By Anne Steele

In the face of stiff competition in a crowded music streaming

landscape, Pandora Media Inc. is fighting for listening time.

The internet-radio company, popular for its free personalized

music stations, has struggled as users have migrated to services

like Spotify AB and Apple Music that allow listeners to play

individual songs on demand. And ad dollars have followed.

Pandora's stock, once a Wall Street darling, has flagged, though

the company remains the largest streaming-music provider in the

U.S. Last year, a $480 million investment from Sirius XM Holdings

Inc. was followed by a management shake-up that brought Sling TV's

founding chief executive, Roger Lynch, to the helm. Mr. Lynch is

now leading Pandora's efforts to woo back listeners and

advertisers.

Hedging its bets on the future of music listening, Pandora last

March launched its own on-demand subscription service, Pandora

Premium. In December, it rolled out a feature allowing users of its

ad-supported radio tier to access about 30 minutes of free

on-demand listening in exchange for watching 15-second ads.

But Pandora also sees a future for its core ad-supported radio

and is doubling down on the technology that enabled it to provide

personalized music. Founded on a technology called the Music Genome

Project, a combination of humans and machines that helped it

analyze music and recommend songs for each listener, Pandora has

collected stores of data on music and its users.

Now Pandora is using its data to help advertisers better target

ads. It is also trying to apply similar analysis and algorithms to

nonmusic content such as podcasts, to be able to make the same type

of personalized recommendations.

Mr. Lynch discussed Pandora's data innovations, the perfect ad

length and the future of listening to music. Edited excerpts

follow.

Updating the service

WSJ: Pandora has been losing users. Why do you think that is,

and what is the most important thing for reversing it?

MR. LYNCH: It's a more competitive market than it used to be,

which means you need to make sure you're always innovating. One of

the main reasons people cite for why they might stop listening to

Pandora is the lack of the ability to listen to a song on demand.

We launched the premium product, which is all on demand, in April

of last year, but also in December we launched a new innovation

bringing on demand into our ad-supported product.

WSJ: Where are you looking for new subscribers, and how are you

thinking about drawing them in to Pandora?

MR. LYNCH: We have a three-tier model. We have our ad-supported

listeners. Then we have two subscription tiers: people who want an

ad-free version of Pandora for $5 a month or full on-demand service

for $10 a month. That's where we decided to capture the growth

that's happening in premium subscription services, while at the

same time going after people who will not pay.

WSJ: You have tons of users and lots of years of listening data.

Are there any untapped or undertapped areas where you think you can

use data to make the listening or ad experience better?

MR. LYNCH: An opportunity for us is to use it better in our

marketing. Today's marketing is less about big brand campaigns and

much more about using data to create a unique connection with an

individual. By unique, I mean targeted for that individual from

whatever data we know about you, and that's an opportunity Pandora

has underexploited because we have strength in data.

WSJ: Can you give an example of what they might look like?

MR. LYNCH: We can serve hyperpersonalized audio ads to

listeners, allowing advertisers to create thousands of versions of

an audio ad easily and efficiently. For example, listeners in San

Diego might hear something like, "Good morning San Diego, it's

going to be hot today. Come grab your iced coffee at (insert coffee

shop)." A New York listener might get something like, "Good morning

New York, it's cold out. Start your day with a warm latte from

(insert coffee shop)."

WSJ: What about users who don't want so many ads?

MR. LYNCH: Much like how we know what song is likely to be

positively received by a listener, we have a pretty good idea what

kind of ad they will be most receptive to, and when best to serve

an ad or not. We won't serve an ad if a listener has just

thumbed-down a song. We're also able to identify if a person

responds better to ads during particular times of day or days of

the week, if they prefer longer but fewer ads or shorter but more

frequent ones.

We personalize advertising to them in the same way we

personalize their music feed.

WSJ: Can you expand on what the Music Genome Project for

podcasts is?

MR. LYNCH: Over the past 12 years, Pandora has been analyzing

listener behavior to create a comprehensive view of the different

characteristics of users on our platform based on historical usage.

We understand the appetite for varieties of genres and audio

content, as well as the propensity to listen to Pandora during

certain times of day, or points in time -- during a morning

commute, for example. Now we are developing an algorithm that

allows us to predict what types of podcasts (sports, news, fashion,

etc.) will resonate with a particular user.

We'll be able to get as specific as the content of the episode,

and then match this information with listener preferences to make

recommendations.

The future of ads

WSJ: What are you looking at for listening in the car?

MR. LYNCH: We're in 200 car models already, and then you have

the growth of Android Auto and Apple CarPlay. That brings Pandora

to many more cars. So I see that as a big opportunity. The

challenge is, you have to make it as easy as pushing an "on"

button. If you think about how easy FM radio is today, I just get

in and push the button, and it plays. We have to make streaming

audio as easy as that, and one of the ways to do that can be

through voice navigation. Obviously, if you're driving a car,

you're otherwise engaged, and fooling around with any type of

physical interface is more challenging. So, if you can use voice to

navigate, you're going to be more in the mode of, let it take over

and play for me the things I like to listen to.

WSJ: How do you see the role of ad-supported music within the

broader music-listening ecosystem that we have?

MR. LYNCH: We do know that in any market, you have to segment

the market. There are people who will pay for a premium experience,

people who won't pay and people who will pay for something in

between. So it's very important that Pandora has the spectrum all

the way from the ad-supported up to the premium service, and I

don't see that changing.

Even though there's growth with subscriptions, you are going to

still see ad-supported audio continuing to be large, maybe the

largest, in terms of listeners at least across the U.S.

Ms. Steele is a Wall Street Journal reporter in Los Angeles. She

can be reached at anne.steele@wsj.com.

(END) Dow Jones Newswires

February 19, 2018 22:16 ET (03:16 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

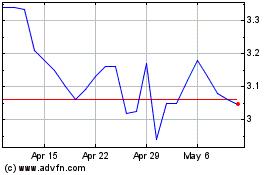

Sirius XM (NASDAQ:SIRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

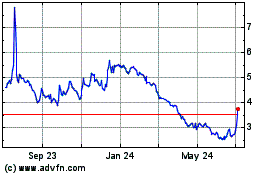

Sirius XM (NASDAQ:SIRI)

Historical Stock Chart

From Apr 2023 to Apr 2024