UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

S-1

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

MicroVision, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

Delaware

|

|

3679

|

|

91-1600822

|

|

(State or Other Jurisdiction of

Incorporation or Organization

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification Number)

|

6244 185

th

Avenue NE, Suite 100

Redmond, WA 98052

(425)

936-6847

(Address, including zip code, and telephone number, including area code of principal

executive offices)

David J. Westgor

Vice

President, General Counsel & Secretary

MicroVision, Inc.

6244 185

th

Avenue NE

Redmond, Washington 98052

(425)

936-6847

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Please send copies of all communications to:

Joel F. Freedman

Ropes & Gray LLP

Prudential Tower

800

Boylston Street

Boston, Massachusetts 02199

(617)

951-7000

Approximate

date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an

offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a

non-accelerated

filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and

“emerging growth company” in Rule

12b-2

of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

☐

|

|

Accelerated filer

|

|

☒

|

|

|

|

|

|

|

Non-accelerated filer

|

|

☐ (Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

☐

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company

|

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

Title of each class of securities to be registered

|

|

Proposed

Maximum

Aggregate

Offering Price

(1)(2)

|

|

Amount of

Registration Fee

|

|

Common Stock

|

|

$15,000,000.00

|

|

$1,867.50

|

|

|

|

|

|

(1)

|

Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act.

|

|

(2)

|

Includes the price of additional shares of common stock and warrants to purchase shares of common stock that the underwriters have the option to purchase to cover over-allotments, if any.

|

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall

become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell

these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction

where the offer or sale is prohibited.

SUBJECT TO COMPLETION, DATED FEBRUARY 5, 2018

PROSPECTUS

MicroVision, Inc.

Shares of Common Stock

We are offering

shares of our common stock. We have granted the underwriters a

30-day

option to purchase up to

additional shares of our common stock to cover over-allotments, if any.

Our shares are traded on The NASDAQ Global Market under the symbol “MVIS.” On February 1, 2018, the last sale price of our

common stock as reported on The NASDAQ Global Market was $1.27 per share.

Investing in

our securities involves a high degree of risk. Please see the sections entitled “

Risk Factors

” on page 4 of this prospectus, as well as in our periodic reports filed with the Securities and Exchange Commission and

incorporated by reference herein, for a discussion of important risks that you should consider before making an investment decision.

|

|

|

|

|

|

|

|

|

|

|

|

|

Per

Share

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

|

|

|

$

|

|

|

|

Underwriting discount

(1)

|

|

$

|

|

|

|

$

|

|

|

|

Proceeds, before expenses, to us

|

|

$

|

|

|

|

$

|

|

|

|

(1)

|

See “Underwriting” on page 8 of this prospectus for a description of the compensation payable to the underwriters.

|

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of

this prospectus is , 2018.

TABLE OF CONTENTS

You should rely only on the information contained in or incorporated by reference into this prospectus (as

supplemented and amended). We have not, and the underwriters have not, authorized anyone to provide you with different information. This document may only be used where it is legal to sell these securities. You should not assume that the information

contained in this prospectus is accurate as of any date other than its date regardless of the time of delivery of the prospectus or any sale of our common stock.

We urge you to read carefully this prospectus (as supplemented and amended), together with the information incorporated herein by reference

as described under the heading “Information Incorporated by Reference,” before deciding whether to invest in any of the common stock being offered.

All references in this prospectus to “MicroVision,” “the Company,” “we,” “us” or “our” mean

MicroVision, Inc., unless we state otherwise or the context otherwise requires.

PROSPECTUS SUMMARY

The following summary is qualified in its entirety by, and should be read together with, the more detailed information and our consolidated financial

statements and related notes thereto appearing elsewhere or incorporated by reference in this prospectus. Before you decide to invest in our securities, you should read the entire prospectus carefully, including the risk factors and the financial

statements and related notes included or incorporated by reference in this prospectus.

Our Company

Overview

MicroVision, Inc. is a pioneer

in laser beam scanning (LBS) technology that we market under our brand name PicoP

®

. We have developed our proprietary PicoP

®

scanning

technology that can be adopted by our customers to create high-resolution miniature projection and three-dimensional sensing and image capture solutions. PicoP

®

scanning technology is based on

our patented expertise in micro-electrical mechanical systems (MEMS), laser diodes, opto-mechanics, and electronics and how those elements are packaged into a small, low power scanning engine that can display, interact and sense, depending on the

needs of the application. For display, the engine can project a high-quality image on any surface (pico projection), a windshield

(head-up

display or HUD), or a retina (augmented reality or AR). For sensing,

we use infrared (IR) lasers to capture three-dimensional data in the form of a point cloud. Interactivity uses the 3D sensing function and the display function to project an image with which the user can interact as one would use a touch screen.

In November 2016, we announced a growth strategy for 2017 and beyond that includes selling LBS engines to original design manufacturers

(ODMs) and original equipment manufacturers (OEMs) in addition to our strategy of licensing LBS technology to licensees to offer their own solutions. We plan to offer three scanning engines to support a wide array of applications: a small form

factor display engine for consumer products, an interactive display engine for smart Internet of Things (IoT) products, and a

mid-range

light detection and ranging (LiDAR) engine for autonomous machines,

industrial products and robotics.

Corporate Information

We were founded in 1993 as a Washington corporation and reincorporated in 2003 under the laws of the State of Delaware. Our principal office is

located at 6244 185th Ave NE, Suite 100, Redmond, WA 98052 and our telephone number is

425-936-6847.

We maintain a website at www.microvision.com, where general

information about us is available. We do not incorporate the information on our website into this prospectus and you should not consider it part of this prospectus.

The Offering

The

following summary contains basic information about this offering. The summary is not intended to be complete. You should read the full text and more specific details contained elsewhere in this prospectus.

|

|

|

|

|

Common stock offered by us

|

|

shares ( shares if the

underwriters’ over-allotment option is exercised in full).

|

|

|

|

|

Common stock to be outstanding immediately after this offering

(1)

|

|

shares ( shares if the

underwriters’ over-allotment option is exercised in full).

|

|

|

|

|

Option to purchase additional shares

|

|

We have granted a

30-day

option to the underwriters to purchase up to a total of additional

shares of our common stock from us at the public offering price, less the underwriting discount payable by us, to cover over-allotments, if any.

|

1

|

|

|

|

|

NASDAQ Global Market symbol

|

|

MVIS

|

|

|

|

|

Use of proceeds

|

|

We estimate that the net proceeds from this offering will be approximately

$ million, or approximately $ million if the underwriters exercise their over-allotment option in full, in

each case, after deducting the underwriting discount and estimated offering expenses payable by us.

We intend to use the net proceeds from the sale of common stock offered by this prospectus for general corporate purposes, which may include, but are not

limited to, working capital and capital expenditures. See “Use of Proceeds.”

|

|

|

|

|

Risk factors

|

|

Investing in our common stock involves a high degree of risk. See “Risk Factors.”

|

|

(1)

|

The number of shares of common stock to be outstanding after this offering is based on 78,596,564 shares outstanding as of December 31, 2017 and excludes, as of that date, the following:

|

|

|

•

|

|

5,034,461 shares of our common stock issuable upon exercise of outstanding options, of which approximately 2,555,423 were exercisable at a weighted average exercise price of $3.90 per share, under our 2013 Incentive

Plan, as amended, or the Incentive Plan, and our Independent Director Stock Option Plan;

|

|

|

•

|

|

185,000 shares of our common stock underlying unvested stock awards;

|

|

|

•

|

|

1,973,000 shares of our common stock issuable upon exercise of outstanding warrants, all of which were exercisable at a weighted average exercise price of $2.47 per share; and

|

|

|

•

|

|

2,184,585 shares of our common stock reserved for issuance pursuant to the Incentive Plan.

|

Unless otherwise indicated, this prospectus assumes no exercise by the underwriters of their over-allotment option.

2

NOTE REGARDING FORWARD-LOOKING INFORMATION

This prospectus and the documents incorporated by reference herein contain forward-looking statements, within the meaning of Section 27A

of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and is subject to the safe harbor created by that section. Such statements may include,

but are not limited to, projections of revenues, income or loss, capital expenditures, plans for product development and cooperative arrangements, future operations, financing needs or plans, as well as assumptions relating to the foregoing. The

words “anticipate,” “believe,” “estimate,” “expect,” “goal,” “may,” “plan,” “project,” “will” and similar expressions identify forward-looking statements,

which speak only as of the date the statement was made.

These forward-looking statements are not guarantees of future performance.

Factors that could cause actual results to differ materially from those projected in our forward-looking statements include the following: our ability to raise additional capital when needed; market acceptance of our technologies and products, and

for products incorporating our technologies; the failure of our commercial partners to perform as expected under our agreements; our ability to identify parties interested in paying any amounts or amounts we deem desirable for the purchase or

license of intellectual property assets; our or our customers’ failure to perform under open purchase orders; our financial and technical resources relative to those of our competitors; our ability to keep up with rapid technological change;

government regulation of our technologies; our ability to enforce our intellectual property rights and protect our proprietary technologies; the ability to obtain additional contract awards and to develop partnership opportunities; the timing of

commercial product launches and delays in product development; the ability to achieve key technical milestones in key products; dependence on third parties to develop, manufacture, sell and market our products; potential product liability claims;

and other factors set forth in the section entitled “Risk Factors” below, and in the documents incorporated by reference into this prospectus. These factors are not intended to represent a complete list of the general or specific factors

that may affect us. It should be recognized that other factors, including general economic factors and business strategies, may be significant, now or in the future, and the factors set forth in this prospectus may affect us to a greater extent than

indicated. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements set forth in or incorporated into this prospectus. Except as required by law, we

undertake no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise.

3

RISK FACTORS

An investment in our securities involves a high degree of risk. You should carefully consider all of the information in this prospectus,

including the risks and uncertainties described below, and all other information included or incorporated by reference in this prospectus, before you decide whether to purchase our securities. The risks and uncertainties we describe are not the only

ones facing us. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. If any of these risks were to occur, our business, financial condition or results of operations would likely

suffer. In that event, the trading price of our common stock could decline and you could lose all or part of your investment.

Risks Related to Our

Common Stock and this Offering

We have broad discretion in the use of the net proceeds from this offering and may not use them effectively.

Our management will have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in

ways that do not necessarily improve our results of operations or enhance the value of our common stock. Our failure to apply these funds effectively could have a material adverse effect on our business, financial condition, operating results and

cash flow, and could cause the price of our common stock to decline.

If you purchase the common stock sold in this offering, you will experience

immediate and substantial dilution in your investment. You will experience further dilution if we issue additional equity securities in future fundraising transactions.

Since the price per share of our common stock being offered is substantially higher than the net tangible book value per share of our common

stock, you will suffer substantial dilution with respect to the net tangible book value of the common stock you purchase in this offering. Based on the public offering price of

$ per share and our net tangible book value as of September 30, 2017, if you purchase shares of common stock in this offering, you will suffer

immediate and substantial dilution of $ per share with respect to the net tangible book value of the common stock. See the section entitled

“Dilution” elsewhere in this prospectus for a more detailed discussion of the dilution you will incur if you purchase common stock in this offering.

If we issue additional common stock, or securities convertible into or exchangeable or exercisable for common stock following the expiration

of the

lock-up

agreement we entered into with the underwriters as described in the section entitled “Underwriting” elsewhere in this prospectus, our stockholders, including investors who purchase

shares of common stock in this offering, could experience additional dilution, and any such issuances may result in downward pressure on the price of our common stock.

Future sales of shares by existing stockholders could cause our stock price to decline.

Sales of a substantial number of shares of our common stock in the public market could occur at any time. These sales, or the perception in the

market that the holders of a large number of shares of common stock intend to sell shares, could reduce the market price of our common stock.

As of December 31, 2017, we had outstanding options to purchase an aggregate of 5,034,461 shares of our common stock, of which

approximately 2,555,423 were exercisable at a weighted average exercise price of $3.90 per share, and outstanding warrants to purchase an aggregate of 1,973,000 shares of our common stock, all of which are exercisable at a weighted average exercise

price of $2.47 per share. The exercise of such outstanding options and warrants will result in further dilution of your investment. If our existing stockholders sell substantial amounts of our common stock in the public market, or if the public

perceives that such sales could occur, this could have an adverse impact on the market price of our common stock, even if there is no relationship between such sales and the performance of our business.

4

We do not currently intend to pay dividends on our common stock, and any return to investors is expected to

come, if at all, only from potential increases in the price of our common stock.

At the present time, we intend to use available funds

to finance our operations. Accordingly, while payment of dividends rests within the discretion of our board of directors, no cash dividends on our common shares have been declared or paid by us and we have no intention of paying any such dividends

in the foreseeable future. Any return to investors is expected to come, if at all, only from potential increases in the price of our common stock.

USE OF PROCEEDS

We estimate that the net proceeds to us from this offering will be approximately

$ million (or approximately $ million if the underwriters’ over-allotment option is exercised in

full), in each case after deducting the underwriting discount and estimated offering expenses payable by us. We anticipate that the net proceeds from the sale of the securities offered under this prospectus will be used for general corporate

purposes, which may include, but are not limited to, working capital and capital expenditures. Pending the application of the net proceeds, we expect to invest the proceeds in investment-grade, interest-bearing instruments or other securities.

5

DESCRIPTION OF SECURITIES WE ARE OFFERING

We are offering shares of our common stock.

We have granted the underwriters an option to purchase up to additional shares of our common stock to cover over-allotments, if any.

Our Certificate of Incorporation, as amended, authorizes us to issue 100,000,000 shares of common stock, $0.001 par value per share, and

25,000,000 shares of preferred stock, $0.001 par value per share. As of December 31, 2017, there were 78,596,564 shares of common stock, and no shares of preferred stock, outstanding.

Common Stock.

All outstanding common stock is, and any stock issued under this prospectus will be, fully paid and nonassessable.

Subject to the rights of the holders of our outstanding preferred stock, holders of common stock:

|

|

•

|

|

are entitled to any dividends validly declared;

|

|

|

•

|

|

will share ratably in our net assets in the event of a liquidation; and

|

|

|

•

|

|

are entitled to one vote per share.

|

The common stock has no conversion rights. Holders of

common stock have no preemption, subscription, redemption, or call rights related to those shares.

American Stock Transfer &

Trust Company is the transfer agent and registrar for our common stock.

Preferred Stock.

The Board of Directors has the

authority, without further action by the shareholders, to issue shares of preferred stock in one or more series and to fix the rights, preferences, privileges and restrictions thereof, including dividend rights, conversion rights, voting rights,

terms of redemption, liquidation preferences, sinking fund terms and the number of shares constituting any series or the designation of such series. The issuance of preferred stock could adversely affect the voting power of holders of our common

stock and the likelihood that such holders will receive dividend payments and payments upon liquidation may have the effect of delaying, deferring or preventing a change in control of MicroVision, which could depress the market price of our common

stock. We currently have no shares of preferred stock outstanding.

6

DILUTION

If you invest in our securities, your interest will be diluted by an amount equal to the difference between the public offering price and the

net tangible book value per share of our common stock after this offering. We calculate net tangible book value per share by dividing our net tangible book value (total assets less intangible assets and total liabilities) by the number of

outstanding shares of common stock.

Our net tangible book value at September 30, 2017 was $11,846,000, or $0.15 per share of common

stock. After giving effect to the sale of shares of common stock, and our receipt of the expected net proceeds from the sale of those shares, our

adjusted net tangible book value at September 30, 2017 would be $ , or

$ per share. This represents an immediate increase in

as-adjusted

net tangible book value of

$ per share to existing shareholders and an immediate and substantial dilution of

$ per share to new investors. The following table illustrates this per share dilution:

|

|

|

|

|

|

|

|

|

|

|

Public offering price per share

|

|

|

|

|

|

$

|

|

|

|

Net tangible book value per share at September 30, 2017

|

|

$

|

0.15

|

|

|

|

|

|

|

Increase in net tangible book value per share attributable to this offering

|

|

$

|

|

|

|

|

|

|

|

As-adjusted

net tangible book value per share as of

September 30, 2017, after giving effect to this offering

|

|

|

|

|

|

$

|

|

|

|

Dilution per share to new investors in this offering

|

|

|

|

|

|

$

|

|

|

The information above assumes that the underwriters do not exercise their over-allotment option. If the

underwriters exercise their over-allotment option in full, the

as-adjusted

net tangible book value after this offering would be approximately

$ per share, representing an increase in net tangible book value of approximately

$ per share to existing shareholders and immediate dilution in net tangible book value of approximately

$ per share to new investors purchasing our common stock in this offering at the public offering price.

The table and discussion above are based on 78,593,614 shares of our common stock outstanding as of September 30, 2017 and excludes, as

of that date, the following:

|

|

•

|

|

5,246,087 shares of our common stock issuable upon exercise of outstanding options, of which approximately 2,514,024 were exercisable at a weighted average exercise price of $3.97 per share, under our 2013 Incentive

Plan, as amended, or the Incentive Plan, and our Independent Director Stock Option Plan;

|

|

|

•

|

|

60,000 shares of our common stock underlying unvested stock awards;

|

|

|

•

|

|

1,973,000 shares of our common stock issuable upon exercise of outstanding warrants, all of which were exercisable at a weighted average exercise price of $2.47 per share; and

|

|

|

•

|

|

2,100,909 shares of our common stock reserved for issuance pursuant to the Incentive Plan.

|

To

the extent that any of the outstanding warrants or options are exercised, there will be further dilution to new investors. In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe

we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity securities, the issuance of these securities could result in further dilution to our stockholders.

7

UNDERWRITING

We have entered into an underwriting agreement with the underwriters named

below. is acting as representative of the several underwriters.

The underwriters named below have agreed to buy, subject to the terms of the underwriting agreement, the number of shares of common stock

listed opposite each of their names below. The underwriters’ obligations are several, which means that each underwriter is required to purchase a specific number of shares, but is not responsible for the commitment of any other underwriter to

purchase shares. The underwriters are committed to purchase and pay for all of the shares if any are purchased, other than those shares covered by the over-allotment option described below.

|

|

|

|

|

Underwriter

|

|

Number of Shares

|

|

|

|

|

|

|

|

|

The underwriters have advised us that they propose to offer the shares of common stock to the public at a

price of $ per share. The underwriters propose to offer the shares of common stock to certain dealers at the same price less a concession of not more than

$ per share. After the offering, these figures may be changed by the underwriters.

The shares sold in this offering are expected to be ready for delivery against payment in immediately available funds on or about

, 2018, subject to customary closing conditions. The underwriters may reject all or part of any order.

We have granted to the underwriters an option to purchase up to an additional

shares of common stock from us at the same price to the public, and with the same underwriting discount, as set forth in the table below. The

underwriters may exercise this option, in whole or in part, any time during the

30-day

period after the date of this prospectus, but only to cover over-allotments, if any. To the extent the underwriters

exercise the option, each of the underwriters will become obligated, subject to certain conditions, to purchase the shares for which they exercise the option in approximately the same proportion as shown in the table above.

Commissions and Discounts

The table

below summarizes the underwriting discounts that we will pay to the underwriters. These amounts are shown assuming both no exercise and full exercise of the over-allotment option. In addition to the underwriting discount, we have agreed to pay up to

$ of the fees and expenses of the underwriters, which may include the fees and expenses of counsel to the underwriters. The fees and expenses of the

underwriters that we have agreed to reimburse are not included in the underwriting discounts set forth in the table below. The underwriters have not received and will not receive from us any other item of compensation or expense in connection with

this offering considered by the Financial Industry Regulatory Authority, Inc., or FINRA, to be underwriting compensation under its rule of fair price. The underwriting discount and other items of compensation the underwriters will receive were

determined through arms’ length negotiations between us and the underwriters.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per

Share

|

|

|

Total with

no

Over-

Allotment

|

|

|

Total with

Over-

Allotment

|

|

|

Underwriting discount

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

We estimate that the total expenses of this offering, excluding underwriting discounts, will be

$ . This includes $ of fees and expenses of the

underwriters. These expenses are payable by us.

8

Indemnification

We also have agreed to indemnify the underwriters against certain liabilities, including civil liabilities under the Securities Act, or to

contribute to payments that the underwriters may be required to make in respect of those liabilities.

No Sales of Similar Securities

We and each of our directors and officers have agreed not to offer, sell, agree to sell, directly or indirectly, or otherwise dispose of any

shares of common stock or any securities convertible into or exchangeable for shares of common stock without the prior written consent of the underwriters for a period

of days after the date of this prospectus. These

lock-up

agreements provide certain exceptions and their

restrictions may be waived at any time by the underwriters.

Price Stabilization, Short Positions and Penalty Bids

To facilitate this offering, the underwriters may engage in transactions that stabilize, maintain or otherwise affect the price of our common

stock during and after the offering. Specifically, the underwriters may create a short position in our common stock for their own accounts by selling more shares of common stock than we have sold to the underwriters. The underwriters may close out

any short position by purchasing shares in the open market.

In addition, the underwriters may stabilize or maintain the price of our

common stock by bidding for or purchasing shares in the open market and may impose penalty bids. If penalty bids are imposed, selling concessions allowed to broker-dealers participating in this offering are reclaimed if shares previously distributed

in this offering are repurchased, whether in connection with stabilization transactions or otherwise. The effect of these transactions may be to stabilize or maintain the market price of our common stock at a level above that which might otherwise

prevail in the open market. The imposition of a penalty bid may also affect the price of our common stock to the extent that it discourages resales of our common stock. The magnitude or effect of any stabilization or other transactions is uncertain.

These transactions may be effected on The NASDAQ Global Market or otherwise and, if commenced, may be discontinued at any time.

In

connection with this offering, the underwriters and selling group members may also engage in passive market making transactions in our common stock on The NASDAQ Global Market. Passive market making consists of displaying bids on The NASDAQ Global

Market limited by the prices of independent market makers and effecting purchases limited by those prices in response to order flow. Rule 103 of Regulation M promulgated by the SEC limits the amount of net purchases that each passive market maker

may make and the displayed size of each bid. Passive market making may stabilize the market price of our common stock at a level above that which might otherwise prevail in the open market and, if commenced, may be discontinued at any time.

Neither we nor the underwriters make any representation or prediction as to the direction or magnitude of any effect that the transactions

described above may have on the price of our common stock. In addition, neither we nor the underwriters make any representation that the underwriters will engage in these transactions or that any transaction, if commenced, will not be discontinued

without notice.

Electronic Offer, Sale and Distribution of Shares

The underwriters or syndicate members may facilitate the marketing of this offering online directly or through one of their affiliates. In

those cases, prospective investors may view offering terms and a prospectus online and place orders online or through their financial advisors. Such websites and the information contained on such websites, or connected to such sites, are not

incorporated into and are not a part of this prospectus.

Other Relationships

The underwriters and their affiliates are full service financial institutions engaged in various activities, which may include securities

trading, commercial and investment banking, financial advisory, investment management, investment research, principal investment, hedging, financing and brokerage activities. The underwriters have in the past, and may in the future, engage in

investment banking and other commercial dealings in the ordinary course of business with us or our affiliates. The underwriters have in the past, and may in the future, receive customary fees and commissions for these transactions.

9

In the ordinary course of their various business activities, the underwriters and their

affiliates may make or hold a broad array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account and for the accounts of their customers,

and such investment and securities activities may involve securities and/or instruments of the issuer. The underwriters and their affiliates may also make investment recommendations and/or publish or express independent research views in respect of

such securities or instruments and may at any time hold, or recommend to clients that it acquires, long and/or short positions in such securities and instruments.

Selling Restrictions

Canada.

The

offering of the common stock in Canada is being made on a private placement basis in reliance on exemptions from the prospectus requirements under the securities laws of each applicable Canadian province and territory where the common stock may be

offered and sold, and therein may only be made with investors that are purchasing as principal and that qualify as both an “accredited investor” as such term is defined in National Instrument

45-106

- Prospectus Exemptions, and as a “permitted client” as such term is defined in National Instrument

31-103

- Registration Requirements, Exemptions and Ongoing Registrant Obligations. Any offer and

sale of the common stock in any province or territory of Canada may only be made through a dealer that is properly registered under the securities legislation of the applicable province or territory wherein the common stock is offered and/or sold

or, alternatively, by a dealer that qualifies under and is relying upon an exemption from the registration requirements therein.

Any

resale of the common stock by an investor resident in Canada must be made in accordance with applicable Canadian securities laws, which may require resales to be made in accordance with prospectus and registration requirements, statutory exemptions

from the prospectus and registration requirements or under a discretionary exemption from the prospectus and registration requirements granted by the applicable Canadian securities regulatory authority. These resale restrictions may under certain

circumstances apply to resales of the common stock outside of Canada.

European Economic Area.

In relation to each Member State of

the European Economic Area which has implemented the Prospectus Directive each, a Relevant Member State, no offer to the public of any of our shares of common stock will be made, other than under the following exemptions:

|

|

•

|

|

to any legal entity that is a qualified investor as defined in the Prospectus Directive;

|

|

|

•

|

|

to fewer than 100 or, if the Relevant Member State has implemented the relevant provision of the 2010 PD Amending Directive, 150, natural or legal persons (other than qualified investors as defined in the Prospectus

Directive), as permitted under the Prospectus Directive, subject to obtaining the prior consent of the issuer for any such offer; or

|

|

|

•

|

|

in any other circumstances falling within Article 3(2) of the Prospectus Directive, provided that no such offer of shares of our common stock will result in a requirement for the publication by us or any underwriter of

a prospectus pursuant to Article 3 of the Prospectus Directive or any supplementary prospectus pursuant to Article 16 of the Prospectus Directive.

|

For the purposes of this provision, the expression an “offer to the public” in relation to any shares of our common stock in any

Relevant Member State means the communication in any form and by any means of sufficient information on the terms of the offer so as to enable an investor to decide to purchase or subscribe for any shares of common stock, as the same may be varied

in that Member State by any measure implementing the Prospectus Directive in that Member State. The expression “Prospectus Directive” means Directive 2003/71/EC (and amendments thereto, including the 2010 PD Amending Directive, to the

extent implemented in the Relevant Member State), and includes any relevant implementing measure in the Relevant Member State, and the expression “2010 PD Amending Directive” means Directive 2010/73/EU.

10

United Kingdom.

This document is not an approved prospectus for the purposes of section 85

of the UK Financial Services and Markets Act 2000, as amended, or FSMA, and a copy of it has not been, and will not be, delivered to or approved by the UK Listing Authority or approved by any other authority which could be a competent authority for

the purposes of the Prospectus Directive.

This prospectus is only being distributed to, and is only directed at, persons in the United

Kingdom that are “qualified investors” within the meaning of section 86(7) of FSMA that are also (i) investment professionals falling within Article 19(5) of the UK Financial Services and Markets Act 2000 (Financial Promotion) Order

2005, as amended, or the Order, and/or (ii) high net worth companies, unincorporated associations or partnerships and the trustees of high value trusts falling within Article 49(2)(a) to (d) of the Order and other persons to whom it may

lawfully be communicated (each such person being referred to as a “relevant person”).

Any person in the United Kingdom that is

not a relevant person should not act or rely on these documents or any of their contents. Any investment, investment activity or controlled activity to which this document relates is available in the United Kingdom only to relevant persons and will

be engaged in only with such persons. Accordingly, this document has not been approved by an authorized person, as would otherwise be required by Section 21 of FSMA. Any purchaser of shares of common stock resident in the United Kingdom will be

deemed to have represented to us and the underwriters, and acknowledge that each of us and the underwriters are relying on such representation, that it, or the ultimate purchaser for which it is acting as agent, is a relevant person.

Transfer Agent and Registrar

The

transfer agent and registrar for our common stock is American Stock Transfer and Trust Company, LLC.

11

LEGAL MATTERS

The validity of the common stock being offered hereby will be passed upon by Ropes & Gray LLP, Boston,

Massachusetts. is acting as counsel for the underwriters in connection with this offering.

EXPERTS

Our consolidated financial statements appearing in our Annual Report on Form

10-K

for the year ended

December 31, 2016, and the effectiveness of our internal control over financial reporting as of December 31, 2016, have been audited by Moss Adams LLP, an independent registered public accounting firm, as stated in their reports, which are

incorporated herein by reference. Such consolidated financial statements have been so incorporated in reliance upon the report of such firm (which report expresses an unqualified opinion and includes an explanatory paragraph regarding a going

concern emphasis) given upon their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE

INFORMATION

We have filed with the SEC a registration statement on Form

S-1

under the

Securities Act with respect to the shares of our common stock being offered by this prospectus. This prospectus, which constitutes part of the registration statement, does not include all of the information contained in the registration statement

and the exhibits to the registration statement. For further information with respect to us and our common stock, you should refer to the registration statement (including this prospectus), the exhibits to the registration statement and the documents

incorporated by reference in this prospectus. Statements contained in this prospectus about the contents of any contract or any other document are not necessarily complete, and in each instance, we refer you to the copy of the contract or other

documents filed as an exhibit to the registration statement. Each of these statements is qualified in all respects by this reference.

We

file annual, quarterly and special reports, proxy statements and other information with the SEC. You may read and copy any document we file at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at

1-800-SEC-0330

for further information. Our SEC filings are also available to the public from the SEC’s website at

http://www.sec.gov and through the “Investors” section of our website at http://www.Microvision.com. The information found on our website is not part of this prospectus and investors should not rely on any such information in deciding

whether to invest.

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to incorporate by reference the information we file with it, which means that we can disclose important information to you

by referring you to another document that we have filed separately with the SEC. You should read the information incorporated by reference because it is an important part of this prospectus. We incorporate by reference the following information or

documents that we have filed with the SEC; provided, however, that we are not incorporating any information furnished under any of Item 2.02 or Item 7.01 (including exhibits furnished under Item 9.01 in connection with information

furnished under Item 2.02 or Item 7.01) of any current report on

Form 8-K:

|

|

•

|

|

Our Annual Report on Form

10-K

for the fiscal year ended December 31, 2016 filed with the SEC on March 6, 2017;

|

|

|

•

|

|

Our Quarterly Reports on Form

10-Q

for the quarters ended March 31, 2017, June 30, 2017 and September 30, 2017 filed with the SEC on April 28,

2017, August 3, 2017 and November 2, 2017, respectively;

|

|

|

•

|

|

Our Definitive Proxy Statement on Schedule 14A filed with the SEC on April 24, 2017; and

|

|

|

•

|

|

Our Current Reports on Form

8-K

filed with the SEC on February 10, 2017, March 28, 2017, May 4, 2017, June 9, 2017, June 13,

2017, August 10, 2017, August 30, 2017, October 10, 2017, November 15, 2017 and November 22, 2017.

|

12

Any statement contained in any document incorporated by reference herein shall be deemed to be

modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or any amendment or supplement modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed,

except as so modified or superseded, to constitute a part of this prospectus.

We also specifically incorporate by reference any documents

filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of the initial filing of this registration statement and prior to the effectiveness of this registration statement.

We will provide to each person, including any beneficial owners, to whom a prospectus is delivered, upon written or oral request of any such

person, a copy of the reports and documents that have been incorporated by reference into this prospectus, at no cost. You may request a copy of these filings, at no cost, by writing or telephoning us at the following address:

MicroVision, Inc.

6244 185th

Avenue NE, Suite 100

Redmond, Washington 98052

Attention: Investor Relations

(425)

936-6847

Copies of these filings are also available through the “Investors” section of our website at http://www.Microvision.com. The

reference to our website address does not constitute incorporation by reference of the information contained on our website.

13

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 13.

Other Expenses of Issuance and Distribution

The following table sets forth the various costs and expenses (other than the underwriting discounts and commissions) payable by the Registrant

in connection with a distribution of securities registered hereby. All amounts are estimates except the SEC registration fee.

|

|

|

|

|

|

|

SEC registration fee

|

|

$

|

1,867.50

|

|

|

FINRA filing fee

|

|

|

|

|

|

Legal fees and expenses

|

|

|

|

|

|

Underwriter expense reimbursement

|

|

|

|

|

|

Accounting fees and expenses

|

|

|

|

|

|

Miscellaneous

|

|

|

|

|

|

Total

|

|

$

|

|

|

Item 14.

Indemnification of Directors and Officers

Section 145 of the Delaware General Corporation Law (“DGCL”) provides that a corporation may indemnify any person who was or is

a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the corporation) by reason of the

fact that the person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or

other enterprise, against expenses (including attorney’s fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection with such action, suit or proceeding if the person acted in good faith

and in a manner the person reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe the person’s conduct was unlawful.

Section 145 further provides that a corporation similarly may indemnify any such person serving in any such capacity who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the

right of the corporation to procure a judgment in its favor, against expenses actually and reasonably incurred in connection with the defense or settlement of such action or suit if the person acted in good faith and in a manner the person

reasonably believed to be in or not opposed to the best interests of the corporation and except that no indemnification shall be made in respect of any claim, issue or matter as to which such person shall have been adjudged to be liable to the

corporation unless and only to the extent that the Delaware Court of Chancery or such other court in which such action or suit was brought shall determine upon application that, despite the adjudication of liability but in view of all the

circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses which the Court of Chancery or such other court shall deem proper.

Section 102(b)(7) of the DGCL permits a corporation to include in its certificate of incorporation a provision eliminating or limiting

the personal liability of a director to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director, provided that such provision shall not eliminate or limit the liability of a director (i) for any

breach of the director’s duty of loyalty to the corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) under Section 174 of the

DGCL (relating to unlawful payment of dividends and unlawful stock purchase and redemption) or (iv) for any transaction from which the director derived an improper personal benefit.

The Registrant’s Certificate provides that the Registrant’s directors shall not be liable to the Registrant or its stockholders for

monetary damages for breach of fiduciary duty as a director except to the extent that exculpation from liabilities is not permitted under the DGCL as in effect at the time such liability is determined. The Registrant’s Certificate further

provides that the Registrant shall indemnify its directors and officers to the fullest extent permitted by the DGCL.

II-1

The Registrant has a liability insurance policy in effect which covers certain claims against any

officer or director of the Registrant by reason of certain breaches of duty, neglect, errors or omissions committed by such person in his or her capacity as an officer or director.

For the undertaking with respect to indemnification, see Item 17 herein.

Item 15.

Recent Sales of Unregistered Securities

On August 28, 2017, the Registrant sold 1,500,000 shares of its common stock at a price of $2.10 per share to a private investor, for

aggregate consideration of $3,150,000, pursuant to Regulation D and Section 4(a)(2) of the Securities Act of 1933.

Item 16.

Exhibits and Financial Statement Schedules

(a)

Exhibits

. The following exhibits are filed herewith or are incorporated by reference to exhibits previously filed with the SEC:

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

1.1

|

|

Form of Underwriting Agreement.

†

|

|

|

|

|

3.1

|

|

Amended and Restated Certificate of Incorporation of MicroVision, Inc., as amended.

(4)

|

|

|

|

|

3.2

|

|

Certificate of Amendment to the Amended and Restated Certificate of Incorporation of MicroVision, Inc.

(6)

|

|

|

|

|

3.3

|

|

Bylaws of MicroVision,

Inc.

(8)

|

|

|

|

|

4.1

|

|

Form of Specimen Stock Certificate for Common Stock.

(1)

|

|

|

|

|

4.2

|

|

Form of Warrant dated March 18, 2014 issued under the Securities Purchase Agreement dated as of March

13, 2014 by and between MicroVision, Inc. and the investors named therein.

(9)

|

|

|

|

|

5.1

|

|

Opinion of Ropes & Gray LLP.

†

|

|

|

|

|

10.1

|

|

2013 MicroVision, Inc. Incentive Plan, as amended.

(10)

*

|

|

|

|

|

10.2

|

|

Independent Director Stock Option Plan, as amended.

(2)

*

|

|

|

|

|

10.3

|

|

Employment Agreement between MicroVision, Inc. and Alexander Y. Tokman dated April

7, 2009.

(3)

|

|

|

|

|

10.4

|

|

Second Amendment to Lease Agreement between Arden Realty, L.P. and MicroVision, Inc., dated January 15, 2013.

(7)

|

|

|

|

|

10.5

|

|

Change of Control Severance Plan.

(5)

|

|

|

|

|

10.6

|

|

Employment Agreement between MicroVision, Inc. and Perry M. Mulligan dated November 21, 2017.

†

|

|

|

|

|

10.7

|

|

Third Amendment to Lease Agreement between Arden Realty, L.P. and MicroVision, Inc., dated July 25, 2017.

†

|

|

|

|

|

10.8

|

|

Letter Agreement between MicroVision, Inc. and Alexander Tokman dated November 14, 2017.

†

|

|

|

|

|

23.1

|

|

Consent of Independent Registered Public Accounting Firm—Moss Adams LLP.

|

|

|

|

|

23.2

|

|

Consent of Ropes & Gray LLP (included in legal opinion filed as Exhibit 5.1 herein).

|

|

|

|

|

24.1

|

|

Powers of Attorney.

|

|

(1)

|

Incorporated by reference to the Company’s Post-Effective Amendment to Form

S-3

Registration Statement, Registration

No. 333-102244.

|

|

(2)

|

Incorporated by reference to the Company’s Form

10-Q

for the quarterly period ended June 30, 2002.

|

|

(3)

|

Incorporated by reference to the Company’s Form

10-Q

for the quarterly period ended March 31, 2009.

|

|

(4)

|

Incorporated by reference to the Company’s Form

10-Q

for the quarterly period ended September 30, 2009.

|

|

(5)

|

Incorporated by reference to the Company’s Form

10-K

for the year ended December 31, 2011.

|

|

(6)

|

Incorporated by reference to the Company’s Current Report on Form

8-K

filed on February 17, 2012.

|

|

(7)

|

Incorporated by reference to the Company’s Form

10-Q

for the quarterly period ended March 31, 2013.

|

|

(8)

|

Incorporated by reference to the Company’s Current Report on Form

8-K

filed on November 27, 2013.

|

|

(9)

|

Incorporated by reference to the Company’s Current Report on Form

8-K

filed on March 13, 2014.

|

|

(10)

|

Incorporated by reference to the Company’s Form

10-Q

for the quarterly period ended June 30, 2017.

|

|

†

|

To be filed by amendment

|

|

*

|

Executive Compensation Plan or Agreement

|

II-2

(b)

Financial Statement Schedules

.

No financial statement schedules are provided because they are inapplicable or the requested information is shown in the consolidated

financial statements of the registrant or related notes thereto included in the registrant’s Annual Report on Form

10-K

filed with the SEC on March 6, 2017.

Item 17.

Undertakings.

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration

statement:

(i) to include any prospectus required by section 10(a)(3) of the Securities Act of 1933;

(ii) to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the

most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of

securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with

the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the

effective registration statement; and

(iii) to include any material information with respect to the plan of distribution

not previously disclosed in the registration statement or any material change to such information in the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment

shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain

unsold at the termination of the offering.

(b) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be

permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is

against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or

controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the

opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the

final adjudication of such issue.

(c) The undersigned registrant hereby undertakes that:

(1) For purposes of determining any liability under the Securities Act of 1933, the information omitted from the form of

prospectus filed as part of this registration statement in reliance upon Rule 430A and contained in a form of prospectus filed by the registrant pursuant to Rule 424(b) (1) or (4) or 497(h) under the Securities Act shall be deemed to be

part of this registration statement as of the time it was declared effective.

(2) For the purpose of determining any

liability under the Securities Act of 1933, each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that

time shall be deemed to be the initial bona fide offering thereof.

II-3

(d) That, for the purpose of determining liability of the registrant under the Securities Act of

1933 to any purchaser in the initial distribution of the securities: The undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting

method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to

offer or sell such securities to such purchaser:

(1) Any preliminary prospectus or prospectus of the undersigned

registrant relating to the offering required to be filed pursuant to Rule 424;

(2) Any free writing prospectus relating to

the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(3) The portion of any other free writing prospectus relating to the offering containing material information about the

undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(4) Any other

communication that is an offer in the offering made by the undersigned registrant to the purchaser.

II-4

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant has duly caused this registration statement to be signed on its

behalf by the undersigned, thereunto duly authorized in the city of Redmond, state of Washington, on the 5

th

day of February, 2018.

|

|

|

|

|

Title:

|

|

Vice President, General Counsel & Secretary

|

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the

following persons in the capacities and on the dates indicated.

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

/s/ Perry M. Mulligan

Perry M. Mulligan

|

|

Chief Executive Officer and Director

(Principal

Executive Officer)

|

|

February 5, 2018

|

|

|

|

|

|

/s/ Stephen P. Holt

Stephen P. Holt

|

|

Chief Financial Officer

(Principal Financial

Officer and Principal Accounting Officer)

|

|

February 5, 2018

|

|

|

|

|

|

/s/ *

Robert P. Carlile

|

|

Director

|

|

February 5, 2018

|

|

|

|

|

|

/s/ *

Yalon Farhi

|

|

Director

|

|

February 5, 2018

|

|

|

|

|

|

/s/ *

Slade Gorton

|

|

Director

|

|

February 5, 2018

|

|

|

|

|

|

/s/ *

Bernee D.L. Strom

|

|

Director

|

|

February 5, 2018

|

|

|

|

|

|

/s/ *

Brian Turner

|

|

Director

|

|

February 5, 2018

|

|

|

|

|

|

/s/ *

Thomas M. Walker

|

|

Director

|

|

February 5, 2018

|

|

|

|

|

|

*By:

/s/ David J. Westgor

|

|

|

|

February 5, 2018

|

|

Attorney-in-Fact

|

|

|

|

|

II-5

EXHIBIT INDEX

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

1.1

|

|

Form of Underwriting Agreement.

†

|

|

3.1

|

|

Amended and Restated

Certificate of Incorporation of MicroVision, Inc., as amended.

(4)

|

|

3.2

|

|

Certificate

of Amendment to the Amended and Restated Certificate of Incorporation of MicroVision, Inc.

(6)

|

|

3.3

|

|

Bylaws of

MicroVision, Inc.

(8)

|

|

4.1

|

|

Form of

Specimen Stock Certificate for Common Stock.

(1)

|

|

4.2

|

|

Form of Warrant

dated March 18, 2014 issued under the Securities Purchase Agreement dated as of March 13, 2014 by and between MicroVision, Inc. and the investors named therein.

(9)

|

|

5.1

|

|

Opinion of Ropes & Gray LLP.

†

|

|

10.1

|

|

2013 MicroVision,

Inc. Incentive Plan, as amended.

(10)

*

|

|

10.2

|

|

Independent

Director Stock Option Plan, as amended.

(2)

*

|

|

10.3

|

|

Employment Agreement

between MicroVision, Inc. and Alexander Y. Tokman dated April 7, 2009.

(3)

|

|

10.4

|

|

Second Amendment

to Lease Agreement between Arden Realty, L.P. and MicroVision, Inc., dated January 15, 2013.

(7)

|

|

10.5

|

|

Change of Control

Severance Plan.

(5)

|

|

10.6

|

|

Employment Agreement between MicroVision, Inc. and Perry M. Mulligan dated November 21, 2017.

†

|

|

10.7

|

|

Third Amendment to Lease Agreement between Arden Realty, L.P. and MicroVision, Inc., dated

July 25, 2017.

†

|

|

10.8

|

|

Letter Agreement between MicroVision, Inc. and Alexander Tokman dated November 14, 2017.

†

|

|

23.1

|

|

Consent of Independent Registered Public Accounting Firm—Moss Adams

LLP.

|

|

23.2

|

|

Consent of Ropes & Gray LLP (included in legal opinion filed as Exhibit 5.1

herein).

|

|

24.1

|

|

Powers of Attorney.

|

|

(1)

|

Incorporated by reference to the Company’s Post-Effective Amendment to Form

S-3

Registration Statement, Registration

No. 333-102244.

|

|

(2)

|

Incorporated by reference to the Company’s Form

10-Q

for the quarterly period ended June 30, 2002.

|

|

(3)

|

Incorporated by reference to the Company’s Form

10-Q

for the quarterly period ended March 31, 2009.

|

|

(4)

|

Incorporated by reference to the Company’s Form

10-Q

for the quarterly period ended September 30, 2009.

|

|

(5)

|

Incorporated by reference to the Company’s Form

10-K

for the year ended December 31, 2011.

|

|

(6)

|

Incorporated by reference to the Company’s Current Report on Form

8-K

filed on February 17, 2012.

|

|

(7)

|

Incorporated by reference to the Company’s Form

10-Q

for the quarterly period ended March 31, 2013.

|

|

(8)

|

Incorporated by reference to the Company’s Current Report on Form

8-K

filed on November 27, 2013.

|

|

(9)

|

Incorporated by reference to the Company’s Current Report on Form

8-K

filed on March 13, 2014.

|

|

(10)

|

Incorporated by reference to the Company’s Form

10-Q

for the quarterly period ended June 30, 2017.

|

|

†

|

To be filed by amendment

|

|

*

|

Executive Compensation Plan or Agreement

|

II-6

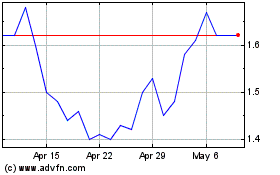

Microvision (NASDAQ:MVIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

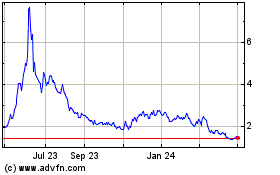

Microvision (NASDAQ:MVIS)

Historical Stock Chart

From Apr 2023 to Apr 2024