By Sharon Terlep

The biggest and most beleaguered names in beauty are trying to

stage a comeback, but first they must shed their reputation as

dated drugstore staples.

Brands like CoverGirl, Maybelline and Revlon for decades

dominated beauty aisles in drugstores and supermarkets, winning

women over with vibrant colors and affordable prices. But they have

lost ground to smaller rivals, from online-only brands to

higher-end names like MAC and Urban Decay to lines popularized by

the rise of specialty retailers like Sephora. Even drugstores have

cut back on beauty mainstays in favor of trendier names.

More recently, the big brands have been slow to catch on as

social media transformed the way beauty products were discovered,

especially by younger shoppers who often hear about new products

from YouTube tutorials and Instagram posts by "influencers," or

social-media stars. Niche brands have been far quicker to market on

social media.

The upheaval has driven losses, prompted the ouster of

executives and spurred acquisitions at companies such as Revlon

Inc., L'Oréal SA and, the biggest player, Coty Inc.

"It's not a matter of big and small. It's a matter of how you

connect with the consumer," Coty CEO Camillo Pane said in an

interview. "And our brands did not necessarily connect with

consumers in the past."

To resuscitate ailing brands, Coty and its rivals are churning

out trendier options such as facial highlighter and metallic

lipcolor, recruiting more relatable spokespeople, and speeding how

quickly new products get to market.

Coty has been struggling since acquiring the bulk of Procter

& Gamble Co.'s beauty business, including CoverGirl, in 2016

for $11.6 billion. The brands, the company said, turned out to be

sicker and more difficult to integrate than the company

anticipated.

Take CoverGirl, which saw its share of the $16 billion U.S.

color cosmetics market fall to 6.9% in 2016, from 9.2% in 2011,

according to Euromonitor.

Now the 60-year-old brand is getting dozens of new products and

made-over store displays. Instead of using only supermodels -- a

mainstay of yesteryear -- its new marketing campaigns feature

spokeswomen like a 69-year-old grandmother and a fitness trainer

with more than 2 million Instagram followers.

Mr. Pane and other top executives have been lobbying retailers

like CVS Health Corp. and Walmart Inc. to give back some of the

shelf space CoverGirl lost over the years as its popularity

flagged.

That can be a hard sell. While CVS says beauty products are

important to sales, its focus isn't necessarily on big-name brands.

At an event last year, executives bragged about attracting niche

beauty makers and launching their own private-label products in

response to demand for nontraditional brands.

The chain is installing new, higher-end beauty sections in

stores, stocked with smaller brands and exclusive offerings, in an

effort to better compete with beauty retailers like Sephora and

Ulta.

"Coty is under a lot of pressure to get this right," said

Jefferies analyst Stephanie Wissink. "CoverGirl might become the

proxy for the success story for a brand that's under attack. Or

they might become the case study for why a makeover in packaging

and marketing isn't enough to rebuild."

Shannon Curtin, head of Coty's consumer beauty unit, said

CoverGirl's rebirth goes deeper.

Development time for new products is down to as little as six

months instead of as much as two years, and one-quarter of the

brand's lineup will be entirely new products, Ms. Curtin said.

"We didn't have items people were buying -- primers, brows,

corrector kits," she said. "And now we do."

Olivia Cecchi, a recent college graduate who was browsing the

cosmetics section of a New Jersey drugstore recently, said she was

willing to spend on makeup but only at a store like Sephora, which

allows customers to sample the products. "I'd only buy something

here if I really needed something and didn't want to spend a lot of

money," she said, passing by CoverGirl and Revlon displays to look

at Wet n Wild, which offers 99-cent lipsticks.

CoverGirl's biggest rivals are also struggling to woo such

shoppers. The five biggest mass-market beauty brands lost a

combined 5 percentage points of market share between 2011 and 2016,

while higher-end and smaller mass-market brands picked up share,

according to Euromonitor.

Slow sales of Maybelline in the U.S. is dogging L'Oréal, whose

luxury and professional brands are still growing. In a November

call with analysts, L'Oréal CEO Jean-Paul Agon described the

mass-beauty segment as "pretty weak" and said the company hopes to

bolster sales in part by leveraging the newer NYX brand, which it

acquired as a startup in 2014 for $500 million.

Last month, Revlon said its CEO, Fabian Garcia, would leave the

New York company, whose shares are down 35% from a year ago amid

financial losses, declining market share and concerns from

investors that the company can't pay its debt.

"The internet has become the true equalizer," said Tarang Amin,

CEO of e.l.f. Beauty Inc. The brand started by selling online in

2004 and now generates most sales from Walmart and other

stores.

In addition to the benefits of online marketing and selling, Mr.

Amin said the New York company is benefiting from ultrafast

development times and consumers who are more willing to shop across

segments. "They are just as likely to have a Chanel item as an

e.l.f item."

Write to Sharon Terlep at sharon.terlep@wsj.com

(END) Dow Jones Newswires

February 05, 2018 05:44 ET (10:44 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

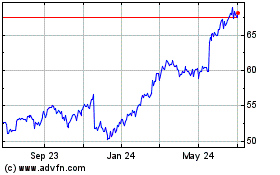

Walmart (NYSE:WMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

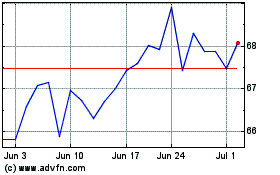

Walmart (NYSE:WMT)

Historical Stock Chart

From Apr 2023 to Apr 2024