PayPal Loses Big Part of eBay Business -- WSJ

February 01 2018 - 3:02AM

Dow Jones News

By Peter Rudegeair

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 1, 2018).

PayPal Holdings Inc. is losing a chunk of the business of one of

its biggest sources of customers.

eBay Inc., the marketplace website that owned PayPal until it

was spun out as a separate company in 2015, said Wednesday that it

would start managing the payments flow of buyers and sellers

transacting on its website. Adyen BV, a financial-technology

startup based in Amsterdam, will take over as eBay's primary

payments processor after its agreement with PayPal ends in

mid-2020.

"We believe that we can offer a more seamless experience while

giving buyers and sellers more choice for payment and payout

options," eBay CEO Devin Wenig said on a conference call with

analysts.

Shares in PayPal fell more than 12% in aftermarket trading,

while shares in eBay rose more than 8%.

Despite being apart for more than two years, eBay is still a

large, though declining, contributor to PayPal's business. Around

22% of PayPal's 2016 revenue came from customers on eBay's

platform, down from 26% in 2015 and 29% in 2014.

PayPal CEO Dan Schulman said on a conference call with analysts

that the loss of part of its business with eBay would be "quite

manageable" and had been assumed for some time.

"Volume is important to us but so is profitability," said John

Rainey, PayPal's finance chief, on the conference call. "Where this

was ending up is something that we weren't interested in from a

profitability perspective."

The executives added that PayPal's eBay volume was growing

slower than its non-eBay volume. They said that trend would get a

boost from recently-signed agreements for PayPal to be a payment

option at large retailers including Walt Disney Co., Dillard's Inc.

and QVC Inc. for the first time.

Mr. Schulman added that eBay users will be able to buy and sell

goods there with PayPal's digital wallet until 2023 thanks to a new

agreement the two companies signed. In an interview, he said that

the PayPal-branded checkout option was the majority, and the most

profitable, part of its business with eBay.

The announcement that eBay was backing away from its

relationship with PayPal overshadowed the payment firm's fourth

quarter results. PayPal said that profit rose 59% despite booking a

big charge related to the U.S. tax overhaul.

The San Jose, Calif.-based payments company reported a quarterly

profit of $620 million, or 50 cents a share. That compares with a

profit of $390 million, or 32 cents a share, in the same period of

2016. On an adjusted basis, PayPal's per-share earnings rose to 55

cents, above the estimate of analysts polled by Thomson

Reuters.

PayPal incurred a tax expense of $180 million because of the

"impact of the recently enacted Tax Cuts and Jobs Act of 2017,"

which brought its effective tax rate to 28.2%. In the fourth

quarter of 2016, PayPal's effective tax rate was 16.8%.

Payment volume totaled $131.45 billion, up nearly one-third from

the same period a year ago. Venmo, PayPal's mobile person-to-person

payments service, handled $10.4 billion in volume during the fourth

quarter. That was 86% more than the volume it handled in the fourth

quarter of 2016.

Expenses rose 15% to $2.9 billion thanks in part to a one-third

increase in transaction costs.

Laura Stevens contributed to this article.

Write to Peter Rudegeair at Peter.Rudegeair@wsj.com

(END) Dow Jones Newswires

February 01, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

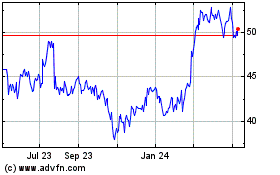

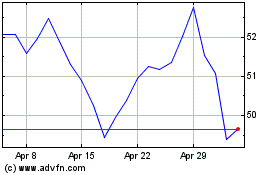

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Apr 2023 to Apr 2024