Report of Foreign Issuer (6-k)

January 24 2018 - 4:45PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of January, 2018

(Commission File No. 001-33356),

Gafisa S.A.

(Translation of Registrant's name into English)

Av. Nações Unidas No. 8501, 19th floor

São Paulo, SP, 05425-070

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes ______ No ___X___

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ______ No ___X___

Indicate by check mark whether by furnishing the information contained in this Form,

the Registrant is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes ______ No ___X___

If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b):

N/A

GAFISA S.A.

CNPJ/MF n° 01.545.826/0001-07

NIRE 35.300.147.952

Publicly-held Company

NOTICE TO SHAREHOLDERS

GAFISA S.A. (B3: GFSA3) (“

Company

”), complementing the information released on the Notice to Shareholders on December 20, 2017 (“

Notice to Shareholders

”), and on January 19, 2018 expired the term to exercise the preemptive right in the subscription of shares referring to the capital increase approved at the Extraordinary Shareholders’ Meeting held on December 20, 2017 (“

Capital Increase

”), informs:

During the period for exercise of preemptive rights, a total of thirteen million, four hundred and fifty-six thousand, four hundred and nine (13,456,409) registered, common shares with no par value were subscribed, at the issue price of fifteen reais (R$15.00) per share, totaling the amount of two hundred and one million, eight hundred and forty-six thousand, one hundred and thirty-five (R$ 201,846,135), above the minimum subscription, as defined in the Notice to Shareholders, was therefore reached, necessary for the partial homologation of the Capital Increase. Considering total maximum number of shares issued within the scope of the Capital Increase, during referred term, a total of six million, five hundred and forty-three thousand, five hundred and ninety-one (6,543,591) of the Company’s common shares were not subscribed.

The referred six million, five hundred and forty-three thousand, five hundred and ninety-one (6.543.591) common shares, therefore, may be subscribed by shareholders who, in the subscription list referring to the exercise of their preemptive rights, expressed their interest in reserving any unsubscribed shares (“

First Period to Subscribe to Unsubscribed Shares

”), as follows:

1.

Issue Price per Share.

Fifteen Reais (R$15.00) per share, set out pursuant to Article 170, Paragraph 1, item II of Law No. 6.404/76, of which one centavo of Real (R$0.01) allocated to the capital stock and fourteen Reais and ninety-nine centavos (R$14.99) to the capital reserve, in accordance with Article 182, Paragraph 1, “a”, of Law No. 6.404/76.

2.

Method of Payment.

The unsubscribed shares will be paid in cash, in domestic currency, upon subscription.

3.

Ratio and Term.

0,488577736 new shares for each share subscribed in the exercise of preemptive right. The right to subscribe to unsubscribed shares shall be exercised between January 29, 2018 (inclusive) and February 2, 2018 (inclusive).

The percentage to exercise the right to subscribe to unsubscribed shares corresponds to 48,857773627 % obtained by dividing the number of unsubscribed shares by total amount of shares subscribed by shareholders who expressed their interest in

unsubscribed shares during the preemptive right period, multiplying the quotient by 100.

4.

Procedure for Subscription to Unsubscribed Shares.

To subscribe unsubscribed shares, the procedures set out by Itaú Unibanco S.A. (“

Itaú

”) shall be observed, the financial institution liable for the bookkeeping of shares issued by the Company and by B3 S.A. – Brazil, Stock Exchange and OTC (“

B3

”), summarized below.

Shareholders whose shares are maintained in the records of Itaú and who wish to exercise their rights to subscribe to unsubscribed shares, within the term provided for herein, may visit any branch of Itaú or specialized branches, identified in item 9 of the Notice to Shareholders, bearing the documents listed in item 10 of the Notice to Shareholders.

The shareholders whose shares are held in custody at B3’s Depositary Center shall exercise their subscription rights through their custody agents, observing the terms and operational procedures stipulated by B3.

The exercise of right to subscribe to unsubscribed shares shall occur by means of completion and signature of the subscription list. The signature of the subscription list shall represent irrevocable and irreversible will of the signatory to subscribe new shares, and the signatory shall irrevocably and irreversibly pay them in full upon signature.

5.

New Unsubscribed Shares.

In accordance with item 8 of the Notice to Shareholders, any unsubscribed shares not subscribed after the First Period to Subscribe to Unsubscribed Shares shall be verified within three (3) business days. Shareholders, who in the subscription list of the First Period to Subscribe to Unsubscribed Shares, express their interest in reserving unsubscribed shares, shall have five (5) business days, after the verification of new unsubscribed shares and the Company’s notice in this regard, to subscribe to these unsubscribed shares, by completing and signing a new subscription list and paying the issue price in cash in domestic currency (“

Second Period to Subscribe to Unsubscribed Shares

” and, jointly with the First Period to Subscribe to Unsubscribed Shares, the “

Period to Subscribe to Unsubscribed Shares

”).

In the event the full subscription of the Capital Increase is not materialized until the end of the Period to Subscribe to Unsubscribed Shares, the Board of Directors, as long as the Minimum Subscription is attained, as defined in the Notice to Shareholders, may partially ratify the Capital Increase. In this assumption, the shares not subscribed after the end of the Period to Subscribe to Unsubscribed Shares shall be cancelled, and the Board of Directors will definitively ratify the Capital Increase, observing the expected conditions and procedures.

The shareholder whose condition to subscribe provided for in respective subscription list is not implemented, will receive the amount fully paid by him, without full or partial monetary restatement, as per option indicated in respective subscription list.

São Paulo, January 24, 2018.

GAFISA S.A.

Carlos Calheiros

Chief Financial and Investor Relations Officer

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: January 24, 2018

|

Gafisa S.A.

|

|

|

|

|

|

By:

|

|

|

|

Name: Sandro Gamba

Title: Chief Executive Officer

|

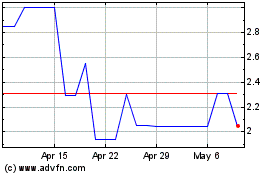

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Mar 2024 to Apr 2024

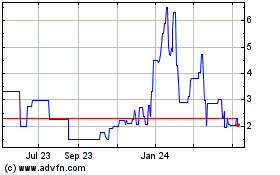

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Apr 2023 to Apr 2024