FirstEnergy Gets $2.5 Billion From Elliott, Bluescape Investor Group -- Update

January 22 2018 - 3:36PM

Dow Jones News

By Bowdeya Tweh and Russell Gold

FirstEnergy Corp. has raised $2.5 billion in a private stock

offering from a group led by activist investor Elliott Management

Corp. and private-equity firm Bluescape, the Ohio-based utility

said Monday.

The unexpected investment comes at a turbulent time for

FirstEnergy. Its unregulated wholesale power subsidiary has been

struggling to compete amid low prices and has been widely expected

to seek bankruptcy protection in coming months.

The company had said it was shedding assets and planned to

become a fully regulated utility. This plan was dealt a significant

setback earlier this month when the federal government rejected a

request to shift a large coal facility from its unregulated to its

regulated business.

It is not clear if the activists intend to steer FirstEnergy in

a new direction. FirstEnergy said it has created a five-member

restructuring working group -- the new investors will get two

seats, including Bluescape Executive Chairman C. John Wilder -- to

maximize value and accelerate the company's exit from the wholesale

power business.

FirstEnergy said Monday the investor group, which includes

Singapore's sovereign-wealth fund GIC and hedge-fund firm Zimmer

Partners LP, could end up owning 16% to 17% of the company

The investment -- which includes $850 million in common stock

and $1.62 billion in convertible preferred stock -- fulfills the

company's goal of issuing at least $1.5 billion of common stock

through next year, FirstEnergy said.

"We are pleased that these premier investors are demonstrating

confidence in our plan to transform FirstEnergy into a fully

regulated utility," said Charles E. Jones, First Energy chief

executive, in prepared remarks. "Elliott and Bluescape have proven

value-added expertise and investment acumen in power and utility

restructurings."

FirstEnergy plans to use the proceeds to pay down its debt and

put money toward its pension fund, among other things. It also said

it doesn't anticipate new equity issuances, excluding

stock-investment plans and employee-benefits programs, through the

end of 2020.

Elliott and Bluescape in other instances have teamed up to push

for changes at companies. Last year, NRG Energy Inc. announced a

plan to sell assets, slash costs and lower its debt after receiving

pressure from the investors in a bid to boost the company's

value.

Mr. Wilder of Dallas-based Bluescape had served as chief

executive of Texas utility TXU Corp. He led a turnaround at the

power producer before the company was sold in 2007, the year

Bluescape was founded.

FirstEnergy serves 6 million customers in Ohio, Pennsylvania,

New Jersey, West Virginia, Maryland and New York. Last year, it

reached an agreement to sell 1,615 megawatts of natural gas and

hydroelectric generation plants for $825 million in cash, about

$100 million less than a similar agreement reached months

earlier.

FirstEnergy shares rose 12% to $32.86 in midday trading, adding

roughly $1.5 billion to its market value. The company had a market

capitalization of $13.08 billion through Friday's close.

--Allison Prang contributed to this article.

Write to Bowdeya Tweh at Bowdeya.Tweh@wsj.com and Russell Gold

at russell.gold@wsj.com

(END) Dow Jones Newswires

January 22, 2018 15:21 ET (20:21 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

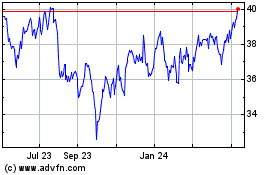

FirstEnergy (NYSE:FE)

Historical Stock Chart

From Mar 2024 to Apr 2024

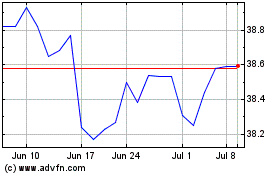

FirstEnergy (NYSE:FE)

Historical Stock Chart

From Apr 2023 to Apr 2024