By Nick Timiraos

A bipartisan spending deal reached by U.S. lawmakers earlier

this month has prompted many Wall Street economists to raise their

projections of how much the Federal Reserve will raise interest

rates this year and next.

More forecasters say they now expect four Fed rate increases

this year, up from three, because of the deal to increase federal

government spending by $300 billion over the next two years.

The funding bill is more generous than many economists

anticipated, and they predict it could boost U.S. economic growth

in 2018 and '19 by around 0.3 percentage points each year --

roughly the same size increase expected from the $1.5 trillion tax

cut signed into law by President Donald Trump in December.

Economists at UBS Group AG, Nomura Securities and Oxford

Economics in the past week raised their projections for rate

increases, joining other prominent forecasting shops that had

already projected four quarter-percentage-point increases in the

Fed's benchmark short-term interest rate this year.

Nomura sees the Fed raising rates four times this year and twice

next year, adding one more additional rate rise to its forecast in

both years. UBS also added one rate increase to its forecast each

year, now expecting the Fed to raise rates four times this year and

three next year.

Economists at Goldman Sachs Group Inc. and JPMorgan Chase &

Co., which were among those already projecting four rate rises this

year, have said the government spending package makes them more

confident in those calls.

Markets have largely priced in at least three rate increases

this year, and futures trading tracked by CME Group shows investors

have placed a 23% probability on a fourth rate increase.

The Fed's rate-setting decisions matter keenly to markets

because of the likely impact on the values of bonds, stocks,

currencies, real estate and other assets. The policies often,

though not always, influence borrowing costs for households and

businesses, such as through rates on credit cards, mortgages and

corporate loans.

The Fed has raised rates five times since December 2015, most

recently last December to a range between 1.25% and 1.5%.

At their December meeting, officials penciled in three rate

increases for this year and two for 2019. Officials will unveil

their updated projections after their March 20-21 meeting, the

first since Congress completed the spending plan.

The Fed's median projection for short-term rate increases in

2018 appears unlikely to change at that meeting, as it would likely

require at least four out of five officials who have been

projecting three rate increases to raise their estimates.

Economists aren't entirely sure how the tax cut will boost

growth. If household and business spending raises demand but not

the size of the workforce or labor productivity, the Fed might

conclude inflation will rise too far above its 2% target.

If it looks like the tax cut is likely to generate more

investment and hiring -- raising the economy's capacity to produce

goods and services -- the Fed can tolerate faster growth without

accelerating rate increases.

Many economists believe the spending bill will mostly boost

demand for goods and services rather than increase supply, pushing

unemployment down from an already low level. That would likely

prompt Fed officials to raise rates a little more than they

otherwise would, the economists say.

Economists at JPMorgan and UBS now see the unemployment rate

falling to 3.2% at the end of next year, which would be the lowest

level since 1953.

"I see a real challenge for the Fed, not because they're not

capable, but this fiscal stimulus coming now made a hard job even

harder," said Seth Carpenter, chief U.S. economist at UBS and a

former Fed and Treasury official.

Even if the tax cuts end up boosting the economy's output, "this

may take some time before it shows," said Michael Feroli,

JPMorgan's chief U.S. economist, in a research note earlier this

month. "In the meantime, the Fed doesn't have the luxury to wait"

if investors expect inflation to rise.

Some private economists still forecast just three Fed rate

increases this year.

If the Fed moves three times by its September meeting, its

benchmark rate will be positive after adjusting for inflation for

the first time in more than a decade, prompting the central bank to

pause quarterly rate rises and see how the economy is responding,

said Ellen Zentner, chief U.S. economist at Morgan Stanley, in a

client note Tuesday.

Stronger growth over the coming two years could reduce the risk

of a recession in those years, but it could also raise the risk of

one in 2020, when the boost from the spending program fades and

growth slows.

Another risk: The boost in debt-issuance by the U.S. Treasury

resulting from higher budget deficits could lead to higher yields

on government securities, driving up interest rates set by markets,

choking the economy.

"We do not forecast a recession as our base case, but we believe

the risk is material and rising," said Mr. Carpenter.

(END) Dow Jones Newswires

February 20, 2018 14:53 ET (19:53 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

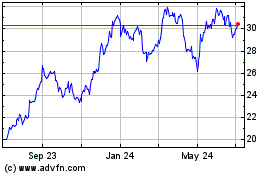

UBS (NYSE:UBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

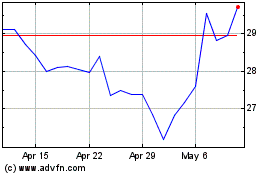

UBS (NYSE:UBS)

Historical Stock Chart

From Apr 2023 to Apr 2024