National Grid Expects $2 Billion Tax Credit After U.S. Tax Reform

February 02 2018 - 2:55AM

Dow Jones News

By Maryam Cockar

National Grid PLC (NG.LN) said Friday that it estimates it will

have a non-cash tax credit of around $2 billion in fiscal 2018

following tax reform in the U.S.

The electricity utility said the tax credit will be reflected as

an exceptional item and is expected to be returned to customers

over a period of 20 to 30 years.

The company said there will be no other material impact on

results for the year ending March 31. It said that overall U.S. tax

reform will be positive for its U.S. customers and economically

neutral for the company.

National Grid said the total yearly revenue increase from the

Niagara Mohawk Electric & Gas business and its gas entities in

Massachusetts and Rhode Island is estimated to reduce by $130

million in fiscal 2019. The company said the reduction in revenue

will be offset by a corresponding reduction in the tax charge.

U.S. tax reform includes a reduction of the corporate-tax rate

to 21% from 35% and limits on the deductibility of corporate

interest payments.

Write to Maryam Cockar at maryam.cockar@dowjones.com

(END) Dow Jones Newswires

February 02, 2018 02:40 ET (07:40 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

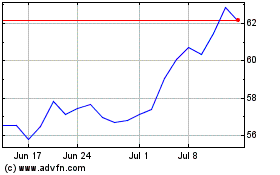

National Grid (NYSE:NGG)

Historical Stock Chart

From Mar 2024 to Apr 2024

National Grid (NYSE:NGG)

Historical Stock Chart

From Apr 2023 to Apr 2024