Record Annual Sales Achieved with New Fourth

Quarter Record of $970.6 Million; Company’s Board of Directors

Authorizes $150 Million Stock Repurchase Program

SKECHERS USA, Inc. (NYSE:SKX), a global footwear leader, today

announced financial results for the fourth quarter and year ended

December 31, 2017.

Fourth Quarter

Highlights

- Record sales of $970.6 million, an

increase of 27.0 percent

- Earnings from operations of $55.7

million, an increase of 96.9 percent

- GAAP diluted loss per share of $0.43

due to a $0.64 one-time tax expense attributable to the Tax Cuts

& Jobs Act, adjusted diluted earnings per share of

$0.21

- International wholesale sales

increased 40.2 percent; total international wholesale and retail

sales combined represented 52.6 percent of total sales

- Domestic wholesale sales increased

11.6 percent

- Company-owned global retail sales

increased 25.8 percent, with a comparable same store sales increase

of 12.0 percent globally

“2017 was a monumental year for Skechers as we achieved sales of

more than $4 billion for the first time in our 25-year history,”

began Robert Greenberg, Skechers chief executive officer. “This

growth is due to our continued focus on efficiencies and

infrastructure as well as innovation, comfort, and relevancy within

our product design. In the United States, we remained the No. 1

walking, work, casual lifestyle, and casual dress footwear brand,

and the No. 2 casual athletic footwear brand*. Our team of

legendary athletes and international celebrities, including the

chart-topping singer Camila Cabello, drove worldwide appeal in

marketing campaigns that represent our diverse product

offering—from our heritage retro styling to the innovation and

comfort that have become hallmarks of Skechers footwear.

Furthermore, we grew our Skechers store base to 2,570 locations at

year-end and saw impressive growth across the globe—including

record sales on Single’s Day in China. As we look ahead, with fresh

styles shipping for Spring, we believe we will remain a leader in

the lifestyle footwear channel in the United States, selectively

expand our retail footprint, and continue our global growth as we

see our international business becoming an increasingly larger

piece of our total business.”

“With three months of strong sales, a robust holiday selling

season that included increased demand for our innovative lighted

children’s footwear and comfortable adult styles, and double-digit

growth in each of our three distribution channels, we achieved a

new fourth quarter sales record of $970.6 million,” stated David

Weinberg, chief operating officer of Skechers. “The four record

sales quarters in 2017 resulted in a new annual sales record of

$4.16 billion, an increase of over $600 million from the previous

year’s sales. This growth is a testament to the worldwide strength

and relevance of our product, marketing and brand.”

Fourth Quarter

Financial Results

($ in millions, except per share data)

For the three months ended December 31,

Change 2017 2016

$ % Sales $

970.6 $ 764.3 $ 206.3 27.0 % Gross Profit 454.1 356.2 97.9

27.5 % Gross Margin 46.8 % 46.6 % SG&A Expenses 404.7

332.9 71.8 21.6 % As a % of Sales 41.7 % 43.6 % Earnings

from Operations 55.7 28.3 27.4 96.9 % Operating Margin 5.7 % 3.7 %

Net Earnings (Loss) (66.7 ) 6.7 (73.4 ) NM GAAP

Diluted Earnings Per Share ($0.43 ) $ 0.04 ($0.47 ) NM

Adjusted Diluted Earnings Per Share $ 0.21 $ 0.04 $ 0.17 425.0 %

Sales grew 27.0 percent as a result of a 40.2 percent increase

in the Company’s international wholesale business, an 11.6

percent increase in the Company’s domestic wholesale

business, and a 25.8 percent increase in its Company-owned global

retail business. Comparable same store sales in

Company-owned stores increased 12.0 percent, including a domestic

increase of 10.5 percent and an international increase of 16.5

percent.

Gross margins increased due to strength in the Company’s

international retail business and increased sales in the Company’s

international subsidiary business.

SG&A expenses increased 21.6 percent. This

increase was driven by $67.4 million in general and

administrative expenses, including $37.8 million to support

international growth in the Company’s joint venture and subsidiary

businesses, and $20.1 million associated with operating 75

additional Company-owned Skechers stores, of which 22 were opened

in the fourth quarter. Selling expenses increased

by $4.4 million primarily due to higher international advertising

expenses as well as $1.5 million in increased sales commissions in

its South Korea joint-venture business.

Earnings from operations increased 96.9 percent primarily

due to sales growth.

Net loss was $66.7 million and diluted loss per

share was $0.43 per share. However, after adjusting for the

impact of Tax Cuts & Jobs Act (“TCJA”), adjusted net

earnings were $33.3 million and adjusted diluted earnings

per share were $0.21.

Income Taxes

The enactment of the Tax Cuts and Jobs Act in December 2017

resulted in a provisional additional income tax expense of $99.9

million in the fourth quarter, or an impact of $0.64 per diluted

share. The additional expense encompasses several elements,

including a one-time tax on accumulated overseas profits and the

revaluation of deferred tax assets and liabilities. As a result,

the Company’s reported tax rate was 194.4 percent for the fourth

quarter, and 38.8 percent for the full year. Excluding the

additional expense, the Company’s tax rate would have been 12.2

percent for the fourth quarter and 12.8 percent for the full year.

The Company will continue to analyze the impact of the TCJA to

determine its full effects. However, based on current expectations,

the Company’s 2018 annual tax rate is estimated to be in the range

of 12 percent to 17 percent.

Full-Year 2017

Financial Results

($ in millions, except per share data)

For the year ended December 31, Change

2017 2016

$ % Sales $ 4,164.2 $

3,563.3 $ 600.9 16.9 % Gross Profit 1,938.9 1,634.6 304.3

18.6 % Gross Margin 46.6 % 45.9 % SG&A Expenses 1,572.7

1,278.0 294.7 23.1 % As a % of Sales 37.8 % 35.9 % Earnings

from Operations 382.9 370.5 12.4 3.3 % Operating Margin 9.2 % 10.4

% Net Earnings (Loss) 179.2 243.5 (64.3 ) (26.4 %)

GAAP Diluted Earnings Per Share $ 1.14 $ 1.57 ($0.43 ) (27.4 %)

Adjusted Diluted Earnings Per Share $ 1.78 $ 1.57 $ 0.21

13.4 %

Full-year sales growth was the result of a 24.3 percent increase

in the Company’s international wholesale business, a 21.9

percent increase in the Company’s global retail business,

and a 4.1 percent increase in the Company’s domestic

wholesale business. Comparable same store sales in

Company-owned stores increased 7.2 percent, including a domestic

increase of 6.4 percent and an international increase of 10.1

percent.

Gross margins improved due to the sale of more in-line

product in 2017 and a stronger Company-owned retail and

international business.

SG&A expenses increased 23.1 percent including

an increase in selling expenses of $70.1 million

primarily to support growth in its international markets. It also

included an increase of 22.0 percent in general and

administrative expenses principally due to $73.7 million

in new store operating costs associated with 75 additional

Company-owned stores opened in the year and $109.5 million to

support growth in the Company’s international joint venture and

subsidiary businesses.

Earnings from operations increased 3.3 percent primarily

from increased sales growth.

Net earnings were $179.2 million and diluted

earnings per share were $1.14 per share. However, after

adjusting for the impact of TCJA, adjusted net earnings were

$279.1 million and adjusted diluted earnings per share were

$1.78.

Balance Sheet

At year-end 2017, cash and cash equivalents were $736.4

million, an increase of $17.9 million, or 2.5 percent over last

year.

Total inventory, including inventory in transit, was

$873.0 million, a $172.5 million increase, or 24.6 percent, over

December 31, 2016, and in line with the Company’s incoming order

rate, as well as the Company’s growing retail and wholesale

businesses.

Working capital was $1.5 billion versus $1.2 billion at

December 31, 2016, primarily reflecting increased investment in

inventory for 2018.

“Our relevant and affordable products are resonating with

consumers across the globe. This, combined with the investments and

efficiencies we have made in our global infrastructure, directly

contributed to our record sales performance in 2017. It also

uniquely positions us for success in 2018 and beyond,” said John

Vandemore, chief financial officer of Skechers. “In addition, our

strong balance sheet and significant free cash flow allows us to

fully execute our capital allocation strategy by continuing to make

high-growth investments and to return cash directly to stockholders

in the form of a stock repurchase.”

Share Repurchase

In February 2018, the Board of Directors authorized a stock

repurchase program, under which the Company plans to repurchase up

to $150 million of its Class A common stock through February

8, 2021 in the open market at prevailing prices.

Under the repurchase program, repurchases can be made from time

to time using a variety of methods, which may include open market

purchases, privately negotiated transactions or otherwise, all in

accordance with the United States Securities and Exchange

Commission and other applicable legal requirements. The specific

timing, price and size of purchases will depend on prevailing stock

prices, general economic and market conditions, and other

considerations. The repurchase program does not obligate the

Company to acquire any particular amount of Class A common stock,

and the repurchase program may be suspended or discontinued at any

time at the Company’s discretion.

Outlook

For the first quarter of 2018, the Company believes it will

achieve sales in the range of $1.175

billion to $1.200 billion, and diluted earnings per share

of $0.70 to $0.75.

Fourth Quarter and Full Year 2017

Conference Call

The Company will host a conference call today at 1:30 p.m. PT /

4:30 p.m. Eastern Time to discuss its fourth quarter and full year

2017 financial results. The call can be accessed on the Investor

Relations section of the Company’s website at www.skx.com. For

those unable to participate during the live broadcast, a replay

will be available beginning February 8, 2018, at 7:30 p.m. ET,

through February 22, 2018, at 11:59 p.m. ET. To access the replay,

dial 844-512-2921 (U.S.) or 412-317-6671 (International) and use

passcode: 13655455.

Non-GAAP Financial

Measures

References in this press release to “Sales” refers to the

Company’s net sales reported under generally accepted accounting

principles in the United States (“GAAP”). To supplement its

financial results presented in accordance with GAAP, the Company

presents certain non-GAAP financial measures within the meaning of

Regulation G promulgated by the SEC. “Income Tax Expense,” “Net

Earnings (Loss),” “Basic and Diluted Earnings (Loss) Per Share” and

the “Effective Tax Rate” are all measures for which the Company

provides the reported GAAP measures and adjusted non-GAAP measures.

References to “Adjusted Basic and Diluted Earnings Per Share”

refers to GAAP reported Basic and Diluted Earnings Per Share

adjusted for certain discrete or one-time items, including the

impact of the recently enacted Tax Cuts & Jobs Act.

Reconciliations of the non-GAAP financial measures with the

comparable GAAP financial measures are described in the table and

related disclosure below.

*SportsOneSource, January 9, 2018

About SKECHERS USA, Inc.

SKECHERS USA, Inc., based in Manhattan Beach, California,

designs, develops and markets a diverse range of lifestyle footwear

for men, women and children, as well as performance footwear for

men and women. SKECHERS footwear is available in the United States

and over 160 countries and territories worldwide via department and

specialty stores, 2,570 SKECHERS Company-owned and

third-party-owned retail stores, and the Company’s e-commerce

websites. The Company manages its international business through a

network of global distributors, joint venture partners in Asia and

the Middle East, and wholly-owned subsidiaries in Canada, Japan,

throughout Europe and Latin America. For more information, please

visit skechers.com and follow us on Facebook

(facebook.com/SKECHERS) and Twitter (twitter.com/SKECHERSUSA).

This announcement contains forward-looking statements that are

made pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements include, without limitation, Skechers’ future domestic

and international growth, financial results and operations

including expected net sales and earnings, its development of new

products, future demand for its products, its planned domestic and

international expansion, opening of new stores and additional

expenditures, and advertising and marketing initiatives.

Forward-looking statements can be identified by the use of

forward-looking language such as “believe,” “anticipate,” “expect,”

“estimate,” “intend,” “plan,” “project,” “will be,” “will

continue,” “will result,” “could,” “may,” “might,” or any

variations of such words with similar meanings. Any such statements

are subject to risks and uncertainties that could cause actual

results to differ materially from those projected in

forward-looking statements. Factors that might cause or contribute

to such differences include international economic, political and

market conditions including the challenging consumer retail markets

in the United States; sustaining, managing and forecasting costs

and proper inventory levels; losing any significant customers;

decreased demand by industry retailers and cancellation of order

commitments due to the lack of popularity of particular designs

and/or categories of products; maintaining brand image and intense

competition among sellers of footwear for consumers, especially in

the highly competitive performance footwear market; anticipating,

identifying, interpreting or forecasting changes in fashion trends,

consumer demand for the products and the various market factors

described above; sales levels during the spring, back-to-school and

holiday selling seasons; and other factors referenced or

incorporated by reference in the Company’s annual report on Form

10-K for the year ended December 31, 2016 and its quarterly report

on Form 10-Q for the nine months ended September 30, 2017. The

risks included here are not exhaustive. Skechers operates in a very

competitive and rapidly changing environment. New risks emerge from

time to time and the companies cannot predict all such risk

factors, nor can the companies assess the impact of all such risk

factors on their respective businesses or the extent to which any

factor, or combination of factors, may cause actual results to

differ materially from those contained in any forward-looking

statements. Given these risks and uncertainties, you should not

place undue reliance on forward-looking statements as a prediction

of actual results. Moreover, reported results should not be

considered an indication of future performance.

SKECHERS U.S.A., INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

(In thousands) December 31,

2017

December 31,

2016

ASSETS Current Assets: Cash and cash equivalents $ 736,431 $

718,536 Trade accounts receivable, net 405,921 326,844 Other

receivables 27,083 19,191 Total receivables

433,004 346,035 Inventories 873,016 700,515 Prepaid expenses and

other current assets 62,573 62,680 Total

current assets 2,105,024 1,827,766 Property, plant and equipment,

net 541,601 494,473 Deferred tax assets 29,922 26,043 Other assets

58,535 45,388 Total non-current assets

630,058 565,904 TOTAL ASSETS

$

2,735,082 $ 2,393,670

LIABILITIES AND EQUITY Current Liabilities: Current

installments of long-term borrowings $ 1,801 $ 1,783 Accounts

payable 505,334 520,437 Short-term borrowings 8,011 6,086 Accrued

expenses 82,202 93,424 Total current

liabilities 597,348 621,730 Long-term borrowings, net of current

installments 71,103 67,159 Deferred tax liabilities 161 412 Other

long-term liabilities 118,259 18,855 Total

non-current liabilities 189,523 86,426 Total

liabilities 786,871 708,156 Stockholders’ equity: Skechers U.S.A.,

Inc. equity 1,829,064 1,603,633 Noncontrolling interests

119,147 81,881 Total equity 1,948,211

1,685,514 TOTAL LIABILITIES AND EQUITY

$

2,735,082 $ 2,393,670

SKECHERS U.S.A., INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF EARNINGS

(Unaudited) (In thousands, except per share data)

Three Months Ended December 31, Twelve Months

Ended December 31,

2017

2016

2017

2016

Net sales $ 970,589 $ 764,290 $ 4,164,160 $ 3,563,311 Cost of sales

516,506 408,078

2,225,271 1,928,715 Gross profit

454,083 356,212 1,938,889 1,634,596 Royalty income 6,297

4,983 16,666

13,885 460,380

361,195 1,955,555

1,648,481 Operating expenses: Selling 63,883 59,502 327,201

257,129 General and administrative 340,843

273,431 1,245,474

1,020,834 404,726 332,933

1,572,675 1,277,963

Earnings from operations 55,654 28,262 382,880 370,518 Other income

(expense): Interest, net (937 ) (1,472 ) (4,257 ) (5,084 ) Other,

net 131 (4,640 ) 5,637

(5,950 ) (806 ) (6,112 )

1,380 (11,034 ) Earnings before

income tax expense 54,848 22,150 384,260 359,484 Income tax expense

106,609 6,981

149,156 74,125 Net (loss) earnings

(51,761 ) 15,169 235,104 285,359 Less: Net earnings attributable to

non-controlling interests 14,889 8,505

55,914 41,866 Net

(loss) earnings attributable to Skechers U.S.A., Inc. $ (66,650 )

$ 6,664 $ 179,190 $ 243,493

Net (loss) earnings per share attributable to

Skechers U.S.A., Inc.: Basic $ (0.43 ) $ 0.04

$ 1.15 $ 1.58 Diluted $ (0.43 ) $ 0.04

$ 1.14 $ 1.57 Weighted

average shares used in calculating (loss) earnings per share

attributable to Skechers U.S.A., Inc.: Basic 156,098

154,658 155,651

154,169 Diluted 156,098

155,405 156,523 155,084

SKECHERS U.S.A., INC. AND SUBSIDIARIES

SUPPLEMENTAL FINANCIAL INFORMATION NON-GAAP MEASURES

(unaudited) (In thousands, except per share data)

Three months ended December 31,

Adjusted

earnings, net (loss) earnings per share and effective tax

rate

2017 2016

ReportedGAAPMeasure

AdjustmentFor TCJA

Adjusted forNon GAAPMeasure (1)

ReportedGAAPMeasure Earnings before income tax expense $ 54,848 -

$

54,848

$ 22,150 Income tax expense 106,609 $ (99,937 )

6,672

6,981 Net (loss) earnings (51,761 ) 99,937

48,176

15,169 Less: Net earnings attributable to non-controlling interests

14,889 -

14,889

8,505

Net (loss) earnings attributable to

Skechers U.S.A., Inc

$ (66,650 ) $ 99,937

$

33,287

$ 6,664 Effective tax rate 194.4 % -

12.2

% 31.5 % Net (loss) earnings per share attributable to

Skechers U.S.A., Inc.: Basic $ (0.43 ) $ 0.64

$

0.21

$ 0.04 Diluted $ (0.43 ) $ 0.64

$

0.21

$ 0.04

Twelve months ended December

31,

Adjusted

earnings, net earnings per share and effective tax

rate

2017 2016

ReportedGAAPMeasure

AdjustmentFor TCJA

Adjusted forNon GAAPMeasure (1)

ReportedGAAPMeasure Earnings before income tax expense $ 384,260

-

$ 384,260 $ 359,484 Income tax expense 149,156

$

(99,937

) 49,219 74,125 Net earnings 235,104

99,937

335,041 285,359 Less: Net earnings attributable to non-controlling

interests 55,914

-

55,914 41,866 Net earnings

attributable to Skechers U.S.A., Inc $

179,190

$

99,937

$ 279,127 $ 243,493 Effective tax rate

38.8 %

-

12.8 % 20.6 % Net earnings per share attributable to

Skechers U.S.A., Inc.: Basic $ 1.15

$

0.64

$ 1.79 $ 1.58 Diluted $ 1.14

$

0.64

$ 1.78 $ 1.57

(1) During the fourth quarter of 2017, the Company recorded a

net tax expense of $99.9 million related to the enactment of the

Tax Cuts and Jobs Act. The expense is primarily related to the

TCJA’s transition tax on previously unremitted earnings of non-U.S.

subsidiaries and is net of remeasurement of Skechers’ deferred tax

assets and liabilities considering the TCJA’s newly enacted tax

rates. This provisional amount is subject to adjustment during the

measurement period of up to one year following the December 2017

enactment of the TCJA, as provided by recent SEC guidance. In

addition to reporting financial results in accordance with U.S.

GAAP, the Company also provides non-GAAP measures that adjust for

the net impact of enactment of the TCJA. This item represents a

significant charge that impacted the Company’s financial results.

Net earnings (loss), income tax expense, basic and diluted earnings

(loss) per share, and the effective tax rate are all measures for

which the Company provides the reported GAAP measure and an

adjusted measure. The adjusted measures are not in accordance with,

nor are they a substitute for, GAAP measures. The Company considers

these non-GAAP measures in evaluating and managing the Company’s

operations. The Company believes that discussion of results

adjusted for this item is meaningful to investors as it provides a

useful analysis of ongoing underlying operating trends. The

determination of this item may not be comparable to similarly

titled measures used by other companies.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180208006337/en/

Company Contact:SKECHERS USA, Inc.David WeinbergChief Operating

OfficerJohn VandemoreChief Financial Officer(310)

318-3100orPress:Jennifer ClayVice President,Corporate

Communications(310) 318-3100orInvestor Relations:Addo Investor

RelationsAndrew Greenebaum(310) 829-5400

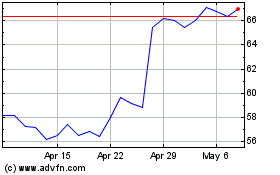

Skechers USA (NYSE:SKX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Skechers USA (NYSE:SKX)

Historical Stock Chart

From Apr 2023 to Apr 2024