- Altria’s 2017 fourth-quarter

reported diluted earnings per share (EPS) decreased 50.7% to $2.60,

as comparisons were affected by special items.

- Altria’s 2017 fourth-quarter

adjusted diluted EPS, which excludes the impact of special items,

increased 33.8% to $0.91.

- Altria’s 2017 full-year reported

diluted EPS decreased 27.1% to $5.31, as comparisons were affected

by special items.

- Altria’s 2017 full-year adjusted

diluted EPS, which excludes the impact of special items, increased

11.9% to $3.39.

- Altria announces a new $1 billion

share repurchase program to be completed by the end of 2018, having

completed its prior $4 billion share repurchase program in

January.

- Altria’s Chairman and Chief

Executive Officer Marty Barrington announces his decision to retire

at the conclusion of the May 17, 2018 Annual Shareholder Meeting;

Altria’s Board of Directors (Board) has elected Howard Willard, 54,

to serve as Chairman and Chief Executive Officer and Billy Gifford,

47, to serve as Vice Chairman and Chief Financial Officer.

Altria Group, Inc. (Altria) (NYSE:MO) today announced its 2017

fourth-quarter and full-year business results and provided its

guidance for 2018 full-year adjusted diluted EPS.

“Altria had another strong year in 2017,” said Marty Barrington,

Altria’s Chairman, Chief Executive Officer and President. “We

delivered outstanding financial performance and continued to focus

on rewarding our shareholders - paying out $4.8 billion in

dividends, increasing our dividend by 8.2% and repurchasing more

than $2.9 billion in shares. Our 2017 total shareholder return of

9.4% follows four consecutive years of returns exceeding 20%. Over

this five-year period, our total shareholder return of 181%

outperformed both the S&P 500 and S&P Food, Beverage and

Tobacco Index by more than 70%.”

“That success was built on our core tobacco businesses, which

delivered strong income growth and expanded their already high

margins, despite a year with some unique challenges. Further, we

acquired Nat Sherman to improve our smokeable segment’s position in

the growing super-premium cigarette segment. We also accomplished

several other important strategic initiatives for future success,

including making significant progress toward our goal of becoming

the U.S. leader in authorized, non-combustible reduced-risk

products. And the passage of federal tax reform strengthens our

financial capability to further invest in our businesses and reward

our shareholders.”

“We thus are forecasting 2018 full-year adjusted diluted EPS

growth in a range of 15% to 19%.”

Conference Call

As previously announced, a conference call with the investment

community and news media will be webcast on February 1, 2018 at

9:00 a.m. Eastern Time. Access to the webcast is available at

www.altria.com/webcasts and via the Altria Investor app.

Chairman and CEO

Transition

Altria announces today that Marty Barrington has decided to

retire later this year at age 65, having completed more than 25

years of distinguished service, including six years as Chairman and

CEO. The Board has elected Howard Willard, 54, to serve as Altria’s

Chairman and CEO, effective May 17, 2018, at the conclusion of the

2018 Annual Meeting of Shareholders (2018 Annual Meeting). The

Board also elected Mr. Willard to Altria’s Board, effective

February 1, 2018.

Mr. Willard has served in numerous senior leadership roles

during his 25-year career at the company. These include his current

position of Chief Operating Officer and prior roles as Chief

Financial Officer and Executive Vice President of Strategy and

Business Development. He also was a director of SABMiller plc

(SABMiller).

Additionally, the Board elected Billy Gifford, 47, to serve as

Altria’s Vice Chairman and Chief Financial Officer, also effective

May 17, 2018, at the conclusion of the 2018 Annual Meeting. Mr.

Gifford’s 23-year career includes his current position as Altria’s

Chief Financial Officer and prior roles as Altria’s Senior Vice

President, Strategy and Business Development and President and CEO

of Philip Morris USA. Mr. Gifford is currently a director at

Anheuser-Busch InBev SA/NV (AB InBev).

“It has been an enormous privilege to lead our great company

with a talented leadership team and terrific employees,” said Mr.

Barrington. “Howard has been essential to that team and is

immensely qualified and ready to take Altria forward when I step

away in May. Billy likewise has been an essential contributor to

our strategies and successful operating performance. Together, they

have the confidence of me and the Board of Directors to continue

Altria’s enduring success.”

“The Board is grateful for Marty’s extraordinary leadership the

last several years, as Altria has outperformed our competitive

benchmarks,” said Thomas Farrell, the Presiding Director. “Our

election of Howard as the next Chairman and CEO is the result of

our long-term succession planning process. We believe he has the

proven leadership skills, track record and strategic mindset to

lead the next chapter of Altria’s remarkable story.”

“I’m honored to be elected to follow Marty in this role,” said

Mr. Willard. “He leads the company with decisive leadership and

clarity, and during the past six years of his leadership, the

company has been tremendously successful. I look forward to

building on that success with Billy Gifford, our strong management

team and our talented employees to continue to generate consistent

growth and long-term value for our shareholders.”

Cash Returns to Shareholders -

Dividends and Share Repurchase

In December 2017, the Board declared a regular quarterly

dividend of $0.66 per share. Altria’s current annualized dividend

rate is $2.64 per share. As of January 26, 2018, Altria’s

annualized dividend yield was 3.7%. Altria paid approximately $1.3

billion in dividends in the fourth quarter and $4.8 billion in

2017. From the end of 2012 through 2017, Altria has paid

shareholders $21 billion in dividends. Altria expects to continue

to return a large amount of cash to shareholders in the form of

dividends by maintaining a dividend payout ratio target of

approximately 80% of its adjusted diluted EPS. Future dividend

payments remain subject to the discretion of the Board.

During the fourth quarter, Altria repurchased 8.4 million shares

under its share repurchase program at an average price of $66.67,

for a total cost of approximately $558 million. As of December 31,

2017, Altria had $18 million remaining in the $4 billion program,

which it subsequently completed in January. Since 2011, Altria has

repurchased approximately $8.5 billion of its shares at an average

price of $44.22. Altria’s Board has authorized a new $1 billion

share repurchase program, which the company expects to complete by

the end of 2018. The timing of share repurchases depends upon

marketplace conditions and other factors. This program remains

subject to the discretion of the Board.

Non-combustible Product

Portfolio

Altria continued to build on its three platforms of

non-combustible, nicotine-containing products for authorization by

the U.S. Food and Drug Administration (FDA).

In smokeless and other oral nicotine-containing products, U.S.

Smokeless Tobacco Company LLC (USSTC) made significant progress on

its modified risk tobacco product application for Copenhagen Snuff,

which it plans to file in the first quarter of 2018.

In e-vapor, Nu Mark LLC grew MarkTen’s full-year volume by

approximately 60%, primarily through expanded distribution and

category growth. MarkTen had a full-year 2017 national retail share

of 12.5% in mainstream retail channels and is present in stores

representing approximately 70% of e-vapor category volume in those

channels. MarkTen Bold is now available in approximately 25,000

retail stores.

In heated tobacco, Philip Morris USA Inc. (PM USA) continues to

build its commercialization plans for IQOS, which it will have the

exclusive right to sell in the U.S. upon FDA authorization.

U.S. Corporate Tax

Reform

On December 22, 2017, the U.S. Government enacted comprehensive

tax legislation commonly referred to as the Tax Cuts and Jobs Act

(Tax Reform Act) which, among other things, reduced the U.S.

federal statutory corporate income tax rate to 21%, effective

January 1, 2018.

The Tax Reform Act affected both Altria’s 2017 full-year

reported effective tax rate and its 2017 full-year adjusted

effective tax rate.

For the reported effective tax rate, Altria revalued its

existing net deferred tax liabilities to reflect the lower rate.

The Tax Reform Act also imposed a one-time deemed repatriation tax,

substantially all of which is related to Altria’s share of

accumulated earnings from its beer investment (Deemed Repatriation

Tax). The effect of these items (Tax Reform Items) reduced Altria’s

fourth-quarter and full-year reported effective tax rates, as

detailed in Schedule 10.

For the adjusted effective tax rate, the Deemed Repatriation Tax

covered historical earnings from Altria’s beer investment through

2017. As a result, no tax was due on the dividends Altria received

from AB InBev during 2017, and Altria’s 2017 full-year adjusted

effective tax rate decreased to 33.4% from Altria’s previous

estimate of approximately 35.5%. This decrease provided an

approximate $0.10 per share benefit to 2017 full-year adjusted

diluted EPS. Altria expects to continue to receive favorable tax

treatment on dividends it receives from AB InBev.

A reconciliation of Altria’s 2017 full-year reported effective

tax rate to its 2017 full-year adjusted effective tax rate is shown

on Schedule 10.

For Altria’s expected 2018 full-year adjusted effective tax

rate, refer to “2018 Full-Year Guidance” below.

Facilities Consolidation

In October 2016, Altria announced the consolidation of certain

of its operating companies’ manufacturing facilities to streamline

operations and achieve greater efficiencies (Facilities

Consolidation). The Facilities Consolidation is expected to be

substantially completed by the end of the first quarter of 2018 and

deliver approximately $50 million in annualized cost savings by the

end of 2018.

As a result of the Facilities Consolidation, Altria recorded

total pre-tax charges of approximately $150 million, including $71

million in 2016 and $78 million for the full year 2017, including

$7 million in the fourth quarter.

2018 Full-Year Guidance

Altria forecasts 2018 full-year adjusted diluted EPS to be in a

range of $3.90 to $4.03, which excludes a $0.09 tax expense for a

tax basis adjustment related to the Deemed Repatriation Tax. This

range represents a growth rate of 15% to 19% from a 2017 adjusted

diluted EPS base of $3.39, which excludes the special items shown

in Table 2. Altria’s 2018 guidance reflects investments in focus

areas for long-term growth, including innovative product

development and launches, regulatory science, brand equity, retail

fixtures and future retail concepts.

Altria expects its 2018 full-year adjusted effective tax rate

will be in a range of approximately 23% to 24%.

Altria expects capital expenditures in a range of $200 million

to $250 million and depreciation and amortization expenses of

approximately $210 million.

Altria’s full-year adjusted diluted EPS guidance and full-year

forecast for its adjusted effective tax rate exclude the impact of

certain income and expense items that management believes are not

part of underlying operations. These items may include, for

example, loss on early extinguishment of debt, restructuring

charges, gain on AB InBev/SABMiller business combination, AB

InBev/SABMiller special items, certain tax items, charges

associated with tobacco and health litigation items, and

resolutions of certain non-participating manufacturer (NPM)

adjustment disputes under the Master Settlement Agreement (such

dispute resolutions are referred to as NPM Adjustment Items).

Altria’s management cannot estimate on a forward-looking basis

the impact of certain income and expense items, including those

items noted in the preceding paragraph, on its reported diluted EPS

and its reported effective tax rate because these items, which

could be significant, may be infrequent, are difficult to predict

and may be highly variable. As a result, Altria does not provide a

corresponding U.S. generally accepted accounting principles (GAAP)

measure for, or reconciliation to, its adjusted diluted EPS

guidance or its adjusted effective tax rate forecast.

The factors described in the Forward-Looking and Cautionary

Statements section of this release represent continuing risks to

Altria’s forecast.

ALTRIA GROUP,

INC.

Altria reports its financial results in accordance with GAAP.

Altria’s management reviews operating companies income (OCI), which

is defined as operating income before general corporate expenses

and amortization of intangibles, to evaluate the performance of,

and allocate resources to, the segments. Altria’s management also

reviews OCI, operating margins and diluted EPS on an adjusted

basis, which excludes certain income and expense items, including

those items noted under “2018 Full-Year Guidance” above. Altria’s

management does not view any of these special items to be part of

Altria’s underlying results as they may be highly variable, may be

infrequent, are difficult to predict and can distort underlying

business trends and results. Altria’s management also reviews

income tax rates on an adjusted basis. Altria’s adjusted effective

tax rate may exclude certain tax items from its reported effective

tax rate. Altria’s management believes that adjusted financial

measures provide useful additional insight into underlying business

trends and results and provide a more meaningful comparison of

year-over-year results. Altria’s management uses adjusted financial

measures for planning, forecasting and evaluating business and

financial performance, including allocating resources and

evaluating results relative to employee compensation targets. These

adjusted financial measures are not consistent with GAAP and may

not be calculated the same as similarly titled measures used by

other companies. These adjusted financial measures should thus be

considered as supplemental in nature and not considered in

isolation or as a substitute for the related financial information

prepared in accordance with GAAP. Reconciliations of historical

adjusted financial measures to corresponding GAAP measures are

provided in this release.

Altria uses the equity method of accounting for its investment

in AB InBev and reports its share of AB InBev’s results using a

one-quarter lag because AB InBev’s results are not available in

time to record them in the concurrent period. The one-quarter

reporting lag does not affect Altria’s cash flows, but does impact

the year-over-year comparability of Altria’s equity earnings from

its beer investment and reported and adjusted diluted EPS in the

short term.

Altria’s reportable segments are smokeable products,

manufactured and sold by PM USA, John Middleton Co. (Middleton) and

Sherman Group Holdings, LLC and its subsidiaries (Nat Sherman);

smokeless products, manufactured and sold by U.S. Smokeless Tobacco

Company LLC (USSTC); and wine, produced and/or distributed by Ste.

Michelle Wine Estates Ltd. (Ste. Michelle).

Comparisons are to the corresponding prior-year period unless

otherwise stated.

Altria’s 2017 fourth-quarter net revenues decreased 2.4% to $6.1

billion, primarily driven by lower net revenues in the smokeable

products segment. Altria’s revenues net of excise taxes were

essentially unchanged at $4.7 billion. For the full year, net

revenues decreased 0.7% to $25.6 billion, and revenues net of

excise taxes increased 0.8% to $19.5 billion.

Altria’s 2017 fourth-quarter reported diluted EPS decreased

50.7% to $2.60, primarily driven by the 2016 gain on the AB

InBev/SABMiller business combination, partially offset by lower

reported taxes, higher reported OCI in the smokeable and smokeless

products segments and fewer shares outstanding. Altria’s

fourth-quarter adjusted diluted EPS, which excludes the special

items shown in Table 1, grew 33.8% to $0.91, primarily driven by

higher equity earnings from Altria’s beer investment due to

reporting AB InBev’s results on a one-quarter lag, higher adjusted

OCI in the smokeable and smokeless products segments, a lower

adjusted effective tax rate and fewer shares outstanding.

Altria’s full-year 2017 reported diluted EPS decreased 27.1% to

$5.31, primarily driven by a lower gain on the AB InBev/SABMiller

business combination and lower equity earnings from Altria’s beer

investment, partially offset by lower reported taxes, the 2016 loss

on early extinguishment of debt, higher reported OCI in the

smokeable and smokeless products segments and fewer shares

outstanding. Altria’s full-year 2017 adjusted diluted EPS, which

excludes the special items shown in Table 1, increased 11.9% to

$3.39, primarily driven by higher adjusted OCI in the smokeable and

smokeless products segments, a lower adjusted effective tax rate

and fewer shares outstanding.

Table 1 - Altria’s

Adjusted Results

Fourth Quarter Full Year 2017

2016 Change 2017 2016 Change

Reported diluted EPS $ 2.60 $

5.27 (50.7 )% $ 5.31 $

7.28 (27.1 )% NPM Adjustment Items — — — 0.01

Tobacco and health litigation items 0.02 0.01 0.03 0.04 AB

InBev/SABMiller special items 0.02 (0.07 ) 0.05 (0.03 ) Loss on

early extinguishment of debt — — — 0.28 Asset impairment, exit,

implementation and acquisition-related costs — 0.03 0.03 0.07

Patent litigation settlement — 0.01 — 0.01 Gain on AB

InBev/SABMiller business combination — (4.56 ) (0.15 ) (4.61 )

Settlement charge for lump sum pension payments 0.03 — 0.03 — Tax

items (1.76 ) (0.01 ) (1.91 ) (0.02 )

Adjusted diluted EPS

$ 0.91 $ 0.68 33.8

% $ 3.39 $ 3.03

11.9 %

Note: For details of pre-tax, tax and after-tax amounts, see

Schedules 7 and 9.

AB InBev/SABMiller Special

Items

In the fourth quarter of 2017, earnings from Altria’s equity

investment in AB InBev included net pre-tax charges of $51 million,

consisting primarily of Altria’s share of AB InBev’s Brazilian tax

item. In the fourth quarter of 2016, Altria recorded net pre-tax

income of $236 million related to SABMiller special items.

For the full year 2017, earnings from Altria’s equity investment

in AB InBev included net pre-tax charges of $160 million. For full

year 2016, earnings from Altria’s equity investment in SABMiller

included net pre-tax income of $89 million.

The EPS impact of these items is shown in Table 1 and Schedules

7 and 9.

Loss on Early Extinguishment of

Debt

In 2016, Altria completed a cash tender offer in which it

purchased approximately $933 million aggregate principal amount of

its senior unsecured 9.95% and 10.20% notes due in 2038 and 2039,

respectively. The transaction resulted in a one-time, pre-tax

charge against reported earnings of $823 million, reflecting the

loss on early extinguishment of debt.

The EPS impact of this charge is shown in Table 1 and Schedule

9.

Asset Impairment, Exit, Implementation

and Acquisition-related Costs

For the full year 2017, Altria recorded pre-tax charges of $89

million, primarily related to the Facilities Consolidation.

In the fourth quarter of 2016, Altria recorded pre-tax charges

of $73 million, primarily related to the Facilities Consolidation.

For the full year 2016, Altria recorded pre-tax charges of $206

million, primarily related to the productivity initiative announced

in January 2016 and the Facilities Consolidation.

The EPS impact of these charges is shown in Table 1 and

Schedules 7 and 9.

Gain on AB InBev/SABMiller Business

Combination

For the full year 2017, Altria recorded a pre-tax gain of $445

million related to AB InBev’s divestitures of certain SABMiller

assets and businesses in connection with the AB InBev/SABMiller

business combination.

In the fourth quarter and full-year 2016, Altria recorded

pre-tax gains of approximately $13.7 billion and $13.9 billion,

respectively, related to the AB InBev/SABMiller business

combination.

The EPS impact of these items is shown in Table 1 and Schedules

7 and 9.

Settlement Charge for Lump Sum Pension

Payments

In the fourth quarter of 2017, Altria recorded a one-time

pre-tax settlement charge of $81 million related to lump sum

payments made in connection with a voluntary, limited-time offer to

former employees with vested benefits in the Altria Retirement Plan

who had not commenced receiving benefit payments and met certain

other conditions.

The EPS impact of this charge is shown in Table 1 and Schedules

7 and 9.

Tax Items

In the fourth quarter of 2017, Altria recorded a $3.4 billion

tax benefit primarily related to Tax Reform Items described in

“U.S. Corporate Tax Reform” above.

For the full year 2017, Altria recorded $3.7 billion in income

tax benefits, primarily related to Tax Reform Items and the

previously disclosed valuation allowance release and federal income

tax audit closure.

The EPS impact of these items is shown in Table 1 and Schedules

7 and 9.

SMOKEABLE

PRODUCTS

The smokeable products segment delivered strong income growth in

the fourth quarter and for 2017.

Smokeable products segment net revenues declined 3.2% in the

fourth quarter as lower volume was partially offset by higher

pricing and lower promotional investments. For the full year,

smokeable products segment net revenues declined 0.9% as lower

volume and higher promotional investments were partially offset by

higher pricing. Revenues net of excise taxes declined 1.0% in the

quarter and increased 0.6% for the full year.

In the fourth quarter, reported OCI increased 1.7%, primarily

driven by higher pricing, lower selling, general and administrative

(SG&A) spending and lower promotional investments, partially

offset by lower volume, higher resolution expense and settlement

charges for lump sum pension payments. Adjusted OCI, which is

calculated excluding the special items identified in Table 2, grew

5.7%, and adjusted OCI margins expanded 3.2 percentage points to

49.9%.

For the full year, reported OCI increased 8.2%, primarily driven

by higher pricing and lower SG&A spending, partially offset by

lower volume. Adjusted OCI, which is calculated excluding the

special items identified in Table 2, grew 7.0%, and adjusted OCI

margins expanded 3.0 percentage points to 51.2%.

Table 2 - Smokeable Products:

Revenues and OCI ($ in millions)

Fourth Quarter Full Year

2017 2016 Change 2017 2016

Change Net revenues $ 5,281 $

5,453 (3.2)% $ 22,636 $

22,851 (0.9)% Excise taxes (1,346 ) (1,478 ) (5,927 )

(6,247 )

Revenues net of excise taxes $ 3,935

$ 3,975 (1.0)% $

16,709 $ 16,604 0.6%

Reported OCI $ 1,844 $

1,813 1.7% $ 8,408 $

7,768 8.2% NPM Adjustment Items — — (5 ) 12 Asset

impairment, exit, implementation and acquisition-related costs 7 29

29 134 Tobacco and health litigation items 56 16 72 88 Settlement

charge for lump sum pension payments 57 — 57 —

Adjusted OCI $ 1,964 $

1,858 5.7% $ 8,561

$ 8,002 7.0% Adjusted OCI

margins 1 49.9 % 46.7 %

3.2 pp 51.2 % 48.2 %

3.0 pp

1 Adjusted OCI margins are calculated as adjusted OCI divided by

revenues net of excise taxes.

In the fourth quarter, the smokeable products segment’s reported

domestic cigarettes shipment volume declined by 8.9%, primarily

driven by the industry’s rate of decline, trade inventory movements

and retail share declines. After adjusting for trade inventory

movements, PM USA’s domestic cigarettes shipment volume decreased

by an estimated 6.5%. Total cigarette industry volumes declined by

an estimated 4.5%.

For the full year, the smokeable products segment’s reported

domestic cigarettes shipment volume decreased by 5.1%, primarily

driven by the industry’s rate of decline, retail share declines and

one fewer shipping day. When adjusted for calendar differences, PM

USA’s domestic cigarettes shipment volume decreased by an estimated

5%. Total cigarette industry volumes declined by an estimated

4%.

The smokeable products segment’s reported cigars shipment volume

increased by 7.9% in the fourth quarter and 9.9% for the full year.

Table 3 summarizes smokeable products segment shipment volume

performance.

Table 3 - Smokeable Products:

Shipment Volume (sticks in millions)

Fourth Quarter Full Year

2017 2016 Change 2017 2016

Change Cigarettes: Marlboro 22,667 24,851

(8.8)% 99,974 105,297 (5.1)%

Other premium 1,400 1,524

(8.1)% 5,967 6,382 (6.5)%

Discount 2,415 2,682

(10.0)% 10,665 11,251 (5.2)%

Total cigarettes

26,482 29,057 (8.9)%

116,606 122,930 (5.1)%

Cigars: Black & Mild 381 351 8.5% 1,527 1,379

10.7%

Other 3 5 (40.0)% 15 24

(37.5)%

Total cigars 384 356

7.9% 1,542 1,403 9.9%

Total smokeable products

26,866 29,413 (8.7)%

118,148 124,333 (5.0)%

Note: Cigarettes volume includes units sold as well as

promotional units, but excludes units sold for distribution to

Puerto Rico, and units sold in U.S. Territories, to overseas

military and by Philip Morris Duty Free Inc., none of which,

individually or in the aggregate, is material to the smokeable

products segment.

In the fourth quarter, Marlboro’s retail share declined by 0.7

share points to 43.0%, primarily driven by competitive activity and

the continued effect of the cigarette excise tax increase in

California. For the full year, Marlboro’s retail share declined by

0.4 share points to 43.3%. PM USA’s total retail share was 50.3% in

the quarter and 50.7% for the full year, down 0.8 and 0.4 share

points, respectively. Table 4 summarizes cigarette retail share

results.

Table 4 - Smokeable Products:

Cigarettes Retail Share (percent)

Fourth Quarter Full Year

2017 2016

Percentagepoint change

2017 2016

Percentagepoint change

Cigarettes: Marlboro 43.0 % 43.7 % (0.7 ) 43.3 % 43.7

% (0.4 )

Other premium 2.7 2.7 — 2.7 2.8 (0.1 )

Discount 4.6 4.7 (0.1 ) 4.7 4.6

0.1

Total cigarettes 50.3 % 51.1

% (0.8 ) 50.7 % 51.1

% (0.4 )

Note: Retail share results for cigarettes are based on data from

IRI/MSAi, a tracking service that uses a sample of stores and

certain wholesale shipments to project market share and depict

share trends. This service tracks sales in the food, drug, mass

merchandisers, convenience, military, dollar store and club trade

classes. For other trade classes selling cigarettes, retail share

is based on shipments from wholesalers to retailers (STARS). This

service is not designed to capture sales through other channels,

including the internet, direct mail and some illicitly

tax-advantaged outlets. It is IRI’s standard practice to

periodically refresh its services, which could restate retail share

results that were previously released in this service.

SMOKELESS

PRODUCTS

The smokeless products segment delivered very strong results in

the fourth quarter and for 2017.

Smokeless products segment net revenues increased 10.4% in the

quarter, primarily driven by higher pricing and lower promotional

investments, partially offset by lower volume. For the full year,

smokeless product segment net revenues increased 5.1%, primarily

driven by higher pricing and lower promotional investments,

partially offset by unfavorable mix and lower volume. Revenues net

of excise taxes increased 11.1% in the quarter and 5.6% for the

full year.

In the fourth quarter, reported OCI increased 41.3%, primarily

driven by higher pricing, lower Facilities Consolidation charges,

lower costs (SG&A and manufacturing) and lower promotional

investments, partially offset by settlement charges for lump sum

pension payments. Adjusted OCI, which is calculated excluding the

special items identified in Table 5, increased 27.2%, and adjusted

OCI margins increased 8.7 percentage points to 68.1%.

For the full year, reported OCI increased 10.5%, primarily

driven by higher pricing and lower costs partially offset by

unfavorable mix and lower volume. Adjusted OCI, which is calculated

excluding the special items identified in Table 5, increased 11.2%,

and adjusted OCI margins increased 3.4 percentage points to

67.8%.

Table 5 - Smokeless Products:

Revenues and OCI ($ in millions)

Fourth Quarter Full Year

2017 2016 Change 2017 2016

Change Net revenues $ 575 $

521 10.4% $ 2,155 $ 2,051

5.1% Excise taxes (33 ) (33 ) (132 ) (135 )

Revenues net

of excise taxes $ 542 $ 488

11.1% $ 2,023 $

1,916 5.6% Reported OCI $

349 $ 247 41.3% $ 1,300

$ 1,177 10.5% Asset impairment, exit and

implementation costs 4 43 56 57 Settlement charge for lump sum

pension payments 16 — 16 —

Adjusted

OCI $ 369 $ 290

27.2% $ 1,372 $ 1,234

11.2% Adjusted OCI margins 1

68.1 % 59.4 % 8.7 pp

67.8 % 64.4 % 3.4 pp

1 Adjusted OCI margins are calculated as adjusted OCI divided by

revenues net of excise taxes.

In the fourth quarter, the smokeless products segment’s reported

domestic shipment volume declined 0.6%. After adjusting for trade

inventory movements and other factors, USSTC estimates that its

domestic smokeless products shipment volume declined approximately

2.5%.

For the full year, reported domestic shipment volume declined

1.4%, driven primarily by declines in Skoal. After adjusting for

trade inventory movements and other factors, USSTC estimates that

its domestic smokeless products shipment volume declined

approximately 2%. USSTC estimates that the smokeless products

category volume was essentially unchanged over the past six

months.

Table 6 summarizes shipment volume performance for the smokeless

products segment.

Table 6 - Smokeless Products: Shipment

Volume(cans and packs in millions)

Fourth

Quarter Full Year 2017 2016 Change

2017 2016 Change Copenhagen 135.5 132.8

2.0% 531.6 525.1 1.2%

Skoal 58.9 63.6 (7.4)%

241.9 260.9 (7.3)%

Copenhagen and Skoal

194.4 196.4 (1.0)% 773.5 786.0

(1.6)% Other 17.5 16.7 4.8% 67.8

67.5 0.4%

Total smokeless products 211.9

213.1 (0.6)% 841.3

853.5 (1.4)%

Note: Volume includes cans and packs sold, as well as

promotional units, but excludes international volume, which is not

material to the smokeless products segment. New types of smokeless

products, as well as new packaging configurations of existing

smokeless products, may or may not be equivalent to existing moist

smokeless tobacco (MST) products on a can-for-can basis. To

calculate volumes of cans and packs shipped, one pack of snus,

irrespective of the number of pouches in the pack, is assumed to be

equivalent to one can of MST.

In the fourth quarter, Copenhagen retail share was unchanged at

33.8%. Copenhagen and Skoal’s combined retail share decreased 1.3

share points in the quarter to 50.1% driven by Skoal.

For the full year, Copenhagen’s 0.5 share point growth was

offset by Skoal’s 1.4 share point loss, contributing to a combined

share decline of 0.9 share points. Table 7 summarizes retail share

results for the smokeless products segment.

Table 7

- Smokeless Products: Retail Share (percent)

Fourth Quarter Full Year 2017 2016

Percentagepoint change

2017 2016

Percentagepoint change

Copenhagen 33.8 % 33.8 % —

33.7

%

33.2

%

0.5

Skoal 16.3 17.6 (1.3 ) 16.7

18.1 (1.4 )

Copenhagen and Skoal

50.1 51.4 (1.3 ) 50.4

51.3 (0.9 ) Other 3.5 3.3

0.2 3.3 3.4 (0.1 )

Total

smokeless products 53.6 % 54.7 %

(1.1 ) 53.7 % 54.7

% (1.0 )

Note: Retail share results for smokeless products are based on

data from IRI InfoScan, a tracking service that uses a sample of

stores to project market share and depict share trends. This

service tracks sales in the food, drug, mass merchandisers,

convenience, military, dollar store and club trade classes on the

number of cans and packs sold. Smokeless products is defined by IRI

as moist smokeless and spit-free tobacco products. New types of

smokeless products, as well as new packaging configurations of

existing smokeless products, may or may not be equivalent to

existing MST products on a can-for-can basis. For example, one pack

of snus, irrespective of the number of pouches in the pack, is

assumed to be equivalent to one can of MST. Because this service

represents retail share performance only in key trade channels, it

should not be considered a precise measurement of actual retail

share. It is IRI’s standard practice to periodically refresh its

InfoScan services, which could restate retail share results that

were previously released in this service.

WINE

In the wine segment, Ste. Michelle’s fourth-quarter and

full-year results were negatively impacted by competitive activity,

continued trade inventory reductions and slower premium wine

category growth.

In the fourth quarter of 2017, Ste. Michelle’s net revenues

declined 8.5%. Reported and adjusted OCI increased 1.6%, primarily

due to lower costs, higher pricing and favorable mix, mostly offset

by lower volume. Reported wine shipment volume for the fourth

quarter declined 9.7% to approximately 2.8 million cases.

For the full year, Ste. Michelle’s net revenues declined 6.4%.

Reported OCI declined 10.4% and adjusted OCI declined 12.0%,

primarily due to lower volume. Reported shipment volume for the

full year declined 8.6% to approximately 8.5 million cases.

Table 8 summarizes revenues, OCI and OCI margins for the wine

segment.

Table 8 - Wine:

Revenues and OCI ($ in millions)

Fourth Quarter Full Year

2017 2016 Change 2017 2016

Change Net revenues $ 227 $

248 (8.5)% $ 698 $ 746

(6.4)% Excise taxes (8 ) (8 ) (23 ) (25 )

Revenues net of

excise taxes $ 219 $ 240

(8.8)% $ 675 $ 721

(6.4)% Reported OCI $ 65

$ 64 1.6% $ 147 $

164 (10.4)% Acquisition-related costs — —

— 3

Adjusted OCI $ 65

$ 64 1.6% $ 147

$ 167 (12.0)% Adjusted OCI

margins 1 29.7 % 26.7 %

3.0 pp 21.8 % 23.2 %

(1.4) pp

1 Adjusted OCI margins are calculated as adjusted OCI divided by

revenues net of excise taxes.

Altria’s Profile

Altria’s wholly-owned subsidiaries include Philip Morris USA

Inc., U.S. Smokeless Tobacco Company LLC, John Middleton Co.,

Sherman Group Holdings, LLC and its subsidiaries, Nu Mark LLC, Ste.

Michelle Wine Estates Ltd. and Philip Morris Capital Corporation.

Altria holds an equity investment in Anheuser-Busch InBev

SA/NV.

The brand portfolios of Altria’s tobacco operating companies

include Marlboro®, Black & Mild®,

Copenhagen®, Skoal®, MarkTen® and Green

Smoke®. Ste. Michelle produces and markets premium wines

sold under various labels, including Chateau Ste. Michelle®,

Columbia Crest®, 14 Hands® and Stag’s Leap Wine

Cellars™, and it imports and markets Antinori®,

Champagne Nicolas Feuillatte™, Torres® and Villa

Maria Estate™ products in the United States. Trademarks and

service marks related to Altria referenced in this release are the

property of Altria or its subsidiaries or are used with permission.

More information about Altria is available at altria.com and on the

Altria Investor app.

Forward-Looking and Cautionary

Statements

This press release contains projections of future results and

other forward-looking statements that involve a number of risks and

uncertainties and are made pursuant to the Safe Harbor Provisions

of the Private Securities Litigation Reform Act of 1995.

Important factors that may cause actual results and outcomes to

differ materially from those contained in the projections and

forward-looking statements included in this press release are

described in Altria’s publicly filed reports, including its Annual

Report on Form 10-K for the year ended December 31, 2016 and its

Quarterly Report on Form 10-Q for the period ended September 30,

2017.

These factors include the following: significant competition;

changes in adult consumer preferences and demand for Altria’s

operating companies’ products; fluctuations in raw material

availability, quality and price; reliance on key facilities and

suppliers; reliance on critical information systems, many of which

are managed by third-party service providers; fluctuations in

levels of customer inventories; the effects of global, national and

local economic and market conditions; changes to income tax laws;

federal, state and local legislative activity, including actual and

potential federal and state excise tax increases; increasing

marketing and regulatory restrictions; the effects of price

increases related to excise tax increases and concluded tobacco

litigation settlements, consumption rates and consumer preferences

within price segments; health concerns relating to the use of

tobacco products and exposure to environmental tobacco smoke;

privately imposed smoking restrictions; and, from time to time,

governmental investigations.

Furthermore, the results of Altria’s tobacco businesses are

dependent upon their continued ability to promote brand equity

successfully; to anticipate and respond to evolving adult consumer

preferences; to develop, manufacture, market and distribute

products that appeal to adult tobacco consumers (including, where

appropriate, through arrangements with, and investments in, third

parties); to improve productivity; and to protect or enhance

margins through cost savings and price increases.

Altria and its tobacco businesses are also subject to federal,

state and local government regulation, including by the FDA. Altria

and its subsidiaries continue to be subject to litigation,

including risks associated with adverse jury and judicial

determinations, courts reaching conclusions at variance with the

companies’ understanding of applicable law, bonding requirements in

the limited number of jurisdictions that do not limit the dollar

amount of appeal bonds and certain challenges to bond cap

statutes.

In addition, the factors related to Altria’s investment in AB

InBev include the following: AB InBev’s inability to achieve the

contemplated synergies and value creation from its business

combination with SABMiller; that Altria’s equity securities in AB

InBev are subject to restrictions on transfer until October 10,

2021; the risk that Altria’s reported earnings from and carrying

value of its equity investment in AB InBev may be adversely

affected by unfavorable foreign currency exchange rates and other

factors, including the risks encountered by AB InBev in its

business; the risk that the tax treatment of Altria’s transaction

consideration from the AB InBev/SABMiller business combination and

the accounting treatment of its equity investment are not

guaranteed; and the risk that the tax treatment of the dividends

Altria expects to receive from AB InBev may not be as favorable as

Altria anticipates.

Altria cautions that the foregoing list of important factors is

not complete and does not undertake to update any forward-looking

statements that it may make except as required by applicable law.

All subsequent written and oral forward-looking statements

attributable to Altria or any person acting on its behalf are

expressly qualified in their entirety by the cautionary statements

referenced above.

Schedule 1

ALTRIA GROUP, INC.and

SubsidiariesConsolidated Statements of EarningsFor the Quarters

Ended December 31,(dollars in millions, except per share

data)(Unaudited)

2017 2016 % Change Net

revenues $ 6,101 $ 6,252

(2.4)% Cost of sales 1 1,844 1,905 Excise taxes on products

1 1,387 1,519 Gross profit 2,870 2,828 1.5%

Marketing, administration and research costs 623 701 Asset

impairment and exit costs 9 56

Operating companies

income 2,238 2,071 8.1% Amortization of

intangibles 6 6 General corporate expenses 69 72

Operating income 2,163 1,993 8.5%

Interest and other debt expense, net 180 176 Earnings from equity

investment in AB InBev/SABMiller (200 ) (231 ) Gain on AB

InBev/SABMiller business combination — (13,660 ) Earnings

before income taxes 2,183 15,708 (86.1)% (Benefit) provision for

income taxes (2,785 ) 5,430

Net earnings 4,968

10,278 (51.7)% Net earnings attributable to

noncontrolling interests (2 ) (2 )

Net earnings attributable to

Altria Group, Inc. $ 4,966 $

10,276 (51.7)% Per share data:

Basic and diluted earnings per share attributable to

Altria Group, Inc.

$ 2.60 $ 5.27 (50.7)%

Weighted-average diluted shares outstanding 1,905 1,946 (2.1)%

1 Cost of sales includes charges for resolution expenses related

to state settlement agreements and FDA user fees. Supplemental

information concerning those items and excise taxes on products

sold is shown in Schedule 5.

Schedule 2

ALTRIA GROUP, INC.

and Subsidiaries

Selected Financial Data

For the Quarters Ended December 31,

(dollars in millions)

(Unaudited)

Net Revenues

SmokeableProducts

SmokelessProducts

Wine All Other

Total 2017 $ 5,281 $ 575 $ 227 $ 18 $ 6,101 2016 5,453 521

248 30 6,252 % Change

(3.2

)%

10.4 %

(8.5

)%

(40.0

)%

(2.4)%

Reconciliation:

For the quarter ended December 31, 2016 $

5,453 $ 521 $ 248 $

30 $ 6,252 Operations

(172

)

54

(21

)

(12

)

(151)

For the quarter ended December 31, 2017

$ 5,281 $ 575

$ 227 $ 18

$ 6,101

Operating

Companies Income (Loss)

SmokeableProducts

SmokelessProducts

Wine All Other

Total 2017 $ 1,844 $ 349 $ 65 $

(20

)

$ 2,238 2016 1,813 247 64

(53

)

2,071 % Change

1.7

%

41.3 %

1.6

%

(62.3

)%

8.1%

Reconciliation:

For the quarter ended December 31, 2016 $

1,813 $ 247 $ 64 $

(53) $ 2,071 Asset impairment, exit and

implementation

costs - 2016

29 43 — 1 73 Patent litigation settlement - 2016 — — — 21 21

Tobacco and health litigation items - 2016 16

— — — 16 45

43 — 22 110 Asset

impairment, exit, implementation and acquisition-related costs -

2017

(7

)

(4 ) — — (11) Tobacco and health litigation items - 2017

(56

)

— — — (56) Settlement charge for lump sum pension payments - 2017

(57

)

(16 ) — — (73)

(120

)

(20 ) — — (140)

Operations 106 79 1 11

197

For the quarter ended December 31, 2017

$ 1,844 $ 349

$ 65 $ (20)

$ 2,238

Schedule 3

ALTRIA GROUP, INC.

and Subsidiaries

Consolidated Statements of Earnings

For the Years Ended December 31,

(dollars in millions, except per share

data)

(Unaudited)

2017 2016 % Change

Net revenues $ 25,576 $ 25,744

(0.7)% Cost of sales 1 7,543 7,746 Excise taxes on products

1 6,082 6,407 Gross profit 11,951 11,591 3.1%

Marketing, administration and research costs 2,114 2,407 Asset

impairment and exit costs 33 174

Operating

companies income 9,804 9,010 8.8%

Amortization of intangibles 21 21 General corporate expenses 227

222 Corporate asset impairment and exit costs — 5

Operating income 9,556 8,762 9.1%

Interest and other debt expense, net 705 747 Loss on early

extinguishment of debt — 823 Earnings from equity investment in AB

InBev/SABMiller (532 ) (795 ) Gain on AB InBev/SABMiller business

combination (445 ) (13,865 ) Earnings before income taxes 9,828

21,852 (55.0)% (Benefit) provision for income taxes (399 ) 7,608

Net earnings 10,227 14,244

(28.2)% Net earnings attributable to noncontrolling

interests (5 ) (5 )

Net earnings attributable to Altria Group,

Inc. $ 10,222 $ 14,239

(28.2)% Per share data 2:

Basic and diluted earnings per share attributable

toAltria Group, Inc. $ 5.31 $

7.28 (27.1)% Weighted-average diluted shares

outstanding 1,921 1,952 (1.6)%

1 Cost of sales includes charges for resolution expenses related

to state settlement agreements and FDA user fees. Supplemental

information concerning those items and excise taxes on products

sold is shown in Schedule 5.

2 Basic and diluted earnings per share attributable to Altria

Group, Inc. are computed independently for each period.

Accordingly, the sum of the quarterly earnings per share amounts

may not agree to the year-to-date amounts.

Schedule 4

ALTRIA GROUP, INC.

and Subsidiaries

Selected Financial Data

For the Years Ended December 31,

(dollars in millions)

(Unaudited)

Net Revenues

SmokeableProducts

SmokelessProducts

Wine All Other Total 2017 $

22,636 $ 2,155 $ 698 $ 87 $ 25,576 2016

22,851 2,051 746 96 25,744 % Change (0.9 )% 5.1 % (6.4 )% (9.4 )%

(0.7 )%

Reconciliation:

For the year ended December 31, 2016 $ 22,851

$ 2,051 $ 746 $ 96

$ 25,744 Operations (215 ) 104

(48 ) (9 ) (168 )

For the year ended December 31,

2017 $ 22,636 $

2,155 $ 698 $

87 $ 25,576

Operating

Companies Income (Loss)

SmokeableProducts

SmokelessProducts

Wine All Other Total 2017 $

8,408 $ 1,300 $ 147 $ (51 ) $ 9,804 2016 7,768 1,177 164 (99 )

9,010 % Change 8.2 % 10.5 % (10.4 )% 48.5 % 8.8 %

Reconciliation:

For the year ended December 31, 2016 $ 7,768

$ 1,177 $ 164 $ (99

) $ 9,010 NPM Adjustment Items - 2016

12 — — — 12 Asset impairment, exit, implementation and

acquisition-related costs - 2016 134 57 3 7 201 Patent litigation

settlement - 2016 — — — 21 21 Tobacco and health litigation items -

2016 88 — — —

88 234 57 3

28 322 NPM Adjustment Items - 2017 5 —

— — 5 Asset impairment, exit, implementation and

acquisition-related costs - 2017 (29 ) (56 ) — — (85 ) Tobacco and

health litigation items - 2017 (72 ) — — — (72 ) Settlement charge

for lump sum pension payments - 2017 (57 ) (16 ) —

— (73 ) (153 ) (72 ) —

— (225 ) Operations 559

138 (20 ) 20 697

For

the year ended December 31, 2017 $ 8,408

$ 1,300 $ 147

$ (51 ) $

9,804

Schedule 5

ALTRIA GROUP, INC.

and Subsidiaries

Supplemental Financial Data

(dollars in millions)

(Unaudited)

For the Quarters Ended December

31, For the Years

Ended December 31,

2017 2016 2017 2016 The segment

detail of excise taxes on products sold is as follows:

Smokeable products $ 1,346 $ 1,478 $ 5,927 $ 6,247 Smokeless

products 33 33 132 135 Wine 8 8 23 25 $ 1,387

$ 1,519 $ 6,082 $ 6,407

The

segment detail of charges for resolution expenses related to state

settlement agreements included in cost of sales is as follows:

Smokeable products $ 1,035 $ 1,057 $ 4,451 $ 4,622 Smokeless

products 2 2 8 8 $ 1,037 $ 1,059

$ 4,459 $ 4,630

The segment detail of FDA

user fees included in cost of sales is

as follows:

Smokeable products $ 72 $ 70 $ 278 $ 281 Smokeless products

1 1 4 4 $ 73 $ 71 $ 282 $

285

Schedule 6

ALTRIA GROUP, INC.

and Subsidiaries

Net Earnings and Diluted Earnings Per

Share - Attributable to Altria Group, Inc.

For the Quarters Ended December 31,

(dollars in millions, except per share

data)

(Unaudited)

Net Earnings Diluted

EPS 2017 Net Earnings $ 4,966

$ 2.60 2016 Net Earnings $

10,276 $ 5.27 % Change (51.7

)% (50.7 )%

Reconciliation:

2016 Net Earnings $ 10,276 $

5.27 2016 Tobacco and health litigation items 15 0.01

2016 SABMiller special items (153 ) (0.07 ) 2016 Asset impairment,

exit and implementation costs 51 0.03 2016 Patent litigation

settlement 13 0.01 2016 Gain on AB InBev/SABMiller business

combination (8,872 ) (4.56 ) 2016 Tax items (13 ) (0.01 ) Subtotal

2016 special items (8,959 ) (4.59 ) 2017 AB InBev special

items (34 ) (0.02 ) 2017 Asset impairment, exit, implementation and

acquisition-related costs (8 ) — 2017 Tobacco and health litigation

items (38 ) (0.02 ) 2017 Settlement charge for lump sum pension

payments (49 ) (0.03 ) 2017 Tax items 3,353 1.76

Subtotal 2017 special items 3,224 1.69 Fewer

shares outstanding — 0.01 Change in tax rate 119 0.06 Operations

306 0.16

2017 Net Earnings $

4,966 $ 2.60

Schedule 7

ALTRIA GROUP, INC.

and Subsidiaries

Reconciliation of GAAP and non-GAAP

Measures

For the Quarters Ended December 31,

(dollars in millions, except per share

data)

(Unaudited)

EarningsbeforeIncomeTaxes

(Benefit)Provisionfor

IncomeTaxes

NetEarnings

Net EarningsAttributable

toAltria Group, Inc.

DilutedEPS

2017 Reported $ 2,183 $

(2,785 ) $

4,968 $ 4,966

$ 2.60 AB InBev special items 51 17 34 34 0.02

Asset impairment, exit, implementation and

acquisition-related costs

12 4 8 8 — Tobacco and health litigation items 62 24 38 38 0.02

Settlement charge for lump sum pension payments 81 32 49 49 0.03

Tax items — 3,353

(3,353

)

(3,353

)

(1.76 )

2017 Adjusted for Special Items

$ 2,389 $ 645

$ 1,744

$ 1,742 $

0.91 2016 Reported $

15,708 $ 5,430 $ 10,278 $

10,276 $ 5.27 Tobacco and health litigation

items 17 2 15 15 0.01 SABMiller special items (236 ) (83 ) (153 )

(153 ) (0.07 ) Asset impairment, exit and implementation costs 73

22 51 51 0.03 Patent litigation settlement 21 8 13 13 0.01 Gain on

AB InBev/SABMiller business

combination

(13,660 ) (4,788 ) (8,872 ) (8,872 ) (4.56 ) Tax items —

13 (13 ) (13 )

(0.01 )

2016 Adjusted for Special Items $

1,923 $ 604

$ 1,319 $

1,317 $ 0.68

2017 Reported Net Earnings $

4,966 $ 2.60 2016 Reported Net Earnings

$ 10,276 $ 5.27 % Change

(51.7 )% (50.7 )% 2017 Net

Earnings Adjusted for Special Items $ 1,742

$ 0.91 2016 Net Earnings Adjusted for Special

Items $ 1,317 $ 0.68 %

Change 32.3 % 33.8 %

Schedule 8

ALTRIA GROUP, INC.

and Subsidiaries

Net Earnings and Diluted Earnings Per

Share - Attributable to Altria Group, Inc.

For the Years Ended December 31,

(dollars in millions, except per share

data)

(Unaudited)

Net Earnings Diluted

EPS 1 2017 Net Earnings $

10,222 $ 5.31 2016 Net Earnings

$ 14,239 $ 7.28 % Change

(28.2 )% (27.1)%

Reconciliation:

2016 Net Earnings $ 14,239 $

7.28 2016 NPM Adjustment Items 11 0.01 2016 Tobacco

and health litigation items 71 0.04 2016 SABMiller special items

(57 ) (0.03) 2016 Loss on early extinguishment of debt 541 0.28

2016 Asset impairment, exit, implementation and acquisition-related

costs 135 0.07 2016 Patent litigation settlement 13 0.01 2016 Gain

on AB InBev/SABMiller business combination (9,001 ) (4.61) 2016 Tax

items (30 ) (0.02) Subtotal 2016 special items (8,317 ) (4.25)

2017 NPM Adjustment Items (2 ) — 2017 Tobacco and health

litigation items (50 ) (0.03) 2017 AB InBev special items (105 )

(0.05) 2017 Asset impairment, exit, implementation and

acquisition-related costs (55 ) (0.03) 2017 Gain on AB

InBev/SABMiller business combination 289 0.15 2017 Settlement

charge for lump sum pension payments (49 ) (0.03) 2017 Tax items

3,674 1.91 Subtotal 2017 special items 3,702 1.92

Fewer shares outstanding — 0.05 Change in tax rate 124 0.06

Operations 474 0.25

2017 Net Earnings $

10,222 $ 5.31

1 Diluted earnings per share attributable to Altria Group, Inc.

is computed independently for each period. Accordingly, the sum of

the quarterly earnings per share amounts may not agree to the

year-to-date amounts.

Schedule 9

ALTRIA GROUP, INC.

and Subsidiaries

Reconciliation of GAAP and non-GAAP

Measures

For the Years Ended December 31,

(dollars in millions, except per share

data)

(Unaudited)

EarningsbeforeIncomeTaxes

(Benefit)Provisionfor

IncomeTaxes

NetEarnings

Net EarningsAttributable

toAltria Group, Inc.

DilutedEPS

2017 Reported $ 9,828 $

(399 ) $ 10,227

$ 10,222 $ 5.31 NPM

Adjustment Items 4 2 2 2 — Tobacco and health litigation items 80

30 50 50 0.03 AB InBev special items 160 55 105 105 0.05 Asset

impairment, exit, implementation and

acquisition-related costs

89 34 55 55 0.03 Gain on AB InBev/SABMiller business

combination

(445 ) (156 ) (289 ) (289 ) (0.15 ) Settlement charge for lump sum

pension

payments

81 32 49 49 0.03 Tax items — 3,674

(3,674 ) (3,674 ) (1.91 )

2017 Adjusted for Special Items $ 9,797

$ 3,272 $

6,525 $ 6,520

$ 3.39 2016

Reported $ 21,852 $ 7,608 $

14,244 $ 14,239 $ 7.28 NPM

Adjustment Items 18 7 11 11 0.01 Tobacco and health litigation

items 105 34 71 71 0.04 SABMiller special items (89 ) (32 ) (57 )

(57 ) (0.03 ) Loss on early extinguishment of debt 823 282 541 541

0.28 Asset impairment, exit, implementation and

acquisition-related costs

206 71 135 135 0.07 Patent litigation settlement 21 8 13 13 0.01

Gain on AB InBev/SABMiller business

combination

(13,865 ) (4,864 ) (9,001 ) (9,001 ) (4.61 ) Tax items —

30 (30 ) (30 )

(0.02 )

2016 Adjusted for Special Items $

9,071 $ 3,144

$ 5,927 $

5,922 $ 3.03

2017 Reported Net Earnings $ 10,222

$ 5.31 2016 Reported Net Earnings $

14,239 $ 7.28 % Change (28.2

)% (27.1 )% 2017 Net Earnings

Adjusted for Special Items $ 6,520 $

3.39 2016 Net Earnings Adjusted for Special Items

$ 5,922 $ 3.03 % Change

10.1 % 11.9 %

Schedule 10

ALTRIA GROUP, INC.

and Subsidiaries

Reconciliation of GAAP and non-GAAP

Measures

For the Periods Ended December 31,

(Unaudited)

Fourth Quarter Full Year U.S. federal

statutory rate 35.0 % 35.0 % Increase (decrease) resulting from:

State and local income taxes, net of federal tax benefit 4.9 3.5

Re-measurement of net deferred tax liabilities (140.3 ) (31.2 ) Tax

basis in foreign investments (35.0 ) (7.8 ) Deemed repatriation tax

18.9 4.2 Uncertain tax positions (2.3 ) (0.9 ) AB InBev dividend

benefit (9.7 ) (5.9 ) Domestic manufacturing deduction (2.1 ) (1.8

) Other 3.0 0.8

Reported effective tax

rate 1 (127.6 )% (4.1

)% Tax reform items 154.2 34.3 Valuation allowance release —

2.4 IRS audit closure — 1.5 Other 0.4 (0.7 )

Adjusted effective tax rate 2 27.0 %

33.4 %

1 Reported effective tax rate is calculated as “(Benefit)

provision for income taxes” divided by “Earnings before income

taxes” from Schedules 1 and 3.

2 Adjusted effective tax rate is calculated as “Adjusted

provision for income taxes” divided by “Adjusted earnings before

income taxes” from Schedules 7 and 9.

Schedule 11

ALTRIA GROUP, INC.

and Subsidiaries

Condensed Consolidated Balance Sheets

(dollars in millions)

(Unaudited)

December 31, 2017 December 31,

2016

Assets

Cash and cash equivalents $ 1,253 $ 4,569 Inventories 2,225 2,051

Other current assets 866 640 Property, plant and equipment, net

1,914 1,958 Goodwill and other intangible assets, net 17,707 17,321

Investment in AB InBev 17,952 17,852 Finance assets, net 899 1,028

Other long-term assets 386 513

Total assets $

43,202 $ 45,932

Liabilities and

Stockholders’ Equity

Current portion of long-term debt $ 864 $ — Accrued settlement

charges 2,442 3,701 Other current liabilities 3,486 3,674 Long-term

debt 13,030 13,881 Deferred income taxes 5,247 8,416 Accrued

postretirement health care costs 1,987 2,217 Accrued pension costs

445 805 Other long-term liabilities 283 427 Total

liabilities 27,784 33,121 Redeemable noncontrolling interest 38 38

Total stockholders’ equity 15,380 12,773

Total

liabilities and stockholders’ equity $ 43,202

$ 45,932 Total debt $ 13,894 $ 13,881

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180201005587/en/

Altria Client ServicesInvestor Relations804-484-8222Altria

Client ServicesMedia Relations804-484-8897

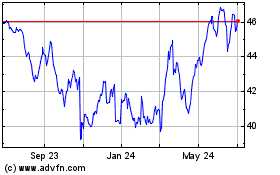

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

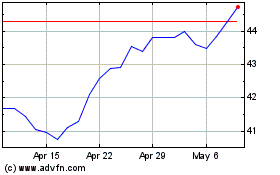

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024