U.K. Deals a Blow to Fox's $15.5 Billion Takeover of Sky -- 2nd Update

January 23 2018 - 11:00AM

Dow Jones News

By Stu Woo and Ben Dummett

British antitrust regulators said that 21st Century Fox's

proposed $16 billion bid to consolidate ownership of U.K. pay-TV

giant Sky PLC would give the Murdoch family too much influence in

the British media -- but they kept the door open to remedial

actions that would still make a deal possible.

The preliminary finding comes after Mr. Murdoch sealed a

separate agreement to sell a chunk of Fox assets, including its 39%

stake in Sky, to Walt Disney Co. for $52 billion in December. That

has made regulatory scrutiny of the Fox-Sky transaction here an

important part of a much bigger, globe-spanning deal.

The determination, by Britain's Competition and Markets

Authority, raises the latest hurdle in Mr. Murdoch's yearslong

efforts to buy the 61% of the broadcaster that his media empire

doesn't already own. Sky investors were encouraged, however, that

the regulator detailed options that could allow a deal to go

through. The CMA will make a final recommendation in May. It will

then fall to the British government to make a decision.

The regulator also said Tuesday the deal passed its other test

-- whether Fox was committed to British broadcasting standards. Sky

shares rose more than 2% in early London trading -- still slightly

below Fox's GBP10.75 a share offer.

In a statement, Fox said that it was "disappointed by the CMA's

provisional findings. We will continue to engage with the CMA ahead

of the publication of the final report in May."

Technically, the CMA move shouldn't affect the terms of the

Disney-Fox deal, since Disney has agreed to buy only Fox's existing

shareholding in Sky. Disney considers Sky one of the jewels of the

Fox assets -- a way to expand its international footprint.

Should the government ultimately block the Fox-Sky deal, or if

Fox walks away instead of agreeing to remedies, Disney would then

have to decide whether to initiate a fresh bid for the rest of Sky,

to take 100% control.

That is all assuming the Disney-Fox transaction is approved -- a

separate regulatory gantlet that will play out in the U.S. and

Europe and that could last more than a year. Disney representatives

weren't immediately available for comment.

The British regulator suggested Tuesday it was more open to 100%

ownership of Sky by Disney than it would be by Fox. If Disney

succeeded in its bid for the Fox assets, it would "significantly

weaken" the link between the Murdoch family and Sky. It said the

Disney deal to buy the Fox assets would be subject to its own

regulatory review.

The regulators' issue is that Sky, a satellite-TV and cable

provider, also runs its own news channel, Sky News. Regulators said

Tuesday if Fox had complete ownership of Sky, that would give the

Murdoch family "greater influence over public opinion and the

political agenda through Sky News, and would add to the...already

significant influence over public opinion and the political agenda

through its control of the News Corp titles."

The Murdoch family is big shareholders in both 21st Century Fox

and News Corp, which publishes widely read U.K. newspapers,

including the Times of London, the Sunday Times and the Sun

tabloid. News Corp also owns The Wall Street Journal.

The regulator listed possible remedies that could ease its

concerns about media concentration. They include spinning off Sky

News, Sky's news channel. Sky had said it might shutter the

business, anyway. Sky declined to comment Tuesday.

Another option floated by regulators was allowing Fox to create

a board of mostly independent members to oversee Sky News. That

arrangement could fall away should Disney clinch its deal with Fox

and take control of Sky. That would offer Fox a relatively simple

way of alleviating the CMA's concerns as it awaits approval on the

Disney deal. Still, the regulator said it was concerned about the

effectiveness of this condition.

The British regulators will allow Fox and groups that support

and oppose the deal to respond to its preliminary recommendations.

They are scheduled to deliver final recommendations in May to the

U.K. culture secretary, who can decide to approve the deal

outright, approve it with conditions or to reject it.

Sky was a satellite-TV provider called British Sky Broadcasting

before turning into a pan-European operation with 22.5 million

customers in the U.K., Ireland, Germany, Austria and Italy. It is

both a telecommunications operator -- selling TV, internet and

wireless plans -- and a media company that broadcasts its own

channels and produces sports, news and entertainment shows.

Mr. Murdoch first tried to consolidate ownership of Sky at the

beginning of the decade, but ended his attempt in 2011 amid

political and public backlash after employees at his now-defunct

News of the World hacked into the phones of politicians and

celebrities, as well as murdered teenager Milly Dowler. Mr. Murdoch

apologized for the hackings and closed the newspaper.

Fox launched its current Sky bid, for GBP11.7 billion, in

December 2016.

Write to Stu Woo at Stu.Woo@wsj.com and Ben Dummett at

ben.dummett@wsj.com

(END) Dow Jones Newswires

January 23, 2018 10:45 ET (15:45 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

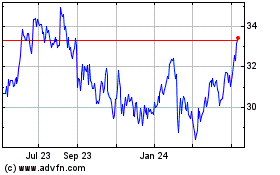

Fox (NASDAQ:FOXA)

Historical Stock Chart

From Mar 2024 to Apr 2024

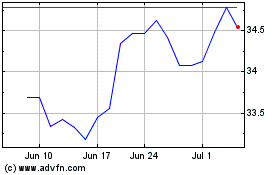

Fox (NASDAQ:FOXA)

Historical Stock Chart

From Apr 2023 to Apr 2024