UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________

FORM 8-K

_______________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) February 2, 2018

_______________________________________

SPRINT CORPORATION

(Exact name of Registrant as specified in its charter)

_______________________________________

|

| | | | |

| | | | |

Delaware | | 1-04721 | | 46-1170005 |

(State of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

|

| | |

| | |

6200 Sprint Parkway, Overland Park, Kansas | | 66251 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (855) 848-3280

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On February 2, 2018, Sprint Corporation announced its results for the third quarter ended December 31, 2017. The press release is furnished as Exhibit 99.1, and its Quarterly Investor Update is attached as Exhibit 99.2.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following exhibits are furnished with this report:

|

| | |

| | |

Exhibit No. | | Description |

| | Press Release Announcing Results for the Third Quarter Ended December 31, 2017 |

| | Quarterly Investor Update |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | | | | |

| | | SPRINT CORPORATION |

| | | |

Date: February 2, 2018 | | | | | | /s/ Stefan K. Schnopp |

| | | | | | By: | | Stefan K. Schnopp |

| | | | | | | | Corporate Secretary |

EXHIBIT INDEX

|

| | | |

| | |

Number | | Exhibit |

99.1 |

| | Press Release Announcing Results for the Third Quarter Ended December 31, 2017 |

99.2 |

| | Quarterly Investor Update |

SPRINT REPORTS HIGHEST RETAIL NET ADDITIONS IN NEARLY THREE YEARS AND RAISES ADJUSTED FREE CASH FLOW* GUIDANCE WITH FISCAL 2017 THIRD QUARTER RESULTS

| |

• | Postpaid net additions of 256,000, including 184,000 phone net additions |

| |

◦ | Tenth consecutive quarter of postpaid phone net additions |

| |

• | Prepaid net additions of 63,000 compared to net losses of 460,000 in the prior year |

| |

◦ | Fourth consecutive quarter of net additions and improved by 523,000 year-over-year |

| |

◦ | Prepaid churn improved year-over-year for the sixth consecutive quarter |

| |

• | Net income of $7.2 billion, operating income of $727 million, and adjusted EBITDA* of $2.7 billion |

| |

◦ | Net income includes approximately $7.1 billion of favorable impact from tax reform |

| |

◦ | Eighth consecutive quarter of operating income |

| |

◦ | Highest fiscal third quarter adjusted EBITDA* in 11 years |

| |

• | Net cash provided by operating activities of $1.2 billion and adjusted free cash flow* of $397 million |

| |

◦ | Adjusted free cash flow* improved by more than $1 billion year-over-year |

| |

◦ | Raising fiscal year 2017 adjusted free cash flow* guidance from around break-even to a range of $500 million to $700 million |

| |

• | Sprint Next-Gen Network to drive further network improvements and provide path to 5G |

OVERLAND PARK, Kan. - Feb. 2, 2018 - Sprint Corporation (NYSE: S) today reported operating results for the third quarter of fiscal year 2017, including its highest retail net additions in nearly three years with postpaid net additions of 256,000 and prepaid net additions of 63,000. The company also reported its eighth consecutive quarter of operating income and the highest fiscal third quarter adjusted EBITDA* in 11 years.

Net cash provided by operating activities of $1.2 billion improved by more than $500 million year-over-year. Adjusted free cash flow* of $397 million improved by more than $1 billion year-over-year and the company is raising its fiscal year 2017 expectation from around break-even to a range of $500 million to $700 million.

“Sprint has now added postpaid phone customers for 10 consecutive quarters and added prepaid customers for four consecutive quarters,” said Sprint CEO Marcelo Claure. “This momentum, along with a continued focus on the cost structure, is driving improvements in profitability metrics and adjusted free cash flow*.”

Customer Growth Continues in Both Postpaid and Prepaid Businesses

Sprint’s execution in both its postpaid and prepaid businesses resulted in the highest retail net additions in nearly three years. Postpaid net additions of 256,000 in the quarter included 184,000 phone net additions, the tenth consecutive quarter of postpaid phone net additions.

Sprint’s prepaid business also continued to add customers with 63,000 net additions, its fourth consecutive quarter of net additions and a 523,000 improvement compared to the prior year. Prepaid churn improved year-over-year for the sixth consecutive quarter and prepaid gross additions grew year-over-year for the second consecutive quarter. The sustained improvement in prepaid customer trends has translated into better financial results, as prepaid wireless service revenue grew year-over-year for the first time in nearly three years.

More Progress on Cost Reduction Program

Sprint continued to make progress on its multi-year plan to improve its cost structure. Excluding approximately $100 million of hurricane-related and other non-recurring charges in the quarter, the company reported approximately $260 million of combined year-over-year reductions in cost of services and selling, general and administrative expenses, bringing the year-to-date total reduction to more than $1 billion. The year-to-date reductions were primarily driven by changes to the device insurance program, as well as lower network expenses.

Net income of $7.2 billion included $7.1 billion of non-cash benefit from tax reform, resulting from a re-measurement of our deferred tax assets and liabilities under provisions contained in the new tax law.

The company also reported the following financial results:

Sprint Next-Gen Network to Drive Further Network Improvements and Provide Path to 5G

Sprint is unlocking the value of the largest mobile broadband spectrum holdings in the U.S. and its Next-Gen Network is designed to drive significant improvements to network performance and the customer experience by investing in four main areas.

| |

• | Upgrade existing towers to leverage all three of the company’s spectrum bands - 800 MHz, 1.9 GHz and 2.5 GHz - for faster, more reliable service. |

| |

• | Build thousands of new cell sites to expand its coverage footprint and extend coverage to more popular customer destinations. |

| |

• | Add more small cells -- including Sprint Magic Boxes, mini-macros and strand mounts to densify every major market and significantly boost capacity and data speeds - and leverage the recent strategic agreements with Altice and Cox. The company has already deployed more than 80,000 Sprint Magic Boxes in approximately 200 cities across the country and plans to deploy more than 1 million as part of its multi-year roadmap. |

| |

• | Deploy game-changing 64T64R Massive MIMO 2.5 GHz radios to increase capacity up to 10 times that of current LTE systems and increase data speeds for more customers in high-traffic locations. Massive MIMO, a key enabler for 5G, will allow the company to support both LTE and 5G NR (New Radio) modes simultaneously without additional tower climbs. |

Sprint’s network has already seen significant improvements. According to Ookla Speedtest Intelligence data, Sprint was the most improved operator in 2017 with a 60 percent year-over-year increase in its national average download speed.1

Fiscal Year 2017 Outlook

| |

• | The company is raising its expectation for operating income to $2.5 billion to $2.7 billion. Its previous expectation was $2.1 billion to $2.5 billion. |

| |

• | The company expects adjusted EBITDA* to be around the mid-point of its prior expectation of $10.8 billion to $11.2 billion. |

| |

• | The company expects cash capital expenditures, excluding devices leased through indirect channels, to be at the low end of its prior expectation of $3.5 billion to $4 billion. |

| |

• | The company is raising its expectation for adjusted free cash flow* to $500 million to $700 million. Its previous expectation was around break-even. |

_______________________________

1 Average download speed increase based on Ookla’s analysis of Speedtest Intelligence data comparing December 2016 to December 2017 for all mobile results.

Conference Call and Webcast

| |

• | Date/Time: 8:30 a.m. (ET) Friday, Feb. 2, 2018 |

| |

◦ | U.S./Canada: 866-360-1063 (ID: 6374738) |

| |

◦ | International: 443-961-0242 (ID: 6374738) |

| |

• | Webcast available at www.sprint.com/investors |

| |

• | Additional information about results is available on our Investor Relations website |

Contact Information

| |

• | Media contact: Dave Tovar, David.Tovar@sprint.com |

| |

• | Investor contact: Jud Henry, Investor.Relations@sprint.com |

Wireless Operating Statistics (Unaudited) |

| | | | | | | | | | | | | | | | |

| Quarter To Date | | Year To Date |

| 12/31/17 | 9/30/17 | 12/31/16 | | 12/31/17 | 12/31/16 |

Net additions (losses) (in thousands) | | | | | | |

Postpaid | 256 |

| 168 |

| 405 |

| | 385 |

| 929 |

|

Postpaid phone | 184 |

| 279 |

| 368 |

| | 551 |

| 888 |

|

Prepaid (f) | 63 |

| 95 |

| (460 | ) | | 193 |

| (1,215 | ) |

Wholesale and affiliate (f) | 66 |

| 115 |

| 619 |

| | 246 |

| 2,051 |

|

Total wireless net additions | 385 |

| 378 |

| 564 |

| | 824 |

| 1,765 |

|

| | | | | | |

End of period connections (in thousands) | | | | | | |

Postpaid (d) (e) | 31,942 |

| 31,686 |

| 31,694 |

| | 31,942 |

| 31,694 |

|

Postpaid phone (d) | 26,616 |

| 26,432 |

| 26,037 |

| | 26,616 |

| 26,037 |

|

Prepaid (d) (f) (g) (h) (i) | 8,997 |

| 8,765 |

| 8,493 |

| | 8,997 |

| 8,493 |

|

Wholesale and affiliate (d) (f) (h) | 13,642 |

| 13,576 |

| 13,084 |

| | 13,642 |

| 13,084 |

|

Total end of period connections | 54,581 |

| 54,027 |

| 53,271 |

| | 54,581 |

| 53,271 |

|

| | | | | | |

Churn | | | | | | |

Postpaid | 1.80 | % | 1.72 | % | 1.67 | % | | 1.73 | % | 1.58 | % |

Postpaid phone | 1.71 | % | 1.59 | % | 1.57 | % | | 1.60 | % | 1.44 | % |

Prepaid (h) | 4.63 | % | 4.83 | % | 5.74 | % | | 4.68 | % | 5.57 | % |

| | | | | | |

Supplemental data - connected devices | | | | | | |

End of period connections (in thousands) | | | | | | |

Retail postpaid | 2,259 |

| 2,158 |

| 1,960 |

| | 2,259 |

| 1,960 |

|

Wholesale and affiliate | 11,272 |

| 11,221 |

| 10,594 |

| | 11,272 |

| 10,594 |

|

Total | 13,531 |

| 13,379 |

| 12,554 |

| | 13,531 |

| 12,554 |

|

| | | | | | |

ARPU (a) | | | | | | |

Postpaid | $ | 45.13 |

| $ | 46.00 |

| $ | 49.70 |

| | $ | 46.14 |

| $ | 50.59 |

|

Postpaid phone | $ | 51.26 |

| $ | 52.34 |

| $ | 57.12 |

| | $ | 52.50 |

| $ | 58.11 |

|

Prepaid (h) | $ | 37.46 |

| $ | 37.83 |

| $ | 33.97 |

| | $ | 37.84 |

| $ | 33.35 |

|

NON-GAAP RECONCILIATION - ABPA* AND ABPU* (Unaudited)

(Millions, except accounts, connections, ABPA*, and ABPU*) |

| | | | | | | | | | | | | | | | |

| Quarter To Date | | Year To Date |

| 12/31/17 | 9/30/17 | 12/31/16 | | 12/31/17 | 12/31/16 |

ABPA* | | | | | | |

Postpaid service revenue | $ | 4,297 |

| $ | 4,363 |

| $ | 4,686 |

| | $ | 13,126 |

| $ | 14,184 |

|

Add: Installment plan and non-operating lease billings | 379 |

| 397 |

| 291 |

| | 1,144 |

| 829 |

|

Add: Lease revenue - operating | 1,047 |

| 966 |

| 887 |

| | 2,912 |

| 2,453 |

|

Total for postpaid connections | $ | 5,723 |

| $ | 5,726 |

| $ | 5,864 |

| | $ | 17,182 |

| $ | 17,466 |

|

| | | | | | |

Average postpaid accounts (in thousands) | 11,193 |

| 11,277 |

| 11,413 |

| | 11,261 |

| 11,368 |

|

Postpaid ABPA* (b) | $ | 170.39 |

| $ | 169.25 |

| $ | 171.28 |

| | $ | 169.53 |

| $ | 170.71 |

|

| Quarter To Date | | Year To Date |

| 12/31/17 | 9/30/17 | 12/31/16 | | 12/31/17 | 12/31/16 |

Postpaid phone ABPU* | | | | | | |

Postpaid phone service revenue | $ | 4,069 |

| $ | 4,132 |

| $ | 4,420 |

| | $ | 12,415 |

| $ | 13,350 |

|

Add: Installment plan and non-operating lease billings | 335 |

| 358 |

| 261 |

| | 1,025 |

| 752 |

|

Add: Lease revenue - operating | 1,037 |

| 953 |

| 873 |

| | 2,877 |

| 2,411 |

|

Total for postpaid phone connections | $ | 5,441 |

| $ | 5,443 |

| $ | 5,554 |

| | $ | 16,317 |

| $ | 16,513 |

|

| | | | | | |

Postpaid average phone connections (in thousands) | 26,461 |

| 26,312 |

| 25,795 |

| | 26,275 |

| 25,528 |

|

Postpaid phone ABPU* (c) | $ | 68.54 |

| $ | 68.95 |

| $ | 71.77 |

| | $ | 69.00 |

| $ | 71.87 |

|

(a) ARPU is calculated by dividing service revenue by the sum of the monthly average number of connections in the applicable service category. Changes in average monthly service revenue reflect connections for either the postpaid or prepaid service category who change rate plans, the level of voice and data usage, the amount of service credits which are offered to connections, plus the net effect of average monthly revenue generated by new connections and deactivating connections. Postpaid phone ARPU represents revenues related to our postpaid phone connections.

(b) Postpaid ABPA* is calculated by dividing service revenue earned from connections plus billings from installment plans and non-operating leases, as well as, operating lease revenue by the sum of the monthly average number of accounts during the period. Installment plan billings represent the substantial majority of the total billings in the table above for all periods presented.

(c) Postpaid phone ABPU* is calculated by dividing postpaid phone service revenue earned from postpaid phone connections plus billings from installment plans and non-operating leases, as well as, operating lease revenue by the sum of the monthly average number of postpaid phone connections during the period. Installment plan billings represent the substantial majority of the total billings in the table above for all periods presented.

(d) As part of the Shentel transaction, 186,000 and 92,000 subscribers were transferred from postpaid and prepaid, respectively, to affiliates, of which 18,000 prepaid subscribers were subsequently excluded from our customer base as a result of the Lifeline regulatory change as noted in (f) below. An additional 270,000 of nTelos' subscribers are now part of our affiliate relationship with Shentel and were reported in wholesale and affiliate subscribers beginning with the quarter ended June 30, 2016. In addition, during the three-month period ended June 30, 2017, 17,000 and 4,000 subscribers were transferred from postpaid and prepaid, respectively, to affiliates as a result of a the transfer of additional subscribers to Shentel.

(e) During the three-month period ended June 30, 2017, 2,000 Wi-Fi connections were adjusted from the postpaid subscriber base.

(f) Sprint is no longer reporting Lifeline subscribers due to recent regulatory changes resulting in tighter program restrictions. We have excluded them from our customer base for all periods presented, including our Assurance Wireless prepaid brand and subscribers through our wholesale MVNO's.

(g) During the three-month period ended September 30, 2017, the Prepaid Data Share platform It's On was decommissioned as the Company continues to focus on higher value contribution offerings resulting in the reduction of 49,000 to prepaid end of period subscribers.

(h) As a result of aligning all prepaid brands, including prepaid affiliate subscribers, under one churn and retention program as of December 31, 2016, end of period prepaid and affiliate subscribers were reduced by 1,234,000 and 21,000, respectively.

(i) During the three-month period ended December 31, 2017, prepaid end of period subscribers increased by 169,000 in conjunction with the PRWireless HoldCo, LLC joint venture.

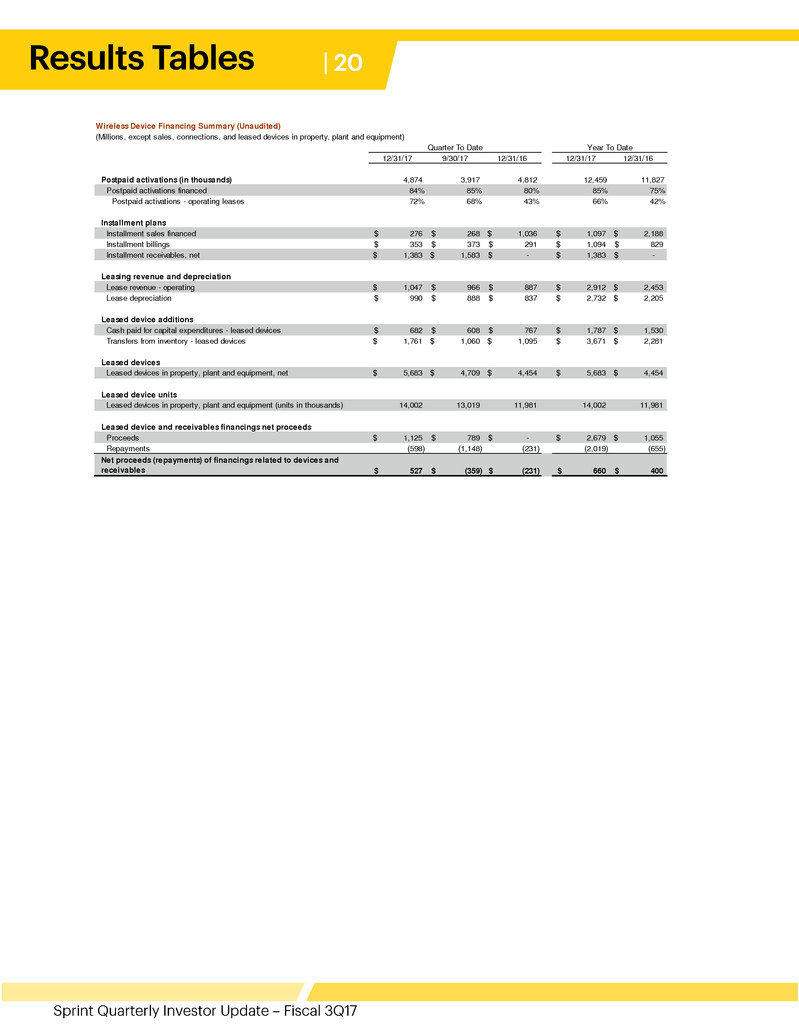

Wireless Device Financing Summary (Unaudited)

(Millions, except sales, connections, and leased devices in property, plant and equipment)

|

| | | | | | | | | | | | | | | | |

| Quarter To Date | | Year To Date |

| 12/31/17 | 9/30/17 | 12/31/16 | | 12/31/17 | 12/31/16 |

| | | | | | |

Postpaid activations (in thousands) | 4,874 |

| 3,917 |

| 4,812 |

| | 12,459 |

| 11,827 |

|

Postpaid activations financed | 84 | % | 85 | % | 80 | % | | 85 | % | 75 | % |

Postpaid activations - operating leases | 72 | % | 68 | % | 43 | % | | 66 | % | 42 | % |

| | | | | | |

Installment plans | | | | | | |

Installment sales financed | $ | 276 |

| $ | 268 |

| $ | 1,036 |

| | $ | 1,097 |

| $ | 2,188 |

|

Installment billings | $ | 353 |

| $ | 373 |

| $ | 291 |

| | $ | 1,094 |

| $ | 829 |

|

Installment receivables, net | $ | 1,383 |

| $ | 1,583 |

| $ | — |

| | $ | 1,383 |

| $ | — |

|

| | | | | | |

Leasing revenue and depreciation | | | | | | |

Lease revenue - operating | $ | 1,047 |

| $ | 966 |

| $ | 887 |

| | $ | 2,912 |

| $ | 2,453 |

|

Lease depreciation | $ | 990 |

| $ | 888 |

| $ | 837 |

| | $ | 2,732 |

| $ | 2,205 |

|

| | | | | | |

Leased device additions | | | | | | |

Cash paid for capital expenditures - leased devices | $ | 682 |

| $ | 608 |

| $ | 767 |

| | $ | 1,787 |

| $ | 1,530 |

|

Transfers from inventory - leased devices | $ | 1,761 |

| $ | 1,060 |

| $ | 1,095 |

| | $ | 3,671 |

| $ | 2,281 |

|

| | | | | | |

Leased devices | | | | | | |

Leased devices in property, plant and equipment, net | $ | 5,683 |

| $ | 4,709 |

| $ | 4,454 |

| | $ | 5,683 |

| $ | 4,454 |

|

| | | | | | |

Leased device units | | | | | | |

Leased devices in property, plant and equipment (units in thousands) | 14,002 |

| 13,019 |

| 11,981 |

| | 14,002 |

| 11,981 |

|

| | | | | | |

Leased device and receivables financings net proceeds | | | | | | |

Proceeds | $ | 1,125 |

| $ | 789 |

| $ | — |

| | $ | 2,679 |

| $ | 1,055 |

|

Repayments | (598 | ) | (1,148 | ) | (231 | ) | | (2,019 | ) | (655 | ) |

Net proceeds (repayments) of financings related to devices and receivables | $ | 527 |

| $ | (359 | ) | $ | (231 | ) | | $ | 660 |

| $ | 400 |

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

(Millions, except per share data)

|

| | | | | | | | | | | | | | | | |

| Quarter To Date | | Year To Date |

| 12/31/17 | 9/30/17 | 12/31/16 | | 12/31/17 | 12/31/16 |

| | | | | | |

Net operating revenues | | | | | | |

Service revenue | $ | 5,930 |

| $ | 5,967 |

| $ | 6,323 |

| | $ | 17,968 |

| $ | 19,252 |

|

Equipment revenue | 2,309 |

| 1,960 |

| 2,226 |

| | 6,355 |

| 5,556 |

|

Total net operating revenues | 8,239 |

| 7,927 |

| 8,549 |

| | 24,323 |

| 24,808 |

|

Net operating expenses | | | | | | |

Cost of services (exclusive of depreciation and amortization below) | 1,733 |

| 1,698 |

| 1,925 |

| | 5,140 |

| 6,125 |

|

Cost of products (exclusive of depreciation and amortization below) | 1,673 |

| 1,404 |

| 1,985 |

| | 4,622 |

| 5,097 |

|

Selling, general and administrative | 2,108 |

| 2,013 |

| 2,080 |

| | 6,059 |

| 5,992 |

|

Depreciation - network and other | 987 |

| 997 |

| 1,000 |

| | 2,961 |

| 3,022 |

|

Depreciation - leased devices | 990 |

| 888 |

| 837 |

| | 2,732 |

| 2,205 |

|

Amortization | 196 |

| 209 |

| 255 |

| | 628 |

| 813 |

|

Other, net | (175 | ) | 117 |

| 156 |

| | (310 | ) | 260 |

|

Total net operating expenses | 7,512 |

| 7,326 |

| 8,238 |

| | 21,832 |

| 23,514 |

|

Operating income | 727 |

| 601 |

| 311 |

| | 2,491 |

| 1,294 |

|

Interest expense | (581 | ) | (595 | ) | (619 | ) | | (1,789 | ) | (1,864 | ) |

Other (expense) income, net | (42 | ) | 44 |

| (60 | ) | | (50 | ) | (67 | ) |

Income (loss) before income taxes | 104 |

| 50 |

| (368 | ) | | 652 |

| (637 | ) |

Income tax benefit (expense) | 7,052 |

| (98 | ) | (111 | ) | | 6,662 |

| (286 | ) |

Net income (loss) | 7,156 |

| (48 | ) | (479 | ) | | 7,314 |

| (923 | ) |

Less: Net loss attributable to noncontrolling interests | 6 |

| — |

| — |

| | 6 |

| — |

|

Net income (loss) attributable to Sprint Corporation | $ | 7,162 |

| $ | (48 | ) | $ | (479 | ) | | $ | 7,320 |

| $ | (923 | ) |

| | | | | | |

Basic net income (loss) per common share | $ | 1.79 |

| $ | (0.01 | ) | $ | (0.12 | ) | | $ | 1.83 |

| $ | (0.23 | ) |

Diluted net income (loss) per common share | $ | 1.76 |

| $ | (0.01 | ) | $ | (0.12 | ) | | $ | 1.79 |

| $ | (0.23 | ) |

Weighted average common shares outstanding | 4,001 |

| 3,998 |

| 3,983 |

| | 3,998 |

| 3,979 |

|

Diluted weighted average common shares outstanding | 4,061 |

| 3,998 |

| 3,983 |

| | 4,080 |

| 3,979 |

|

| | | | | | |

Effective tax rate | -6,780.8 | % | 196.0 | % | -30.2 | % | | -1,021.8 | % | -44.9 | % |

NON-GAAP RECONCILIATION - NET INCOME (LOSS) TO ADJUSTED EBITDA* (Unaudited)

(Millions) |

| | | | | | | | | | | | | | | | |

| Quarter To Date | | Year To Date |

| 12/31/17 | 9/30/17 | 12/31/16 | | 12/31/17 | 12/31/16 |

| | | | | | |

Net income (loss) | $ | 7,156 |

| $ | (48 | ) | $ | (479 | ) | | $ | 7,314 |

| $ | (923 | ) |

Income tax (benefit) expense | (7,052 | ) | 98 |

| 111 |

| | (6,662 | ) | 286 |

|

Income (loss) before income taxes | 104 |

| 50 |

| (368 | ) | | 652 |

| (637 | ) |

Other expense (income), net | 42 |

| (44 | ) | 60 |

| | 50 |

| 67 |

|

Interest expense | 581 |

| 595 |

| 619 |

| | 1,789 |

| 1,864 |

|

Operating income | 727 |

| 601 |

| 311 |

| | 2,491 |

| 1,294 |

|

Depreciation - network and other | 987 |

| 997 |

| 1,000 |

| | 2,961 |

| 3,022 |

|

Depreciation - leased devices | 990 |

| 888 |

| 837 |

| | 2,732 |

| 2,205 |

|

Amortization | 196 |

| 209 |

| 255 |

| | 628 |

| 813 |

|

EBITDA* (1) | 2,900 |

| 2,695 |

| 2,403 |

| | 8,812 |

| 7,334 |

|

Loss (gain) from asset dispositions, exchanges, and other, net (2) | — |

| — |

| 28 |

| | (304 | ) | (326 | ) |

Severance and exit costs (3) | 13 |

| — |

| 19 |

| | 13 |

| 30 |

|

Contract terminations (4) | — |

| — |

| — |

| | (5 | ) | 113 |

|

Litigation and other contingencies (5) | (260 | ) | — |

| — |

| | (315 | ) | 103 |

|

Hurricanes (6) | 66 |

| 34 |

| — |

| | 100 |

| — |

|

Adjusted EBITDA* (1) | $ | 2,719 |

| $ | 2,729 |

| $ | 2,450 |

| | $ | 8,301 |

| $ | 7,254 |

|

| | | | | | |

Adjusted EBITDA margin* | 45.9 | % | 45.7 | % | 38.7 | % | | 46.2 | % | 37.7 | % |

| | | | | | |

Selected items: | | | | | | |

Cash paid for capital expenditures - network and other | $ | 696 |

| $ | 682 |

| $ | 478 |

| | $ | 2,499 |

| $ | 1,421 |

|

Cash paid for capital expenditures - leased devices | $ | 682 |

| $ | 608 |

| $ | 767 |

| | $ | 1,787 |

| $ | 1,530 |

|

WIRELESS STATEMENTS OF OPERATIONS (Unaudited)

(Millions)

|

| | | | | | | | | | | | | | | | |

| Quarter To Date | | Year To Date |

| 12/31/17 | 9/30/17 | 12/31/16 | | 12/31/17 | 12/31/16 |

| | | | | | |

Net operating revenues | | | | | | |

Service revenue | | | | | | |

Postpaid | $ | 4,297 |

| $ | 4,363 |

| $ | 4,686 |

| | $ | 13,126 |

| $ | 14,184 |

|

Prepaid (7) | 993 |

| 990 |

| 985 |

| | 2,982 |

| 3,096 |

|

Wholesale, affiliate and other (7) | 329 |

| 296 |

| 275 |

| | 884 |

| 784 |

|

Total service revenue | 5,619 |

| 5,649 |

| 5,946 |

| | 16,992 |

| 18,064 |

|

| | | | | | |

Equipment revenue | 2,309 |

| 1,960 |

| 2,226 |

| | 6,355 |

| 5,556 |

|

Total net operating revenues | 7,928 |

| 7,609 |

| 8,172 |

| | 23,347 |

| 23,620 |

|

| | | | | | |

Net operating expenses | | | | | | |

Cost of services (exclusive of depreciation and amortization below) | 1,466 |

| 1,422 |

| 1,649 |

| | 4,300 |

| 5,226 |

|

Cost of products (exclusive of depreciation and amortization below) | 1,673 |

| 1,404 |

| 1,985 |

| | 4,622 |

| 5,097 |

|

Selling, general and administrative | 2,024 |

| 1,936 |

| 2,032 |

| | 5,835 |

| 5,797 |

|

Depreciation - network and other | 931 |

| 944 |

| 947 |

| | 2,800 |

| 2,868 |

|

Depreciation - leased devices | 990 |

| 888 |

| 837 |

| | 2,732 |

| 2,205 |

|

Amortization | 196 |

| 209 |

| 255 |

| | 628 |

| 813 |

|

Other, net | 139 |

| 117 |

| 150 |

| | 54 |

| 248 |

|

Total net operating expenses | 7,419 |

| 6,920 |

| 7,855 |

| | 20,971 |

| 22,254 |

|

Operating income | $ | 509 |

| $ | 689 |

| $ | 317 |

| | $ | 2,376 |

| $ | 1,366 |

|

| | | | | | |

WIRELESS NON-GAAP RECONCILIATION (Unaudited)

(Millions) |

| | | | | | | | | | | | | | | | |

| Quarter To Date | | Year To Date |

| 12/31/17 | 9/30/17 | 12/31/16 | | 12/31/17 | 12/31/16 |

| | | | | | |

Operating income | $ | 509 |

| $ | 689 |

| $ | 317 |

| | $ | 2,376 |

| $ | 1,366 |

|

Loss (gain) from asset dispositions, exchanges, and other, net (2) | — |

| — |

| 28 |

| | (304 | ) | (326 | ) |

Severance and exit costs (3) | 4 |

| — |

| 13 |

| | (1 | ) | 18 |

|

Contract terminations (4) | — |

| — |

| — |

| | (5 | ) | 113 |

|

Litigation and other contingencies (5) | 63 |

| — |

| — |

| | 63 |

| 103 |

|

Hurricanes (6) | 66 |

| 34 |

| — |

| | 100 |

| — |

|

Depreciation - network and other | 931 |

| 944 |

| 947 |

| | 2,800 |

| 2,868 |

|

Depreciation - leased devices | 990 |

| 888 |

| 837 |

| | 2,732 |

| 2,205 |

|

Amortization | 196 |

| 209 |

| 255 |

| | 628 |

| 813 |

|

Adjusted EBITDA* (1) | $ | 2,759 |

| $ | 2,764 |

| $ | 2,397 |

| | $ | 8,389 |

| $ | 7,160 |

|

| | | | | | |

Adjusted EBITDA margin* | 49.1 | % | 48.9 | % | 40.3 | % | | 49.4 | % | 39.6 | % |

| | | | | | |

Selected items: | | | | | | |

Cash paid for capital expenditures - network and other | $ | 565 |

| $ | 539 |

| $ | 389 |

| | $ | 2,042 |

| $ | 1,123 |

|

Cash paid for capital expenditures - leased devices | $ | 682 |

| $ | 608 |

| $ | 767 |

| | $ | 1,787 |

| $ | 1,530 |

|

WIRELINE STATEMENTS OF OPERATIONS (Unaudited)

(Millions)

|

| | | | | | | | | | | | | | | | |

| Quarter To Date | | Year To Date |

| 12/31/17 | 9/30/17 | 12/31/16 | | 12/31/17 | 12/31/16 |

Net operating revenues | | | | | | |

Voice | $ | 94 |

| $ | 109 |

| $ | 153 |

| | $ | 327 |

| $ | 506 |

|

Data | 29 |

| 33 |

| 41 |

| | 96 |

| 127 |

|

Internet | 254 |

| 256 |

| 281 |

| | 765 |

| 871 |

|

Other | 16 |

| 11 |

| 22 |

| | 47 |

| 59 |

|

Total net operating revenues | 393 |

| 409 |

| 497 |

| | 1,235 |

| 1,563 |

|

| | | | | | |

Net operating expenses | | | | | | |

Cost of services (exclusive of depreciation and amortization below) | 352 |

| 372 |

| 400 |

| | 1,111 |

| 1,284 |

|

Selling, general and administrative | 71 |

| 66 |

| 49 |

| | 194 |

| 189 |

|

Depreciation and amortization | 55 |

| 49 |

| 51 |

| | 155 |

| 148 |

|

Other, net | (314 | ) | — |

| 6 |

| | (309 | ) | 13 |

|

Total net operating expenses | 164 |

| 487 |

| 506 |

| | 1,151 |

| 1,634 |

|

Operating income (loss) | $ | 229 |

| $ | (78 | ) | $ | (9 | ) | | $ | 84 |

| $ | (71 | ) |

WIRELINE NON-GAAP RECONCILIATION (Unaudited)

(Millions)

|

| | | | | | | | | | | | | | | | |

| Quarter To Date | | Year To Date |

| 12/31/17 | 9/30/17 | 12/31/16 | | 12/31/17 | 12/31/16 |

| | | | | | |

Operating income (loss) | $ | 229 |

| $ | (78 | ) | $ | (9 | ) | | $ | 84 |

| $ | (71 | ) |

Severance and exit costs (3) | 9 |

| — |

| 6 |

| | 14 |

| 13 |

|

Litigation and other contingencies (5) | (323 | ) | — |

| — |

| | (323 | ) | — |

|

Depreciation and amortization | 55 |

| 49 |

| 51 |

| | 155 |

| 148 |

|

Adjusted EBITDA* | $ | (30 | ) | $ | (29 | ) | $ | 48 |

| | $ | (70 | ) | $ | 90 |

|

| | | | | | |

Adjusted EBITDA margin* | -7.6 | % | -7.1 | % | 9.7 | % | | -5.7 | % | 5.8 | % |

| | | | | | |

Selected items: | | | | | | |

Cash paid for capital expenditures - network and other | $ | 30 |

| $ | 40 |

| $ | 24 |

| | $ | 132 |

| $ | 75 |

|

CONDENSED CONSOLIDATED CASH FLOW INFORMATION (Unaudited)

(Millions)

|

| | | | | | |

| Year To Date |

| 12/31/17 | 12/31/16 |

Operating activities | | |

Net income (loss) | $ | 7,314 |

| $ | (923 | ) |

Depreciation and amortization | 6,321 |

| 6,040 |

|

Provision for losses on accounts receivable | 312 |

| 406 |

|

Share-based and long-term incentive compensation expense | 137 |

| 57 |

|

Deferred income tax (benefit) expense | (6,707 | ) | 276 |

|

Gains from asset dispositions and exchanges | (479 | ) | (354 | ) |

Call premiums paid on debt redemptions | (129 | ) | — |

|

Loss on early extinguishment of debt | 65 |

| — |

|

Amortization of long-term debt premiums, net | (125 | ) | (234 | ) |

Loss on disposal of property, plant and equipment | 533 |

| 368 |

|

Contract terminations | (5 | ) | 96 |

|

Other changes in assets and liabilities: | | |

Accounts and notes receivable | (74 | ) | (542 | ) |

Inventories and other current assets | (3,216 | ) | (2,254 | ) |

Deferred purchase price from sale of receivables | — |

| (220 | ) |

Accounts payable and other current liabilities | (104 | ) | (97 | ) |

Non-current assets and liabilities, net | 260 |

| (313 | ) |

Other, net | 302 |

| 594 |

|

Net cash provided by operating activities | 4,405 |

| 2,900 |

|

| | |

Investing activities | | |

Capital expenditures - network and other | (2,499 | ) | (1,421 | ) |

Capital expenditures - leased devices | (1,787 | ) | (1,530 | ) |

Expenditures relating to FCC licenses | (92 | ) | (46 | ) |

Change in short-term investments, net | 5,271 |

| (2,349 | ) |

Proceeds from sales of assets and FCC licenses | 367 |

| 126 |

|

Other, net | 16 |

| 26 |

|

Net cash provided by (used in) investing activities | 1,276 |

| (5,194 | ) |

| | |

Financing activities | | |

Proceeds from debt and financings | 3,073 |

| 6,830 |

|

Repayments of debt, financing and capital lease obligations | (7,159 | ) | (3,266 | ) |

Debt financing costs | (19 | ) | (272 | ) |

Other, net | (6 | ) | 68 |

|

Net cash (used in) provided by financing activities | (4,111 | ) | 3,360 |

|

| | |

Net increase in cash and cash equivalents | 1,570 |

| 1,066 |

|

| | |

Cash and cash equivalents, beginning of period | 2,870 |

| 2,641 |

|

Cash and cash equivalents, end of period | $ | 4,440 |

| $ | 3,707 |

|

RECONCILIATION TO CONSOLIDATED FREE CASH FLOW* (NON-GAAP) (Unaudited)

(Millions) |

| | | | | | | | | | | | | | | | |

| Quarter To Date | | Year To Date |

| 12/31/17 | 9/30/17 | 12/31/16 | | 12/31/17 | 12/31/16 |

| | | | | | |

Net cash provided by operating activities | $ | 1,166 |

| $ | 1,959 |

| $ | 650 |

| | $ | 4,405 |

| $ | 2,900 |

|

| | | | |

|

|

Capital expenditures - network and other | (696 | ) | (682 | ) | (478 | ) | | (2,499 | ) | (1,421 | ) |

Capital expenditures - leased devices | (682 | ) | (608 | ) | (767 | ) | | (1,787 | ) | (1,530 | ) |

Expenditures relating to FCC licenses, net | (73 | ) | (6 | ) | (14 | ) | | (92 | ) | (46 | ) |

Proceeds from sales of assets and FCC licenses | 149 |

| 117 |

| 60 |

| | 367 |

| 126 |

|

Other investing activities, net | 6 |

| (1 | ) | 134 |

| | 2 |

| 98 |

|

Free cash flow* | $ | (130 | ) | $ | 779 |

| $ | (415 | ) | | $ | 396 |

| $ | 127 |

|

| | | | | | |

Net proceeds (repayments) of financings related to devices and receivables | 527 |

| (359 | ) | (231 | ) | | 660 |

| 400 |

|

Adjusted free cash flow* | $ | 397 |

| $ | 420 |

| $ | (646 | ) | | $ | 1,056 |

| $ | 527 |

|

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

(Millions)

|

| | | | | | |

| 12/31/17 | 3/31/17 |

ASSETS | | |

Current assets | | |

Cash and cash equivalents | $ | 4,440 |

| $ | 2,870 |

|

Short-term investments | 173 |

| 5,444 |

|

Accounts and notes receivable, net | 3,917 |

| 4,138 |

|

Device and accessory inventory | 1,009 |

| 1,064 |

|

Prepaid expenses and other current assets | 626 |

| 601 |

|

Total current assets | 10,165 |

| 14,117 |

|

| | |

Property, plant and equipment, net | 19,712 |

| 19,209 |

|

Goodwill | 6,586 |

| 6,579 |

|

FCC licenses and other | 41,222 |

| 40,585 |

|

Definite-lived intangible assets, net | 2,667 |

| 3,320 |

|

Other assets | 1,067 |

| 1,313 |

|

Total assets | $ | 81,419 |

| $ | 85,123 |

|

| | |

LIABILITIES AND EQUITY | | |

Current liabilities | | |

Accounts payable | $ | 3,176 |

| $ | 3,281 |

|

Accrued expenses and other current liabilities | 3,859 |

| 4,141 |

|

Current portion of long-term debt, financing and capital lease obligations | 4,036 |

| 5,036 |

|

Total current liabilities | 11,071 |

| 12,458 |

|

| | |

Long-term debt, financing and capital lease obligations | 32,825 |

| 35,878 |

|

Deferred tax liabilities | 7,709 |

| 14,416 |

|

Other liabilities | 3,509 |

| 3,563 |

|

Total liabilities | 55,114 |

| 66,315 |

|

| | |

Stockholders' equity | | |

Common stock | 40 |

| 40 |

|

Paid-in capital | 27,825 |

| 27,756 |

|

Accumulated deficit | (1,264 | ) | (8,584 | ) |

Accumulated other comprehensive loss | (366 | ) | (404 | ) |

Total stockholders' equity | 26,235 |

| 18,808 |

|

Noncontrolling interests | 70 |

| — |

|

Total equity | 26,305 |

| 18,808 |

|

Total liabilities and equity | $ | 81,419 |

| $ | 85,123 |

|

NET DEBT* (NON-GAAP) (Unaudited)

(Millions)

|

| | | | | | |

| 12/31/17 | 3/31/17 |

| | |

Total debt | $ | 36,861 |

| $ | 40,914 |

|

Less: Cash and cash equivalents | (4,440 | ) | (2,870 | ) |

Less: Short-term investments | (173 | ) | (5,444 | ) |

Net debt* | $ | 32,248 |

| $ | 32,600 |

|

SCHEDULE OF DEBT (Unaudited)

(Millions)

|

| | | | |

| | 12/31/17 |

ISSUER | MATURITY | PRINCIPAL |

Sprint Corporation | | |

7.25% Senior notes due 2021 | 09/15/2021 | $ | 2,250 |

|

7.875% Senior notes due 2023 | 09/15/2023 | 4,250 |

|

7.125% Senior notes due 2024 | 06/15/2024 | 2,500 |

|

7.625% Senior notes due 2025 | 02/15/2025 | 1,500 |

|

Sprint Corporation | | 10,500 |

|

| | |

Sprint Spectrum Co LLC, Sprint Spectrum Co II LLC, and Sprint Spectrum Co III LLC | | |

3.36% Senior secured notes due 2021 | 09/20/2021 | 3,281 |

|

Sprint Spectrum Co LLC, Sprint Spectrum Co II LLC, and Sprint Spectrum Co III LLC | | 3,281 |

|

| | |

Sprint Communications, Inc. | | |

Export Development Canada secured loan | 12/17/2019 | 300 |

|

9% Guaranteed notes due 2018 | 11/15/2018 | 1,800 |

|

7% Guaranteed notes due 2020 | 03/01/2020 | 1,000 |

|

7% Senior notes due 2020 | 08/15/2020 | 1,500 |

|

11.5% Senior notes due 2021 | 11/15/2021 | 1,000 |

|

9.25% Secured debentures due 2022 | 04/15/2022 | 200 |

|

6% Senior notes due 2022 | 11/15/2022 | 2,280 |

|

Sprint Communications, Inc. | | 8,080 |

|

| | |

Sprint Capital Corporation | | |

6.9% Senior notes due 2019 | 05/01/2019 | 1,729 |

|

6.875% Senior notes due 2028 | 11/15/2028 | 2,475 |

|

8.75% Senior notes due 2032 | 03/15/2032 | 2,000 |

|

Sprint Capital Corporation | | 6,204 |

|

| | |

Credit facilities | | |

PRWireless secured term loan | 06/28/2020 | 183 |

|

Secured equipment credit facilities | 2020 - 2021 | 555 |

|

Secured term loan | 02/03/2024 | 3,970 |

|

Credit facilities | | 4,708 |

|

| | |

Accounts receivable facility | 11/18/2019 | 2,966 |

|

| | |

Financing obligations | 2018 - 2021 | 614 |

|

| | |

Capital leases and other obligations | 2018 - 2026 | 532 |

|

Total principal | | 36,885 |

|

| | |

Net premiums and debt financing costs | | (24 | ) |

Total debt | | $ | 36,861 |

|

NOTES TO THE FINANCIAL INFORMATION (Unaudited)

| |

(1) | As more of our customers elect to lease a device rather than purchasing one under our subsidized program, there is a significant positive impact to EBITDA* and Adjusted EBITDA* from direct channel sales primarily due to the fact the cost of the device is not recorded as cost of products but rather is depreciated over the customer lease term. Under our device leasing program for the direct channel, devices are transferred from inventory to property and equipment and the cost of the leased device is recognized as depreciation expense over the customer lease term to an estimated residual value. The customer payments are recognized as revenue over the term of the lease. Under our subsidized program, the cash received from the customer for the device is recognized as equipment revenue at the point of sale and the cost of the device is recognized as cost of products. During the three and nine-month periods ended December 31, 2017, we leased devices through our Sprint direct channels totaling approximately $1,761 million and $3,671 million, respectively, which would have increased cost of products and reduced EBITDA* if they had been purchased under our subsidized program. |

The impact to EBITDA* and Adjusted EBITDA* resulting from the sale of devices under our installment billing program is generally neutral except for the impact from the time value of money element related to the imputed interest on the installment receivable.

| |

(2) | During the first quarter of fiscal year 2017, the company recorded losses on dispositions of assets primarily related to cell site construction and network development costs that are no longer relevant as a result of changes in the company's network plans. Additionally, the company recorded a pre-tax non-cash gain related to spectrum swaps with other carriers. During the third quarter of fiscal year 2016, the company recorded losses on dispositions of assets primarily related to cell site construction and network development costs that are no longer relevant as a result of changes in the company's network plans. During the second quarter of fiscal year 2016 the company recorded a pre-tax non-cash gain of $354 million related to spectrum swaps with other carriers. |

| |

(3) | Severance and exit costs consist of lease exit costs primarily associated with tower and cell sites, access exit costs related to payments that will continue to be made under the company's backhaul access contracts for which the company will no longer be receiving any economic benefit, and severance costs associated with reduction in its work force. |

| |

(4) | During the first quarter of fiscal year 2017, we recorded a $5 million gain due to reversal of a liability recorded in relation to the termination of our relationship with General Wireless Operations, Inc. (Radio Shack). During the first quarter of fiscal year 2016, contract terminations primarily relate to the termination of our pre-existing wholesale arrangement with NTELOS Holding Corp. |

| |

(5) | During the third and first quarters of fiscal year 2017, litigation and other contingencies consist of reductions associated with legal settlements or favorable developments in pending legal proceedings as well as non-recurring charges of $51 million related to a regulatory fee matter. During the second quarter of fiscal year 2016, litigation and other contingencies consist of unfavorable developments associated with legal matters as well as federal and state matters such as sales, use or property taxes. |

| |

(6) | During the third and second quarters of fiscal year 2017 we recorded estimated hurricane-related charges of $66 million and $34 million, respectively, consisting of customer service credits, incremental roaming costs, network repairs and replacements. |

| |

(7) | Sprint is no longer reporting Lifeline subscribers due to recent regulatory changes resulting in tighter program restrictions. We have excluded them from our customer base for all periods presented, including our Assurance Wireless prepaid brand and subscribers through our wholesale Lifeline mobile virtual network operators (MVNO). The table reflects the reclassification of the related Assurance Wireless prepaid revenue from Prepaid service revenue to Wholesale, affiliate and other revenue of $92 million and $275 million for the three and nine-month periods ended December 31, 2016, respectively. Revenue associated with subscribers through our wholesale Lifeline MVNO's continue to remain in Wholesale, affiliate and other revenue following this change. |

*FINANCIAL MEASURES

Sprint provides financial measures determined in accordance with GAAP and adjusted GAAP (non-GAAP). The non-GAAP financial measures reflect industry conventions, or standard measures of liquidity, profitability or performance commonly used by the investment community for comparability purposes. These measurements should be considered in addition to, but not as a substitute for, financial information prepared in accordance with GAAP. We have defined below each of the non-GAAP measures we use, but these measures may not be synonymous to similar measurement terms used by other companies.

Sprint provides reconciliations of these non-GAAP measures in its financial reporting. Because Sprint does not predict special items that might occur in the future, and our forecasts are developed at a level of detail different than that used to prepare GAAP-based financial measures, Sprint does not provide reconciliations to GAAP of its forward-looking financial measures.

The measures used in this release include the following:

EBITDA is operating income/(loss) before depreciation and amortization. Adjusted EBITDA is EBITDA excluding severance, exit costs, and other special items. Adjusted EBITDA Margin represents Adjusted EBITDA divided by non-equipment net operating revenues for Wireless and Adjusted EBITDA divided by net operating revenues for Wireline. We believe that Adjusted EBITDA and Adjusted EBITDA Margin provide useful information to investors because they are an indicator of the strength and performance of our ongoing business operations. While depreciation and amortization are considered operating costs under GAAP, these expenses primarily represent non-cash current period costs associated with the use of long-lived tangible and definite-lived intangible assets. Adjusted EBITDA and Adjusted EBITDA Margin are calculations commonly used as a basis for investors, analysts and credit rating agencies to evaluate and compare the periodic and future operating performance and value of companies within the telecommunications industry.

Postpaid ABPA is average billings per account and calculated by dividing postpaid service revenue earned from postpaid customers plus billings from installment plans and non-operating leases, as well as, operating lease revenue by the sum of the monthly average number of postpaid accounts during the period. We believe that ABPA provides useful information to investors, analysts and our management to evaluate average postpaid customer billings per account as it approximates the expected cash collections, including billings from installment plans and non-operating leases, as well as, operating lease revenue, per postpaid account each month.

Postpaid Phone ABPU is average billings per postpaid phone user and calculated by dividing service revenue earned from postpaid phone customers plus billings from installment plans and non-operating leases, as well as, operating lease revenue by the sum of the monthly average number of postpaid phone connections during the period. We believe that ABPU provides useful information to investors, analysts and our management to evaluate average postpaid phone customer billings as it approximates the expected cash collections, including billings from installment plans and non-operating leases, as well as, operating lease revenue, per postpaid phone user each month.

Free Cash Flow is the cash provided by operating activities less the cash used in investing activities other than short-term investments, including changes in restricted cash, if any, and excluding the sale-leaseback of devices and equity method investments. Adjusted Free Cash Flow is Free Cash Flow plus the proceeds from device financings and sales of receivables, net of repayments. We believe that Free Cash Flow and Adjusted Free Cash Flow provide useful information to investors, analysts and our management about the cash generated by our core operations and net proceeds obtained to fund certain leased devices, respectively, after interest and dividends, if any, and our ability to fund scheduled debt maturities and other financing activities, including discretionary refinancing and retirement of debt and purchase or sale of investments.

Net Debt is consolidated debt, including current maturities, less cash and cash equivalents, short-term investments and, if any, restricted cash. We believe that Net Debt provides useful information to investors, analysts and credit rating agencies about the capacity of the company to reduce the debt load and improve its capital structure.

SAFE HARBOR

This release includes “forward-looking statements” within the meaning of the securities laws. The words “may,” “could,” “should,” “estimate,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “target,” “plan”, “outlook,” “providing guidance,” and similar expressions are intended to identify information that is not historical in nature. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future - including statements relating to our network, cost reductions, connections growth, and liquidity; and statements expressing general views about future operating results - are forward-looking statements. Forward-looking statements are estimates and projections reflecting management’s judgment based on currently available information and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. With respect to these forward-looking statements, management has made assumptions regarding, among other things, the development and deployment of new technologies and services; efficiencies and cost savings of new technologies and services; customer and network usage; connection growth and retention; service, speed, coverage and quality; availability of devices; availability of various financings, including any leasing transactions; the timing of various events and the economic environment. Sprint believes these forward-looking statements are reasonable; however, you should not place undue reliance on forward-looking statements, which are based on current expectations and speak only as of the date when made. Sprint undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our company's historical experience and our present expectations or projections. Factors that might cause such differences include, but are not limited to, those discussed in Sprint Corporation’s Annual Report on Form 10-K for the fiscal year ended March 31, 2017. You should understand that it is not possible to predict or identify all such factors. Consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties.

About Sprint:

Sprint (NYSE: S) is a communications services company that creates more and better ways to connect its customers to the things they care about most. Sprint served 54.6 million connections as of December 31, 2017 and is widely recognized for developing, engineering and deploying innovative technologies, including the first wireless 4G service from a national carrier in the United States; leading no-contract brands including Virgin Mobile USA, Boost Mobile, and Assurance Wireless; instant national and international push-to-talk capabilities; and a global Tier 1 Internet backbone. Sprint has been named to the Dow Jones Sustainability Index (DJSI) North America for the past five years. You can learn more and visit Sprint at www.sprint.com or www.facebook.com/sprint and www.twitter.com/sprint.

###

[2] Average download speed increase based on Ookla’s analysis of Speedtest

Intelligence data comparing December 2016 to December 2017 for all mobile results.[1] after adjusting for hurricane and other non-recurring charges

564

368

61

378 385

53.3

53.6 53.7

54.0

54.6

3QFY16 4QFY16 1QFY17 2QFY17 3QFY17

Net Additions - In Thousands End of Period - In Millions

The company had 385,000 net additions in the current quarter compared with 564,000 in the year-

ago period and 378,000 net additions in the prior quarter.

Sprint ended the quarter with nearly 54.6 million connections, including 31.9 million postpaid, 9.0

million prepaid, and nearly 13.7 million wholesale and affiliate connections.

The company has had nearly 1.2 million net additions over the last four quarters.

405

(118)

(39)

168

256

3QFY16 4QFY16 1QFY17 2QFY17 3QFY17

Postpaid Net Additions (Losses)

In Thousands

Postpaid net additions were

256,000 during the quarter

compared to net additions of

405,000 in the year-ago period

and 168,000 in the prior quarter.

The year-over-year decline was

primarily driven by lower phone

net additions and partially offset

by higher other device net

additions, while the sequential

increase was primarily driven by

higher other device net additions.

1.57% 1.58%

1.50%

1.59%

1.71%

1.67%

1.75%

1.65%

1.72%

1.80%

3QFY16 4QFY16 1QFY17 2QFY17 3QFY17

Postpaid Phone Churn Postpaid Total Churn

Postpaid Total Churn and Postpaid Phone Churn

Postpaid phone churn of 1.71 percent compared

to 1.57 percent in the year-ago period and 1.59

percent in the prior quarter. Both the year-over-year

and sequential increases were driven by network

quality in certain areas within our footprint, and the

company’s decision to selectively manage both

higher ARPU customers and customers rolling off

device commitments in order to maximize the net

present value of the base. The sequential increase

was also impacted by typical seasonality.

Postpaid total churn of 1.80 percent for

the quarter compared to 1.67 percent in

the year-ago period and 1.72 percent in

the prior quarter. Both the year-over-year

and sequential increases were primarily

driven by higher postpaid phone churn.

The year-over-year increase was also

impacted by higher tablet churn as

customers rolled off promotional offers.

368

42

88

279

184

3QFY16 4QFY16 1QFY17 2QFY17 3QFY17

Postpaid Phone Net Additions

In Thousands

Postpaid phone net additions of

184,000 compared to net

additions of 368,000 in the year-

ago period and 279,000 in the

prior quarter. Both the year-over-

year and sequential decreases

were primarily driven by higher

churn. The company ended the

quarter with 26.6 million phone

connections.

Tablet and other device net additions of 72,000 in the quarter compared to net additions of 37,000

in the year-ago period and net losses of 111,000 in the prior quarter. Both the year-over-year and

sequential increases were primarily driven by the launch of the Apple watch. The company ended

the quarter with 5.3 million tablet and other device connections. The current quarter included

69,000 tablet net losses, compared to 30,000 in the year-ago period and 145,000 in the prior

quarter.

26.0 26.1 26.2 26.4 26.6

5.7 5.5 5.3 5.3 5.3

31.7 31.6 31.5 31.7 31.9

3QFY16 4QFY16 1QFY17 2QFY17 3QFY17

Phones Tablets and Other DevicesPostpaid Connections

In Millions

2.75 2.77

2.78 2.80

2.83

3QFY16 4QFY16 1QFY17 2QFY17 3QFY17

Average Postpaid Connections per AccountAverage postpaid connections

per account of 2.83 at quarter

end compared to 2.75 in the year-

ago period and 2.80 in the prior

quarter. The growth has been

driven by higher phones per

account, partially offset by tablet

pressure.

Wholesale & affiliate net

additions were 66,000 in the

quarter compared to

619,000 in the year-ago

period and 115,000 in the

prior quarter. The year-over-

year decline was primarily

impacted by lower

connected device net

additions, which generally

have a lower ARPU than

other wholesale & affiliate

customers.

Prepaid net additions of 63,000 during the quarter compared to net losses of 460,000 in the year-

ago period and net additions of 95,000 in the prior quarter. The year-over-year improvement was

mostly driven by lower churn and higher gross additions in the Boost brand. Sequentially, the

decrease was mostly driven by lower gross additions, partially offset by lower churn.

Prepaid churn was 4.63 percent compared to 5.74 percent for the year-ago period and 4.83 percent

for the prior quarter. The year-over-year improvement was mostly due to lower churn in the Boost

brand, while the sequential improvement was mostly driven by lower churn in the Virgin brand.

(460)

195

35

95 63

3QFY16 4QFY16 1QFY17 2QFY17 3QFY17

Prepaid Net Additions

In Thousands

4.8

3.5 3.7 3.9

4.9

2.3

2.5 2.3

2.5

2.4

7.1

6.0 6.0 6.4

7.3

3QFY16 4QFY16 1QFY17 2QFY17 3QFY17

Postpaid PrepaidRetail Activations

In Millions

Retail activations were 7.3

million during the quarter

compared to 7.1 million in the

year-ago period and 6.4

million in the prior quarter.

Year-over-year, the increase

was primarily driven by higher

prepaid gross additions and

postpaid phone upgrades.

Sequentially, the increase was

primarily driven by higher

postpaid phone upgrades.

9.0%

6.1%

6.8% 6.7%

9.2%

3QFY16 4QFY16 1QFY17 2QFY17 3QFY17

Postpaid Upgrades as a Percent of Total Postpaid Subscribers

Postpaid upgrade rate was 9.2 percent during the quarter compared to 9.0 percent for the year-

ago period and 6.7 percent for the prior quarter. The sequential increase was due to seasonality.

71%

74%

76% 78%

79%

3QFY16 4QFY16 1QFY17 2QFY17 3QFY17

Postpaid Phone Connections on Unsubsidized Service PlansPostpaid phone connections

on unsubsidized service plans

represented 79 percent of the

base at the end of the quarter,

compared to 71 percent in the

year-ago period and 78 percent

in the prior quarter.

Postpaid device financing rate was 84 percent of postpaid activations for the quarter compared

to 80 percent for the year-ago period and 85 percent in the prior quarter. At the end of the quarter,

45 percent of the postpaid connection base was active on a leasing agreement compared to 38

percent in the year-ago quarter and 42 percent in the prior quarter.

Postpaid phone financing rate was 89 percent of phone activations for the quarter compared to

84 percent for the year-ago period and 89 percent in the prior quarter.

Postpaid carrier aggregation

capable phones, which allow

for higher download data

speeds, were 94 percent of

postpaid phones activated

during the quarter, increasing

the number of these phones

within the phone base to 72

percent.

80% 82%

85% 85% 84%

84% 86%

89% 89% 89%

3QFY16 4QFY16 1QFY17 2QFY17 3QFY17

Total Financed Percentage of Activations

Phone Financed Percentage of Phone Activations

Postpaid Device

Financing

Upgrade existing towers to leverage all three of the company’s spectrum bands – 800 MHz,

1.9 GHz and 2.5 GHz – for faster, more reliable service.

Build thousands of new cell sites to expand its coverage footprint and extend coverage to

more popular customer destinations.

Add more small cells -- including Sprint Magic Boxes, mini-macros and strand mounts to

densify every major market and significantly boost capacity and data speeds – and leverage

the recent strategic agreements with Altice and Cox. The company has already deployed

more than 80,000 Sprint Magic Boxes in approximately 200 cities across the country and

plans to deploy more than 1 million as part of its multi-year roadmap.

Deploy game-changing 64T64R Massive MIMO 2.5 GHz radios to increase capacity up to 10

times that of current LTE systems and increase data speeds for more customers in high-

traffic locations. Massive MIMO, a key enabler for 5G, will allow the company to support both

LTE and 5G NR (New Radio) modes simultaneously without additional tower climbs.

Sprint’s network has already seen significant improvements. According to Ookla Speedtest

Intelligence data, Sprint was the most improved operator in 2017 with a 60 percent year-over-year

increase in its national average download speed.1

1 Average download speed increase based on Ookla’s analysis of Speedtest Intelligence data comparing December 2016 to December 2017 for

all mobile results.

Average Download Speed Change1

Dec. ‘16 to Dec. ‘17

Sprint is unlocking the value of the

largest mobile broadband spectrum

holdings in the U.S. and Sprint’s Next-Gen

Network is designed to drive significant

improvements to network performance

and the customer experience by

investing in four main areas.

$8.5 $8.5 $8.2 $7.9 $8.2

3QFY16 4QFY16 1QFY17 2QFY17 3QFY17

Net Operating Revenues

Dollars In Billions

Net operating revenues of $8.2 billion for the quarter declined $310 million year-over-year and

increased $312 million sequentially. The year-over-year decrease was mostly driven by lower

wireless and wireline service revenue, partially offset by higher equipment revenue. Sequentially,

the increase was primarily driven by higher equipment revenue.

Wireless service revenue of $5.6 billion declined $327 million year-over-year and $30 million

sequentially. Over half of the year-over-year decrease was driven by changes to the company’s

device insurance program, which were accretive to Adjusted EBITDA* but resulted in lower

insurance revenue as the program revenue is accounted for and presented on a net basis. The year-

over-year reduction was also impacted by lower postpaid phone ARPU, partially offset by growth in

the postpaid phone customer base. Sequentially, wireless service revenue was relatively flat.

Equipment revenue of $2.3 billion increased $83 million year-over-year and increased $349 million

sequentially. The year-over-year growth was driven by increased sales of used devices to third

parties and higher lease revenue, and was partially offset by a lower mix of installment billing sales,

which recognize more revenue at the point of sale relative to leasing sales. Sequentially, the increase

was mostly driven by higher postpaid sales volume, higher average unit prices, and growth in lease

revenue. Sales of used devices to third parties, which have a corresponding impact to cost of

products expense and are relatively neutral to Adjusted EBITDA*, were in line with recent quarters.

Wireline revenues of $393 million for the quarter declined $104 million year-over-year and $16

million sequentially. The year-over-year and sequential declines were primarily driven by lower voice

volumes, as the company continues to de-emphasize certain voice services. The year-over-year

decline was also impacted by the annual process of resetting the intercompany rate, based on

current market prices for voice and IP services sold to the wireless segment.

$71.77

$68.66 $69.51 $68.95 $68.54

3QFY16 4QFY16 1QFY17 2QFY17 3QFY17

Service Equipment

Postpaid Phone Average Billings Per User

(ABPU)*

Postpaid Phone Average Billings Per

User (ABPU)* of $68.54 for the quarter

decreased 5 percent year-over-year

and less than 1 percent sequentially.

The year-over-year decline was

primarily due to lower insurance

revenue resulting from the change in

the company’s device insurance

program, which was accretive to

Adjusted EBITDA*, promotions, and

hurricane-related credits. Normalizing

for the device insurance program

change and hurricane-related credits,

ABPU* would have decreased less

than 1% year-over-year.

$985 $982 $999 $990 $993

3QFY16 4QFY16 1QFY17 2QFY17 3QFY17

Prepaid Service Revenue

Dollars In Millions

Prepaid Service Revenue of $993 million increased $8

million year-over-year and $3 million sequentially. When

adjusting for the removal of low-engagement

customers from the base in the third fiscal quarter of

2016, relatively stable ARPU combined with four

straight quarters of net additions have led to year-over-

year growth in prepaid service revenue for the first time

in nearly three years.

Prepaid Average Revenue Per

User (ARPU) of $37.46 for the

quarter increased 10 percent

year-over-year and decreased 1

percent sequentially. The year-

over-year increase was primarily

driven by a change in the

company’s churn rules resulting in

the removal of low-engagement

customers from the base in the

third fiscal quarter of 2016.

/--------------------------Normalized--------------------------/

$1.9

$1.7 $1.7 $1.7 $1.7

3QFY16 4QFY16 1QFY17 2QFY17 3QFY17

Cost of Services

Dollars In Billions

Cost of services (CoS) of $1.7 billion

for the quarter decreased $192

million year-over-year and increased

$35 million sequentially. The current

quarter included non-recurring

charges of $51 million related to a

regulatory fee matter and $30 million

related to hurricane expenses.

Adjusting for these impacts, the year-

over-year decline would have been

approximately $273 million, primarily

driven by changes to the company’s

device insurance program, as the

program revenue is accounted for

and reported on a net basis and

related expenses are no longer

incurred by Sprint, as well as lower

network expenses. Sequentially, cost

of services would have decreased

approximately $31 million when

adjusting for the aforementioned

charges.

$2.1

$2.0

$1.9

$2.0

$2.1

3QFY16 4QFY16 1QFY17 2QFY17 3QFY17

Selling, General, and Administrative

Dollars In Billions

Selling, general and administrative

expenses (SG&A) of $2.1 billion for the

quarter increased by $28 million year-

over-year and $95 million sequentially.

The year-over-year increases in

prepaid marketing and sales as well as

general and administrative expenses

were mostly offset by lower bad debt

expenses related to a decrease in

installment billing sales. Sequentially,

the increases were mostly driven by

seasonally higher postpaid sales and

marketing expenses.

YTD in CoS and SG&A*

year-over-year

$1.0 $1.0 $1.0 $1.0 $1.0

$0.8 $0.9 $0.9 $0.9 $1.0

$0.3 $0.2 $0.2 $0.2

$0.2

$2.1 $2.1 $2.1 $2.1 $2.2

3QFY16 4QFY16 1QFY17 2QFY17 3QFY17

Network and Other

Leased Devices

Amortization

Depreciation and

Amortization

Dollars In Billions

$2.0 $2.0

$1.5 $1.4

$1.7

3QFY16 4QFY16 1QFY17 2QFY17 3QFY17

Cost of Products

Dollars In Billions

Cost of products of $1.7 billion for

the quarter decreased $312 million

year-over-year and increased $269

million sequentially. The year-over-

year decrease was impacted by a

lower mix of installment billing

sales, and was partially offset by

more sales of used devices to third

parties. The sequential increase

was impacted by higher postpaid

sales volume and higher average

unit costs.

Depreciation and amortization expense of $2.2 billion for the

quarter increased $81 million year-over-year and $79 million

sequentially. Leased device depreciation was $990 million in the

quarter, $837 million in the year-ago period, and $888 million in

the prior quarter.

Other, net in the current

quarter represented a net

benefit of $175 million,

primarily resulting from $343

million associated with

favorable legal settlements

for patent infringement

lawsuits net of legal fees,

partially offset by $32 million

in litigation and other

contingencies expense, $13

million in severance and exit

costs, and $123 million in

loss on leased devices, the

latter of which impacted

Adjusted EBITDA*.

$0.3

$0.5

$1.2

$0.6

$0.7

3QFY16 4QFY16 1QFY17 2QFY17 3QFY17

Operating Income

Dollars In Billions

Operating income of $727 million

compared to $311 million in the year-

ago period and $601 million in the

prior quarter. The current quarter

included $343 million in favorable

settlements for patent infringement

lawsuits net of legal fees, $66 million of

hurricane-related impacts, a $51

million charge related to a regulatory

fee matter, $32 million litigation and

other contingencies expense, and $13

million in severance and exit costs. The

year-ago period included $47 million

primarily related to asset dispositions

and severance costs, while the prior

quarter included $34 million of

hurricane-related impacts. Adjusting

for items in each period, operating

income would have improved by

approximately $190 million year-over-

year and declined approximately $90

million sequentially.

$2.5

$2.7

$2.9

$2.7 $2.7

3QFY16 4QFY16 1QFY17 2QFY17 3QFY17

Adjusted EBITDA*

Dollars In Billions

Adjusted EBITDA* was $2.7 billion

for the quarter, compared to $2.5

billion in the year-ago period and

$2.7 billion in the prior quarter. The

year-over-year improvement was

primarily due to lower cost of

services and cost of products

expenses, partially offset by lower

operating revenues. Sequentially

higher equipment revenues offset

higher cost of products expenses.

Net income of $7.2 billion for the quarter compared to

a net loss of $479 million in the year-ago period and a

net loss of $48 million in the prior quarter.

The current quarter included a $7.1 billion non-cash

income tax benefit resulting from a re-measurement of

the company’s deferred tax assets and liabilities due to

changes in tax laws included in the Tax Cuts and Jobs

Act, which was enacted into law in December 2017.

Excluding tax reform, hurricane-related impacts, and

other non-recurring items, the net loss would have

improved by approximately $300 million year-over-year.

$0.7

$1.3 $1.3

$2.0

$1.2

3QFY16 4QFY16 1QFY17 2QFY17 3QFY17

Cash Provided by Operating Activities

Dollars In Billions

Adjusted free cash flow* of $397

million for the quarter compared to

negative $646 million in the year-

ago period and $420 million in the

prior quarter. The year-over-year

improvement was primarily driven

by higher net proceeds of

financings related to devices and

receivables and higher cash

provided by operating activities,

partially offset by higher network

capital expenditures. Sequentially,

higher net proceeds of financings

related to devices and receivables

was offset by lower cash provided

by operating activities.

Cash provided by operating

activities of $1.2 billion for the

quarter compared to $650 million in

the year-ago period and $2.0 billion

in the prior quarter. Both the year-

over-year and sequential changes

benefitted from a cash settlement

related to a patent infringement

lawsuit. In addition, the year-over-

year increase was driven by

improvements in Adjusted EBITDA*,

while the sequential decrease was

primarily driven by unfavorable

working capital changes.

Cash capital expenditures were $1.4 billion in the quarter compared to $1.2 billion in the year-

ago period and $1.3 billion in the prior quarter. The year-over-year increase was driven by higher

capital expenditures for network equipment. Capital expenditures for leased devices were $682

million in the current quarter compared to $767 million in the year-ago period and $608 million in

the prior quarter.

($646)

$80

$239

$420 $397

3QFY16 4QFY16 1QFY17 2QFY17 3QFY17

Adjusted Free Cash Flow *

Dollars In Millions

2.7

4.6

1.8

0.8

0.4

3.2

0.5

0.4

Liquidity as of

12/31/17

Current Maturities**

Cash, Cash Equiv, Short-Term Investments Revolver

Network Equipment Financing

Receivables/Device Financing

Vendor Financing Note Maturities

Other

** Includes maturities due through December 2018.

Liquidity and Debt

Dollars In Billions

$10.4 of

General

Purpose

Liquidity

$ 4.0

$ 10.8

Unsecured Credit Facility Commitment

Total general purpose liquidity was $10.4 billion at the end of the quarter, including $4.6 billion

of cash, cash equivalents and short-term investments. Additionally, the company has approximately

$427 million of availability under vendor financing agreements that can be used toward the

purchase of 2.5GHz network equipment.

excluding devices

leased through

indirect channels

Wireless Operating Statistics (Unaudited)

Quarter To Date

12/31/17 9/30/17 12/31/16 12/31/17 12/31/16

Net additions (losses) (in thousands)

Postpaid 256 168 405 385 929

Postpaid phone 184 279 368 551 888

Prepaid (f ) 63 95 (460) 193 (1,215)

Wholesale and affiliate (f ) 66 115 619 246 2,051

Total wireless net additions 385 378 564 824 1,765

End of period connections (in thousands)

Postpaid (d) (e) 31,942 31,686 31,694 31,942 31,694

Postpaid phone (d) 26,616 26,432 26,037 26,616 26,037

Prepaid (d) (f ) (g) (h) (i) 8,997 8,765 8,493 8,997 8,493

Wholesale and affiliate (d) (f ) (h) 13,642 13,576 13,084 13,642 13,084