Current Report Filing (8-k)

February 16 2018 - 7:39AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

|

|

Date of Report (Date of earliest event reported)

February 15, 2018

|

|

|

|

|

Vishay Intertechnology, Inc.

|

|

|

|

(Exact name of registrant as specified in its charter)

|

|

Delaware

|

1-7416

|

38-1686453

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification Number)

|

|

|

|

|

63 Lancaster Avenue

Malvern, PA 19355-2143

|

19355-2143

|

|

(Address of Principal Executive Offices)

|

Zip Code

|

|

|

|

Registrant's telephone number, including area code 610-644-1300

|

|

|

|

(Former name or former address, if changed since last report.)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 5.02 - Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

(e) Compensatory Arrangements of Certain Officers

On February 15, 2018, Vishay Intertechnology, Inc. (the "Company"), directly and/or through its subsidiaries, entered into new executive employment agreements with each of Lori Lipcaman, its Executive Vice President and Chief Financial Officer; Clarence Tse, its Executive Vice President, Business Head Semiconductors; Joel Smejkal, its Executive Vice President, Business Head Passive Components; David Valletta, its Executive Vice President, Worldwide Sales; and Werner Gebhardt, its Executive Vice President, Global Human Resources. Each of these agreements is referred to in this Current Report on Form 8-K as an "Executive Employment Agreement." In addition, on February 15, 2018, the Company entered into an amendment to its services agreement with Johan Vandoorn, its Executive Vice President and Chief Technical Officer (the "Services Agreement Amendment," and together with the Executive Employment Agreements, the "Agreements").

The principal terms of the Agreements are summarized below:

|

·

|

Term

: Each Agreement continues in effect indefinitely, subject to termination in accordance the with severance and notice provisions described below.

|

|

·

|

Title, Salary, Pension and Cash Bonus Opportunities

: The Agreements preserve the executives' current titles, salaries and pension entitlements. The executives will continue to be eligible to receive cash bonuses substantially consistent with previously disclosed terms, and the Compensation Committee of the Company's Board of Directors will have discretion in setting the goals used in determining such cash bonuses.

|

|

·

|

Annual Equity Awards

: Each executive will be entitled to an annual equity grant, each with a grant date fair value equal to a specified percentage of such executive's then-current base salary. Up to 75% of the awards granted in any year may be subject to performance-based vesting, with the balance of the awards subject to time-based vesting. All annual equity awards will vest in full immediately prior to the consummation of a change of control transaction. The agreements also provide for acceleration of the annual equity awards under the following circumstances:

|

|

o

|

Time-based vesting conditions will be deemed satisfied, and performance-based vesting conditions will remain in effect, upon the executive's death, disability, termination without cause, resignation for good reason, or resignation for any reason following the attainment of age 62 (except where cause exists).

|

|

o

|

Accelerated or continued vesting, as applicable, will be subject to the executive's execution of a release (except in the event of the executive's death).

|

|

·

|

Compensation on Termination

:

|

|

o

|

Severance

: Upon a termination without cause or resignation with good reason, and subject to the execution of a general release, the executives will be entitled to receive:

|

|

§

|

continuation of base salary for 36 months;

|

|

§

|

payment of any earned but unpaid bonus for the previously completed year; and

|

|

§

|

payment of a pro-rata bonus for the year of termination, based on that year's actual performance.

|

|

o

|

Effect of Change in Control on Severance

:

|

|

§

|

Upon a termination without cause or resignation with good reason within 16 months following a change in control, the 36 months of base salary continuation will be paid as a lump sum payment.

|

|

§

|

In the event a change in control, any resignation during the 12 month period beginning 4 months following the change in control will trigger the severance payment described above, unless cause then exists.

|

|

o

|

Death or Disability

: In the event of termination due to death or disability, the executive or their estate will receive:

|

|

§

|

payment of any earned but unpaid bonus for the previously completed year; and

|

|

§

|

payment of a pro-rata bonus for the year of termination, based on that year's actual performance.

|

The Executive Employment Agreements with Ms. Lipcaman and Mr. Gebhardt, who are both German residents, provide the benefits described above, but vary slightly from the other Executive Employment Agreements to accommodate the requirements of German employment law, including notice of termination and other requirements.

|

·

|

Restrictive Covenants

: The Agreements also provide for customary non-compete and non-solicitation covenants, which apply during employment and for one year thereafter, except for German executives, who may be subject to "garden leaves" that have substantially similar effects.

|

The foregoing summary is qualified in its entirety by reference to the Agreements, which are filed as Exhibits 10.1–10.6, respectively, to this Current Report on Form 8-K.

Item 8.01 - Other Events

Cash Dividend Declaration

On February 15, 2018, Vishay declared a quarterly cash dividend of $0.0675 per share of common stock and Class B common stock outstanding payable on March 29, 2018 to stockholders of record at the close of business on March 14, 2018. A copy of the press release announcing the dividend declaration is attached as Exhibit 99.1 to this report.

Item 9.01 - Financial Statements and Exhibits

(d) Exhibits

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: February 15, 2018

|

|

VISHAY INTERTECHNOLOGY, INC.

|

|

|

Name:

|

Lori Lipcaman

|

|

|

Title:

|

Executive Vice President and

|

|

|

|

Chief Financial Officer

|

|

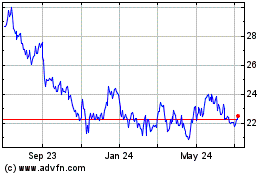

Vishay Intertechnology (NYSE:VSH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vishay Intertechnology (NYSE:VSH)

Historical Stock Chart

From Apr 2023 to Apr 2024