Facebook to Viacom Targeted by SEC Regulator's Attack on Dual-Class Shares

February 15 2018 - 5:00PM

Dow Jones News

By Dave Michaels

WASHINGTON -- Corporate titans who control companies through

special classes of stock that give them extra voting power should

have to give up the system after a limited number of years, a

senior Democratic regulator said Thursday.

Companies such as Viacom Inc., Facebook Inc. and Ford Motor Co.

have multiple classes of stock that don't expire until after the

founder or longtime controlling shareholder dies. The practice

"raises the prospect that control over our public companies, and

ultimately of Main Street's retirement savings, will be forever

held by a small, elite group of corporate insiders," Securities and

Exchange Commission member Robert Jackson Jr., a Democrat, said in

remarks prepared for a speech at the University of California

Berkeley Law School.

About 16% of companies that have gone public on U.S. exchanges

since 2013 had at least two classes of stock, according to data

provider Dealogic. Many technology companies have structured their

initial public offerings with dual-class stock in recent years to

give founders a viselike grip on the business. Snap Inc., for

instance, gave new shareholders no voting rights whatsoever when it

went public last year.

The founders of the Snapchat parent, Evan Spiegel and Robert

Murphy, control the company through class C shares that give them

10 votes per share. The stock only loses its supervoting power nine

months after their deaths, according to Snap's corporate

charter.

Class B shares held by Facebook founder Mark Zuckerberg, which

grant him 10 votes per share, convert to common, one-vote shares

three years after his death or -- under more complex circumstances

-- if he resigns, according to Facebook's corporate charter.

Such outsize voting power gives controlling shareholders

dominance over all decisions, ranging from the election of

directors to whether to sell the company someday.

News Corp., the owner of The Wall Street Journal's parent, Dow

Jones & Co., has two classes of shares, which allow Rupert

Murdoch and his family to maintain greater influence over the media

company.

An investor backlash against Snap's deal prompted the keepers of

the S&P 500 to say they would block newcomers with multiple

classes of stock from joining their flagship index. Barring those

companies from prominent indexes could reduce demand for their

stock from increasingly popular index funds.

Dual-class stock may benefit investors early in a company's

life, when the visionary who launched it needs freedom to build the

business without outside pressure from stockholders, Mr. Jackson

said. But that benefit wanes over time, he said. His staff's

analysis showed that firms with never-ending dual-class stock trade

at a discount to ones that retire the structure later in the

company's life.

The solution isn't banning companies with dual-class stock from

the major indexes, as S&P did, Mr. Jackson said. That would

hurt Main Street investors who invest through passive funds and

stand to miss out on those companies' growth, he said.

Instead, he said in his first speech since joining the SEC, U.S.

stock exchanges should force companies to retire their dual-class

share structure after a period of time.

He declined to say how quickly that should happen, saying other

critics have proposed ideas. "By giving investors more say in the

governance of their companies, we can help protect them from

managers who would misuse dual-class to extract value rather than

build it," he said.

Exchanges, while regulated by the SEC, don't have to follow the

recommendations of a single commissioner. Democratic SEC

Commissioner Kara Stein also criticized dual-class shares in a

speech this week, saying they disrupt the relationship that should

exist between companies and shareholders.

Write to Dave Michaels at dave.michaels@wsj.com

(END) Dow Jones Newswires

February 15, 2018 16:45 ET (21:45 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

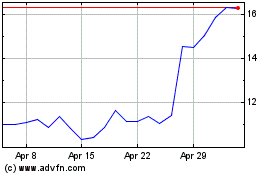

Snap (NYSE:SNAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Snap (NYSE:SNAP)

Historical Stock Chart

From Apr 2023 to Apr 2024