Ackman's Pershing Square Takes Stake in Nike -- Update

January 25 2018 - 8:30PM

Dow Jones News

By David Benoit

William Ackman's Pershing Square Capital Management LP has taken

a passive stake in Nike Inc. based on a belief in the sneaker

giant's long-term growth prospects.

Mr. Ackman announced the position, accumulated since October, at

an event for his investors Thursday evening, according to a person

familiar with the matter. It isn't clear how big the stake is.

Mr. Ackman, one of the best-known activist investors, doesn't

intend to agitate for change at the Beaverton, Ore., company, the

person said, believing it is already on the right path.

Nike has a market value of about $110 billion. The shares have

only recently returned to heights reached in late 2015. The stock

rose 1.9% in after-hours trading Thursday, after closing at

$67.71.

Nike is overhauling the way it brings its pricey Jordan sneakers

and sports jerseys to market. The company -- traditionally a

wholesale distributor -- said in October it would shift away from

what it called "mediocre" retailers, focusing instead on

highlighting just 40 stores and chains from its nearly 30,000

retail partners.

Nike founder Phil Knight has stepped aside from day-to-day

operations but still holds the title of chairman emeritus and is a

large shareholder with supervoting shares. In 2015, Mr. Knight

created Swoosh LLC to hold most of his shares. Swoosh has the power

to elect 75% of Nike's board, and the entity's directors include

several Nike directors, including Mr. Knight's son, Travis.

The company is also aiming to sell more online and directly to

its own consumers. Nike, long a holdout from Amazon.com Inc.,

finally agreed to sell some of its products to the e-commerce giant

last spring in hopes of fighting a growing number of third-party

sellers.

Nike has also refurbished a suite of its own sales apps,

launching coveted products through its own channels instead of at

big chains like Foot Locker Inc. One such launch, for a collection

of shoes designed by Virgil Abloh, drew scores of complaints from

customers who said the app froze or blocked them from filling in

information.

In a statement at the time, Nike said "We'll continue to learn

from issues that some consumers faced today to help us continuously

improve."

In recent years, Nike has also faced competition from a

resurgent rival, Germany's Adidas AG, as well as upstarts in the

crowded women's athletic-wear category, which include Lululemon

Athletica Inc., Fabletics and others.

Pershing Square is facing its own challenges after losing $4

billion on a bet on drugmaker Valeant Pharmaceuticals International

Inc. The fund hasn't made money in any of the last three years, and

even after stabilizing losses last year it remains well below its

highs, putting pressure on Mr. Ackman to find big stock winners in

2018. The firm is already up about 30% on the Nike bet, having

bought at about $52 a share, the person said.

Write to David Benoit at david.benoit@wsj.com

(END) Dow Jones Newswires

January 25, 2018 20:15 ET (01:15 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

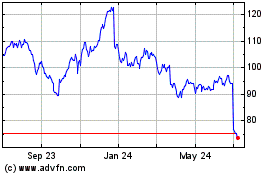

Nike (NYSE:NKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

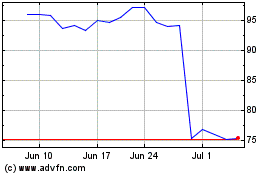

Nike (NYSE:NKE)

Historical Stock Chart

From Apr 2023 to Apr 2024