Annaly Capital Management, Inc. (NYSE:NLY) (the “Company” or

“Annaly”) today announced its financial results for the quarter and

year ended December 31, 2017.

Quarterly Financial

Highlights

- GAAP net income of $746.8 million,

$0.62 per average common share

- Core earnings (excluding PAA) were

$387.0 million, $0.31 per average common share

- GAAP return on average equity was

20.58% and core return on average equity (excluding PAA) was

10.67%

- Book value per common share of

$11.34

- Economic leverage of 6.6x as compared

to 6.9x at September 30, 2017

- Net interest margin (excluding PAA) of

1.51%, up from 1.47% in the prior quarter

- Declared common stock dividend of $0.30

per share for the 17th consecutive fiscal quarter

- 2017 annual economic return of

12.4%

Business

Highlights

- Total 2017 shareholder return of 32% is

~50% better than both the S&P 500 and the Bloomberg Mortgage

REIT Index

- Raised $2.4 billion through a series of

common and preferred equity offerings in 2017, along with an

additional $425.0 million of preferred equity issued in January

2018

- Proceeds from preferred equity

issuances used, in part, to redeem $597.8 million of outstanding

preferred shares, of which $412.5 million settled in February 2018,

lowering our cost of preferred capital from 7.62% to 7.05%

- Continued growth of credit businesses,

representing 24% of dedicated capital at year-end 2017 compared to

20% in the prior year; corporate debt investments exceeded and

residential mortgage loans approached the $1.0 billion

milestone

- Appointed Chief Executive Officer and

President Kevin Keyes as Chairman of the Board of Directors,

effective January 1, 2018

- Appointed two new independent members

to the Board of Directors effective January 1, 2018; female

representation on the Board now at 36%

- Created Public Responsibility Committee

to assist the Company's Board of Directors in its oversight and

review of corporate social responsibility initiatives

- Recognized in the 2018 Bloomberg

Gender-Equality Index, reflecting the Company’s commitment to

creating a gender equal workplace

- Established joint venture with Capital

Impact Partners, a prominent community development financial

institution

- Senior executive team voluntarily

increased their stock ownership commitments beyond applicable

ownership guidelines, with such positions to be achieved solely

through open market purchases by July 2020

“We concluded 2017 having made significant progress on a number

of key goals and initiatives that further strengthen Annaly’s

industry leading position,” commented Kevin Keyes, Chairman, Chief

Executive Officer and President. “We accomplished a record breaking

return to the capital markets, raising $2.8 billion in the common

and preferred equity markets over the past six months and we

further diversified our portfolio, growing our allocation to credit

to 24% of equity while broadening our investment options.

Additionally, in 2017 we expanded our institutional relationships

with investment partners across our four businesses and through our

continued ESG endeavors. These strategic initiatives, combined with

our prudent risk management and portfolio positioning, contributed

to our outperformance last year, evidenced by a total shareholder

return of 32%, an economic return of 12.4% and $1.4 billion of

dividends paid to our Annaly shareholders.”

Mr. Keyes continued, “Entering into 2018, we reduced leverage to

enhance our liquidity in order to quickly take advantage of future

market dislocations and we have increased our hedging activity

within the portfolio to preserve our earnings power and protect

book value as rates have risen. As we look ahead, we are confident

in our seasoned investment teams, our diversification strategy and

our unique ability to continue to generate attractive risk-adjusted

returns in a more volatile market environment.”

Financial

Performance

The following table summarizes certain key performance

indicators as of and for the quarters ended December 31, 2017,

September 30, 2017 and December 31, 2016:

December 31, 2017 September 30,

2017 December 31, 2016 Book value

per common share $ 11.34 $ 11.42 $ 11.16 Economic

leverage at period-end (1) 6.6:1 6.9:1 6.4:1 GAAP net income (loss)

per average common share (2) $ 0.62 $ 0.31 $ 1.79 Annualized GAAP

return (loss) on average equity 20.58 % 10.98 % 57.23 % Net

interest margin (3) 1.47 % 1.33 % 2.49 % Average yield on interest

earning assets (4) 2.97 % 2.79 % 3.81 % Average cost of interest

bearing liabilities (5) 1.83 % 1.82 % 1.53 % Net interest spread

1.14 % 0.97 % 2.28 %

Core Earnings

Metrics: *

Core earnings (excluding PAA) per average common share (2)(6) $

0.31 $ 0.30 $ 0.30 Core earnings per average common share (2)(6) $

0.30 $ 0.26 $ 0.53 PAA cost (benefit) per average common share $

0.01 $ 0.04 $ (0.23 ) Annualized core return on average equity

(excluding PAA) 10.67 % 10.57 % 10.13 % Net interest margin

(excluding PAA) (3) 1.51 % 1.47 % 1.53 % Average yield on interest

earning assets (excluding PAA) (4) 3.02 % 2.97 % 2.68 % Net

interest spread (excluding PAA) 1.19 % 1.15 % 1.15 %

*

Represents non-GAAP financial measures.

Please refer to the ‘Non-GAAP Financial Measures’ section for

additional information.

(1) Computed as the sum of recourse debt, to-be-announced (“TBA”)

derivative notional outstanding and net forward purchases of

investments divided by total equity. Recourse debt consists of

repurchase agreements and other secured financing. Securitized

debt, participation sold and mortgages payable are non-recourse to

the Company and are excluded from this measure. (2) Net of

dividends on preferred stock. The quarter ended December 31, 2017

excludes, and the quarter ended September 30, 2017 includes,

cumulative and undeclared dividends of $8.3 million on the

Company's Series F Preferred Stock as of September 30, 2017. (3)

Represents the sum of the Company’s annualized economic net

interest income (inclusive of interest expense on interest rate

swaps used to hedge cost of funds) plus TBA dollar roll income

(less interest expense on swaps used to hedge TBA dollar roll

transactions) divided by the sum of its average interest earning

assets plus average outstanding TBA derivative balances. (4)

Average yield on interest earning assets represents annualized

interest income divided by average interest earning assets. Average

interest earning assets reflects the average amortized cost of our

investments during the period. Average yield on interest earning

assets (excluding PAA) is calculated using annualized interest

income (excluding PAA). (5) Includes interest expense on interest

rate swaps used to hedge cost of funds. (6) Core earnings is

defined as net income (loss) excluding gains or losses on disposals

of investments and termination of interest rate swaps, unrealized

gains or losses on interest rate swaps and investments measured at

fair value through earnings, net gains and losses on trading

assets, impairment losses, net income (loss) attributable to

noncontrolling interest, corporate acquisition related expenses and

certain other non-recurring gains or losses, and inclusive of TBA

dollar roll income (a component of Net gains (losses) on trading

assets) and realized amortization of mortgage servicing rights

("MSR") (a component of net unrealized gains (losses) on

investments measured at fair value through earnings). Core earnings

(excluding PAA) excludes the premium amortization adjustment

(“PAA”) representing the cumulative impact on prior periods, but

not the current period, of quarter-over-quarter changes in

estimated long-term prepayment speeds related to the Company’s

Agency mortgage-backed securities.

Other

Information

The Company continues to analyze the overall effects of tax

reform legislation, the Tax Cuts and Jobs Act, to our operations,

our industry and the economy in general. While we do not expect to

see a material impact on our operations, we anticipate certain of

our individual taxable shareholders may benefit by receiving a 20%

deduction on the portion of our dividends characterized as ordinary

income. The Company has posted 'Tax Cuts and Jobs Act Treatment of

REIT Dividends' on its website (www.annaly.com) in the Investors

section under Tax Information. The Company also advises its

shareholders to contact their individual tax advisor to determine

how their individual tax profile is affected.

This news release and our public documents to which we refer

contain or incorporate by reference certain forward-looking

statements which are based on various assumptions (some of which

are beyond our control) and may be identified by reference to a

future period or periods or by the use of forward-looking

terminology, such as “may,” “will,” “believe,” “expect,”

“anticipate,” “continue,” or similar terms or variations on those

terms or the negative of those terms. Actual results could differ

materially from those set forth in forward-looking statements due

to a variety of factors, including, but not limited to, changes in

interest rates; changes in the yield curve; changes in prepayment

rates; the availability of mortgage-backed securities and other

securities for purchase; the availability of financing and, if

available, the terms of any financing; changes in the market value

of our assets; changes in business conditions and the general

economy; our ability to grow our commercial real estate business;

our ability to grow our residential mortgage credit business; our

ability to grow our middle market lending business; credit risks

related to our investments in credit risk transfer securities,

residential mortgage-backed securities and related residential

mortgage credit assets, commercial real estate assets and corporate

debt; risks related to investments in mortgage servicing rights;

our ability to consummate any contemplated investment

opportunities; changes in government regulations and policy

affecting our business; our ability to maintain our qualification

as a REIT for U.S. federal income tax purposes; and our ability to

maintain our exemption from registration under the Investment

Company Act of 1940, as amended. For a discussion of the risks and

uncertainties which could cause actual results to differ from those

contained in the forward-looking statements, see “Risk Factors” in

our most recent Annual Report on Form 10-K and any subsequent

Quarterly Reports on Form 10-Q. We do not undertake, and

specifically disclaim any obligation, to publicly release the

result of any revisions which may be made to any forward-looking

statements to reflect the occurrence of anticipated or

unanticipated events or circumstances after the date of such

statements, except as required by law.

Annaly is a leading diversified capital manager that invests in

and finances residential and commercial assets. Annaly’s principal

business objective is to generate net income for distribution to

its stockholders and to preserve capital through prudent selection

of investments and continuous management of its portfolio. Annaly

has elected to be taxed as a real estate investment trust, or REIT,

for federal income tax purposes. Annaly is externally managed by

Annaly Management Company LLC. Additional information on the

Company can be found at www.annaly.com.

The Company prepares a supplemental investor presentation and a

financial summary for the benefit of its shareholders. Both the

Fourth Quarter 2017 Investor Presentation and the Fourth Quarter

2017 Financial Summary can be found at the Company’s website

(www.annaly.com) in the Investors section under Investor

Presentations.

Conference

Call

The Company will hold the fourth quarter 2017 earnings

conference call on February 15, 2018 at 10:00 a.m. Eastern Time.

The number to call is 888-317-6003 for domestic calls and

412-317-6061 for international calls. The conference passcode is

5565471. There will also be an audio webcast of the call on

www.annaly.com. The replay of the call will be available for one

week following the conference call. The replay number is

877-344-7529 for domestic calls and 412-317-0088 for international

calls and the conference passcode is 10115830. If you would like to

be added to the e-mail distribution list, please visit

www.annaly.com, click on Investors, then select Email Alerts and

complete the email notification form.

Financial

Statements

ANNALY CAPITAL MANAGEMENT, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF FINANCIAL

CONDITION

(dollars in thousands, except per share

data)

December 31, 2017

September 30, 2017

June 30, 2017

March 31, 2017

December 31, 2016

(1)

(Unaudited) (Unaudited)

(Unaudited) (Unaudited)

ASSETS Cash and cash equivalents (2) $ 706,589 $ 867,840 $

700,692 $ 819,421 $ 1,539,746 Investments, at fair value: Agency

mortgage-backed securities 90,551,763 85,889,131 73,963,998

72,708,490 75,589,873 Credit risk transfer securities 651,764

582,938 605,826 686,943 724,722 Non-Agency mortgage-backed

securities 1,097,294 1,227,235 1,234,053 1,409,093 1,401,307

Residential mortgage loans (3) 1,438,322 895,919 779,685 682,416

342,289 Mortgage servicing rights 580,860 570,218 605,653 632,166

652,216 Commercial real estate debt investments (4) 3,089,108

3,869,110 3,972,560 4,102,613 4,321,739 Commercial real estate debt

and preferred equity, held for investment 1,029,327 981,748 928,181

985,091 970,505 Commercial loans held for sale, net — — — — 114,425

Investments in commercial real estate 485,953 470,928 474,510

462,760 474,567 Corporate debt 1,011,275 856,110 773,957 841,265

773,274 Interest rate swaps, at fair value (2) 30,272 12,250 10,472

19,195 68,194 Other derivatives, at fair value 283,613 266,249

154,004 196,935 171,266 Receivable for investments sold 1,232

340,033 9,784 354,126 51,461 Accrued interest and dividends

receivable 323,526 293,207 263,217 266,887 270,400 Other assets

384,117 353,708 399,456 388,224 333,063 Goodwill 71,815 71,815

71,815 71,815 71,815 Intangible assets, net 23,220

25,742 28,715 31,517

34,184 Total assets $ 101,760,050 $ 97,574,181

$ 84,976,578 $ 84,658,957

$ 87,905,046

LIABILITIES AND STOCKHOLDERS’ EQUITY

Liabilities: Repurchase agreements $ 77,696,343 $ 69,430,268 $

62,497,400 $ 62,719,087 $ 65,215,810 Other secured financing

3,837,528 3,713,256 3,785,543 3,876,150 3,884,708 Securitized debt

of consolidated VIEs (5) 2,971,771 3,357,929 3,438,675 3,477,059

3,655,802 Participation sold — — — 12,760 12,869 Mortgages payable

309,686 311,886 311,810 311,707 311,636 Interest rate swaps, at

fair value (2) 569,129 606,960 614,589 572,419 1,443,765 Other

derivatives, at fair value 38,725 75,529 99,380 52,496 86,437

Dividends payable 347,876 326,425 305,709 305,691 305,674 Payable

for investments purchased 656,581 5,243,868 1,043,379 340,383

65,041 Accrued interest payable 253,068 231,611 185,720 182,478

163,013 Accounts payable and other liabilities 207,770

121,231 84,948 161,378

184,319 Total liabilities 86,888,477

83,418,963 72,367,153 72,011,608

75,329,074 Stockholders’ Equity: 7.875% Series A

Cumulative Redeemable Preferred Stock (6) — — 177,088 177,088

177,088 7.625% Series C Cumulative Redeemable Preferred Stock (7)

290,514 290,514 290,514 290,514 290,514 7.50% Series D Cumulative

Redeemable Preferred Stock (8) 445,457 445,457 445,457 445,457

445,457 7.625% Series E Cumulative Redeemable Preferred Stock (9)

287,500 287,500 287,500 287,500 287,500 6.95% Series F

Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock (10)

696,910 696,910 — — — Common stock, par value $0.01 per share (11)

11,596 10,881 10,190 10,190 10,189 Additional paid-in capital

17,221,265 16,377,805 15,581,760 15,580,038 15,579,342 Accumulated

other comprehensive income (loss) (1,126,020 ) (640,149 ) (850,767

) (1,126,091 ) (1,085,893 ) Accumulated deficit (2,961,749 )

(3,320,160 ) (3,339,228 ) (3,024,670 )

(3,136,017 ) Total stockholders’ equity 14,865,473 14,148,758

12,602,514 12,640,026 12,568,180 Noncontrolling interest 6,100

6,460 6,911 7,323

7,792 Total equity 14,871,573

14,155,218 12,609,425 12,647,349

12,575,972 Total liabilities and equity $ 101,760,050

$ 97,574,181 $ 84,976,578

$ 84,658,957 $ 87,905,046 (1) Derived

from the audited consolidated financial statements at December 31,

2016. (2) As a result of a change to a clearing organization’s

rulebook effective January 3, 2017, beginning with the first

quarter 2017 and in subsequent periods the Company is presenting

the fair value of centrally cleared interest rate swaps net of

variation margin pledged under such transactions. The variation

margin was previously reported under cash and cash equivalents and

is currently reported as a reduction to interest rate swaps, at

fair value. Balances reported prior to the effective date will not

be adjusted. (3) Includes securitized residential mortgage loans of

a consolidated variable interest entity (“VIE”) carried at fair

value of $478.8 million, $139.8 million, $150.9 million, $155.6

million and $165.9 million at December 31, 2017, September 30,

2017, June 30, 2017, March 31, 2017 and December 31, 2016,

respectively. (4) Includes senior securitized commercial mortgage

loans of consolidated VIEs with a carrying value of $2.8 billion,

$3.6 billion, $3.7 billion, $3.7 billion and $3.9 billion at

December 31, 2017, September 30, 2017, June 30, 2017, March 31,

2017 and December 31, 2016, respectively. (5) Includes securitized

debt of consolidated VIEs carried at fair value of $3.0 billion,

$3.4 billion, $3.4 billion, $3.5 billion and $3.7 billion at

December 31, 2017, September 30, 2017, June 30, 2017, March 31,

2017 and December 31, 2016, respectively. (6) Includes 0 shares

authorized, issued and outstanding at December 31, 2017. Includes

7,412,500 authorized shares and 0 shares issued and outstanding at

September 30, 2017. Includes 7,412,500 shares authorized, issued

and outstanding at each of June 30, 2017, March 31, 2017 and

December 31, 2016. (7) Includes 12,000,000 shares authorized,

issued and outstanding at December 31, 2017. Includes 12,650,00

shares authorized and 12,000,000 shares issued and outstanding at

each of September 30, 2017, June 30, 2017, March 31, 2017 and

December 31, 2016. (8) Includes 18,400,000 shares authorized,

issued and outstanding. (9) Includes 11,500,000 shares authorized,

issued and outstanding. (10) Includes 28,800,000 shares authorized,

issued and outstanding at December 31, 2017. Includes 32,200,000

shares authorized and 28,800,000 shares issued and outstanding at

September 30, 2017. Includes 0 shares authorized, issued and

outstanding at each of June 30, 2017, March 31, 2017 and December

31, 2016. (11) Includes 1,929,300,000 shares authorized and

1,159,585,078 issued and outstanding at December 31, 2017. Includes

1,917,837,500 shares authorized and 1,088,083,794 issued and

outstanding at September 30, 2017. Includes 1,945,437,500 shares

authorized and 1,019,027,880 shares issued and outstanding at June

30, 2017. Includes 1,945,437,500 shares authorized and

1,018,971,441 shares issued and outstanding at March 31, 2017.

Includes 1,945,437,500 shares authorized and 1,018,913,249 shares

issued and outstanding at December 31, 2016.

ANNALY CAPITAL MANAGEMENT, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME (LOSS)

(Unaudited)

(dollars in thousands, except per share

data)

For the quarters ended

December 31, 2017

September 30, 2017

June 30,2017

March 31, 2017

December 31, 2016

Net interest income: Interest

income $ 745,423 $ 622,550 $ 537,426 $ 587,727 $ 807,022 Interest

expense 318,711 268,937 222,281

198,425 183,396

Net interest

income 426,712 353,613 315,145

389,302 623,626

Realized and unrealized gains (losses): Realized gains

(losses) on interest rate swaps (1) (82,271 ) (88,211 ) (96,470 )

(104,156 ) (103,872 ) Realized gains (losses) on termination of

interest rate swaps (160,075 ) — (58 ) — (55,214 ) Unrealized gains

(losses) on interest rate swaps 484,447 56,854

(177,567 ) 149,184 1,430,668

Subtotal 242,101 (31,357 ) (274,095 )

45,028 1,271,582 Net gains (losses) on

disposal of investments 7,895 (11,552 ) (5,516 ) 5,235 7,782 Net

gains (losses) on trading assets 121,334 154,208 (14,423 ) 319

(139,470 ) Net unrealized gains (losses) on investments measured at

fair value through earnings (12,115 ) (67,492 )

16,240 23,683 110,742

Subtotal 117,114 75,164 (3,699 )

29,237 (20,946 )

Total realized and

unrealized gains (losses) 359,215 43,807

(277,794 ) 74,265 1,250,636

Other income (loss) 25,064 28,282 30,865 31,646 30,918

General and administrative expenses: Compensation and

management fee 44,129 41,993 38,938 39,262 39,845 Other general and

administrative expenses 15,128 15,023

15,085 14,566 15,608

Total

general and administrative expenses 59,257 57,016

54,023 53,828 55,453

Income (loss) before income taxes 751,734 368,686

14,193 441,385 1,849,727

Income taxes 4,963

1,371 (329 ) 977 1,244

Net income (loss) 746,771 367,315 14,522 440,408 1,848,483

Net income (loss) attributable to noncontrolling interest

(151 ) (232 ) (102 ) (103 ) (87 )

Net income (loss) attributable to Annaly 746,922 367,547

14,624 440,511 1,848,570

Dividends on preferred stock

(2) 32,334 30,355 23,473

23,473 23,473

Net income (loss)

available (related) to common stockholders $ 714,588

$ 337,192 $ (8,849 ) $ 417,038

$ 1,825,097

Net income (loss) per share

available (related) to common stockholders: Basic $ 0.62

$ 0.31 $ (0.01 ) $ 0.41 $

1.79 Diluted $ 0.62 $ 0.31 $

(0.01 ) $ 0.41 $ 1.79

Weighted average number of common shares outstanding: Basic

1,151,653,296 1,072,566,395

1,019,000,817 1,018,942,746

1,018,886,380 Diluted 1,152,138,887

1,073,040,637 1,019,000,817

1,019,307,379 1,019,251,111

Net

income (loss) $ 746,771 $ 367,315 $

14,522 $ 440,408 $ 1,848,483

Other comprehensive income (loss): Unrealized gains (losses)

on available-for-sale securities (487,597 ) 195,251 261,964 (59,615

) (2,206,288 ) Reclassification adjustment for net (gains) losses

included in net income (loss) 1,726 15,367

13,360 19,417 718 Other

comprehensive income (loss) (485,871 ) 210,618

275,324 (40,198 ) (2,205,570 ) Comprehensive

income (loss) 260,900 577,933 289,846 400,210 (357,087 )

Comprehensive income (loss) attributable to noncontrolling interest

(151 ) (232 ) (102 ) (103 ) (87 )

Comprehensive income (loss) attributable to Annaly 261,051 578,165

289,948 400,313 (357,000 ) Dividends on preferred stock 32,334

30,355 23,473 23,473

23,473

Comprehensive income (loss)

attributable to common stockholders $ 228,717 $

547,810 $ 266,475 $ 376,840

$ (380,473 ) (1) Interest expense related to the

Company’s interest rate swaps is recorded in Realized gains

(losses) on interest rate swaps on the Consolidated Statements of

Comprehensive Income. (2) The quarter ended December 31, 2017

excludes, and the quarter ended September 30, 2017 includes,

cumulative and undeclared dividends of $8.3 million on the

Company's Series F Preferred Stock as of September 30, 2017.

ANNALY CAPITAL MANAGEMENT, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME (LOSS)

(dollars in thousands, except per share

data)

(Unaudited)

For the years ended

December 31, 2017

December 31, 2016

Net interest income: Interest income $ 2,493,126 $

2,210,951 Interest expense 1,008,354 657,752

Net interest income 1,484,772 1,553,199

Realized and unrealized gains (losses): Realized gains

(losses) on interest rate swaps (1) (371,108 ) (506,681 ) Realized

gains (losses) on termination of interest rate swaps (160,133 )

(113,941 ) Unrealized gains (losses) on interest rate swaps 512,918

282,190

Subtotal (18,323 )

(338,432 ) Net gains (losses) on disposal of investments (3,938 )

33,089 Net gains (losses) on trading assets 261,438 230,580 Net

unrealized gains (losses) on investments measured at fair value

through earnings (39,684 ) 86,391 Bargain purchase gain —

72,576

Subtotal 217,816 422,636

Total realized and unrealized gains (losses) 199,493

84,204

Other income (loss) 115,857

44,144

General and administrative expenses: Compensation and

management fee 164,322 151,599 Other general and administrative

expenses 59,802 98,757

Total general and

administrative expenses 224,124 250,356

Income (loss) before income taxes 1,575,998 1,431,191

Income taxes 6,982 (1,595 )

Net income

(loss) 1,569,016 1,432,786

Net income (loss) attributable to

noncontrolling interest (588 ) (970 )

Net income

(loss) attributable to Annaly 1,569,604 1,433,756

Dividends

on preferred stock 109,635 82,260

Net

income (loss) available (related) to common stockholders $

1,459,969 $ 1,351,496

Net income

(loss) per share available (related) to common stockholders:

Basic $ 1.37 $ 1.39 Diluted $ 1.37

$ 1.39

Weighted average number of common

shares outstanding: Basic 1,065,923,652 969,787,583

Diluted 1,066,351,616 970,102,353

Net income (loss) $ 1,569,016 $ 1,432,786

Other comprehensive income (loss): Unrealized gains

(losses) on available-for-sale securities (89,997 ) (686,414 )

Reclassification adjustment for net (gains) losses included in net

income (loss) 49,870 (21,883 ) Other comprehensive

income (loss) (40,127 ) (708,297 ) Comprehensive income

(loss) 1,528,889 724,489 Comprehensive income (loss) attributable

to noncontrolling interest (588 ) (970 ) Comprehensive

income (loss) attributable to Annaly 1,529,477 725,459 Dividends on

preferred stock 109,635 82,260

Comprehensive income (loss) attributable to common

stockholders $ 1,419,842 $ 643,199 (1)

Interest expense related to the Company’s interest rate

swaps is recorded in Realized gains (losses) on interest rate swaps

on the Consolidated Statements of Comprehensive Income.

Key

Metrics

The following table presents key metrics of the Company’s

portfolio, liabilities and hedging positions, and performance as of

and for the quarters ended December 31, 2017,

September 30, 2017, and December 31, 2016:

December 31, 2017 September

30,2017 December 31, 2016

Portfolio Related

Metrics:

Fixed-rate Residential Investment Securities as a

percentage of total Residential Investment Securities 90 % 89 % 83

% Adjustable-rate and floating-rate Residential Investment

Securities as a percentage of total Residential Investment

Securities 10 % 11 % 17 % Weighted average experienced CPR for the

period 9.8 % 10.3 % 15.6 % Weighted average projected long-term CPR

at period-end 10.4 % 10.4 % 10.1 %

Liabilities and

Hedging Metrics:

Weighted average days to maturity on repurchase agreements

outstanding at period-end 58 65 96 Hedge ratio (1) 70 % 67 % 56 %

Weighted average pay rate on interest rate swaps at period-end (2)

2.22 % 2.27 % 2.22 % Weighted average receive rate on interest rate

swaps at period-end (2) 1.58 % 1.35 % 1.02 % Weighted average net

rate on interest rate swaps at period-end (2) 0.64 % 0.92 % 1.20 %

Leverage at period-end (3) 5.7:1 5.4:1 5.8:1 Economic leverage at

period-end (4) 6.6:1 6.9:1 6.4:1 Capital ratio at period-end 12.9 %

12.3 % 13.1 %

Performance

Related Metrics:

Book value per common share $ 11.34 $ 11.42 $ 11.16 GAAP net income

(loss) per average common share (5) $ 0.62 $ 0.31 $ 1.79 Annualized

GAAP return (loss) on average equity 20.58 % 10.98 % 57.23 % Net

interest margin 1.47 % 1.33 % 2.49 % Average yield on interest

earning assets (6) 2.97 % 2.79 % 3.81 % Average cost of interest

bearing liabilities (7) 1.83 % 1.82 % 1.53 % Net interest spread

1.14 % 0.97 % 2.28 % Dividend declared per common share $ 0.30 $

0.30 $ 0.30 Annualized dividend yield (8) 10.09 % 9.84 % 12.04 %

Core Earnings Metrics * Core earnings (excluding PAA) per

average common share (5) $ 0.31 $ 0.30 $ 0.30 Core earnings per

average common share (5) $ 0.30 $ 0.26 $ 0.53 PAA cost (benefit)

per average common share $ 0.01 $ 0.04 $ (0.23 ) Annualized core

return on average equity (excluding PAA) 10.67 % 10.57 % 10.13 %

Net interest margin (excluding PAA) 1.51 % 1.47 % 1.53 % Average

yield on interest earning assets (excluding PAA) (6) 3.02 % 2.97 %

2.68 % Net interest spread (excluding PAA) 1.19 % 1.15 %

1.15 % * Represents non-GAAP financial measures.

Please refer to the ‘Non-GAAP Financial Measures’ section for

additional information. (1) Measures total notional balances of

interest rate swaps, interest rate swaptions and futures relative

to repurchase agreements, other secured financing and TBA notional

outstanding; excludes MSRs and the effects of term financing, both

of which serve to reduce interest rate risk. Additionally, the

hedge ratio does not take into consideration differences in

duration between assets and liabilities. (2) Excludes forward

starting swaps. (3) Debt consists of repurchase agreements, other

secured financing, securitized debt, participation sold and

mortgages payable. Securitized debt, participation sold and

mortgages payable are non-recourse to the Company. (4) Computed as

the sum of recourse debt, TBA derivative notional outstanding and

net forward purchases of investments divided by total equity. (5)

Net of dividends on preferred stock. The quarter ended December 31,

2017 excludes, and the quarter ended September 30, 2017 includes,

the cumulative and undeclared dividends as of September 30, 2017 on

the Company's Series F Preferred Stock of $8.3 million. (6) Average

yield on interest earning assets represents annualized interest

income divided by average interest earning assets. Average interest

earning assets reflects the average amortized cost of our

investments during the period. Average yield on interest earning

assets (excluding PAA) is calculated using annualized interest

income (excluding PAA). (7) Included interest expense on interest

rate swaps used to hedge cost of funds. (8) Based on the closing

price of the Company’s common stock of $11.89, $12.19 and $9.97 at

December 31, 2017, September 30, 2017 and December 31, 2016,

respectively.

Non-GAAP Financial

Measures

To supplement its consolidated financial statements, which are

prepared and presented in accordance with U.S. generally accepted

accounting principles (“GAAP”), the Company provides the following

non-GAAP measures:

- core earnings and core earnings

(excluding PAA);

- core earnings and core earnings

(excluding PAA) per average common share;

- annualized core return on average

equity (excluding PAA);

- interest income (excluding PAA);

- economic interest expense;

- economic net interest income (excluding

PAA);

- average yield on interest earning

assets (excluding PAA);

- net interest margin (excluding PAA);

and

- net interest spread (excluding

PAA).

These measures should not be considered a substitute for, or

superior to, financial measures computed in accordance with GAAP.

While intended to offer a fuller understanding of the Company’s

results and operations, non-GAAP financial measures also have

limitations. For example, the Company may calculate its non-GAAP

metrics, such as core earnings, or the PAA, differently than its

peers making comparative analysis difficult. Additionally, in the

case of non-GAAP measures that exclude the PAA, the amount of

amortization expense excluding the PAA is not necessarily

representative of the amount of future periodic amortization nor is

it indicative of the term over which the Company will amortize the

remaining unamortized premium. Changes to actual and estimated

prepayments will impact the timing and amount of premium

amortization and, as such, both GAAP and non-GAAP results.

These non-GAAP measures provide additional detail to enhance

investor understanding of the Company’s period-over-period

operating performance and business trends, as well as for assessing

the Company’s performance versus that of industry peers. Additional

information pertaining to the Company’s use of these non-GAAP

financial measures, including discussion of how each such measure

is useful to investors, and reconciliations to their most directly

comparable GAAP results are provided below.

Amortization

In accordance with GAAP, the Company amortizes or accretes

premiums or discounts into interest income for its Agency

mortgage-backed securities, excluding interest-only securities,

taking into account estimates of future principal prepayments in

the calculation of the effective yield. The Company recalculates

the effective yield as differences between anticipated and actual

prepayments occur. Using third-party model and market information

to project future cash flows and expected remaining lives of

securities, the effective interest rate determined for each

security is applied as if it had been in place from the date of the

security’s acquisition. The amortized cost of the security is then

adjusted to the amount that would have existed had the new

effective yield been applied since the acquisition date. The

adjustment to amortized cost is offset with a charge or credit to

interest income. Changes in interest rates and other market factors

will impact prepayment speed projections and the amount of premium

amortization recognized in any given period.

The Company’s GAAP metrics include the unadjusted impact of

amortization and accretion associated with this method. Certain of

the Company’s non-GAAP metrics exclude the effect of the PAA, which

quantifies the component of premium amortization representing the

cumulative impact on prior periods, but not the current period, of

quarter-over-quarter changes in estimated long-term CPR.

The following table illustrates the impact of the PAA on premium

amortization expense for the Company’s Residential Investment

Securities portfolio for the quarters ended December 31, 2017,

September 30, 2017, and December 31, 2016:

For the quarters ended December 31,

2017 September 30,2017

December 31, 2016 (dollars in thousands)

Premium amortization expense (accretion) $ 203,951 $ 220,636

$ (19,812 ) Less: PAA cost (benefit) 11,367

39,899 (238,941 ) Premium amortization expense

exclusive of PAA $ 192,584 $ 180,737 $

219,129

For the quarters ended December

31, 2017 September 30,2017

December 31, 2016 (per average common share)

Premium amortization expense (accretion) $ 0.18 $ 0.21 $ (0.02 )

Less: PAA Cost (Benefit) 0.01 0.04

(0.23 ) Premium amortization expense exclusive of PAA $ 0.17

$ 0.17 $ 0.21

Core earnings and core earnings (excluding PAA), core

earnings and core earnings (excluding PAA) per average common share

and annualized core return on average equity (excluding

PAA)

One of the Company’s principal business objectives is to

generate net income by earning a net interest spread on its

investment portfolio, which is a function of the Company’s interest

income from its investment portfolio less financing, hedging and

operating costs. Core earnings, which is comprised of interest

income plus TBA dollar roll incomei, less financing and hedging

costsii and general and administrative expenses, and core earnings

(excluding PAA), are used by management and, we believe, used by

our analysts and investors, to measure its progress in achieving

this objective.

The Company defines “core earnings”, a non-GAAP measure, as net

income (loss) excluding gains or losses on disposals of investments

and termination of interest rate swaps, unrealized gains or losses

on interest rate swaps and investments measured at fair value

through earnings, net gains and losses on trading assets,

impairment losses, net income (loss) attributable to noncontrolling

interest, corporate acquisition related expenses and certain other

non-recurring gains or losses, and inclusive of TBA dollar roll

income (a component of Net gains (losses) on trading assets) and

realized amortization of MSRs (a component of net unrealized gains

(losses) on investments measured at fair value through earnings).

Core earnings (excluding PAA) excludes the premium amortization

adjustment representing the cumulative impact on prior periods, but

not the current period, of quarter-over-quarter changes in

estimated long-term prepayment speeds related to the Company’s

Agency mortgage-backed securities.

The Company believes these non-GAAP measures provide management

and investors with additional details regarding the Company’s

underlying operating results and investment portfolio trends by (i)

making adjustments to account for the disparate reporting of

changes in fair value where certain instruments are reflected in

GAAP net income (loss) while others are reflected in other

comprehensive income (loss), and (ii) by excluding certain

unrealized, non-cash or episodic components of GAAP net income

(loss) in order to provide additional transparency into the

operating performance of the Company’s portfolio. Annualized core

return on average equity (excluding PAA), which is calculated by

dividing core earnings (excluding PAA) over average stockholders’

equity, provides investors with additional detail on the core

earnings generated by the Company’s invested equity capital.

The following table presents a reconciliation of GAAP financial

results to non-GAAP core earnings for the periods presented.

i TBA dollar roll transactions are accounted for as derivatives,

with gains and losses reflected as a component of Net gains

(losses) on trading assets in the Company’s Consolidated Statements

of Comprehensive Income (Loss). TBA dollar roll income represents

the economic equivalent of interest income on the underlying

security less the implied cost of financing. ii The interest

component of hedging costs is reported as realized gains (losses)

on interest rate swaps in the Company’s Consolidated Statements of

Comprehensive Income (Loss).

For the quarters

ended December 31, 2017 September

30,2017 December 31, 2016

(dollars in thousands, except per share data) GAAP net

income (loss) $ 746,771 $ 367,315 $ 1,848,483 Less:

Realized (gains) losses on termination of interest rate swaps

160,075 — 55,214 Unrealized (gains) losses on interest rate swaps

(484,447 ) (56,854 ) (1,430,668 ) Net (gains) losses on disposal of

investments (7,895 ) 11,552 (7,782 ) Net (gains) losses on trading

assets (121,334 ) (154,208 ) 139,470 Net unrealized (gains) losses

on investments measured at fair value through earnings 12,115

67,492 (110,742 ) Net (income) loss attributable to noncontrolling

interest 151 232 87 Plus: TBA dollar roll income (1) 89,479 94,326

98,896 MSR amortization (2) (19,331 ) (16,208 )

(27,018 ) Core earnings * 375,584 313,647 565,940 Less: Premium

amortization adjustment cost (benefit) 11,367 39,899

(238,941 ) Core earnings (excluding PAA) * $ 386,951

$ 353,546 $ 326,999 GAAP net

income (loss) per average common share (3) $ 0.62 $

0.31 $ 1.79 Core earnings per average common

share *(3) $ 0.30 $ 0.26 $ 0.53

Core earnings (excluding PAA) per average common share *(3) $ 0.31

$ 0.30 $ 0.30 Annualized GAAP

return (loss) on average equity 20.58 % 10.98 % 57.23

% Annualized core return on average equity (excluding PAA) * 10.67

% 10.57 % 10.13 %

For the years

ended December 31, 2017 December

31, 2016 (dollars in thousands, except per share

data) GAAP net income (loss) $ 1,569,016 $ 1,432,786

Less: Realized (gains) losses on termination of interest rate swaps

160,133 113,941 Unrealized (gains) losses on interest rate swaps

(512,918 ) (282,190 ) Net (gains) losses on disposal of investments

3,938 (33,089 ) Net (gains) losses on trading assets (261,438 )

(230,580 ) Net unrealized (gains) losses on investments measured at

fair value through earnings 39,684 (86,391 ) Bargain purchase gain

— (72,576 ) Corporate acquisition related expenses (4) — 48,887 Net

(income) loss attributable to noncontrolling interest 588 970 Plus:

TBA dollar roll income (1) 334,824 351,778 MSR amortization (2)

(66,667 ) (48,652 ) Core earnings * 1,267,160 1,194,884

Less: Premium amortization adjustment cost (benefit) 141,836

18,941 Core earnings (excluding PAA) * $ 1,408,996

$ 1,213,825 GAAP net income (loss) per average

common share (3) $ 1.37 $ 1.39 Core earnings

per average common share *(3) $ 1.09 $ 1.15

Core earnings (excluding PAA) per average common share *(3) $ 1.22

$ 1.17 Annualized GAAP return (loss) on

average equity 11.73 % 11.75 % Annualized core return on

average equity (excluding PAA) * 10.54 % 9.96 % *

Represents a non-GAAP financial measure. (1) Represents a component

of Net gains (losses) on trading assets. (2) Represents the portion

of changes in fair value that is attributable to the realization of

estimated cash flows on the Company’s MSR portfolio and is reported

as a component of Net unrealized gains (losses) on investments

measured at fair value. (3) Net of dividends on preferred stock.

The quarter ended December 31, 2017 excludes, and the quarter ended

September 30, 2017 includes, cumulative and undeclared dividends of

$8.3 million on the Company's Series F Preferred Stock as of

September 30, 2017. (4) Represents transaction costs incurred in

connection with the Company’s acquisition of Hatteras Financial

Corp.

From time to time, the Company enters into TBA forward contracts

as an alternate means of investing in and financing Agency

mortgage-backed securities. A TBA contract is an agreement to

purchase or sell, for future delivery, an Agency mortgage-backed

security with a specified issuer, term and coupon. A TBA dollar

roll represents a transaction where TBA contracts with the same

terms but different settlement dates are simultaneously bought and

sold. The TBA contract settling in the later month typically prices

at a discount to the earlier month contract with the difference in

price commonly referred to as the “drop”. The drop is a reflection

of the expected net interest income from an investment in similar

Agency mortgage-backed securities, net of an implied financing

cost, that would be foregone as a result of settling the contract

in the later month rather than in the earlier month. The drop

between the current settlement month price and the forward

settlement month price occurs because in the TBA dollar roll

market, the party providing the financing is the party that would

retain all principal and interest payments accrued during the

financing period. Accordingly, TBA dollar roll income generally

represents the economic equivalent of the net interest income

earned on the underlying Agency mortgage-backed security less an

implied financing cost.

TBA dollar roll transactions are accounted for under GAAP as a

series of derivatives transactions. The fair value of TBA

derivatives is based on methods similar to those used to value

Agency mortgage-backed securities. The Company records TBA

derivatives at fair value on its Consolidated Statements of

Financial Condition and recognizes periodic changes in fair value

as Net gains (losses) on trading assets in the Consolidated

Statements of Comprehensive Income (Loss), which includes both

unrealized and realized gains and losses on derivatives (excluding

interest rate swaps).

TBA dollar roll income is calculated as the difference in price

between two TBA contracts with the same terms but different

settlement dates multiplied by the notional amount of the TBA

contract. Although accounted for as derivatives, TBA dollar rolls

capture the economic equivalent of net interest income, or carry,

on the underlying Agency mortgage-backed security (interest income

less an implied cost of financing). TBA dollar roll income is

reported as a component of Net gains (losses) on trading assets in

the Consolidated Statements of Comprehensive Income (Loss).

Interest income (excluding PAA), economic interest expense

and economic net interest income (excluding PAA)

Interest income (excluding PAA) represents interest income

excluding the effect of the PAA, and serves as the basis for

deriving average yield on interest earning assets (excluding PAA),

net interest spread (excluding PAA) and net interest margin

(excluding PAA), which are discussed below. The Company believes

this measure provides management and investors with additional

detail to enhance their understanding of the Company’s operating

results and trends by excluding the component of premium

amortization expense representing the cumulative impact on prior

periods, but not the current period, of quarter-over-quarter

changes in estimated long-term prepayment speeds related to the

Company’s Agency mortgage-backed securities (other than

interest-only securities), which can obscure underlying trends in

the performance of the portfolio.

Economic interest expense is comprised of interest expense, as

computed in accordance with GAAP, plus interest expense on interest

rate swaps used to hedge cost of funds, which is a component of

Realized gains (losses) on interest rate swaps in the Company’s

Consolidated Statements of Comprehensive Income (Loss). The Company

uses interest rate swaps to manage its exposure to changing

interest rates on its repurchase agreements by economically hedging

cash flows associated with these borrowings. Accordingly, adding

the contractual interest payments on interest rate swaps to

interest expense, as computed in accordance with GAAP, reflects the

total contractual interest expense and thus, provides investors

with additional information about the cost of the Company's

financing strategy.

Similarly, economic net interest income (excluding PAA), as

computed below, provides investors with additional information to

enhance their understanding of the net economics of our primary

business operations.

For the quarters ended December 31,

2017 September 30,2017

December 31, 2016 (dollars in thousands)

Interest Income

(Excluding PAA) Reconciliation

GAAP interest income $ 745,423 $ 622,550 $ 807,022

Premium amortization adjustment 11,367 39,899

(238,941 ) Interest income (excluding PAA) * $ 756,790

$ 662,449 $ 568,081

Economic Interest

Expense Reconciliation

GAAP interest expense $ 318,711 $ 268,937 $ 183,396 Add: Interest

expense on interest rate swaps used to hedge cost of funds 73,957

78,564 92,841 Economic interest

expense * $ 392,668 $ 347,501 $ 276,237

Economic Net

Interest Income (Excluding PAA) Reconciliation

Interest income (excluding PAA) * $ 756,790 $ 662,449 $ 568,081

Less: Economic interest expense * 392,668 347,501

276,237 Economic net interest income

(excluding PAA) * $ 364,122 $ 314,948 $

291,844 * Represents a non-GAAP financial measure.

Average yield on interest earning assets (excluding PAA), net

interest spread (excluding PAA) and net interest margin (excluding

PAA)

Net interest spread (excluding PAA), which is the difference

between the average yield on interest earning assets (excluding

PAA) and the average cost of interest bearing liabilities, and net

interest margin (excluding PAA), which is calculated as the sum of

the Company’s annualized economic net interest income (inclusive of

interest expense on interest rate swaps used to hedge cost of

funds) plus TBA dollar roll income (less interest expense on swaps

used to hedge TBA dollar roll transactions) divided by the sum of

its average interest earning assets plus average outstanding TBA

derivative balances, provide management with additional measures of

the Company’s profitability that management relies upon in

monitoring the performance of the business.

Disclosure of these measures, which are presented below,

provides investors with additional detail regarding how management

evaluates the Company’s performance.

For the quarters ended December 31,

2017 September 30,2017

December 31, 2016

Economic Metrics

(Excluding PAA)

(dollars in thousands) Interest income (excluding PAA) * $

756,790 $ 662,449 $ 568,081 Average interest earning

assets $ 100,247,589 $ 89,253,094 $ 84,799,222 Average yield on

interest earning assets (excluding PAA) * 3.02 % 2.97 %

2.68 % Economic interest expense * $ 392,668 $ 347,501 $

276,237 Average interest bearing liabilities $ 85,992,215 $

76,382,315 $ 72,032,600 Average cost of interest bearing

liabilities 1.83 % 1.82 % 1.53 % Net interest spread

(excluding PAA) * 1.19 % 1.15 % 1.15 % Net interest

margin (excluding PAA) * 1.51 % 1.47 % 1.53 % *

Represents a non-GAAP financial measure.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180214006266/en/

Annaly Capital Management, Inc.Investor

Relations1-888-8Annalywww.annaly.com

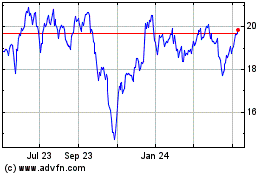

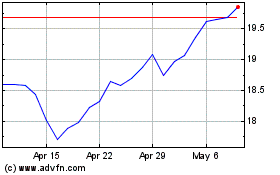

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Apr 2023 to Apr 2024