CitiDirect BE® Ranked #1 Globally in Greenwich Associates Digital Banking Benchmarking Study

February 05 2018 - 9:00AM

Business Wire

Citi Awarded Top Ranking for Twelfth

Consecutive Year

CitiDirect BE®, Citi's institutional online banking platform has

been ranked # 1 in the 2017 Greenwich Associates Digital Banking

Benchmarking study for the twelfth consecutive year. The study

assesses "Best of Breed" features and functionality among online,

mobile and direct integration channels that differentiate treasury

and cash management providers globally.

This year, Citi was the only bank to be recognized with the

global #1 ranking with CitiDirect BE placing first in North

America, Asia and Europe among a peer group of global and regional

competitors. CitiDirect BE received the highest rating in the study

across 32 categories, including:

- Usability/Ease of Use

- Portal Features

- CitiConnect solutions including

APIs/ERP/SWIFT connectivity

- Online Help/Support

- Off-line Customer Service/Support

- Client Onboarding

- User

Administration/Entitlements/Authentication

- Availability/Functionality by

Country

- Cross-Product Integration – Cash

Management Product / Services

- Integrated Payments/Workflow

- Fraud Prevention/Monitoring

- User Customization

“On behalf of the team, I am honored that Greenwich Associates

has recognized Citi as #1 in their Digital Banking Benchmarking

Study. At Citi we are focused on innovation across the entire suite

of Treasury and Trade Solutions to simplify the entire client

journey across our network,” said Tapodyuti Bose, Global Head of

Channel and Enterprise Services, Citi’s Treasury and Trade

Solutions. “We continue to explore new technologies and approaches

based on client feedback and market trends to enhance the digital

banking experience for our clients.”

Conducted by Greenwich Associates, an independent research and

consulting firm, the annual study evaluates online and mobile

banking applications and scores them based on over 40 evaluation

factors and over 1,600 sub criteria. The study serves as a

barometer of market trends and development priorities that can

provide a forward-view of next-generation capabilities. Leading

banks and non-bank providers are evaluated in the study annually

with the bank group consisting of elite global and regional peers

in the transaction banking industry.

Chris McDonnell, Managing Director at Greenwich Associates and

global manager for the Digital Banking Benchmarking study added,

“Digital experiences are increasingly driving decisions as

companies select banking partners. As Corporate Treasury

professionals’ expectations continue to be impacted by digital

consumer experiences, Omnichannel banking capabilities and seamless

integration will become increasingly essential. Citi’s digital

experiences across online, mobile and tablet, along with various

integration capabilities, offer corporates the ability to achieve

cash management goals and optimize productivity the way they see

best.”

The Greenwich Associates study evaluated Citi's institutional

online banking solution set, including CitiDirect BE, CitiDirect

BE® Mobile, CitiDirect BE® Tablet, CitiConnect®, FX Pulse and

Liquidity Manager along with supporting services. Together, these

channels process approximately $4 trillion of payments daily,

helping organizations conduct business in 140 currencies and 160

countries.

With many focused enhancements around simplification and

clients' ease of doing business, CitiDirect BE received the highest

rating for Portal Features, User Customization, User

Administration/Entitlements, User Authentication, Fraud

Prevention/Monitoring, Communications within the Platform, and Site

Measurement. Additionally, CitiConnect®, which is fully integrated

with CitiDirect BE, was again recognized for its depth of

functionality and extensive set of product features, all focused on

enabling deep integration with Citi's clients' systems and

services. CitiConnect® is Citi's industry leading connectivity

platform. The CitiConnect® API allows Citi's treasury services

clients to directly connect with Citi to access services using

their own Treasury Workstations or Enterprise Resource Platform

(ERP) providing convenience, potential cost savings, and reduced

risk. Citi supports API based integration across 96 countries,

representing one of the largest API-supported geographies.

Citi Treasury and Trade Solutions (TTS) enables our clients'

success by providing an integrated suite of innovative and tailored

cash management and trade finance services to multinational

corporations, financial institutions and public sector

organizations across the globe. Based on the foundation of the

industry's largest proprietary network with banking licenses in

over 90 countries and globally integrated technology platforms, TTS

continues to lead the way in offering the industry's most

comprehensive range of digitally enabled treasury, trade and

liquidity management solutions.

About CitiCiti, the leading global bank, has

approximately 200 million customer accounts and does business in

more than 160 countries and jurisdictions. Citi provides consumers,

corporations, governments and institutions with a broad range of

financial products and services, including consumer banking and

credit, corporate and investment banking, securities brokerage,

transaction services, and wealth management. Additional information

may be found at www.citigroup.com | Twitter: @Citi | YouTube:

www.youtube.com/citi | Blog: http://blog.citigroup.com | Facebook:

www.facebook.com/citi | LinkedIn: www.linkedin.com/company/citi

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180205005272/en/

Media:Citi:Nina Das, 1-212-816-9267nina.das@citi.com

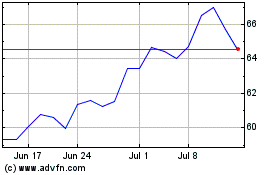

Citigroup (NYSE:C)

Historical Stock Chart

From Mar 2024 to Apr 2024

Citigroup (NYSE:C)

Historical Stock Chart

From Apr 2023 to Apr 2024