Silvercorp Metals Inc. ("Silvercorp” or the

“Company”) (TSX:SVM) (NYSE American:SVM) is pleased to report

results of its 2016 and 2017 exploration program at its GC Ag-Pb-Zn

mine, Guangdong Province, China.

In 2016 and 2017, the Company launched extensive

exploration program and completed a total of 33,029 meters (“m”) of

underground diamond drilling and 19,619 m of exploration tunneling

at its GC Ag-Pb-Zn mine. Significant high-grade mineralized zones

have been exposed at and below the current production levels, and

major mineralized zones have been extended along strike and

downdip.

The drilling program included infill drilling to

define and upgrade the current resource model, and step-out

drilling for new resources surrounding and below the current

resource area. Between 2016 and 2017, 294 NQ sized diamond drill

holes with total length of 33,029 meters were accomplished at 7

production levels from 150 m to -200 m at 50 m interval (the

elevation of the head frame is 258.5 m). Among them, 153 holes

intersected ore veins with Ag equivalent (AgEq) values greater than

194 g/t, and another 36 holes hit mineralized veins with AgEq

values between 97 and194 g/t (Tab. 1).

Table 1: Summary of the drilling

programs in 2016 and 2017

|

Year |

Meters Drilled |

Holes Completed |

Samples Collected |

Holes InterceptedMineralization |

Holes InterceptedOre |

|

2016 |

11,878 |

129 |

2,235 |

29 |

77 |

|

2017 |

21,151 |

165 |

4,595 |

7 |

76 |

|

Total |

33,029 |

294 |

6,830 |

36 |

153 |

In 2016 and 2017, 19,619 m of tunneling were

driven along and across the major mineralized vein structures to

upgrade the resource model and test for new vein structures. These

included 7,767 m key drifts that exposed 4,803 m of ore veins, as

well as 4,351 m of key raises that exposed 3,002 m of ore veins

(Tab. 2).

Table 2: Summary of the

tunneling programs in 2016 and 2017

|

Year |

Tunneling (m) |

Samples Collected |

Key Drifts Included (m) |

Ore Exposed in Drifts

(m) |

Key Raise Included (m) |

Ore Exposed in Raises (m) |

|

2016 |

9,152 |

4,063 |

2,482 |

1,980 |

1,683 |

1,266 |

|

2017 |

10,467 |

5,608 |

5,285 |

2,823 |

2,668 |

1,736 |

|

Total |

19,619 |

9,671 |

7,767 |

4,803 |

4,351 |

3,002 |

Tables 3 and 4 below list assay results of some

selected drill holes that intercepted ores and drift tunnels that

exposed ore zones in the 2016 and 2017 exploration programs.

Table 3: Selected drilling

results from the 2016 and 2017 drilling programs at GC

mine

|

Year |

Hole ID |

From (m) |

To (m) |

True Width (m) |

Vein |

Elevation (m) |

Ag (g/t) |

Pb (%) |

Zn (%) |

AgEq (1,2) (g/t) |

|

2016 |

CK10381 |

29.97 |

32.74 |

2.54 |

V12 |

52.1 |

97 |

0.11 |

9.65 |

590 |

|

2016 |

CK10582 |

85.74 |

89.84 |

2.84 |

V36 |

-73.7 |

78 |

2.66 |

3.21 |

383 |

|

2016 |

CK11201 |

17.44 |

19.65 |

2.02 |

V28-4 |

-152.0 |

233 |

4.68 |

2.30 |

601 |

|

2016 |

CK11301 |

11.68 |

27.51 |

8.64 |

V1 |

-151.9 |

48 |

2.03 |

6.08 |

464 |

|

2016 |

CK3086 |

0 |

8.2 |

6.39 |

V7E |

-101.2 |

90 |

0.62 |

1.69 |

209 |

|

2016 |

CK3087 |

0 |

6.27 |

3.58 |

V7E |

-100.4 |

134 |

1.48 |

4.01 |

416 |

|

2016 |

CK4083 |

82.22 |

87.6 |

4.48 |

V7N |

-145.4 |

45 |

1.24 |

3.53 |

290 |

|

2016 |

CK4083 |

103.44 |

109.69 |

5.20 |

V7E |

-157.4 |

49 |

0.91 |

2.07 |

203 |

|

2016 |

CK4084 |

50.88 |

60.04 |

7.35 |

V7E |

-115.4 |

43 |

0.89 |

3.87 |

286 |

|

2016 |

CK4280 |

17.25 |

21.71 |

3.48 |

V10 |

-99.9 |

45 |

1.69 |

5.65 |

421 |

|

2017 |

18CK26A04 |

126.59 |

132.08 |

3.77 |

V2-4 |

-316.7 |

72 |

0.91 |

3.72 |

309 |

|

2017 |

18CK26A05 |

277.32 |

281.96 |

3.31 |

V2-2 |

-463.7 |

171.2 |

1.99 |

5.12 |

537 |

|

2017 |

18CK28A05 |

295.05 |

297.97 |

1.97 |

V6-1 |

-453.0 |

310 |

2.13 |

14.69 |

1,167 |

|

2017 |

CK10586 |

114.16 |

116.39 |

1.61 |

V9W-2 |

89.2 |

491 |

0.69 |

5.63 |

813 |

|

2017 |

CK10588 |

33.11 |

37.23 |

2.83 |

V19 |

78.9 |

87 |

3.12 |

2.62 |

387 |

|

2017 |

CK10691 |

99.57 |

102.38 |

2.14 |

V33 |

43.1 |

191 |

3.68 |

3.09 |

545 |

|

2017 |

CK1080 |

83.13 |

84.28 |

1.11 |

V40 |

-2.6 |

758 |

1.97 |

2.98 |

1,015 |

|

2017 |

CK10982 |

117.35 |

128.37 |

6.51 |

V7E |

-193.2 |

55 |

2.02 |

3.55 |

343 |

|

2017 |

CK10986 |

97.06 |

100.35 |

3.23 |

V14 |

14.3 |

94 |

0.46 |

5.95 |

419 |

|

2017 |

CK2282 |

56.56 |

60.64 |

3.90 |

V9-9 |

-94.0 |

57 |

1.21 |

6.52 |

451 |

|

2017 |

CK2688 |

115.76 |

123.59 |

7.57 |

V2E1 |

-245.6 |

64 |

0.75 |

4.00 |

306 |

|

2017 |

CK26A84 |

135.49 |

138.33 |

2.56 |

V2E1 |

-294.6 |

92 |

1.58 |

5.74 |

467 |

|

2017 |

CK26A88 |

106.15 |

108.95 |

2.79 |

V2-1 |

-239.4 |

109 |

4.59 |

5.29 |

624 |

|

2017 |

CK26A88 |

128.67 |

134.78 |

5.53 |

V2E1 |

-248.1 |

58 |

0.82 |

5.65 |

388 |

|

2017 |

CK28A84 |

116.96 |

120.93 |

3.47 |

V2-4 |

-272.6 |

299 |

3.00 |

10.54 |

993 |

|

2017 |

CK28A84 |

143.19 |

152.1 |

7.79 |

V2E |

-289.4 |

143 |

3.58 |

4.08 |

542 |

|

2017 |

CK28A86 |

96.95 |

97.89 |

0.77 |

V18 |

142.0 |

932 |

5.83 |

5.05 |

1,501 |

|

2017 |

CK30A83 |

184.5 |

191.15 |

5.01 |

V2E |

-297.6 |

101 |

0.90 |

2.89 |

295 |

(1) Metal

prices assumed: Ag USD19/Oz, Pb USD1.0/lb., Zn

USD1.2/lb.(2) Ag equivalent AgEq

= Ag grade (g/t) + 53.9 x Pb grade (%) + 50.5 x Zn grade

(%)

Table 4: Selected drifts that

exposed ore zones at GC mine in 2016 and 2017

|

Drift ID |

Vein |

Elevation (m) |

Length (m) |

True Width(m) |

Ag (g/t) |

Pb (%) |

Zn (%) |

AgEq(g/t) |

|

V2W-(-150)-22YM |

V2W |

-150 |

128 |

1.89 |

132 |

2.77 |

3.48 |

457 |

|

V2W-(-150)-22AYM+CM |

V2W |

-150 |

54 |

8.00 |

132 |

3.12 |

4.63 |

534 |

|

V2E-(-150)-26EYM |

V2E |

-150 |

300 |

1.70 |

134 |

2.85 |

3.89 |

484 |

|

V2E-(-200)-28EYM |

V2E |

-200 |

117 |

2.69 |

99 |

1.25 |

4.19 |

379 |

|

-150-V2E1-26YM |

V2E1 |

-150 |

86 |

5.99 |

96 |

0.66 |

1.78 |

221 |

|

V2E1-(-200)-26AYM |

V2E1 |

-200 |

71 |

2.70 |

163 |

2.18 |

2.79 |

421 |

|

V7E(V36)-(-100)-40YM |

V7E |

-100 |

110 |

1.75 |

106 |

2.14 |

4.04 |

426 |

|

V9-5-(-150)-30WYM |

V9-5 |

-150 |

150 |

1.45 |

96 |

3.41 |

3.57 |

461 |

|

-100-V10-40AYM |

V10 |

-100 |

210 |

1.29 |

41 |

1.29 |

3.34 |

280 |

|

V10-1-0-42SYM |

V10-1 |

0 |

145 |

1.57 |

101 |

0.86 |

4.16 |

357 |

|

V14-50-(105-111)YM |

V14 |

50 |

163 |

0.83 |

129 |

1.93 |

6.15 |

544 |

|

-100-V16-22AYM |

V16 |

-100 |

208 |

1.73 |

44 |

0.48 |

2.75 |

209 |

|

V24-0-14SWYM |

V24 |

0 |

90 |

1.10 |

312 |

2.63 |

5.81 |

747 |

The step-out drilling and tunneling in the east

of the mine defined new mineralized vein structures including

V7E、NV10、V14、V19、V31、V32 and V33. Vein V7E has been defined 95 m in

strike length, 150 m in downdip length and 0.8-1.75 m in width,

with average grade of 81 g/t Ag, 1.43 % Pb and 3.08% Zn. The

exploration program at -150m and -200m levels indicated that the

length and width, ore continuity and ore grades improved greatly

with the increase of depth (Tab. 5).

Table 5: Increases of average

grades in veins V2E and V2W with depth

|

Vein |

Level (m) |

Length (m) |

True Width (m) |

Ag (g/t) |

Pb (%) |

Zn (%) |

AgEq (g/t) |

|

V2E |

100 |

30 |

1.52 |

212 |

1.42 |

0.59 |

318 |

| |

50 |

164 |

1.24 |

71 |

1.73 |

2.83 |

307 |

| |

0 |

229 |

1.02 |

74 |

1.32 |

2.40 |

266 |

| |

-50 |

225 |

1.2 |

94 |

1.47 |

2.62 |

306 |

| |

-100 |

450 |

1.48 |

105 |

1.33 |

2.80 |

318 |

| |

-150 |

418 |

1.28 |

122 |

1.94 |

3.35 |

396 |

|

|

-200 |

400 |

1.92 |

126 |

2.10 |

3.82 |

432 |

|

V2W |

100 |

77 |

3.57 |

100 |

0.15 |

2.20 |

219 |

| |

50 |

174 |

2.15 |

118 |

0.83 |

3.91 |

360 |

| |

0 |

106 |

3.03 |

139 |

1.71 |

3.38 |

402 |

| |

-50 |

242 |

3.4 |

141 |

1.62 |

3.48 |

404 |

| |

-100 |

128 |

2.19 |

120 |

1.39 |

2.51 |

322 |

|

|

-150 |

183 |

6.32 |

277 |

5.00 |

6.53 |

876 |

In addition, two drill holes, 18CK26A04 and

18CK28A05, hit high-grade mineralization with true width of 3.31 m

and 1.97 m, respectively, at elevation around -455 m. The host rock

of the mineralization is slate, which indicated that the

mineralization system is not limited to granite, but extend into

the sedimentary rock underneath the granite intrusive. Also, the

trend of increasing Ag, Pb, Zn and Cu grades with depth continued

to below -450 m elevation. The assay results of the intercepted ore

of drill hole 18CK28A05 are 310 g/t Ag, 2.13% Pb, 14.96% Zn, 0.73%

Cu, 0.19% Sn and 0.34 g/t Au.

Quality

Control

Drill core samples were taken from sawn half

core for every 1.5m or limited by apparent wall rock and

mineralization contact. Half of the core was sent to the laboratory

for analysis and the other half retained for archive. The channel

samples are collected along sample lines perpendicular to the

mineralized vein structure in exploration tunnels. Sample length

ranges from 0.2 m to more than 1.0 m, depending on the width of the

mineralized vein and the mineralization type. Spacing between

sampling lines is typically 5 m along strike. Both the mineralized

vein and the altered wall rocks are cut with continuous chisel

chipping. The samples are individually secured in cotton sample

bags and then collectively secured in rice bags for shipment to the

on-site laboratory.

For analysis, the sample is dried and crushed to

minus 1 mm and then split to a 200-300 g subsample which is further

pulverized to minus 200 mesh. A duplicate sample of minus 1 mm is

made and kept at the laboratory archives. Two subsamples are

prepared from the pulverized sample. One is digested with two-acids

for analysis of silver, lead, zinc and copper with AAS. The other

is retained as pulp reject at the lab for future reference.

A routine quality assurance/quality control

(QA/QC) procedure is adopted to monitor the analytical quality at

the lab. Certified reference materials (CRMs), pulp duplicates and

blanks are inserted into each lab batch of samples. QA/QC data at

the lab are attached to the assay certificates for each batch of

samples.

The Company maintains its own comprehensive

QA/QC program to ensure best practices in sample preparation and

analysis of the exploration samples. Project geologists regularly

insert CRM, field duplicates and blanks to each batch of core

samples to monitor the sample preparation and analysis procedures

at the labs. The analytical quality of the labs is further

evaluated with external checks by sending about 3-5% of the pulp

samples to higher level labs to check for lab bias.

Data from both the Company's and the lab’s QA/QC

programs are reviewed on a timely basis by project geologists.

Guoliang Ma, P. Geo, Silvercorp’s Manager of

Exploration and Resource, reviewed the exploration data and

prepared the scientific and technical information regarding

exploration results contained herein. He is the Qualified

Person on the project as defined under National Instrument 43-101

and has verified and approved the contents of this news

release.

About

Silvercorp

Silvercorp is a low-cost silver-producing

Canadian mining company with multiple mines in China. The Company's

vision is to deliver shareholder value by focusing on the

acquisition of under developed projects with resource potential and

the ability to grow organically. For more information, please visit

our website at www.silvercorp.ca.

For further

informationSilvercorp Metals Inc.Lorne Waldman

Senior Vice PresidentPhone: (604) 669-9397Toll Free 1(888)

224-1881Email: investor@silvercorp.ca Website:

www.silvercorp.ca

CAUTIONARY DISCLAIMER - FORWARD

LOOKING STATEMENTS

Certain of the statements and information in

this press release constitute “forward-looking statements” within

the meaning of the United States Private Securities Litigation

Reform Act of 1995 and “forward-looking information” within the

meaning of applicable Canadian provincial securities laws.

Forward-looking statements or information relate to, among other

things: the price of silver and other metals; the accuracy of

mineral resource and mineral reserve estimates and exploration

results at the Company’s GC mine.

Forward-looking statements or information are

subject to a variety of known and unknown risks, uncertainties and

other factors that could cause actual events or results to differ

from those reflected in the forward-looking statements or

information, including, without limitation, risks relating to:

fluctuating commodity prices; calculation of resources, reserves

and mineralization and precious and base metal recovery;

interpretations and assumptions of mineral resource and mineral

reserve estimates; and exploration results. This list is not

exhaustive of the factors that may affect any of the Company’s

forward-looking statements or information. Forward-looking

statements or information are statements about the future and are

inherently uncertain, and actual achievements of the Company or

other future events or conditions may differ materially from those

reflected in the forward-looking statements or information due to a

variety of risks, uncertainties and other factors, including,

without limitation, those referred to in the Company’s Annual

Information Form for the year ended March 31, 2017 under the

heading “Risk Factors”. Although the Company has attempted to

identify important factors that could cause actual results to

differ materially, there may be other factors that cause results

not to be as anticipated, estimated, described or intended.

Accordingly, readers should not place undue reliance on

forward-looking statements or information.

The Company’s forward-looking statements and

information are based on the assumptions, beliefs, expectations and

opinions of management as of the date of this press release, and

other than as required by applicable securities laws, the Company

does not assume any obligation to update forward-looking statements

and information if circumstances or management’s assumptions,

beliefs, expectations or opinions should change, or changes in any

other events affecting such statements or information. For the

reasons set forth above, investors should not place undue reliance

on forward-looking statements and information.

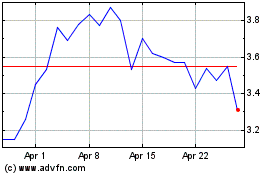

Silvercorp Metals (AMEX:SVM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Silvercorp Metals (AMEX:SVM)

Historical Stock Chart

From Apr 2023 to Apr 2024