By Laura Stevens

Amazon.com Inc.'s search for a second headquarters location has

disappointed a couple hundred small towns and big metros across

North America.

But there is a silver lining, which officials at some losing

cities say they factored into their applications -- the chance to

tout themselves to Amazon as a destination for a smaller

investment, such as one of the data centers and warehouses the

company is rapidly building in the U.S.

Amazon on Thursday announced 20 finalists, selected from 238

North American applicants, to be its so-called HQ2. The company

expects to finalize its choice this year and has said the winner

can expect up to 50,000 high-paying jobs and $5 billion in

investment over nearly two decades.

Amazon added, in a statement, it learned about new communities

that it will consider for future projects.

"There'll be one bride and over 200 bridesmaids," says John

Boyd, principal at the Boyd Co., which helps companies select

sites. "It's still a very valuable process for cities that fall

short."

Amazon has started to reach out to some losers. Small-business

owners who proposed Anchorage, Alaska, for HQ2 knew it was a long

shot. Because of its location, the city -- which boasts flight

times of 9.5 hours or less to 95% of the industrialized world --

already hosts major United Parcel Service Inc. and FedEx Corp. air

hubs and could prove attractive to Amazon as it develops its own

logistics network.

Meghan Stapleton and Carmen Baker, two business owners who

hand-delivered Anchorage's proposal to Amazon headquarters, said

one of the company's economic-development team members called

Thursday to say he appreciated their efforts and planned to contact

the state's economic development team to discuss further

possibilities, although he declined to specify what they might

be.

"We made another pitch on our call on our merits, making sure

that we're on their radar," Ms. Stapleton said. "That was all we

wanted, was to be considered for a place at the table."

Amazon's individual logistics and operations facilities to date

don't compare with the scale of HQ2, but the company is on a

construction tear. According to estimates by supply-chain

consultancy MWPVL International Inc., which tracks Amazon warehouse

growth, the company now has about 320 fulfillment centers, sort

centers, hubs and other logistics facilities in the U.S. That's up

from 239 a year earlier and 77 five years ago.

Amazon also has been opening data centers and offices around the

world. And it held a job fair in August to hire 50,000 mostly

warehouse workers across the country, part of its larger pledge to

create more than 100,000 full-time U.S. jobs through the middle of

this year. Its number of employees topped 540,000 in the third

quarter, up about 77% from the same quarter in 2016, in part due to

its acquisition of Whole Foods.

An Amazon spokesman said the company invested more than $100

billion in the U.S. between 2011 and 2016.

Typically, a new warehouse, such as one Amazon recently

announced for a Baltimore suburb, brings roughly 1,500 full-time

jobs with benefits, as well as millions of dollars in investments

and further advantages, such as additional indirect job

creation.

Still, those blue-collar jobs tend to be hourly, often paying

starting wages between about $12 and $14 based on location. That

compares with the promised average salary at the new headquarters

of $100,000 a year. And those new jobs can be tough, requiring

heavy lifting and standing all day.

Major cities held an edge in Amazon's headquarters competition,

given requirements like population size and transportation options.

But that didn't stop less-prominent locales from trying, including

small, rural towns like Rockdale, Texas, and bigger cities like

Birmingham, Ala., which on Thursday tweeted an Amazon smile logo

underlining "HQ3?"

Officials in some smaller areas said getting on Amazon's radar

for possible investments was a factor in their HQ2 application.

"We feel that there's a future for Amazon here in the state of

Idaho," said Clark Krause, executive director of the Boise Valley

Economic Partnership. He said he hopes Amazon chooses to locate a

future new development there. "I don't know exactly when that would

be, but I think we're well positioned because they don't have a lot

of distribution points in the state," he said.

His group promoted the region's cluster of companies with food

logistics expertise to Amazon, which last year bought Whole Foods

in an expansion into groceries. "We knew they weren't coming" for

HQ2, Mr. Krause said, but "hey, if you're inviting us to talk to

you, we're going to take that opportunity."

Still, many applicants won't be considered for new projects. And

some local governments have drawn criticism for wasting taxpayer

money on long-shot proposals.

Losing out on Amazon could still leave room to use resources

compiled from that process to attract another major company, some

officials said. Long Beach, Calif., proposed a location for Amazon

-- but would also like to woo rival Alibaba Group Holding Ltd. of

China, said John Keisler, Long Beach's director of economic

development. The city is banking on its expertise as a logistics

hub between the companies' two home countries.

Connecticut publicized pieces of its proposals to capitalize on

the enormous attention around Amazon's contest and to try to draw

interest from other companies, says Catherine Smith, commissioner

of the Connecticut Department of Economic and Community

Development.

Connecticut knew "it's a long shot for HQ2," she said. But "I

think the process itself was very valuable for the state."

(END) Dow Jones Newswires

January 19, 2018 11:54 ET (16:54 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

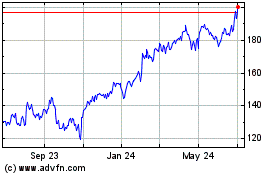

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

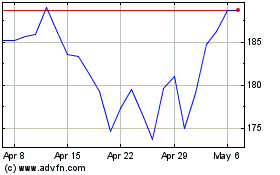

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Apr 2023 to Apr 2024