By Anna Wilde Mathews, Dana Cimilluca and Emily Glazer

The high-profile health-care partnership JPMorgan Chase &

Co. struck last week with Amazon.com Inc. and Berkshire Hathaway

Inc. has created consternation among some clients of the lender's

investment-banking arm, according to people familiar with the

matter.

The new initiative, announced Tuesday, sent shock waves through

a number of health-care stocks. Its aim, to overhaul health care

for the three companies' legions of employees, sparked concern that

it could siphon business from existing health-care players.

Shares of health insurers UnitedHealth Group Inc., Cigna Corp.,

Humana Inc., Anthem Inc. and Aetna Inc. dropped after the news

emerged. Other sectors of the health-care industry also felt the

sting.

A couple of the big insurers expressed concerns to JPMorgan

officials following the announcement, some of the people said.

In a reflection of the sensitivity of the subject, JPMorgan

Chief Executive James Dimon hit the phones Tuesday to assuage

clients' concerns, people familiar with the matter said. So did

some of the firm's health-care bankers, who get paid handsomely to

help clients with mergers and other deals and worry the move could

cost them business.

"The response has been overwhelmingly positive," said JPMorgan

spokesman Brian Marchiony. "We've had hundreds of phone calls and

emails from client CEOs, doctors and health-care administrators

looking to see how they can get involved." He added, "We see this

as an opportunity to work with the industry to tackle the issues

facing our country."

On a Thursday conference call with industry analysts to discuss

earnings, Cigna CEO David Cordani said such employer moves create

"more opportunity versus less for us, because we seek to be an

integrated partner from a services standpoint."

JPMorgan, the largest U.S. bank by assets, is eager to avoid

even a small disruption to its health-care investment-banking

franchise, a powerhouse on Wall Street that took in $682 million in

revenue in the U.S. last year. Its leading market share of 14% was

trailed by Goldman Sachs Group Inc. at 10.6% and Morgan Stanley at

7%, according to Dealogic.

Though details of the project are scant, the idea is for the

three companies to launch a not-for-profit company to reduce costs

and improve the health-care experience for hundreds of thousands of

U.S. employees.

JPMorgan health-care bankers learned of the plan only at around

9 p.m. the evening before it was announced, according to people

familiar with the matter.

A small team largely including members of JPMorgan's

corporate-strategy group, which delves into big-impact projects

across the firm, quietly worked on the plan for several months with

Mr. Dimon and counterparts from Amazon and Berkshire, people

familiar with the process said. Marvelle Sullivan Berchtold, a

managing director in the strategy group, is JPMorgan's point

person. She joined the bank in August after stints as global head

of mergers and acquisitions for pharmaceutical company Novartis AG

and as a senior official at GSK Consumer Healthcare, a division of

drugmaker GlaxoSmithKline PLC.

After the plan was announced, JPMorgan bankers fielded calls

from clients concerned and confused about the impact.

Mr. Dimon began making calls from his office atop the bank's

Park Avenue headquarters, these people said. In those

conversations, Mr. Dimon told clients the planned health-care

initiative is for JPMorgan, Amazon and Berkshire employees

only.

Simultaneously, JPMorgan bankers nearby on Madison Avenue were

reiterating those points to clients, with some also telling them

the initiative is akin to a group purchasing organization, a type

of setup used by hospitals to buy supplies, so the companies can

get better deals for their employees, some of these people

said.

The bank isn't getting into business with Amazon, which earlier

jolted health-care companies with moves like adding health-care

supply options to its business-to-business marketplace. Worries

about a potential

Amazon entry into the pharmacy-services business were a factor in CVS Health Corp.'s $69 billion proposed acquisition of insurance giant Aetna.

JPMorgan bankers were also taking incoming calls from technology

companies, including health-care tech firms, intrigued by the

initiative's potential to disrupt the industry, a person familiar

with the matter said, adding that there's possibility for

additional business from those firms.

At one stage, there was discussion about whether the venture

should take over administration of employees' pharmacy and

health-insurance benefits from the current insurers and

pharmacy-benefit managers, according to a document from December

reviewed by The Wall Street Journal. But the document was an

initial proposal and that idea isn't currently on the table, people

familiar with the matter have said.

The December document also took aim at some of the industry's

middlemen, saying that past efforts to address health costs didn't

work "because they conceded the existence and role of

intermediaries (PBMs, insurance administrators, wholesale

distributors and pharmacies) which have a vested interest in

maintaining the status quo." One person with knowledge of the

matter has said the focus now is on helping the current vendors

work better, not on replacing them.

In 2017, JPMorgan spent $1.25 billion on medical benefits for

employees based in the U.S., where the medical plan covers almost

300,000 individuals, including employees and their family members,

the bank disclosed earlier in January.

Write to Anna Wilde Mathews at anna.mathews@wsj.com, Dana

Cimilluca at dana.cimilluca@wsj.com and Emily Glazer at

emily.glazer@wsj.com

(END) Dow Jones Newswires

February 04, 2018 07:14 ET (12:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

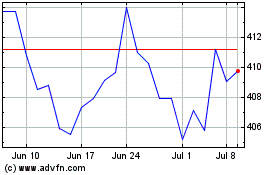

Berkshire Hathaway (NYSE:BRK.B)

Historical Stock Chart

From Mar 2024 to Apr 2024

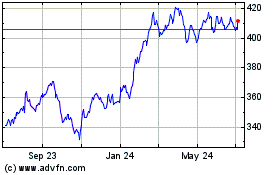

Berkshire Hathaway (NYSE:BRK.B)

Historical Stock Chart

From Apr 2023 to Apr 2024