Launched new e-commerce business model in

China

LifeVantage Corporation (Nasdaq:LFVN) today reported financial

results for its second quarter ended December 31, 2017.

Second Quarter Fiscal 2018 Summary:

- Revenue increased 1.1% to $49.5 million year over year and 0.7%

sequentially;

- Revenue in the Americas decreased 1.9% while revenue in

Asia/Pacific & Europe increased 11.0% including a 9.3% increase

in Japan, both on a year over year basis. On a sequential basis,

revenue in the Americas increased 2.0% while revenue in

Asia/Pacific & Europe decreased 3.0%, including a 4.4% decrease

in Japan;

- Active independent distributors and active preferred customers

decreased 1.6% and 2.7%, respectively, year over year and decreased

on a sequential basis 1.6% and 0.9%, respectively;

- Adjusted EBITDA decreased 5.0% year over year to $3.7 million

while increasing 37.6% sequentially;

- Earnings per diluted share were $0.02 and adjusted earnings per

diluted share were $0.11; and

- Completed first share repurchases under the Company's $5.0

million shares repurchase program.

”We continue to execute on our key initiatives for fiscal 2018

and generated both year over year and sequential revenue growth

during the second quarter,” stated LifeVantage President and Chief

Executive Officer Darren Jensen. “The recent launch of our highly

anticipated Vitality Stack Packets is a key aspect of our product

strategy initiatives. We are also pleased to have successfully

completed our commercial test of the new business model supporting

our entry into China and formally launched in this promising new

market on February 1, 2018. As we enter the second half of our

fiscal year, we are focused on accelerating revenue growth as our

transformational initiatives take hold across LifeVantage’s growing

global footprint.”

Second Quarter Fiscal 2018 Results

For the second fiscal quarter ended December 31, 2017, the

Company reported revenue of $49.5 million, an increase of 1.1% as

compared to $48.9 million in the second quarter of fiscal 2017.

Revenue in the Americas for the second quarter decreased 1.9%

compared to the second quarter of fiscal 2017, while revenue in the

Asia/Pacific & Europe region increased 11.0% compared to the

second quarter of fiscal 2017. Revenue in Japan increased 9.3%

compared to the second quarter of fiscal 2017. Revenue for the

second quarter of fiscal 2018 was negatively impacted $0.1 million,

or 0.3%, by foreign currency fluctuations associated with revenue

generated in several international markets when compared to the

second quarter of fiscal 2017.

Gross profit for the second quarter of fiscal 2018 was $40.4

million, or 81.6% of revenue, compared to $41.4 million, or 84.7%

of revenue, for the same period in fiscal 2017. Commissions and

incentives expense for the second quarter of fiscal 2018 was $23.4

million, or 47.3% of revenue, compared to $23.5 million, or 48.1%

of revenue, for the same period in fiscal 2017. Selling, general

and administrative expense (SG&A) for the second quarter of

fiscal 2018 was $14.6 million, or 29.6% of revenue, compared to

$17.2 million, or 35.2% of revenue, for the same period in fiscal

2017.

Operating income for the second quarter of fiscal 2018 was $2.3

million, compared to $0.7 million for the second quarter of fiscal

2017. Operating income during the second quarter of fiscal 2018

included approximately $0.2 million of expenses associated with

recruiting and transition fees and approximately $20,000 for

expenses associated with class-action lawsuits. Adjusted EBITDA was

$3.7 million for the second quarter of fiscal 2018, compared to

$3.9 million for the comparable period in fiscal 2017.

Net income for the second quarter of fiscal 2018 was $0.3

million, or $0.02 per diluted share. This compares to net income

for the second quarter of fiscal 2017 of $0.3 million, or $0.02 per

diluted share. Adjusted for recruiting and transition expenses of

$0.2 million and class-action lawsuit expense of $20,000, net of

$56,000 of tax impacts of these adjustments, and $1.2 million of

one-time, non-cash tax expense associated with the re-valuation of

deferred tax assets to the new federal corporate tax rate, adjusted

Non-GAAP net income was $1.6 million for the second quarter of

fiscal 2018, or $0.11 per diluted share; compared to $1.6 million,

or $0.11 per diluted share for the comparable period of fiscal

2017. Non-GAAP adjustments to net income during the second quarter

of fiscal 2017 included costs associated with the audit committee's

independent review of $1.7 million and executive recruiting and

transition expenses of $0.1 million, net of $0.6 million of tax

impacts for this adjustment.

Fiscal 2018 First Six Months Results

For the first six months of fiscal 2018, the Company reported

net revenue of $98.6 million, a decrease of 5.0% compared to $103.8

million for the first six months of fiscal 2017. In the first six

months of fiscal 2018, revenue in the Americas decreased 6.0% and

revenue in Asia/Pacific & Europe decreased 2.1%. Revenue for

the first six months of fiscal 2018 was negatively impacted $0.9

million, or 0.9%, by foreign currency fluctuations associated with

revenue generated in several international markets.

Gross profit for the first six months of fiscal 2018 was $80.8

million, or 81.9% of revenue, compared to $87.5 million, or 84.3%

of revenue, for the first six months of fiscal 2017. Commissions

and incentives expense for the first six months of fiscal 2018 was

$46.8 million, or 47.5% of revenue, compared to $49.8 million, or

48.0% of revenue, for the first six months of fiscal 2017. SG&A

for the first six months of fiscal 2018 was $30.2 million, or 30.7%

of revenue, compared to $35.0 million, or 33.7% of revenue, for the

first six months of fiscal 2017.

Operating income for the first six months of fiscal 2018 was

$3.7 million, compared to $2.7 million for the first six months of

fiscal 2017. Operating income for the first six months of fiscal

2018 includes $0.2 million for expenses associated with executive

recruiting fees, $0.2 million for expenses associated with

class-action lawsuit expenses and $0.1 million for expenses

associated with non-recurring legal and accounting expenses.

Operating income in the first six months of fiscal 2017 included

$2.7 million for expenses associated with the audit committee

review and $0.1 million for net executive severance, recruiting and

transition expenses. Adjusted EBITDA was $6.3 million for the first

six months of fiscal 2018, compared to $8.2 million for the same

period in fiscal 2017.

Net income for the first six months of fiscal 2018 was $1.1

million, or $0.08 per diluted share, compared to $1.5 million, or

$0.10 per diluted share for the first six months of fiscal 2017.

Adjusted for recruiting and transition expenses of $0.2 million,

class-action lawsuit expenses of $0.2 million, and non-recurring

legal and accounting expenses of $0.1 million, net of $0.1 million

of tax impacts of these adjustments, and $1.2 million of one-time,

non-cash tax expense associated with the re-valuation of deferred

tax assets to the new federal corporate tax rate, adjusted Non-GAAP

net income for the first six months of fiscal 2018 was $2.6

million, or $0.19 per diluted share. On a tax-adjusted basis,

adjusting for expenses associated with the audit committee review

of $1.9 million, along with $0.1 million of costs for net executive

severance, recruiting and transition expenses, adjusted Non-GAAP

net income for the first six months of fiscal year 2017 was $3.5

million or $0.24 per diluted share.

Balance Sheet & Liquidity

The Company generated $4.7 million of cash from operations

during the first six months of fiscal 2018 compared to $5.1 million

in fiscal 2017. The year-over-year decrease in cash provided by

operations during fiscal 2018 primarily relates to decreases in

certain working capital asset accounts, partially offset by a

decrease in net income. The Company's cash and cash equivalents at

December 31, 2017 were $12.8 million, an increase of $1.3

million when compared to $11.5 million at June 30, 2017. Total debt

at December 31, 2017 was $6.5 million compared to $7.4 million

at June 30, 2017.

Fiscal Year 2018 Guidance

The Company expects to be at the lower end of its prior revenue

guidance range, or about $206 million, in fiscal year 2018 and

reiterates its prior adjusted non-GAAP diluted earnings per share

guidance in the range of $0.40 to $0.50. The Company's adjusted

non-GAAP earnings per diluted share guidance excludes any

non-operating or non-recurring expenses that may materialize during

fiscal 2018. The Company is not providing GAAP earnings per diluted

share guidance for fiscal 2018 due to the potential occurrence of

one or more non-operating, one-time expenses, which the Company

does not believe it can reliably predict.

Conference Call Information

The Company will hold an investor conference call today at 2:30

p.m. MST (4:30 p.m. EST). Investors interested in participating in

the live call can dial (800) 239-9838 from the

U.S. International callers can dial (323) 794-2551. A

telephone replay will be available approximately two hours after

the call concludes and will be available through Wednesday,

February 14, 2018, by dialing (844) 512-2921 from the U.S. and

entering confirmation code 3965070, or (412) 317-6671 from

international locations, and entering confirmation code

3965070.

There will also be a simultaneous, live webcast available on the

Investor Relations section of the Company's web site at

http://investor.lifevantage.com/events.cfm. The webcast will be

archived for approximately 30 days.

About LifeVantage Corporation

LifeVantage Corporation is a science-based health, wellness and

anti-aging company dedicated to helping people transform themselves

internally and externally at a cellular level. Its

scientifically-validated product lines include Protandim® Nrf2 and

NRF1 Synergizers, TrueScience® Anti-Aging Skin Care Regimen,

Petandim® for Dogs, AXIO® Smart Energy and the PhysIQ™ Smart Weight

Management System. LifeVantage was founded in 2003 and is

headquartered in Salt Lake City, Utah. For more information, visit

www.lifevantage.com.

Forward Looking Statements

This document contains forward-looking statements made pursuant

to the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. Words and expressions reflecting optimism,

satisfaction or disappointment with current prospects, as well as

words such as "believe", "hopes", "intends", "estimates",

"expects", "projects", "plans", "anticipates", "look forward to",

"goal", “may be”, and variations thereof, identify forward-looking

statements, but their absence does not mean that a statement is not

forward-looking. Examples of forward-looking statements include,

but are not limited to, statements we make regarding the

effectiveness of our policies and procedures, future growth and

expected financial performance. Such forward-looking statements are

not guarantees of performance and the Company's actual results

could differ materially from those contained in such statements.

These forward-looking statements are based on the Company's current

expectations and beliefs concerning future events affecting the

Company and involve known and unknown risks and uncertainties that

may cause the Company's actual results or outcomes to be materially

different from those anticipated and discussed herein. These risks

and uncertainties include, among others, those discussed in greater

detail in the Company's Annual Report on Form 10-K and the

Company's Quarterly Report on Form 10-Q under the caption "Risk

Factors," and in other documents filed by the Company from time to

time with the Securities and Exchange Commission. The Company

cautions investors not to place undue reliance on the

forward-looking statements contained in this document. All

forward-looking statements are based on information currently

available to the Company on the date hereof, and the Company

undertakes no obligation to revise or update these forward-looking

statements to reflect events or circumstances after the date of

this document, except as required by law.

About Non-GAAP Financial Measures

We define Non-GAAP EBITDA as earnings before interest expense,

income taxes, depreciation and amortization and Non-GAAP Adjusted

EBITDA as earnings before interest expense, income taxes,

depreciation and amortization, stock compensation expense, other

income, net, and certain other adjustments. Non-GAAP EBITDA and

Non-GAAP Adjusted EBITDA may not be comparable to similarly titled

measures reported by other companies. We define Non-GAAP Net

Income as GAAP net income less certain tax adjusted non-recurring

one-time expenses incurred during the period and Non-GAAP Earnings

per Share as Non-GAAP Net Income divided by weighted-average shares

outstanding.

We are presenting Non-GAAP EBITDA, Non-GAAP Adjusted EBITDA,

Non-GAAP Net Income and Non-GAAP Earnings Per Share because

management believes that they provide additional ways to view our

operations when considered with both our GAAP results and the

reconciliation to net income, which we believe provides a more

complete understanding of our business than could be obtained

absent this disclosure. Non-GAAP EBITDA, Non-GAAP Adjusted EBITDA,

Non-GAAP Net Income and Non-GAAP Earnings Per Share are presented

solely as supplemental disclosure because: (i) we believe these

measures are a useful tool for investors to assess the operating

performance of the business without the effect of these items; (ii)

we believe that investors will find this data useful in assessing

shareholder value; and (iii) we use Non-GAAP EBITDA, Non-GAAP

Adjusted EBITDA, Non-GAAP Net Income and Non-GAAP Earnings Per

Share internally as benchmarks to evaluate our operating

performance or compare our performance to that of our competitors.

The use of Non-GAAP EBITDA, Non-GAAP Adjusted EBITDA, Non-GAAP Net

Income and Non-GAAP Earnings per Share has limitations and you

should not consider these measures in isolation from or as an

alternative to the relevant GAAP measure of net income prepared in

accordance with GAAP, or as a measure of profitability or

liquidity.

The tables set forth below present Non-GAAP EBITDA, Non-GAAP

Adjusted EBITDA, Non-GAAP Net Income and Non-GAAP Earnings per

Share which are non-GAAP financial measures to Net Income and

Earnings per Share, our most directly comparable financial measures

presented in accordance with GAAP.

Investor Relations Contacts:

Scott Van WinkleManaging Director, ICR(617)

956-6736scott.vanwinkle@icrinc.com

| |

| LIFEVANTAGE CORPORATION AND

SUBSIDIARIES |

| CONSOLIDATED BALANCE SHEETS |

| (unaudited) |

| (In thousands, except

per share data) |

December 31, 2017 |

|

June 30, 2017 |

| ASSETS |

|

|

|

| Current assets |

|

|

|

| Cash and

cash equivalents |

$ |

12,794 |

|

|

$ |

11,458 |

|

| Accounts

receivable |

1,542 |

|

|

1,334 |

|

| Income

tax receivable |

86 |

|

|

913 |

|

|

Inventory, net |

16,819 |

|

|

16,575 |

|

| Prepaid

expenses and deposits |

4,052 |

|

|

5,266 |

|

| Total

current assets |

35,293 |

|

|

35,546 |

|

| |

|

|

|

| Property

and equipment, net |

4,644 |

|

|

3,127 |

|

|

Intangible assets, net |

1,181 |

|

|

1,247 |

|

| Long-term

deferred income tax asset |

3,396 |

|

|

4,087 |

|

| Other

long-term assets |

1,142 |

|

|

1,242 |

|

| TOTAL ASSETS |

$ |

45,656 |

|

|

$ |

45,249 |

|

| |

|

|

|

| LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

|

|

| Current

liabilities |

|

|

|

| Accounts

payable |

$ |

3,269 |

|

|

$ |

4,850 |

|

|

Commissions payable |

6,692 |

|

|

6,837 |

|

| Income

tax payable |

407 |

|

|

215 |

|

| Other

accrued expenses |

10,360 |

|

|

9,453 |

|

| Current

portion of long-term debt |

2,000 |

|

|

2,000 |

|

| Total

current liabilities |

22,728 |

|

|

23,355 |

|

| |

|

|

|

| Long-term debt |

|

|

|

| Principal

amount |

4,500 |

|

|

5,500 |

|

|

Less: unamortized discount and deferred offering costs |

(43 |

) |

|

(60 |

) |

| Long-term

debt, net of unamortized discount and deferred offering costs |

4,457 |

|

|

5,440 |

|

| Other long-term

liabilities |

1,966 |

|

|

1,927 |

|

| Total

liabilities |

29,151 |

|

|

30,722 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders'

equity |

|

|

|

| Preferred

stock — par value $0.001 per share, 50,000 shares authorized, no

shares issued or outstanding |

— |

|

|

— |

|

| Common

stock — par value $0.001 per share, 250,000 shares authorized and

14,211 and 14,232 issued and outstanding as of December 31, 2017

and June 30, 2017, respectively |

|

14 |

|

|

|

14 |

|

|

Additional paid-in capital |

122,627 |

|

|

121,599 |

|

|

Accumulated deficit |

(106,108 |

) |

|

(106,992 |

) |

|

Accumulated other comprehensive loss |

(28 |

) |

|

(94 |

) |

| Total

stockholders’ equity |

16,505 |

|

|

14,527 |

|

| TOTAL LIABILITIES AND

STOCKHOLDERS’ EQUITY |

$ |

45,656 |

|

|

$ |

45,249 |

|

| |

|

|

|

|

|

|

|

| |

| LIFEVANTAGE CORPORATION AND

SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF

OPERATIONS |

| (unaudited) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended December 31, |

|

Six Months Ended December 31, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| (In thousands, except

per share data) |

|

|

|

|

|

|

|

| Revenue, net |

$ |

49,482 |

|

|

$ |

48,947 |

|

|

$ |

98,609 |

|

|

$ |

103,841 |

|

| Cost of sales |

9,117 |

|

|

7,500 |

|

|

17,856 |

|

|

16,332 |

|

| Gross

profit |

40,365 |

|

|

41,447 |

|

|

80,753 |

|

|

87,509 |

|

| |

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

Commissions and incentives |

23,395 |

|

|

23,540 |

|

|

46,804 |

|

|

49,836 |

|

| Selling,

general and administrative |

14,643 |

|

|

17,207 |

|

|

30,224 |

|

|

34,987 |

|

| Total

operating expenses |

38,038 |

|

|

40,747 |

|

|

77,028 |

|

|

84,823 |

|

| Operating income |

2,327 |

|

|

700 |

|

|

3,725 |

|

|

2,686 |

|

| |

|

|

|

|

|

|

|

| Other expense: |

|

|

|

|

|

|

|

| Interest

expense |

(103 |

) |

|

(138 |

) |

|

(265 |

) |

|

(275 |

) |

| Other

expense, net |

(169 |

) |

|

(150 |

) |

|

(147 |

) |

|

(321 |

) |

| Total other

expense |

(272 |

) |

|

(288 |

) |

|

(412 |

) |

|

(596 |

) |

| Income before income

taxes |

2,055 |

|

|

412 |

|

|

3,313 |

|

|

2,090 |

|

| Income tax expense |

(1,738 |

) |

|

(129 |

) |

|

(2,179 |

) |

|

(627 |

) |

| Net income |

$ |

317 |

|

|

$ |

283 |

|

|

$ |

1,134 |

|

|

$ |

1,463 |

|

| Net income per

share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.02 |

|

|

$ |

0.02 |

|

|

$ |

0.08 |

|

|

$ |

0.11 |

|

|

Diluted |

$ |

0.02 |

|

|

$ |

0.02 |

|

|

$ |

0.08 |

|

|

$ |

0.10 |

|

| Weighted-average shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

13,956 |

|

|

13,840 |

|

|

13,959 |

|

|

13,830 |

|

|

Diluted |

14,153 |

|

|

14,132 |

|

|

14,117 |

|

|

14,176 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| LIFEVANTAGE CORPORATION AND

SUBSIDIARIES |

|

|

| |

Revenue by Region |

|

|

|

|

|

|

|

|

| |

(unaudited) |

|

|

|

|

|

|

|

|

| |

|

|

|

| |

Three Months Ended December 31, |

|

Six Months Ended December 31, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| (In thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Americas |

$ |

36,903 |

|

|

75 |

% |

|

$ |

37,613 |

|

|

77 |

% |

|

$ |

73,066 |

|

|

74 |

% |

|

$ |

77,748 |

|

|

75 |

% |

| Asia/Pacific &

Europe |

12,579 |

|

|

25 |

% |

|

11,334 |

|

|

23 |

% |

|

25,543 |

|

|

26 |

% |

|

26,093 |

|

|

25 |

% |

| Total |

$ |

49,482 |

|

|

100 |

% |

|

$ |

48,947 |

|

|

100 |

% |

|

$ |

98,609 |

|

|

100 |

% |

|

$ |

103,841 |

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Active Independent Distributors

(1) |

|

|

|

|

|

|

|

|

| |

(unaudited) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

As of December 31, |

|

|

|

|

|

|

|

|

| |

2017 |

|

2016 |

|

|

|

|

|

|

|

|

| Americas |

44,000 |

|

|

71 |

% |

|

46,000 |

|

|

73 |

% |

|

|

|

|

|

|

|

|

| Asia/Pacific &

Europe |

18,000 |

|

|

29 |

% |

|

17,000 |

|

|

27 |

% |

|

|

|

|

|

|

|

|

| Total |

62,000 |

|

|

100 |

% |

|

63,000 |

|

|

100 |

% |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Active Preferred Customers (2) |

|

|

|

|

|

|

|

|

| |

(unaudited) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

As of December 31, |

|

|

|

|

|

|

|

|

| |

2017 |

|

2016 |

|

|

|

|

|

|

|

|

| Americas |

86,000 |

|

|

80 |

% |

|

89,000 |

|

|

80 |

% |

|

|

|

|

|

|

|

|

| Asia/Pacific &

Europe |

22,000 |

|

|

20 |

% |

|

22,000 |

|

|

20 |

% |

|

|

|

|

|

|

|

|

| Total |

108,000 |

|

|

100 |

% |

|

111,000 |

|

|

100 |

% |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1)

Active Independent Distributors have purchased product in the prior

three months for retail or personal consumption. |

| (2)

Active Preferred Customers have purchased product in the prior

three months for personal consumption only. |

|

|

| |

| LIFEVANTAGE CORPORATION AND

SUBSIDIARIES |

| Reconciliation of GAAP Net Income to Non-GAAP

EBITDA and Non-GAAP Adjusted EBITDA |

| (Unaudited) |

| |

|

|

|

| |

Three Months Ended December 31, |

|

Six Months Ended December 31, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| (In thousands) |

|

|

|

|

|

|

|

| GAAP Net income |

$ |

317 |

|

|

$ |

283 |

|

|

$ |

1,134 |

|

|

$ |

1,463 |

|

| Interest Expense |

103 |

|

|

138 |

|

|

265 |

|

|

275 |

|

| Provision for income

taxes |

1,738 |

|

|

129 |

|

|

2,179 |

|

|

627 |

|

| Depreciation and

amortization |

322 |

|

|

414 |

|

|

672 |

|

|

826 |

|

| Non-GAAP EBITDA: |

2,480 |

|

|

964 |

|

|

4,250 |

|

|

3,191 |

|

| Adjustments: |

|

|

|

|

|

|

|

| Stock compensation

expense |

830 |

|

|

576 |

|

|

1,453 |

|

|

1,515 |

|

| Other (income) expense,

net |

169 |

|

|

150 |

|

|

147 |

|

|

321 |

|

| Other

adjustments(1) |

183 |

|

|

2,165 |

|

|

474 |

|

|

3,176 |

|

| Total adjustments |

1,182 |

|

|

2,891 |

|

|

2,074 |

|

|

5,012 |

|

| Non-GAAP Adjusted

EBITDA |

$ |

3,662 |

|

|

$ |

3,855 |

|

|

$ |

6,324 |

|

|

$ |

8,203 |

|

| |

|

|

|

|

|

|

|

| (1) Other

adjustments for the three months ended December 31, 2017 include

approximately $0.2 million for expenses associated with executive

transition fees and $20,000 for expenses associated with

class-action lawsuits. Other adjustments for the three months ended

December 31, 2016 include approximately $1.7 million for costs

associated with the audit committee review and $0.5 million for

executive severance and recruiting fees. Other adjustments for the

six months ended December 31, 2017 include approximately $0.2

million for expenses associated with executive recruiting fees,

$0.2 million for expenses associated with class-action lawsuits and

$0.1 million for expenses associated with non-recurring legal and

accounting expenses. Other adjustments for the six months ended

December 31, 2016 include approximately $2.7 million for costs

associated with the audit committee review and $0.5 million for

executive severance and recruiting fees. |

|

|

| |

| LIFEVANTAGE CORPORATION AND

SUBSIDIARIES |

| Reconciliation of GAAP Net Income to Non-GAAP

Net Income and Non-GAAP Adjusted EPS |

| (Unaudited) |

| |

|

|

|

| |

Three Months Ended December 31, |

|

Six Months Ended December 31, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| (In thousands) |

|

|

|

|

|

|

|

| GAAP Net income |

$ |

317 |

|

|

$ |

283 |

|

|

$ |

1,134 |

|

|

$ |

1,463 |

|

| Adjustments: |

|

|

|

|

|

|

|

| Executive

team severance expenses, net |

— |

|

|

79 |

|

|

— |

|

|

79 |

|

| Executive

team recruiting and transition expenses |

163 |

|

|

65 |

|

|

207 |

|

|

65 |

|

| Audit

committee independent review expenses |

— |

|

|

1,730 |

|

|

— |

|

|

2,742 |

|

|

Class-action lawsuit expenses |

20 |

|

|

— |

|

|

216 |

|

|

— |

|

| Other

nonrecurring legal and accounting expenses |

— |

|

|

— |

|

|

51 |

|

|

— |

|

| Tax

impact of adjustments (1) |

(56 |

) |

|

(563 |

) |

|

(145 |

) |

|

(867 |

) |

| Tax

expense impact of revaluation of deferred tax assets (2) |

1,166 |

|

|

— |

|

|

1,166 |

|

|

— |

|

| Total adjustments, net

of tax |

1,293 |

|

|

1,311 |

|

|

1,495 |

|

|

2,019 |

|

| Non-GAAP Net

Income: |

$ |

1,610 |

|

|

$ |

1,594 |

|

|

$ |

2,629 |

|

|

$ |

3,482 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Three Months Ended December 31, |

|

Six Months Ended December 31, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| |

|

|

|

|

|

|

|

| Diluted earnings per

share, as reported |

$ |

0.02 |

|

|

$ |

0.02 |

|

|

$ |

0.08 |

|

|

$ |

0.10 |

|

| Total

adjustments, net of tax |

0.09 |

|

|

0.09 |

|

|

0.11 |

|

|

0.14 |

|

| Diluted earnings per

share, as adjusted |

$ |

0.11 |

|

|

$ |

0.11 |

|

|

$ |

0.19 |

|

|

$ |

0.24 |

|

|

|

|

|

|

|

|

|

|

| (1) Tax impact of adjustments excludes the effect of the

one-time deferred tax asset adjustment. |

| (2) Tax impact of the remeasurement of our deferred tax

assets, pursuant to the 2017 tax reform legislation. Deferred

tax assets were reduced as the reversal of the underlying

transactions will be deductible at the lower corporate tax rates

included in the 2017 legislation. |

| |

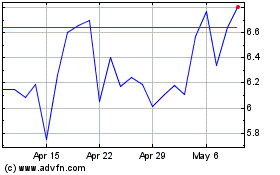

Lifevantage (NASDAQ:LFVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

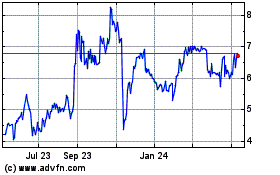

Lifevantage (NASDAQ:LFVN)

Historical Stock Chart

From Apr 2023 to Apr 2024