NorthEast Community Bancorp, Inc. (OTC:NECB) (the “Company”), a

majority owned subsidiary of NorthEast Community Bancorp, MHC, and

the parent holding company of NorthEast Community Bank (the

“Bank”), reported net income of $8.05 million for the year ended

December 31, 2017 compared to net income of $5.03 million for the

year ended December 31, 2016, an increase of 60.13%.

The increase in net income for 2017 continues to

be the result of construction loan growth in the lower Hudson

Valley and on-going loan portfolio restructuring through attrition

of specific asset types.

The Company’s net income for the three and

twelve-month periods ended December 31, 2017 was impacted

negatively by a one-time adjustment to the net deferred tax asset

in the amount of $1.08 million due to the effect of the tax law

changes established by the Tax Cuts and Jobs Act (the “Tax Act”),

which was signed into law on December 22, 2017. The Tax Act

reduced the federal corporate tax rate to 21%. This change required

the Company to revalue its net deferred tax asset, which represents

corporate tax benefits anticipated to be realized in the future.

The reduction in the federal corporate tax rate reduces the tax

benefits of the net deferred tax asset. While the one-time

adjustment caused a reduction in after-tax net income for the three

and twelve-month periods ended December 31, 2017, the reduction of

the corporate income tax rate is expected to be favorable to the

Company in future periods.

Financial Condition and Operating

Results for December 31, 2017 compared to December 31,

2016:

Net interest income for the year ended December

31, 2017 increased by $7.61 million, or 32.78%, to $30.81 million

from $23.20 million for the year ended December 31, 2016.

Net income before taxes for the year ended

December 31, 2017 was $14.53 million compared to $8.14 million for

the year ended December 31, 2016, an increase of

78.50%. Provision for income taxes for 2017 was $6.48

million compared to $3.12 million for 2016. The increase in

net income before taxes was primarily the result of our continued

focus on construction lending in Rockland and Orange

Counties. The increase in income taxes was the result of

increased net income and the write-down of the deferred tax assets

required by the new Tax Act signed in December 2017.

Total consolidated assets increased by $80.32

million, or 10.93%, to $814.82 million at December 31, 2017 from

$734.50 million at December 31, 2016. Loans receivable (net)

increased by $77.98 million, or 12.45%, to $704.12 million at

December 31, 2017 from $626.14 million at December 31, 2016, while

commitments, loans-in-process and standby letters of credit

outstanding increased to $359.42 million at December 31, 2017

compared to $253.83 million at December 31, 2016. The

increase in loans receivable was primarily due to growth in our

construction loan portfolio resulting from our continued focus on

growing our construction lending operations in the lower Hudson

Valley.

Total liabilities at December 31, 2017 were

$697.92 million compared to $625.05 million at December 31, 2016,

an increase of $72.87 million, or 11.66%. The increase in

total liabilities was primarily due to a $79.86 million increase in

deposits from $545.35 million at December 31, 2016 to $625.21

million at December 31, 2017.

Federal Home Loan Bank advances and other

borrowings decreased by $7.38 million to $62.87 million at December

31, 2017, compared to $70.25 million at December 31, 2016. The

decrease in Federal Home Loan Bank Borrowing was the result of a

payoff of a maturing advance.

Total stockholder’s equity increased by $7.45

million, or 6.80%, to $116.90 million at December 31, 2017 from

$109.45 million at December 31, 2016. The increase was

primarily a result of net income of $8.05 million for the year

ended December 31, 2017, partially offset by dividends declared and

paid during the year.

Financial Condition and Operating

Results for December 31, 2017 compared to September 30,

2017:

Net interest income for the three months ending

December 31, 2017 increased by $540.22 thousand, or 6.81% to $8.49

million compared to $7.95 million for the three months ending

September 30, 2017.

Net income before taxes for the three months

ending December 31, 2017 was $4.36 million compared to $3.91

million for the three months ending September 31, 2017.

Provision for income taxes during the fourth quarter of 2017 was

$2.42 million compared to $1.57 million for the third quarter of

2017. The increase in income taxes was partially due to

the write-down of the deferred tax assets required by the Tax Act

signed into law in December 2017.

Total consolidated assets increased by $46.19

million, or 6.01%, to $814.82 million at December 31, 2017 from

$768.63 million at September 30, 2017. Loans receivable (net)

increased by $30.12 million or 4.47% to $704.12 million at December

31, 2017 from $674.00 million at September 31, 2017, while

commitments, loans-in-process and standby letters of credit

outstanding decreased to $359.42 million as of December 31, 2017

compared to $361.64 million at September 30, 2017.

Total liabilities at December 31, 2017 were

$697.92 million compared to $653.55 million at September 30, 2017,

an increase of $44.37 million, or 6.79%. The increase in

total liabilities was due to a $48.16 million increase in deposits

from $577.05 million at September 30, 2017 to $625.21 million at

December 31, 2017, partially offset by a reduction of $1.00 million

in Federal Home Loan Bank advances and other borrowings to $62.87

million at the end of the fourth quarter of 2017, compared to

$63.87 million at September 30, 2017.

NorthEast Community Bancorp, Inc.’s total

stockholders’ equity at December 31, 2017 is a strong 14.35%

compared to 14.97% at September 30, 2017.

NorthEast Community Bancorp, Inc. is the holding

company for NorthEast Community Bank. NorthEast Community Bank is a

New York State-chartered savings bank that operates four

full-service branches in New York State and three full-service

branches in Danvers, Framingham and Quincy, Massachusetts and loan

production offices in Danvers, Massachusetts and White Plains and

New City, New York.

This release contains “forward-looking

statements” that are based on assumptions and may describe future

plans, strategies and expectations of the Company. These

forward-looking statements are generally identified by the use of

the words “believe,” “expect,” “intend,” “anticipate,” “estimate,”

“project” or similar expressions. The Company’s ability to predict

results or the actual effect of future plans or strategies is

inherently uncertain. Factors that could have a material adverse

effect on the operations of the Company and its subsidiaries

include, but are not limited to, changes in market interest rates,

regional and national economic conditions, legislative and

regulatory changes, monetary and fiscal policies of the United

States government, including policies of the United States Treasury

and the Federal Reserve Board, the quality and composition of the

loan or investment portfolios, demand for loan products, deposit

flows, competition, demand for financial services in the Company’s

market area, changes in the real estate market values in the

Company’s market area and changes in relevant accounting principles

and guidelines These risks and uncertainties should be

considered in evaluating any forward-looking statements and undue

reliance should not be placed on such statements. Except as

required by applicable law or regulation, the Company does not

undertake, and specifically disclaims any obligation, to release

publicly the result of any revisions that may be made to any

forward-looking statements to reflect events or circumstances after

the date of the statements or to reflect the occurrence of

anticipated or unanticipated events.

Contact:Kenneth A. MartinekChief Executive Officer(914)

684-2500

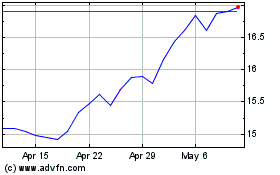

NorthEast Community Banc... (NASDAQ:NECB)

Historical Stock Chart

From Mar 2024 to Apr 2024

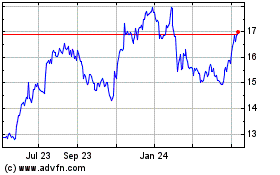

NorthEast Community Banc... (NASDAQ:NECB)

Historical Stock Chart

From Apr 2023 to Apr 2024