By Victor Reklaitis, MarketWatch

Apple earnings on deck after the closing bell

U.S. stock-index futures on Thursday were little changed as a

new month kicked off, with gains for eBay and Facebook offset by

drops for PayPal and other names.

Investors are getting more corporate earnings later, and Apple

is scheduled to report financial results after the close.

What are the main benchmarks doing?

Dow Jones Industrial Average futures dipped by 4 points, or less

than 0.1%, to 26,132, while S&P 500 futures rose by 5.20

points, or 0.2%, to 2,831. Nasdaq-100 futures edged up by 3 points,

or less than 0.1%, to 6,965.50.

On Wednesday, the Dow rose by 72.50 points, or 0.3%

(http://www.marketwatch.com/story/dow-set-to-stabilize-after-shedding-540-points-in-2-days-2018-01-31),

while the S&P and Nasdaq Composite inched higher. The moves

came as the Federal Reserve kept a key interest rate steady but

signaled it's on course to hike rates

(http://www.marketwatch.com/story/fed-takes-step-toward-rate-hike-as-baton-set-to-pass-to-powell-2018-01-31)

at its meeting next month.

The three equity gauges stand less than 2% below last Friday's

record closes after declining on Monday and Tuesday. They are up

between 24% and 31% over the last 12 months, boosted by an

expanding U.S. economy and growth in corporate profits. For

January, the Dow gained 5.8%; the S&P, 5.6%; and the Nasdaq,

7.4%.

Check out:Here's how the Dow, S&P 500 tend to perform after

a rip-roaring January

(http://www.marketwatch.com/story/heres-how-the-dow-sp-500-tend-to-perform-after-a-rip-roaring-january-2018-01-31)

What are strategists saying?

"The Federal Reserve has given us a clear message that, barring

some sort of collapse in sentiment over the next few weeks, March

is good to go to lift the fed funds rate," said Chris Weston, chief

market strategist at IG.

"The narrative perhaps even throws weight to the camp that we

would see hikes in the August, September and December meetings,

too," he said in a note.

Which stocks look like key movers?

Shares in eBay Inc.(EBAY) were up 10% in premarket trading for

the S&P 500's biggest gain. The online auctioneer late

Wednesday posted better-than-expected quarterly earnings and said

it plans to take over crucial payments-processing duties

(http://www.marketwatch.com/story/ebay-breaks-up-with-paypal-again-stock-soars-as-paypal-shares-dive-2018-01-31)

from PayPal Holdings Inc.(PYPL)

PayPal's stock fell 9% premarket in the wake of that

announcement, even as the payments company posted quarterly profit

that beat forecasts

(http://www.marketwatch.com/story/paypal-stock-falls-after-fourth-quarter-earnings-2018-01-31).

Facebook Inc.'s stock (FB) was 2% higher ahead of the open,

after the social media giant late Wednesday reported double-digit

advertising price growth

(http://www.marketwatch.com/story/facebook-earnings-stock-touches-record-after-massive-ad-price-increase-2018-01-31)

amid massive changes to its core product. Shares initially dropped

as the company's release revealed a drop in usage of its

platform.

Apple Inc. shares (AAPL) were little changed premarket ahead of

the tech giant's report after the closing bell.

See:The $1,000 iPhone X remains the story as Apple's earnings

arrive

(http://www.marketwatch.com/story/apple-earnings-forget-taxes-and-batteries-the-1000-iphone-x-remains-the-story-2018-01-26)

Microsoft Corp.'s stock (MSFT) was little changed after the

software heavyweight posted better-than-expected earnings

(http://www.marketwatch.com/story/shares-of-microsoft-slide-as-software-giant-reports-a-quarterly-loss-on-tax-cuts-2018-01-31).

First Take:Microsoft earnings show Nadella is blazing the right

path

(http://www.marketwatch.com/story/microsoft-earnings-show-nadella-is-blazing-the-right-path-2018-01-31)

What could help drive markets?

As traders wait for the key monthly U.S. jobs report due Friday,

they will get plenty of other economic data.

A reading on weekly jobless claims is slated to hit at 8:30 a.m.

Eastern Time, with economists polled by MarketWatch forecasting

240,000 claims. A release on fourth-quarter productivity and labor

costs is due at that time as well, with economists expecting growth

of 0.2% and 1.3%, respectively.

At 9:45 a.m. Eastern, investors are slated to get a Markit

report on January manufacturing, then an ISM reading on that same

topic is due at 10 a.m. Eastern. A December release on construction

spending is due at 10 a.m. Eastern, too.

Reports on U.S. auto sales for January are expected to roll in

throughout the session.

Check out:MarketWatch's Economic Calendar

(http://www.marketwatch.com/economy-politics/calendars/economic)

On the Federal Reserve front, San Francisco Fed President John

Williams is due to give a speech at The City Club in San Francisco

at 3:30 p.m. Eastern.

What are other assets doing?

European stocks traded higher

(http://www.marketwatch.com/story/european-stocks-break-3-day-losing-run-after-solid-finance-tech-earnings-2018-02-01),

while Asian markets closed mixed. Gold were little changed, as oil

futures advanced. The ICE U.S. Dollar Index was dipping.

(END) Dow Jones Newswires

February 01, 2018 05:53 ET (10:53 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

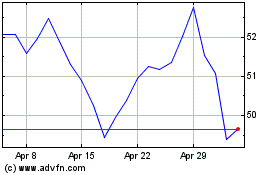

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

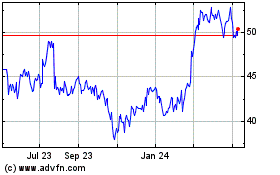

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Apr 2023 to Apr 2024