Report of Foreign Issuer (6-k)

February 01 2018 - 8:25AM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of February, 2018

Commission File Number: 001-15002

ICICI Bank

Limited

(Translation of registrant’s name into English)

ICICI Bank Towers,

Bandra-Kurla Complex

Mumbai, India 400 051

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file

annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark if the registrant

is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant

is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing

the information

contained in this Form, the Registrant is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934:

If “Yes” is marked, indicate

below the file number assigned to the registrant in

connection with Rule 12g 3-2(b):

Not Applicable

Table of Contents

Item 1

OTHER NEWS

Subject: Disclosure under Indian Listing

Regulations

IBN

ICICI Bank Limited (the ‘Bank’)

Report on Form 6-K

The Bank has made the following announcement

to the Indian stock exchanges under the Indian listing regulations with respect to the equity shares and compulsorily convertible

cumulative preference shares (CCCPS) which ICICI Bank Limited proposes to acquire in Tapits Technologies Private Limited.

|

a.

|

Name of the target entity, details in brief as size, turnover etc.

|

Tapits Technologies Private Limited (FY17)

Total Income (FY17) – Less

than Rs.

0.

1 million. Since this is an early stage startup, it

is not generating significant revenue.

|

|

b.

|

Whether the acquisition would fall within related party transaction(s) and whether the promoter/ promoter group/ group companies have any interest in the entity being acquired? If yes, nature of interest and details thereof and whether the same is done at “arms length”

|

This transaction does not constitute a related party transaction. ICICI Bank has no promoters. None of the group companies of ICICI Bank have any interest in the entity being acquired.

|

|

c.

|

industry to which the entity being acquired belongs

|

Tapits enables merchants

to accept digital payments from customers through biometric authentication using Aadhaar Enabled Payment System (AEPS). It forms

a part of digital payment business.

|

|

d.

|

objects and effects of acquisition (including but not limited to, disclosure of reasons for acquisition of target entity, if its business is outside the main line of business of the listed entity)

|

Objective of this investment is to promote digital and Aadhaar based payments.

|

|

ICICI

Bank Limited

ICICI Bank Towers

Bandra-Kurla Complex

Mumbai 400 051, India.

|

Tel.:

(91-22) 2653 1414

Fax: (91-22) 2653 1122

Website www.icicibank.com

CIN.: L65190GJ1994PLC021012

|

Regd.

Office: ICICI Bank Tower,

Near Chakli Circle,

Old Padra Road

Vadodara 390007. India

|

|

e.

|

Brief details of any governmental or regulatory approvals required for the acquisition

|

Since the acquisition of shareholding is below 10%, regulatory approval is not required.

|

|

f.

|

Indicative time period for completion of the acquisition

|

By end of February 2018.

|

|

g.

|

Nature of consideration - whether cash consideration or share swap and details of the same

|

Cash consideration of Rs. 9.9 million.

|

|

h.

|

Cost of acquisition or the price at which the shares are acquired

|

Cash consideration of Rs. 9.9 million for

9.9% stake of Tapits Technologies Private Limited.

Details of the transaction: Purchase

of 100 equity shares of Rs. 10 each at a share premium of Rs.8998.20 each, and 999 CCCPS of Rs. 100 each at a share premium of

Rs. 8908.20 each.

|

|

i.

|

Percentage of shareholding / control acquired and / or number of shares acquired

|

ICICI Bank will hold 9.9% stake in Tapits Technologies Private Limited through acquisition of 100 equity shares and 999 CCCPS on as-if-converted basis.

|

|

j.

|

Brief background about the entity acquired in terms of products/line of business acquired, date of incorporation, history of last 3 years turnover, country in which the acquired entity has presence and any other significant information (in brief)

|

Tapits Technologies Private Limited (Tapits)

Date of incorporation: April 27, 2016

Products/Line of business: Tapits enables

merchants to accept digital payments from customers through biometric authentication using Aadhaar Enabled Payment System (AEPS)

without the necessity of a card/ mobile/ wallet.

History of last 3 years turnover: –

Less than Rs.

0.

1 million. Since this is an early stage startup,

it is not generating significant revenue.

Country of presence: India.

|

You are requested to please take the above

changes on record.

|

ICICI

Bank Limited

ICICI Bank Towers

Bandra-Kurla Complex

Mumbai 400 051, India.

|

Tel.:

(91-22) 2653 1414

Fax: (91-22) 2653 1122

Website www.icicibank.com

CIN.: L65190GJ1994PLC021012

|

Regd.

Office: ICICI Bank Tower,

Near Chakli Circle,

Old Padra Road

Vadodara 390007. India

|

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorised.

|

|

|

|

For ICICI Bank Limited

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

February 1, 2018

|

|

By:

|

/s/ P. Sanker

|

|

|

|

|

|

Name :

|

Mr. P. Sanker

|

|

|

|

|

|

Title :

|

Senior General Manager (Legal) & Company Secretary

|

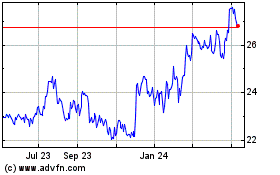

Icici Bank (NYSE:IBN)

Historical Stock Chart

From Mar 2024 to Apr 2024

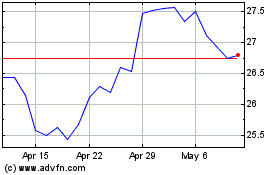

Icici Bank (NYSE:IBN)

Historical Stock Chart

From Apr 2023 to Apr 2024