BP Takes Tax Hit But Shows Strength -- WSJ

February 07 2018 - 3:02AM

Dow Jones News

By Sarah Kent

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 7, 2018).

LONDON -- BP PLC took a big fourth-quarter hit from costs tied

to the U.S. tax overhaul and the Gulf of Mexico oil spill, but

otherwise performed well as it works to re-establish itself among

Big Oil's elite.

BP's underlying profit, which excludes one-time costs, soared to

$2.1 billion in the quarter, compared with $400 million a year

earlier. The British oil-and-gas company was buoyed by a recovering

crude market during a quarter when oil prices averaged more than

$61 a barrel -- up 24% from 2016's final period.

On paper, though, BP's earnings were effectively wiped out by a

nearly $1 billion loss related to U.S. corporate-tax changes and a

$1.7 billion charge from unexpectedly high settlements from the

Deepwater Horizon accident in 2010. For the quarter, the company

recorded a $583 million replacement-cost loss -- a measure

analogous to the net income that U.S. oil companies report.

BP said on Tuesday that the U.S. tax overhaul enacted late in

2017 will be positive in the long term. The company says its Gulf

of Mexico costs are manageable and are largely wrapping up.

Despite the quarterly net loss, BP executives hailed the

company's financial standing. For all of 2017, BP had a

replacement-cost profit of $2.8 billion, compared with a loss of $1

billion in 2016. It was BP's first annual profit since 2014. The

company reported stronger production and healthy earnings from its

refining-and-marketing division.

The company's return to profit last year reflects early success

in delivering on its growth plan. Excluding BP's nearly 20% share

in Russian state-oil company PAO Rosneft, annual production rose

12%, and in a sign of growing financial resilience, the company

began a share buyback program in the fourth quarter.

Chief Executive Bob Dudley described 2017 as "one of the

strongest years in BP's recent history," adding that the company is

increasingly confident it can continue to grow.

BP finance chief Brian Gilvary said the company should be able

to cover its spending and dividend with cash from operations at $50

a barrel this year. The company is targeting a break-even price of

$35 to $40 a barrel by 2021.

"This time last year we were talking about $60 a barrel, so we

have a pretty good trajectory," Mr. Gilvary said.

The company's net debt rose 6% from a year earlier to $37.8

billion, although it was on a downward trajectory in the fourth

quarter compared with the previous three months.

BP's earnings are the latest in a choppy reporting season for

big oil companies. Shell's net profit tripled last year, but a drop

in cash flow in the fourth quarter raised concerns among investors.

U.S. rivals Exxon Mobil Corp. and Chevron Corp. both missed

earnings expectations and their shares suffered substantial

selloffs as a result.

BP used its earnings announcement to advance a campaign to

convince shareholders it can regain its position among the elite

tier of big energy companies. The company has lagged behind its

peers since the fatal Deepwater Horizon explosion and oil spill in

the Gulf of Mexico eight years ago. The disaster forced the company

to sell off billions of dollars in assets to help finance cleanup

and legal costs that have ballooned to more than $60 billion.

BP outlined a path last February to boost profit and return to

its former size by the early 2020s, but analysts raised concerns

about the company's longer-term growth outlook. BP on Tuesday

outlined efforts to boost production and returns out to 2025 and

said it would add 900,000 barrels a day of new oil and gas

production by 2021 compared with 2015. The company had previously

said it would pump an additional 800,000 barrels a day by 2020.

"We see growth without the need for acquisitions," said Bernard

Looney, the company's chief of exploration and production.

Write to Sarah Kent at sarah.kent@wsj.com

(END) Dow Jones Newswires

February 07, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

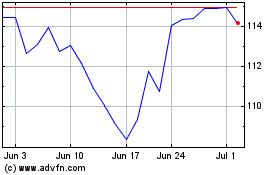

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

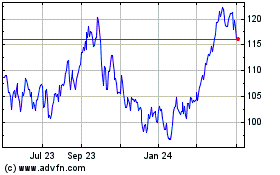

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024