UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the

Registrant ☒ Filed by a Party other than the

Registrant ☐

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, For Use of the Commission Only (as permitted by Rule

14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

|

|

☒

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material Pursuant to §

240.14a-12

|

Lifetime Brands, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules

14a-6(i)(4)

and

0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act

Rule 0-11

(set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule

0-11(a)(2)

and identify the filing for which the offsetting fee was paid previously. Identify the

previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

On December 22, 2017, Lifetime Brands, Inc. (the “Company”) entered into a merger agreement with

certain of its wholly-owned merger subsidiaries and Taylor Holdco, LLC (dba Filament Brands), a Delaware limited liability company (“Taylor”) and Taylor Parent, LLC, a Delaware limited liability company (“Taylor Parent”) and the

other parties thereto providing for the acquisition of Taylor by the Company (the “Acquisition”).

Concurrent with the Acquisition, and pursuant

to the commitment letter dated December 22, 2017, by and among the Company, JPMorgan Chase Bank, N.A. (“JPMorgan”) and Golub Capital LLC (“Golub Capital”), the Company expects to enter into (1) a credit agreement among

JPMorgan, as administrative agent, the lenders from time to time party thereto, the Company, the foreign subsidiary borrowers from time to time party thereto, and certain of its other domestic and foreign subsidiaries from time to time party thereto

(the “ABL Credit Agreement”) providing for a senior secured asset-based $150.0 million revolving credit facility with a maturity five years from the completion of the Acquisition (the “ABL Credit Financing”) and (2) a

credit agreement among JPMorgan, as term loan administrative agent, Golub Capital, as lender, and the other lenders from time to time party thereto and the Company (the “Term Loan Credit Agreement”) providing for a $275.0 million term

loan facility with a maturity seven years from the completion of the Acquisition and quarterly principal payments equal to 1% per annum of the original amount of the term loan facility (the “Term Loan Credit Financing” and together with

the ABL Credit Financing, the “Debt Financing”).

In connection with the Debt Financing, the Company is furnishing to prospective lenders

certain business information about the Company and Taylor that the Company considers material information that, in part, has not been available to the public. Accordingly, the Company is providing such information herewith

2

FINANCING TRANSACTION OVERVIEW (1) EV

calculated based on LCUT’s share price of $16.87, estimated Filament debt balance at closing of $185.0mm, cash considerations to seller of $27.5mm and $6.5mm of transaction expenses; (2) Excludes $3.1mm letters of credit; (3) Market cap based

on share price of $17.40 as of 1/24/18; (4) PF 2017E Adjusted EBITDA of $87.7mm, defined as $34.5mm of Filament 2017E EBITDA (inclusive of PlanetBox EBITDA) + $45.2mm of Lifetime 2017E EBITDA (inclusive of $2.3mm of cost savings and $2.0mm of

savings from UK operations consolidation) + $8.1mm of other cost savings. Sources & Uses Pro Forma Capitalization Sources ($mm) $150.0mm RC facility $53 Term loan B 275 Equity funding 94 Total sources $422 Uses ($mm) Consideration to Filament(1)

$313 Refinance existing Lifetime ABL(2) 95 Other fees / expenses 14 Total uses $422 ($mm) FYE 12/31 x FYE 12/31 EBITDA PF FYE 12/31 xPF 12/31 EBITDA Total cash and equivalents $6 – $6 – Existing $175mm ABL due 2019(2) 95 2.1x –

– New ABL revolving facility due 2023 – – 53 0.6x New $275mm term loan B due 2025 – – 275 3.1x Total debt $95 2.1x $328 3.7x Net debt $89 2.0x $323 3.7x Market capitalization(3) 258 – 352 – Total

capitalization $353 – $680 – Applied EBITDA(4) – $45 – $88

Category #1 Segment Position Home

Décor Portable Beverageware and Food Storage Lunch Bags & Wine Totes Pantryware & Spice Racks Category #1 Segment Position Dinnerware Stemware Flatware Category #1 Segment Position Kitchen Tools & Gadgets Cutlery, Cutting Boards

& Shears Cookware & Bakeware LIFETIME BRANDS – OVERVIEW Lifetime Brands is a leading global provider of branded kitchenware, tableware and other products used in the home U.S. market: $6.8bn Kitchenware One of the top 3 market share

leaders in a $3.0bn category Tableware Home Solutions U.S. market: $6.5bn

FILAMENT BRANDS – OVERVIEW Gross

Sales Profile Key Brands Commercial 36% Bath & Other 21% LTM 9/30/17 Sales: $178mm1 Category Brands #1 Segment Position Kitchenware 36% Kitchen Measurement Kitchen Tools & Gadgets Wine & Bar Commercial Bath Measurement Weather

Measurement & Travel Retail Direct Kitchenware 38% Commercial 33% Bath & Other 21% Retail Direct 8% (1) Pro forma for PlanetBox acquisition

Sales ($mm) FILAMENT BRANDS – KEY

BUSINESSES Commercial Kitchenware Ideation, trends, design, development, and engineering services focused on customer driven projects #1 ranked Starbucks ware designer and supplier, with hot, cold, hydration, tea, accessories, gift and ceramic

categories served 14 years with Starbucks, largest supplier in cold category, 2nd largest supplier in hot, won exclusive supplier program in hydration in 2016 #1 supplier of kitchen measurement devices to serve the food industry Note: Filament

fiscal year end of 3/31 Kitchen measurement: #1 brand in retail kitchen measurement and #1 in food service measurement (thermometers, food scales, timers) Taylor: leading provider of measurement devices to the industrial market Chef’n: Leading

innovator in kitchen tools and gadgets Rabbit: Pioneer in wine accessories category with high consumer recognition Bath & Other Bath: 30%+ market share, leading supplier of bath scales, brands include Taylor, Homedics, Salter Weather: category

pioneer for weather thermometers under brands Taylor and Springfield Retail Direct Online only brand EatSmart sells direct to consumer as a market place seller through Amazon EatSmart substantial online presence (25,000+ reviews on leading SKUs) is

a large competitive advantage. Leading 5 star ratings and #1 ranked position in bath scales and travel cubes Planet Box is 95% sold online, nearly all on its own website Direct to Consumer Brand of eco friendly products featuring lunchboxes and

related accessories

CAGR: 26.6% Amazon North America Retail

sales ($bn) Lifetime and Filament Amazon Gross Sales ($mm) Online sales for Amazon will continue to grow rapidly, as estimates report that 71% of the penetrable Gen Y market and 66% of the penetrable Gen X market are Amazon prime members or

interested in becoming Amazon prime members This compares to 58% and 38% of the Boomers and Seniors generations, respectively Currently, 58% of all shoppers are Amazon prime members or interested in becoming Amazon prime members CAGR: 3.0% Filament

Lifetime CAGR: 61.0% FYE: December 31 FYE: March 31 Overall, Lifetime estimates that 27% of their products are purchased online through online retailers which includes pure play online and the on line sites of brick and mortar retailers 1 …

WITH STRONGER PRO FORMA ONLINE POSITIONING

BY CUSTOMERS: INCREASED PRO FORMA

RELEVANCE AND EXPANSION OF DISTRIBUTION CHANNELS Commercial: 1.2x 11.1x 1.9x 1.6x 1.7x Direct-to-Consumer 1.2x 1.4x 2.0x Important Growth Opportunities Combined Revenue Relative to Lifetime Brands International: Complimentary channel capabilities

create white space opportunities in: 4

~400 bps immediate margin expansion with

transaction Consistent EBITDA generation CASH FLOW GENERATION: HISTORY OF STRONG CASH FLOW SUPPORTED BY LOW-CAPEX MODEL Note: LTM 9/30/17 Lifetime EBITDA includes $2.3mm of achieved cost savings and $2.0mm of savings from UK operations

consolidation. The run-rate $4.3mm of cost savings includes $2.3mm of cost savings and $2.0mm of savings from UK operations consolidation. (1) 6 TBU – not in proxy Steady Net Sales Growth Lifetime Brands Filament Brands % conversion 88.5%

92.8% 88.7% 96.0% 96.9% 95.6% Current asset-lite / low-capex model combined with forecasted growth & expansion from Filament acquisition

FINANCIAL POLICY Targeted debt / EBITDA

below 3.00x Maintain strong free cash flow generation Maintain solid liquidity position Access to asset-based revolving credit facility for growing working capital and other general corporate purposes Target minimum liquidity (ABL R/C availability

and cash on balance sheet) of $75.0 million Emphasis on organic growth complemented with tuck-in acquisitions of global brands Continued focus on de-leveraging FINANCIAL POLICY

$20 MILLION OF ANNUAL IDENTIFIED COST

SAVINGS OPPORTUNITIES Lifetime Cost Saving Initiatives Supply Chain: ($2.8 million) Consolidate warehouses and eliminate overlapping functions related to warehousing Rationalize footprint and workforce in China Sales & Marketing: ($2.2 million)

Utilize Lifetime’s in-house sales force to reduce costs Eliminate overlapping marketing positions Overlapping G&A: ($3.1 million) Elimination of redundant back office operations Expect one-time costs not to exceed $4.5 million to achieve

identified synergies Merger Synergies Lifetime extracted $4.3 million of savings through initiatives undertaken in the past year(1) This includes consolidation of international operations Additional savings of $8.0 million upon completion of

business optimization plan Total savings of $12.3 million Total savings of $8.1 million All cost savings expected to recur every year going forward (1) $4.3 million of cost savings calculated as $2.3mm of cost saving initiatives already completed +

$2.0mm U.K. operations consolidation under way Not currently included in pro forma stats and model

SUMMARY CREDIT HIGHLIGHTS Meaningfully

enhances scale: Fragmented industry where Lifetime is #1 on a pro forma basis (previously #2) Scale creates a competitive advantage and enhanced platform to consolidate industry Large international upside for Filament with ability to go direct to

market via Lifetime’s platform Enables access to 3rd party data creating a competitive advantage supporting product placement at retailers Enhanced pro forma financial profile Meaningful margin accretion (~400 bps increase in EBITDA margin,

200 bps increase in gross margin) Doubling of EBITDA and Free Cash Flow Superior free cash flow model: asset lite, low capex primarily related to maintenance Strong anticipated pro forma free cash flow conversion Leading market positions #1 in 9

categories, representing 61% of sales Highly complementary businesses with little category overlap Long established brands with wide consumer and trade recognition Demonstrated brand loyalty and longevity Long-term customer relationships across

distribution channels Consistent track record: Both companies have demonstrated stable financial performance Management has successful track record of M&A and post-merger integration, as well as a commitment to a conservative balance sheet

Strong presence across distribution channels Retail presence from Walmart to Tiffany International via KitchenCraft in the UK Ecommerce – Amazon, Omnichannel, and direct to consumer Commercial Merger utilizes unique infrastructure built at

Lifetime, creating significant synergies Unique and difficult to replicate platform in the industry 60 years of sourcing, engineering, logistics, quality control, etc. State of the art distribution facilitates on the East and West costs Strong

in-house sales force with long-term customer relationships Leading IT infrastructure run on SAP (1) FCF conversion calculated as (Cash from operations – CapEx) / Adjusted EBITDA

EBITDA RECONCILIATION FY2016A

LTM 9/30/17 FY2017E LCUT EBITDA build Net Income $15.7 $15.7 $8.7 (+) Provision for Income Taxes 7.0 7.7 5.2 (+) Interest Expense (Incl. Amortization of Fees) 5.1 4.5 4.8 (+) Depreciation & Amortization 14.2 13.1 14.5 (+) Vasconia

Dividend 0.2 0.2 - (+) Stock Option Expense 2.9 3.3 3.4 (+) Rialto warehouse - - 1.2 (+) Restructuring 2.4 1.4 1.2 (+) Equity (Income) in Earnings (0.7) (1.7) (0.7) (+) Acquisition Costs / Unrealized MTM Gain / Loss 0.1 1.6 2.6 Reported EBITDA $46.9

$45.8 $40.9 (+) Positions eliminated - 1.7 1.7 (+) La Cafetiere - 0.7 0.7 (+) Consolidation of UK operations - 2.0 2.0 Adjusted EBITDA $46.9 $50.1 $45.2 Calendarized FY 2016 LTM 9/30/17 Calendarized FY 2017E Filament EBITDA build Net

Sales $169.0 $177.7 $175.2 (-) Cost of sales 95.2 102.8 101.8 Gross Profit $73.8 $74.9 $73.3 (-) Freight and direct selling 7.2 7.1 6.9 (-) Sales, Marketing, Operations, Product Development 23.2 24.2 24.1 (-) Finance, HR / Exec, IT , Other 11.0 10.7

10.9 EBIT $32.5 $32.8 $31.4 (+) Depreciation 1.9 1.6 1.6 (+) Management fees / BOD fees 0.8 0.7 0.8 (+) Acquisition Adjustments 1.1 0.6 0.6 (+) Non-Recurring 0.2 0.1 0.1 Adjusted EBITDA $36.6 $35.9 $34.5 FY 2016 LTM 9/30/17 FYE 2017E Pro forma

adjusted EBITDA build (no synergies) $83.4 $86.0 $79.7 (+) Combined efficiencies - $8.1 $8.1 Pro forma adjusted EBITDA (with synergies) $94.0 $87.7 Note: Filament revenue figures pro forma for PlanetBox acquisition

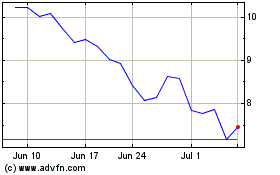

Lifetime Brands (NASDAQ:LCUT)

Historical Stock Chart

From Mar 2024 to Apr 2024

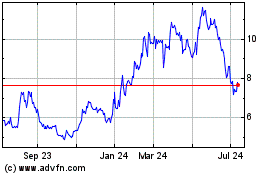

Lifetime Brands (NASDAQ:LCUT)

Historical Stock Chart

From Apr 2023 to Apr 2024