P&G Earnings: What to Watch

January 22 2018 - 4:11PM

Dow Jones News

By Sharon Terlep

Procter & Gamble Co. is scheduled to report earnings for the

quarter ended Jan. 23 before the market opens Tuesday. Here's what

you need to know.

EARNINGS FORECAST: Analysts expect P&G to report "core"

earnings of $1.14 cents a share, according to Thomson Reuters. That

compares with core earnings of $1.08 cents a share a year earlier.

Core earnings strips out currency moves and acquisitions and

divestitures.

SALES FORECAST: Net sales are expected to rise to $17.39 billion

from $16.85 billion a year earlier. Barclays estimates 1.9% organic

sales growth, which also excludes currency moves and acquisitions

and divestitures.

WHAT TO WATCH:

CONSUMER SPENDING: A buoyant stock market and strengthening

economy appear to be little help to makers of household goods, who

spent 2017 struggling with lackluster sales. Look for P&G to

give some color on shopper behavior and whether spending is

expected to pick up on everything from diapers to razors. P&G

and rival Kimberly-Clark Corp., which also reports results on

Tuesday, are the first big consumer-products companies to release

the latest results.

TAX CHANGES: Wall Street will be looking for details on how the

tax overhaul will factor into P&G's balance sheet and long-term

planning. P&G's effective tax rate last quarter was 23.4%,

slightly above the new 21% corporate rate. The company also stands

to benefit from a provision that allows spending on capital

projects to be written off immediately.

MARKET SHARE: Analysts and rival consumer-products makers have

pointed to price cuts by P&G as one of the factors behind the

industrywide sales slump. As the biggest player, P&G has the

clout to affect pricing and demand across the industry. P&G

took the unusual step early last year of reducing prices on

high-margin Gillette razors by up to 20%, and has made reductions

elsewhere. Wall Street will look to P&G's results to see how

much price reductions played into any market share gains.

PODS FALLOUT: P&G has been struggling to quash an internet

meme in which teens bite into Tide Pods laundry packets. The

company opted not to speak up about the troublesome game when it

learned of it years ago, but took action once videos of the

behavior began going viral online. The company is eager for buzz to

die down around the so-called Tide Pod challenge, but may face

questions from analysts.

(END) Dow Jones Newswires

January 22, 2018 15:56 ET (20:56 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

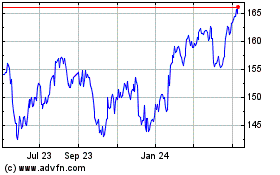

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

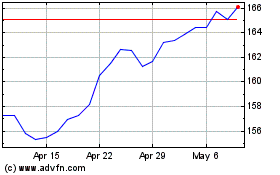

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024