Today's Top Supply Chain and Logistics News From WSJ

February 02 2018 - 7:02AM

Dow Jones News

By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

Trucking's capacity crunch is starting to squeeze earnings

across corporate America. Companies including candy sellers,

pharmaceutical distributors and agriculture suppliers have been

pointing to higher shipping costs that shaved profits in the most

recent quarter, and the WSJ's Austen Hufford writes that several

businesses say they are girding for still higher costs this year.

Tight trucking capacity is only part of the story: Shippers

including Prestige Brand Holdings Inc. and Hershey Co. also point

to pressures from higher warehousing costs and rising diesel fuel

prices that are trimming margins. Cardboard maker Packaging Corp.

of America says higher shipping costs sliced 4 cents a share from

its adjusted fourth-quarter profit. The companies are moving faster

to tap into growing U.S. and global economies but the

transportation costs probably haven't peaked yet. While truckers

are adding capacity, they're also setting plans to embed the higher

rates in the spot market into new shipping contracts this year.

United Parcel Service Inc. is trying to ensure it isn't caught

short-handed again by unexpected surges in volume. The parcel giant

is scaling up its capital spending to $7 billion this year, the

WSJ's Paul Ziobro reports. The company is moving to bolster its

operations in the air and on the ground after a tough fourth

quarter that saw the company whip-sawed between fast-rising demand

and the soaring costs of handling a flood of packages. UPS says it

spent an extra $125 million as it scrambled to lease trucks and

planes while clearing away backlogs early in the peak season. The

company's overall operating profit rose 3.2% in the fourth quarter,

well behind the 11% gain in revenue. New upgrades include expanded

automation at sorting centers and 18 jumbo jets, including 14

Boeing Co. 747-8 freighters. That will give UPS more capacity to

handle any growth in the near future, and it will speed up an

digital commerce-driven overhaul of U.S. distribution networks.

Amazon.com Inc. is starting to focus on reining back costs now

that it's built an online juggernaut. The Seattle company's

quarterly profit during the all-important holiday quarter topped $1

billion for the first time, as Amazon demonstrated a stronger

fiscal discipline that it plans to extend this year. The WSJ's

Laura Stevens reports the strong performance came with better

efficiency at the company's burgeoning network of fulfillment

centers, and that Chief Financial Officer Brian Olsavsky expects

more cost cutting and productivity moves, "specifically in our

warehouses." The company is still expanding at a rapid rate, but

revenue growth in the fourth quarter still outpaced costs, while

the 31% increase in shipping expenses was slower than the growth in

recent quarters -- a notable achievement during the busy holiday

period. Shipping costs have more than doubled in three years but

Amazon now wants to keep its sales expanding at a fast pace while

pulling back the cost of getting goods to customers.

E-COMMERCE

China's biggest digital commerce business wants to use its

online payment operation to open doors to the physical retail

world. Alibaba Group Holding Ltd. is taking a 33% stake in its

financial services affiliate Ant Financial Services Group, a move

that could set up the payments operation for a public offering and

signals broader changes as Alibaba expands and redraws its digital

commerce platform. The WSJ's Liza Lin reports that the tighter

tie-up with Ant may allow Alibaba to build up services such as

mobile payments and linking them to traditional brick-and-mortar

businesses. It would also give Alibaba more firepower to expand in

overseas markets such as India, Japan and South Korea, where

payment methods are a critical piece of online retail sales. Its

expansion into physical retail business is expensive, as well.

Alibaba put $2.9 billion in Chinese big-box retailer Sun Art Retail

last year, and more investments likely are on the way.

QUOTABLE

IN OTHER NEWS

U.S. worker productivity grew below its long-run average for the

seventh straight year in 2017. (WSJ)

The U.S. manufacturing sector maintained its momentum in

January. (WSJ)

U.S. car sales rose 1% in January in an underwhelming start to

the year. (WSJ)

Apple Inc. is lowering sales expectations after higher iPhone

prices helped deliver record revenue and profit in the past

quarter. (WSJ)

Consumer-goods supplier Unilever PLC bucked a trend roiling its

American rivals by selling more products at higher prices in the

fourth quarter. (WSJ)

Mattel Inc. posted a steep sales decline during the key holiday

quarter. (WSJ)

Lenovo Group Ltd. says a semiconductor shortage that weighed on

its supply chain last year is easing. (WSJ)

Tesla Inc. sold $546 million of bonds backed by vehicle lease

payments, extending a search for cash to ramp up production of its

mass-market sedan. (WSJ)

A federal study shows a widely-accepted industry estimate of U.

S. truck driver jobs could be over-stated by as much as 40%.

(Trucks.com)

Sears Holdings Corp. laid off about 220 employees at its

corporate headquarters. (Chicago Tribune)

Canadian grocer Metro Inc. says its buy of meal-kit company

MissFresh drove more traffic to its stores in last quarter.

(Financial Post)

Norway's DNB Bank cut it bad loan portfolio by $1 billion as

shipping and offshore markets started turning around. (Shipping

Watch)

China will expand freight rail capacity by 5% this year to

ensure flow of coal supplies. (Reuters)

BNSF Railway will hold its capital spending steady this year at

$3.3 billion. (Railway Age)

Workers at three Cargill soy processing plants and ports in

Argentina went on strike. (World-Grain)

Toyota Motor Corp. is moving to a cloud-based supply-chain

management system called RapidResponse. (Automotive Logistics)

Global air freight volume rose 9% in 2017, three times more than

capacity growth, the International Air Transportation says. (Air

Transport World)

Roadrunner Transportation Systems Inc. issued re-stated

financial reports that included a $360 million net loss for 2016.

(DC Velocity)

Truck-trailer volume in U.S. intermodal operations jumped 12.2%

in the fourth quarter. (Logistics Management)

Massachusetts-based Road One IntermodaLogistics is merging with

North Carolina-based Robin Hood Container Express. (Fleet

Owner)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin , @jensmithWSJ and @EEPhillips_WSJ. Follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

February 02, 2018 06:47 ET (11:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

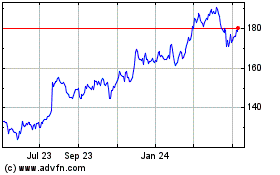

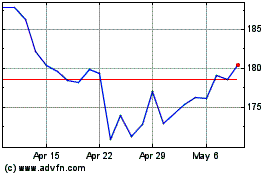

Packaging (NYSE:PKG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Packaging (NYSE:PKG)

Historical Stock Chart

From Apr 2023 to Apr 2024