Current Report Filing (8-k)

January 17 2018 - 5:13PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 17, 2018

Jabil Inc.

(Exact name

of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-14063

|

|

38-1886260

|

(State

of incorporation)

|

|

(Commission

file number)

|

|

(IRS Employer

Identification No.)

|

10560 Dr. Martin Luther King Jr. Street North, St. Petersburg, Florida 33716

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (727) 577-9749

N/A

(Former name or

former address, if changed since last report)

Check the appropriate box below

if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to

Rule l4a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to

Rule 14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to

Rule 13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of

this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On January 17, 2018, Jabil Inc. (the

“

Company

”) issued $500 million aggregate principal amount of the Company’s 3.950% Senior Notes due 2028 (the “

Notes

”) in an underwritten public offering (the

“

Offering

”). The form and term of the Notes were established pursuant to an Officers’ Certificate, dated as of January 17, 2018 (the “

Officers’ Certificate

”), supplementing the

Indenture, dated as of January 16, 2008, between the Company and The Bank of New York Mellon Trust Company, N.A. (formerly known as The Bank of New York Trust Company, N.A.), as trustee (the “

Indenture

”).

The Notes mature on January 12, 2028 and bear interest at the rate of 3.950% per annum, payable semi-annually in arrears on

January 12 and July 12 of each year, beginning July 12, 2018. The Notes are unsecured obligations of the Company and rank equally in right of payment with all of the Company’s other existing and future senior unsecured

indebtedness.

Prior to October 12, 2027 (three months prior to the scheduled maturity date of the Notes), the Company is entitled,

at its option, to redeem all or a portion of the Notes at a redemption price equal to 100% of the principal amount thereof, plus a “make-whole” premium and accrued and unpaid interest, if any, to, but excluding, the redemption date. On or

after October 12, 2027 (three months prior to the scheduled maturity date of the Notes), the Company may redeem all or a portion of the Notes at a redemption price equal to 100% of the principal amount thereof, plus accrued and unpaid interest,

if any, to, but excluding, the redemption date. The Company may also be required to offer to repurchase the Notes upon the occurrence of a Change of Control Repurchase Event (as defined in the Officers’ Certificate) at a repurchase price equal

to 101% of the aggregate principal amount of Notes to be repurchased.

The Indenture contains certain covenants, including, but not

limited to, covenants limiting the Company’s ability and/or its subsidiaries’ ability to: create certain liens; enter into sale and leaseback transactions; create, incur, issue, assume or guarantee any funded debt (applicable only to the

Company’s “restricted subsidiaries”); guarantee any of the Company’s indebtedness (applicable only to the Company’s subsidiaries); and consolidate or merge with, or convey, transfer or lease all or substantially all of its

assets to another person.

The foregoing description of the Notes is qualified in its entirety by reference to the complete terms and

conditions of the Officers’ Certificate and the form of Note, which are filed as Exhibits 4.1 and 4.2, respectively, to this Current Report on Form

8-K

and are incorporated herein by reference.

In connection with the Offering, the Company entered into an Underwriting

Agreement (the “

Underwriting Agreement

”) between the Company and BNP Paribas Securities Corp., Citigroup Global Markets Inc., J.P. Morgan Securities LLC and Mizuho Securities USA LLC, as representatives of the several

underwriters listed in Schedule I of the Underwriting Agreement, with respect to the offer and sale of the Notes. The Underwriting Agreement contains customary representations, warranties and agreements by the Company and customary closing

conditions, indemnification rights and termination provisions.

The foregoing description of the Underwriting Agreement is qualified in

its entirety by reference to the complete terms and conditions of the Underwriting Agreement, which is filed as Exhibit 1.1 to this Current Report on

Form 8-K

and is incorporated herein by reference.

The Notes were issued in a public offering pursuant to the Company’s Registration Statement on

Form S-3

(File No. 333-221020)

and a related prospectus supplement dated as of January 9, 2018. The Company is filing Exhibits 5.1 and 12.1 with this

Current Report on

Form 8-K

in connection with such Registration Statement.

2

|

Item 9.01.

|

Financial Statements and Exhibits.

|

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Date: January 17, 2018

|

|

|

|

|

|

JABIL INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Susan Wagner-Fleming

|

|

|

|

|

|

|

|

Name:

|

|

Susan Wagner-Fleming

|

|

|

|

|

|

|

|

Title:

|

|

Vice President and Corporate Secretary

|

4

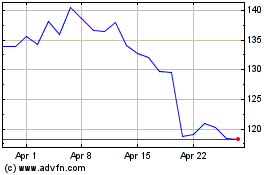

Jabil (NYSE:JBL)

Historical Stock Chart

From Mar 2024 to Apr 2024

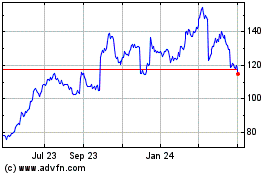

Jabil (NYSE:JBL)

Historical Stock Chart

From Apr 2023 to Apr 2024