By Mark DeCambre and Victor Reklaitis, MarketWatch

Apple earnings on deck after the closing bell

U.S. stock indexes lost some momentum Thursday afternoon, but

still held their ground in positive territory as gains in energy

and financials helped buoy the broader market.

Concerns about a pick up in inflation and rising bond yields

against equities that have almost relentlessly risen to records

have fostered a new era of emerging volatility on Wall Street.

What are the main benchmarks doing?

The Dow Jones Industrial Average was up 70 points, or 0.3%, to

26,219, well off its opening nadir at 26,014, when the average was

down by 135 points. Shares of Boeing Co..(BA) and shares of Walt

Disney Co.(DIS) were contributing about 50 points to the blue-chip

gauge.

Meanwhile, the S&P 500 index added about 6 points, or 0.2%,

to 2,829.

The Nasdaq Composite Index , meanwhile, was up 11 points, or

0.1%, at about 7,421.

On Wednesday, the Dow rose by 72.50 points, or 0.3%

(http://www.marketwatch.com/story/dow-set-to-stabilize-after-shedding-540-points-in-2-days-2018-01-31),

while the S&P and Nasdaq Composite inched higher. The moves

came as the Federal Reserve kept a key interest rate steady but

signaled it's on course to hike rates

(http://www.marketwatch.com/story/fed-takes-step-toward-rate-hike-as-baton-set-to-pass-to-powell-2018-01-31)

at its meeting next month.

Check out:Here's how the Dow, S&P 500 tend to perform after

a rip-roaring January

(http://www.marketwatch.com/story/heres-how-the-dow-sp-500-tend-to-perform-after-a-rip-roaring-january-2018-01-31)

What are driving markets?

Market participants say fears of resurgent inflation, which has

been sluggish and hanging below the Federal Reserve's 2% annual

target, are beginning to resurface and rattle investors. Signs of

tightness in the labor market, implies that wage growth, and rises

prices might pick up sooner than Wall Street has been expecting,

compelling the Fed to accelerate its pace of interest-rate

hikes.

Fridays job report will be closely pored over to determine if

the unemployment rate falls below 4% and an increase in wage, both

factors would point to a resurgence of rising prices.

What are strategists saying?

"The market doesn't seem to know which way it wants to go right

now," said Randy Frederick, vice president for trading and

derivatives at the Schwab Center for Financial Research.

"Labor shortages all of sudden could mean that inflationary

pressures are showing their teeth," he said. Rising inflation is

bad for bonds because it undercuts a bond's fixed value and can

lead to selling, pushing yields higher. Bond prices move inversely

to yields.

"And we are already seeing yields rise and obviously that

creates problems for equities and that could potentially stifle

earnings," he said.

Robert Pavlik, chief investment strategist at SlateStone Wealth

LLC, said reflationary fears, as the 10-year Treasury yield rises

to a fresh three-year high above 2.75%, may be causing

concerns.

"I think the market has been sniffing around for something to

get concerned about and I think that the more directionless trade

is the more you worry about inflation," he said.

"The Federal Reserve has given us a clear message that, barring

some sort of collapse in sentiment over the next few weeks, March

is good to go to lift the fed-funds rate," said Chris Weston, chief

market strategist at IG.

"The narrative perhaps even throws weight to the camp that we

would see hikes in the August, September and December meetings,

too," he said in a note.

What data are in focus?

The number of people who applied for unemployment benefits in

late January fell by 1,000 to 230,000

(http://www.marketwatch.com/story/jobless-claims-fall-slightly-to-230000-layoffs-extremely-low-2018-02-01),

keeping initial U.S. jobless claims near a 45-year low. Economists

polled by MarketWatch had forecast a 240,000 reading in the seven

days ended Jan. 27.

Meanwhile, the productivity of U.S. firms and workers fell

(http://www.marketwatch.com/story/us-productivity-dips-01-in-fourth-quarter-ends-2017-on-sour-note-2018-02-01)

at a 0.1% annual pace in the fourth quarter. Economists polled by

MarketWatch forecast a 0.2% gain.

The Institute for Supply Management

(https://www.instituteforsupplymanagement.org/ISMReport/MfgROB.cfm?navItemNumber=31000&SSO=1)said

its manufacturing index in January slipped to 59.1% from 59.3% in

December. Economists polled by MarketWatch expected a reading of

58.6%. The IHS Markit manufacturing reading showed that final U.S.

PMI steady at 55.5 in January from flash estimates.

Separately, the Commerce Department reported a 0.7% gain in

construction spending

(http://www.marketwatch.com/story/construction-spending-climbs-for-fifth-month-to-new-record-2018-02-01)

in December, and a 2.6% advance over the last 12 months. That is

the fifth monthly gain in a row and a record high.

Detroit auto makers on Thursday reported underwhelming U.S. auto

sales in January

(http://www.marketwatch.com/story/car-makers-post-lackluster-us-january-sales-2018-02-01),

signaling car industry volumes will get off to a relatively muted

start even as the broader economy is strong.

Check out:MarketWatch's Economic Calendar

(http://www.marketwatch.com/economy-politics/calendars/economic)

On the Federal Reserve front, San Francisco Fed President John

Williams is due to give a speech at The City Club in San Francisco

at 3:30 p.m. Eastern.

Which stocks look like key movers?

Shares of online auctioneer eBay Inc.(EBAY) rose more than 15%

after announcing that it plans to take over crucial

payments-processing duties

(http://www.marketwatch.com/story/ebay-breaks-up-with-paypal-again-stock-soars-as-paypal-shares-dive-2018-01-31)

from PayPal Holdings Inc.(PYPL) as it posted quarterly earnings

(http://www.marketwatch.com/story/paypal-stock-falls-after-fourth-quarter-earnings-2018-01-31).

Shares of PayPal were off 6.3%.

Qorvo Inc.'s stock (QRVO) was up 15% after it reported quarterly

revenue that was better than expected

(https://www.barrons.com/articles/qorvo-stock-already-reflects-weak-apple-results-says-drexel-1517437350).

The company, an Apple supplier, was created by the merger of

TriQuint Semiconductor and RF Micro Devices.

Facebook Inc.'s stock (FB) was 3.7% higher after the social

media giant late Wednesday reported double-digit advertising price

growth

(http://www.marketwatch.com/story/facebook-earnings-stock-touches-record-after-massive-ad-price-increase-2018-01-31)

amid massive changes to its core product. Shares initially dropped

as the company's release revealed a decline in usage of its

platform.

Check out:Facebook's 'powerful' ad business means it's time to

buy--analysts react to earnings

(http://www.marketwatch.com/story/facebooks-powerful-ad-business-means-its-time-to-buy-analysts-react-to-earnings-2018-02-01)

Apple Inc. shares (AAPL) were off less than 0.1% ahead of the

tech giant's report after the closing bell.

See:The $1,000 iPhone X remains the story as Apple's earnings

arrive

(http://www.marketwatch.com/story/apple-earnings-forget-taxes-and-batteries-the-1000-iphone-x-remains-the-story-2018-01-26)

Microsoft Corp.'s stock (MSFT) was up 0.1% after the software

heavyweight posted better-than-expected earnings

(http://www.marketwatch.com/story/shares-of-microsoft-slide-as-software-giant-reports-a-quarterly-loss-on-tax-cuts-2018-01-31).

Shares of Fiat Chrysler Automobiles NV(FCA.MI) slipped 0.1% in

morning trade

(http://www.marketwatch.com/story/fiat-chryslers-stock-falls-as-us-vehicles-sales-drop-sharply-2018-02-01)Thursday,

after the auto maker reported a sharp drop in U.S. vehicle sales in

January. Total sales declined 13% to 132,803 vehicles, as Chrysler

brand sales dropped 21%.

Shares of Hershey Co.(HSY) were down 5.9% after the

confectionery maker reported fourth-quarter net income of $181.1

million

(http://www.marketwatch.com/story/hershey-earnings-and-sales-miss-consensus-2018-02-01),

or 85 cents per share, up from $116.9 million, or 55 cents per

share, for the same period last year.

First Take:Microsoft earnings show Nadella is blazing the right

path

(http://www.marketwatch.com/story/microsoft-earnings-show-nadella-is-blazing-the-right-path-2018-01-31)

What are other assets doing?

European stocks ended firmly lower

(http://www.marketwatch.com/story/european-stocks-break-3-day-losing-run-after-solid-finance-tech-earnings-2018-02-01),

while Asian markets closed mixed. Gold futures edged modestly

higher

(http://www.marketwatch.com/story/gold-slips-finds-little-traction-in-feds-inflation-view-2018-02-01),

as oil futures advanced

(http://www.marketwatch.com/story/oil-resumes-climb-on-us-gasoline-demand-2018-02-01-81031226).

The ICE U.S. Dollar Index was dipping.

(END) Dow Jones Newswires

February 01, 2018 13:52 ET (18:52 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

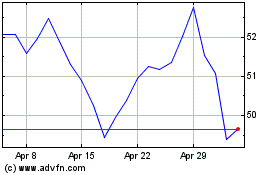

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

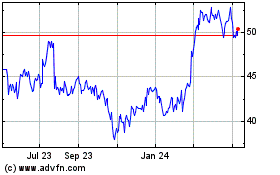

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Apr 2023 to Apr 2024