Bank of New York Mellon Plans to Move Its Corporate Headquarters in Lower Manhattan -- Update

January 31 2018 - 7:12PM

Dow Jones News

By Justin Baer and Keiko Morris

Bank of New York Mellon Corp. is moving its global headquarters

for the second time in less than four years.

The custody bank plans to relocate all of its employees from

Brookfield Place, the downtown office complex formerly known as the

World Financial Center, to a nearby building it owns at 101 Barclay

St. The move consolidates BNY Mellon's presence in New York,

bringing together some 4,500 employees under one roof, a spokesman

for the bank said.

"As part of our multiyear corporate real estate strategy, we

have continued to review our occupancy needs in Lower Manhattan,

and there are real benefits for us bringing together the teams

currently at 225 Liberty with our colleagues in 101 Barclay,"

Michael Santomassimo, BNY Mellon's finance chief, wrote in a memo

to employees.

BNY Mellon signed a 20-year lease at 225 Liberty St., one of the

buildings within Brookfield Place, in 2014. The agreement, which

covered 350,000 square feet, began the following January.

The bank plans to sublet the office space, a person familiar

with the company's plans said.

A spokesman for Brookfield Property Partners, the building's

owner, declined to comment.

BNY Mellon is shedding office space as its new chief executive,

Charles Scharf, reviews the bank's businesses and operations. Mr.

Scharf, a former protégé to JPMorgan Chase & Co.'s James Dimon,

arrived last year expected to modernize the custody bank, find new

sources of revenue growth and trim costs.

Earlier this month, BNY Mellon reported it had taken a

fourth-quarter charge to absorb severance costs related to the

review. The bank didn't say how many jobs would be affected by

possible cuts.

The 225 Liberty St. offices house BNY Mellon's executive team,

along with support functions such as its finance and legal

departments. It's part of a large complex with 8 million square

feet of office space. Ninety-seven percent is leased, Brookfield

said.

The move, set to begin this summer, will fill vacant space at

101 Barclay. The bank intends to redesign and modernize its space,

Mr. Santomassimo wrote. Those changes will include open floor plans

without offices, he wrote.

BNY Mellon sold its former Wall Street headquarters in 2014, and

had weighed several New York and New Jersey locations before

striking a deal with Brookfield.

New York made a big push to keep the bank, which was founded in

1784 by Alexander Hamilton. The state agreed to provide $20 million

in funding for redevelopment of the Barclay Street offices and a

build-out of the newly leased space at 225 Liberty St., according

to the state's economic development agency. The incentives included

a $5 million grant and $15 million in state capital funds. BNY

Mellon in turn agreed to invest $200 million and maintain 5,700

jobs in New York City, including 3,935 jobs at the two lower

Manhattan locations.

The company will be able to receive these incentives if it meets

the investment and job requirements for either location.

The consolidation likely won't have a big impact on the downtown

Manhattan office market and Brookfield, said Jeffrey Peck, vice

chairman for real estate services firm Savills Studley.

"Brookfield has a great credit tenant on the hook for the lease

for the long term," Mr. Peck said. "There has been good demand

downtown, specifically at Brookfield Place and the World Trade

Center site."

Write to Justin Baer at justin.baer@wsj.com and Keiko Morris at

Keiko.Morris@wsj.com

(END) Dow Jones Newswires

January 31, 2018 18:57 ET (23:57 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

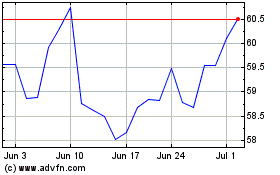

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Apr 2023 to Apr 2024