Gap Seeks New Leader for Flagship Brand -- WSJ

February 21 2018 - 3:02AM

Dow Jones News

By Khadeeja Safdar and Cara Lombardo

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 21, 2018).

Gap Inc. is searching for a new leader of its flagship brand as

it looks to jump-start sales.

The apparel retailer said Tuesday that Jeff Kirwan has resigned

after three years as Gap brand president and chief executive. Brent

Hyder, Gap executive vice president of global talent and

sustainability, will serve as interim brand president.

Shares of the company, which also owns Old Navy and Banana

Republic, fell 5% to $31.62 on Tuesday.

"While I am pleased with our progress in brand health and

product quality, we have not achieved the operational excellence

and accelerated profit growth that we know is possible at Gap

brand," Gap Inc. Chief Executive Art Peck said in prepared remarks.

"As we move into the brand's next phase of development, Jeff and I

agreed it was an appropriate time for a change in leadership."

The Gap brand has long struggled to recapture the magic of its

1990s glory days. Mr. Kirwan, a company veteran, was promoted by

Mr. Peck to reinvigorate the iconic brand after serving as Gap's

president for China. Under his leadership, the retailer focused on

fabric innovations, sizing issues and supply-chain efficiency. The

brand last year launched a 1990s-inspired fashion collection.

Wardrobe basics have evolved since Gap's heyday, with many

customers swapping out denim for yoga pants. In recent years, the

brand has lost market share to fast-fashion rivals such as H&M

and Zara. Old Navy, the company's budget brand and biggest division

by sales, has been a bright spot, helping to shore up companywide

results even as Gap and Banana Republic have struggled.

The parent company has been shifting its footprint accordingly.

Last year, it announced plans to close about 200 Banana Republic

and Gap stores over the next three years, while opening new Old

Navy and Athleta locations.

Gap brand same-store sales dropped in the first two quarters of

the retailer's just-ended fiscal year and rose slightly in its

third quarter. Analysts expect the brand to show a 0.2% decline in

same-store sales when the company reports its fourth-quarter

results next week.

Write to Khadeeja Safdar at khadeeja.safdar@wsj.com and Cara

Lombardo at cara.lombardo@wsj.com

(END) Dow Jones Newswires

February 21, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

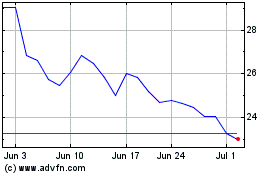

Gap (NYSE:GPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gap (NYSE:GPS)

Historical Stock Chart

From Apr 2023 to Apr 2024