicing and a seamless experience across all channels.

This will include:

●

remaining the number 1 digital bank in the UK with open

banking functionality;

●

unrivalled reach with UK's largest branch network serving

complex needs; and

●

data-driven and personalised customer

propositions.

Digitising the Group

We will

deploy new technology to drive additional operational efficiencies

that will make banking simple and easier for customers whilst

reducing operating costs, pursuing the following

initiatives:

●

deeper end-to-end transformation targeting over 70 per cent

of cost base;

●

simplification and progressive modernisation of our data and

IT infrastructure; and

●

technology enabled productivity improvements across the

business.

Maximising the Group's capabilities

We will

deepen customer relationships, grow in targeted segments and better

address our customers' banking and insurance needs as an integrated

financial services provider. This will include:

●

increasing Financial Planning and Retirement (FP&R) open

book assets by more than £50 billion by 2020 with more than 1

million new pension customers;

●

implementing an integrated FP&R proposition with single

customer view; and

●

start-up, SME and Mid Market net lending growth (more than

£6 billion in the plan period).

Transforming ways of working

We are

making our biggest ever investment in people, increasing colleague

training and development by 50 per cent to 4.4 million hours

per annum and embracing new technology to drive better customer

outcomes. The hard work, commitment and expertise of our colleagues

has enabled us to deliver to date and we will further invest in

capabilities and agile working practices. We have already

restructured the business and reorganised the leadership team to

ensure effective implementation of the new strategy.

Financial returns

The UK

economy has proven resilient and going forward our plans and

projections assume this performance continues with a steady

increase in base rate to 1.25 per cent by the end of

2020.

The

strategy outlined today will enable the Group to deliver strong

statutory profit growth supported by targeted asset growth in key

segments, a resilient net interest margin, lower operating costs,

strong asset quality and lower remediation costs, whilst delivering

strong capital generation and sustainable and superior shareholder

returns.

Costs

will continue to be a competitive advantage as we deliver market

leading efficiency. We expect operating costs to be less than

£8 billion in 2020. We also expect to achieve a cost:income

ratio in the low 40s as we exit 2020, including future remediation

costs. We continue to expect improvements in the cost:income ratio

every year.

Asset

quality remains strong and, given our low risk business model and

the significant portfolio improvements in recent years, we now

expect an asset quality ratio of around 35 basis points through the

cycle and less than 30 basis points through the plan

period.

We

expect to deliver an improved return on tangible equity (RoTE) of

14.0-15.0 per cent from 2019 onwards on a higher CET1 capital base

of c.13 per cent plus a management buffer of around 1 per

cent.

Capital

generation is expected to remain strong with 170-200 basis points

of capital generation per year pre dividend and as a result we

expect to deliver progressive and sustainable ordinary dividends

whilst maintaining the flexibility to return surplus capital to

shareholders.

Forward looking statements

This

document contains certain forward looking statements with respect

to the business, strategy, plans and /or results of Lloyds Banking

Group and its current goals and expectations relating to its future

financial condition and performance. Statements that are not

historical facts, including statements about Lloyds Banking Group's

or its directors' and/or management's beliefs and expectations, are

forward looking statements. By their nature, forward looking

statements involve risk and uncertainty because they relate to

events and depend upon circumstances that will or may occur in the

future. Factors that could cause actual business, strategy, plans

and/or results (including but not limited to the payment of

dividends) to differ materially from forward looking statements

made by the Group or on its behalf include, but are not limited to:

general economic and business conditions in the UK and

internationally; market related trends and developments;

fluctuations in interest rates, inflation, exchange rates, stock

markets and currencies; the ability to access sufficient sources of

capital, liquidity and funding when required; changes to the

Group's credit ratings; the ability to derive cost savings and

other benefits including, but without limitation as a result of any

acquisitions, disposals and other strategic transactions; changing

customer behaviour including consumer spending, saving and

borrowing habits; changes to borrower or counterparty credit

quality; instability in the global financial markets, including

Eurozone instability, instability as a result of the exit by the UK

from the European Union (EU) and the potential for other countries

to exit the EU or the Eurozone and the impact of any sovereign

credit rating downgrade or other sovereign financial issues;

technological changes and risks to the security of IT and

operational infrastructure, systems, data and information resulting

from increased threat of cyber and other attacks; natural, pandemic

and other disasters, adverse weather and similar contingencies

outside the Group's control; inadequate or failed internal or

external processes or systems; acts of war, other acts of

hostility, terrorist acts and responses to those acts,

geopolitical, pandemic or other such events; changes in laws,

regulations, accounting standards or taxation, including as a

result of the exit by the UK from the EU, or a further possible

referendum on Scottish independence; changes to regulatory capital

or liquidity requirements and similar contingencies outside the

Group's control; the policies, decisions and actions of

governmental or regulatory authorities or courts in the UK, the EU,

the US or elsewhere including the implementation and interpretation

of key legislation and regulation together with any resulting

impact on the future structure of the Group; the ability to attract

and retain senior management and other employees and meet its

diversity objectives; actions or omissions by the Group's

directors, management or employees including industrial action;

changes to the Group's post-retirement defined benefit scheme

obligations; the extent of any future impairment charges or

write-downs caused by, but not limited to, depressed asset

valuations, market disruptions and illiquid markets; the value and

effectiveness of any credit protection purchased by the Group; the

inability to hedge certain risks economically; the adequacy of loss

reserves; the actions of competitors, including non-bank financial

services, lending companies and digital innovators and disruptive

technologies; and exposure to regulatory or competition scrutiny,

legal, regulatory or competition proceedings, investigations or

complaints. Please refer to the latest Annual Report on Form 20-F

filed with the US Securities and Exchange Commission for a

discussion of certain factors together with examples of forward

looking statements. Except as required by any applicable law or

regulation, the forward looking statements contained in this

document are made as of today's date, and Lloyds Banking Group

expressly disclaims any obligation or undertaking to release

publicly any updates or revisions to any forward looking

statements. The information, statements and opinions contained in

this document do not constitute a public offer under any applicable

law or an offer to sell any securities or financial instruments or

any advice or recommendation with respect to such securities or

financial instruments.

LLOYDS

BANKING GROUP plc

(Registrant)

By: Douglas

Radcliffe

Name: Douglas

Radcliffe

Title: Group

Investor Relations Director

Date: 21st

February 2018

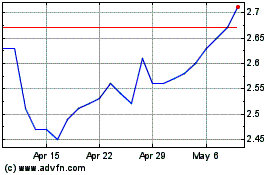

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Mar 2024 to Apr 2024

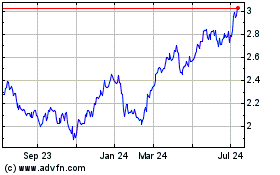

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Apr 2023 to Apr 2024