By Mark DeCambre and Victor Reklaitis, MarketWatch

Apple earnings on deck after the closing bell

U.S. stock benchmarks struggled for direction Thursday,

underlining what may be a new era of emerging volatility on Wall

Street as investors weigh concerns about pick up in inflation and

rising bond yields against equities that have almost relentlessly

risen to records.

What are the main benchmarks doing?

The Dow Jones Industrial Average were down 31 points, or 0.1%,

to 26,117, well off its opening nadir at 26,014, when the average

was down by 135 points. Shares of Boeing Co.(BA) were contributing

about 30 points to the blue-chip gauge.

Meanwhile, the S&P 500 index retreated 2 points, or 0.1%, to

2,821, with telecommunications, consumer staples, utilities and

materials sectors all down firmly.

The Nasdaq Composite Index , meanwhile, traded flat to slightly

higher at about 7,420.

On Wednesday, the Dow rose by 72.50 points, or 0.3%

(http://www.marketwatch.com/story/dow-set-to-stabilize-after-shedding-540-points-in-2-days-2018-01-31),

while the S&P and Nasdaq Composite inched higher. The moves

came as the Federal Reserve kept a key interest rate steady but

signaled it's on course to hike rates

(http://www.marketwatch.com/story/fed-takes-step-toward-rate-hike-as-baton-set-to-pass-to-powell-2018-01-31)

at its meeting next month.

Check out:Here's how the Dow, S&P 500 tend to perform after

a rip-roaring January

(http://www.marketwatch.com/story/heres-how-the-dow-sp-500-tend-to-perform-after-a-rip-roaring-january-2018-01-31)

What are driving markets?

Market participants say fears of resurgent inflation, which has

been sluggish and hanging below the Federal Reserve's 2% annual

target, is beginning to resurface and rattle investors. Signs of

tightness in the labor market, implies that wage growth, and

inflation might pick up sooner than Wall Street has been expecting,

compelling the Fed to accelerate its pace of interest-rate

hikes.

Fridays job report will be closely pored over to determine if

the unemployment rate falls below 4% and an increase in wage, both

factors would point to a resurgence of rising prices.

What are strategists saying?

Robert Pavlik, chief market strategist at Boston Private Wealth,

said reflationary fears, as the 10-year Treasury yield rises to a

fresh three-year high above 2.75%, may be causing concerns. He also

said that signs that inflation may be rearing up has been rattling

investors.

"I think the market has been sniffing around for something to

get concerned about and I think that the more directionless trade

is the more you worry about inflation," he said.

"The market doesn't seem to know which way it wants to go right

now," said Randy Frederick,vice president for trading and

derivatives at the Schwab Center for Financial Research.

"Labor shortages all of sudden could mean that inflationary

pressures are showing their teeth," he said. Rising inflation is

bad for bonds because it undercuts a bond's fixed value and can

lead to selling, pushing yields higher. Bond prices move inversely

to yields.

"And we are already seeing yields rise and obviously that

creates problems for equities and that could potentially stifle

earnings," he said.

"The Federal Reserve has given us a clear message that, barring

some sort of collapse in sentiment over the next few weeks, March

is good to go to lift the fed funds rate," said Chris Weston, chief

market strategist at IG.

"The narrative perhaps even throws weight to the camp that we

would see hikes in the August, September and December meetings,

too," he said in a note.

What data are in focus?

The number of people who applied for unemployment benefits in

late January fell by 1,000 to 230,000

(http://www.marketwatch.com/story/jobless-claims-fall-slightly-to-230000-layoffs-extremely-low-2018-02-01),

keeping initial U.S. jobless claims near a 45-year low. Economists

polled by MarketWatch had forecast a 240,000 reading in the seven

days ended Jan. 27.

Meanwhile, the productivity of U.S. firms and workers fell

(http://www.marketwatch.com/story/us-productivity-dips-01-in-fourth-quarter-ends-2017-on-sour-note-2018-02-01)

at a 0.1% annual pace in the fourth quarter. Economists polled by

MarketWatch forecast a 0.2% gain.

The Institute for Supply Management

(https://www.instituteforsupplymanagement.org/ISMReport/MfgROB.cfm?navItemNumber=31000&SSO=1)said

its manufacturing index in January slipped to 59.1% from 59.3% in

December. Economists polled by MarketWatch expected a reading of

58.6%. The IHS Markit manufacturing reading showed that final U.S.

PMI steady at 55.5 in January from flash estimates.

Separately, the Commerce Department reported a 0.7% gain in

construction spending

(http://www.marketwatch.com/story/construction-spending-climbs-for-fifth-month-to-new-record-2018-02-01)

in December, and a 2.6% advance over the last 12 months. That's the

fifth monthly gain in a row and a record high.

Detroit auto makers on Thursday reported underwhelming U.S. auto

sales in January

(http://www.marketwatch.com/story/car-makers-post-lackluster-us-january-sales-2018-02-01),

signaling car industry volumes will get off to a relatively muted

start even as the broader economy is strong.

Check out:MarketWatch's Economic Calendar

(http://www.marketwatch.com/economy-politics/calendars/economic)

On the Federal Reserve front, San Francisco Fed President John

Williams is due to give a speech at The City Club in San Francisco

at 3:30 p.m. Eastern.

Which stocks look like key movers?

Shares of online auctioneer eBay Inc.(EBAY) rose 14% after

announcing that it plans to take over crucial payments-processing

duties

(http://www.marketwatch.com/story/ebay-breaks-up-with-paypal-again-stock-soars-as-paypal-shares-dive-2018-01-31)

from PayPal Holdings Inc.(PYPL) as it posted quarterly earnings

(http://www.marketwatch.com/story/paypal-stock-falls-after-fourth-quarter-earnings-2018-01-31).

Shares of PayPal were off 8.4%, meanwhile.

Qorvo Inc.'s stock (QRVO) was up 16% after it reported quarterly

revenue that was better than expected

(https://www.barrons.com/articles/qorvo-stock-already-reflects-weak-apple-results-says-drexel-1517437350).

The company, an Apple supplier, was created by the merger of

TriQuint Semiconductor and RF Micro Devices.

Facebook Inc.'s stock (FB) was 3% higher after the social media

giant late Wednesday reported double-digit advertising price growth

(http://www.marketwatch.com/story/facebook-earnings-stock-touches-record-after-massive-ad-price-increase-2018-01-31)

amid massive changes to its core product. Shares initially dropped

as the company's release revealed a decline in usage of its

platform.

Check out:Facebook's 'powerful' ad business means it's time to

buy -- analysts react to earnings

(http://www.marketwatch.com/story/facebooks-powerful-ad-business-means-its-time-to-buy-analysts-react-to-earnings-2018-02-01)

Apple Inc. shares (AAPL) were off less than 0.1% ahead of the

tech giant's report after the closing bell.

See:The $1,000 iPhone X remains the story as Apple's earnings

arrive

(http://www.marketwatch.com/story/apple-earnings-forget-taxes-and-batteries-the-1000-iphone-x-remains-the-story-2018-01-26)

Microsoft Corp.'s stock (MSFT) was up 0.2% after the software

heavyweight posted better-than-expected earnings

(http://www.marketwatch.com/story/shares-of-microsoft-slide-as-software-giant-reports-a-quarterly-loss-on-tax-cuts-2018-01-31).

Shares of Fiat Chrysler Automobiles N.V. (FCA.MI) slumped 2.1%

in morning trade

(http://www.marketwatch.com/story/fiat-chryslers-stock-falls-as-us-vehicles-sales-drop-sharply-2018-02-01)Thursday,

after the auto maker reported a sharp drop in U.S. vehicle sales in

January. Total sales declined 13% to 132,803 vehicles, as Chrysler

brand sales dropped 21%.

Shares of Hershey Co.(HSY) were down 6% in early trade reported

fourth-quarter net income of $181.1 million

(http://www.marketwatch.com/story/hershey-earnings-and-sales-miss-consensus-2018-02-01),

or 85 cents per share, up from $116.9 million, or 55 cents per

share, for the same period last year.

First Take:Microsoft earnings show Nadella is blazing the right

path

(http://www.marketwatch.com/story/microsoft-earnings-show-nadella-is-blazing-the-right-path-2018-01-31)

What are other assets doing?

European stocks traded lower

(http://www.marketwatch.com/story/european-stocks-break-3-day-losing-run-after-solid-finance-tech-earnings-2018-02-01),

while Asian markets closed mixed. Gold were little changed, as oil

futures advanced. The ICE U.S. Dollar Index was dipping.

(END) Dow Jones Newswires

February 01, 2018 10:52 ET (15:52 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

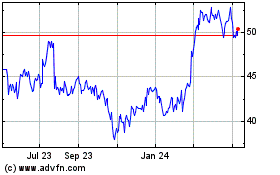

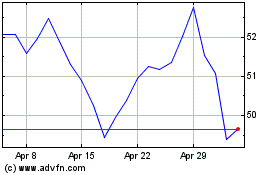

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Apr 2023 to Apr 2024