NetworkNewsWire

Editorial Coverage: Less than a decade ago, blockchain sounded

like the fodder of science fiction; today, the technology is

demonstrating its ability to revolutionize the finance industry. By

stepping outside the existing payment structures, blockchain

provides a new and secure way to execute financial transactions.

The use of the technology is rapidly expanding, and because of the

innovative nature of the technology, its wide-ranging possibilities

are being explored and developed by a range of companies with

unique objectives. Some, such as SinglePoint, Inc. (SING)

(SING

Profile), are looking at how to

integrate these technologies to provide a better service for select

markets. While alarming articles predict the bursting of the

“blockchain bubble,” established companies such as Bank of

America Corp. (BAC) and Mastercard, Inc.

(MA) have moved to adopt blockchain technology, signalling

its acceptance by mainstream banking. Meanwhile, companies such as

Bitcoin Services, Inc. (BTSC) and Discover

Financial Services (DFS) continue looking for new ways to

exploit the technology’s potential.

The Future of Payment

Blockchain is a system for recording and sharing information,

including financial data. Because of the way data is stored within

a blockchain, there is no need for a central organization tasked

with controlling records. This decentralization makes it easier to

transfer data or money while reducing the risk of fraud or error.

The benefits are such that the World Economic Forum has predicted

that 10% of GDP will

be stored on blockchain technology by 2025.

Blockchain has become famous mostly through the meteoric rise of

bitcoin, which has seen the market value of cryptocurrencies rise

to over $540

billion. But its use goes far beyond this. Its ability to

verify clients and products is expected to lead to better records

of property ownership and certification of diamonds. It could

provide smart contracts that automatically pay out when success

criteria are hit. By acting as a secure system for direct payments,

it will reduce the need for intermediaries in financial systems,

allowing people to make payments more quickly and directly.

Putting the Pieces Together

One of the companies seeking to take advantage of these

capabilities is SinglePoint

(SING), which has grown from a mobile technology provider into

a diverse holding company with a growing portfolio of investments

in blockchain-related technology. SinglePoint’s aggressive,

acquisition-based growth strategy has seen it dramatically expand

its services and brand awareness in the investment community.

SinglePoint is implementing blockchain to the core of its

business strategy, specifically as it pertains to the cannabis and

other “high-risk” industries. By acquiring companies and

technologies with established roots in blockchain services,

SinglePoint can provide increasingly integrated options for

blockchain-based payment systems. For example, the company’s recent

agreement to acquire Bitcoin Beyond will provide SinglePoint a

user-friendly point-of-sale payment system that will provide

merchants and bitcoin users a range of unprecedented capabilities.

Bitcoin Beyond was created to overcome the challenges of merchants

in the cannabis industry, which is crippled by cash management

issues due to the lack of banking options. Functioning as a

general-purpose point-of-sale system, Bitcoin Beyond is poised to

address the growing demand for fast and reliable electronic payment

processing for the cannabis industry.

“We are thrilled with this opportunity. Acquiring Bitcoin Beyond

put us ahead of what we believe merchants have access to now. This

platform has by far the easiest user interface we have seen in the

market, and we are confident merchants will be quick to adopt this

solution as it stands as the sole alternative to traditional

options offered to the cannabis industry,” SinglePoint President

Wil Ralston stated in the press release (http://nnw.fm/l7DK5).

One of the advantages of the Bitcoin Beyond System is that it

makes cryptocurrency transactions easy by instantly doing the

conversion for USD for merchants and customers. It can process

payments in bitcoin, the most popular blockchain payment system,

from any web-enabled terminal available at checkout, from a cell

phone or tablet to a full PC.

SinglePoint also has its own proprietary bitcoin exchange

(app.singleseed.com), launched in November 2017. Customers can

easily sign up using a credit or debit card, then use the system to

benefit from blockchain’s quick, secure payments.

SinglePoint’s commitment to integrated solutions extends beyond

acquiring companies and into collaborations. The company has

agreements with various businesses, including fintech solutions

provider Global Payout

(GOHE), to advance and streamline the process involved in

delivering payment applications.

The company has also teamed up with SharkTank veteran and

entrepreneur Kevin Harrington - which has led 20 companies to reach

revenues of over $100 million - to develop and promote a range of

cryptocurrency projects, including SinglePoint’s exchange and

bitcoin payment platform and the integration of Procurrency, an

e-commerce and rewards platform using blockchain currency (http://nnw.fm/qV7Xp).

With these initiatives, SinglePoint is tapping into not just one

fast-growing sector but two, as many of its financial and

technological solutions are geared toward cannabis merchants.

Financial Services for a New Market

With cannabis sales now legal in 29 U.S. states, and legislators

opening the way to recreational as well as medical use, cannabis is

a lucrative business. But federal legislation designed for the war

on illegal drugs has created problems for legal cannabis

businesses. Many are unable to access the financial services

available to other companies and have been forced to work on a cash

basis, making them vulnerable to theft and fraud. Blockchain

payment systems provide them with a secure alternative to cash

payments without needing to engage with banks.

Services such as SingleSeed are specifically geared toward this

market, providing a much-needed product for a growing industry.

SinglePoint’s blockchain-based services allow secure payments for

cannabis merchants. Its collaborations with other companies,

including developing mobile apps with AppSwarm (SWRM), ensure that

these services are easily accessible. SinglePoint’s willingness to

move quickly is vital in these fast-growing sectors. The AppSwarm

collaboration began with an aim to launch their first app within 90

days.

SinglePoint’s services for the cannabis sector show how

blockchain technology and the companies behind it can provide more

than just financial solutions. The work with AppSwarm will allow

safe delivery to customers in their homes, increasing the speed,

security, and efficiency of the cannabis supply chain.

The technology provided by SinglePoint goes beyond just a

payment system. It also provides vendors with a system to digitally

track their inventories, provide information about products to

customers, and automatically remove products from the inventory

once sold. Though this is currently targeted at cannabis suppliers,

it is a system that could be useful for any cash-based business

looking for a more secure way to operate. Thanks to money from the

fast-growing legal cannabis market, SinglePoint is creating

software that will be useful for all manner of small

businesses.

SinglePoint’s interest in integrating systems and supply chains

extends into other parts of the cannabis industry. The company

recently established a joint venture with Smart Cannabis (SCNA),

making a major move into California’s cannabis market before

blanket marijuana legalization in that state. Having previously

acquired Discount Indoor Garden Supply in California and invested

in California-based cannabis equipment supplier Convectium,

SinglePoint is now the owner or investor in products and services

covering the whole cannabis supply chain. It is in a position to

provide the same sort of integrated services it has pioneered in

blockchain payments.

The partnership with Smart Cannabis is particularly valuable in

capturing market share within California’s red-hot commercial

marijuana cultivation market. Smart Cannabis provides a range of

innovative products for cannabis growers, including automated

greenhouse systems and a unique seed-to-sale app. Seed-to-sale

systems are important in

managing cannabis sales and ensuring compliance with government

regulations. The joint venture will allow the two companies to

incorporate blockchain currency into Smart Cannabis’ SMARTAPP and

sell it to growers, integrating seed-to-sale and payment mechanisms

(http://nnw.fm/t2SAz).

The Bigger Picture on Blockchain

While SinglePoint is providing some of the most interesting

examples of integrated systems using blockchain, an increasing

number of companies are also exploring the services this technology

can provide.

Bank of America (BAC), the second largest bank

in America and the largest wealth management company in the world,

has long distanced itself from bitcoin, the leading blockchain

currency. But as the holder of at least 27 blockchain patents and

39 relating to cryptocurrency, including some

for exchanging currencies, it is clear that the bank is

interested in the broader technologies. CEO Brian Moynihan has played down

the bank’s interest in cryptocurrencies, even as his

organisation prepares for a future built around blockchain.

Mastercard (MA), one of the largest payment

processing companies in the world, prides itself on its

forward-looking approach to finance, listing “Putting technology

first” among its areas of focus. It has repeatedly shown an

interest in blockchain. In a patent filed

on the 9th of November 2017, it set out details for a

blockchain database that would reduce delays in payment transfers.

Like Bank of America, its leaders are pro-blockchain but

anti-bitcoin.

Bitcoin Services (BTSC) provides support

services for people dealing in the most prominent blockchain

currency, bitcoin. The company is also working on developing

blockchain software, as this technology keeps moving forward.

Direct banking and payments company Discover Financial

Services (DFS) has singled out blockchain as one of the

most important technologies shaping the future of payments.

Describing blockchain as secure, transparent, and closer in the way

it works to cash than to card payments, Discover has identified the

technology as one to keep an eye on. Though the company has not yet

announced any blockchain innovations of its own, comments on its

Discover Network suggest it is preparing its customers for a

blockchain future (http://nnw.fm/BlW3O).

Like any transformative technology, blockchain creates

challenges as well as benefits. It relies on large data sets,

meaning that new infrastructure may be needed to support widespread

use. Its ability to provide direct payments with a minimal data

trail has created concerns about money laundering and regulatory

oversight. But the genie is out of the bottle, and given its

benefits, the question isn’t whether anyone will overcome these

challenges, it is who will.

For more information on SinglePoint, visit SinglePoint

(SING)

About NetworkNewsWire

NetworkNewsWire (NNW) is a financial news and content

distribution company that provides (1) access to a network of wire

services via NetworkWire to

reach all target markets, industries and demographics in the most

effective manner possible, (2) article and editorial syndication to

5,000+ news outlets (3), enhanced press release services to ensure

maximum impact, (4) social media distribution via the Investor

Brand Network (IBN) to nearly 2 million followers, and (5) a full

array of corporate communications solutions. As a multifaceted

organization with an extensive team of contributing journalists and

writers, NNW is uniquely positioned to best serve private and

public companies that desire to reach a wide audience of investors,

consumers, journalists and the general public. By cutting through

the overload of information in today’s market, NNW brings its

clients unparalleled visibility, recognition and brand awareness.

NNW is where news, content and information converge.

For more information, please visit https://www.NetworkNewsWire.com

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW is a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertakes no

obligation to update such statements.

Source:

NetworkNewsWire

Contact:

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

SinglePoint (QB) (USOTC:SING)

Historical Stock Chart

From Mar 2024 to Apr 2024

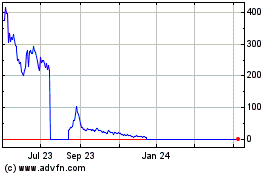

SinglePoint (QB) (USOTC:SING)

Historical Stock Chart

From Apr 2023 to Apr 2024